Press release

Study Reveals 73% of Travelers Overpay for Rental Car Insurance, CarInsuRent Offers 60% Cost Reduction

IntroductionAre you among the many travelers who have paid more for rental car insurance than necessary? A recent study highlights that a staggering 73% of travelers fall into this trap https://carinsurent.com/guides/travel-tips/analysis-of-car-rental-insurance-pricing-disparities-at-airport-locations/, often due to unforeseen charges and last-minute decisions. Thankfully, CarInsuRent promises significant savings, offering up to a 60% reduction on your rental car insurance costs. This post will delve into the common missteps travelers make, how CarInsuRent can help, and provide tips to ensure you're getting the best deal possible.

Unpacking the Rental Car Insurance Dilemma

The Hidden Costs of Convenience

The Global Car Rental Market is surging https://www.openpr.com/news/4219971/global-car-rental-market-set-to-surge-from-usd-140-4-billion and when renting a car, it's easy to opt for convenience by selecting insurance provided directly by rental agencies. However, this often results in unexpected costs. Many renters discover extra fees disguised under vague terms, contributing to a considerably higher bill. For instance, some agencies apply steep charges for additional drivers or claim fees for minor damages that could otherwise be covered under a third-party policy.

The allure of immediate coverage might obscure these higher rates, with travelers opting in hurriedly at the rental desk without fully understanding their alternatives. These choices frequently stem from time constraints or a lack of prior research, leading to regrets once the final cost unfolds. Understanding these pitfalls can dramatically affect your travel budget, directing you toward smarter choices.

Additionally, airport-based rental locations often tack on excessive convenience fees, adding to the perception of a straightforward and quick pick-up, which is sometimes neither. Being prepared can help dodge these swollen prices that significantly inflate total travel costs.

By examining the breakdown of these concealed expenses, you empower yourself to make informed decisions, ensuring that convenience doesn't come at a premium cost.

Common Missteps Travelers Make

When it comes to rental car insurance, travelers often make a few common mistakes that lead to overpaying. Awareness of these pitfalls is essential for making budget-friendly decisions.

One frequent misstep is assuming their existing car insurance or credit card offers comprehensive coverage for rental cars. Unfortunately, this assumption can lead to paying for redundant protection or lacking coverage in specific circumstances. Not all personal policies or credit card insurances cover rental vehicles, or they might cover only certain types of incidents.

Another error is overlooking terms and conditions. Buried within lengthy contracts are clauses that, if ignored, may expose travelers to unforeseen costs later. Besides, last-minute decisions at the rental desk can lead to panic buying. Succumbing to pressure from sales pitches may see travelers adding unnecessary options due to confusion or misinformation.

A lack of planning is also a significant contributor. Many travelers do not investigate or compare insurance options before their trip. Without prior research, it's easy to opt for the easiest but often the most expensive option at the rental counter.

By identifying and understanding these common errors, travelers can better navigate rental car insurance, avoiding unnecessary expenditures and making informed decisions.

Proper preparation, such as checking with your insurance provider or credit card company for coverage details and reading rental agreements thoroughly, helps sidestep these pitfalls. Additionally, booking insurance in advance and using third-party companies like CarInsuRent can eliminate last-minute pressures and lead to considerable savings. With these insights, travelers are better equipped to navigate the often confusing world of rental car insurance.

Factors Influencing Rental Car Insurance Costs

Understanding Pricing Disparities at Airport Locations

When renting cars at airport locations, you'll often notice higher pricing for both rentals and insurance. These disparities arise due to various factors, starting with convenience fees. Airports impose extra charges on rental companies operating on-site, which are then passed on to you as higher costs.

The demand for immediate mobility upon landing also contributes to inflated prices, allowing agencies to capitalize on travelers' urgency and willingness to pay a premium for convenience. Additionally, airport rentals typically include facility charges, taxes, and other surcharges neatly tucked into the final amount, further elevating costs.

It's also important to consider that competition may be limited within airport premises, meaning fewer opportunities for you to shop around for better rates.

To navigate these disparities, consider renting from agencies located off airport premises, which often provide more competitive rates. Additionally, booking in advance and exploring third-party insurance options like CarInsuRent can mitigate unexpected costs, offering a savvy approach to balancing convenience and expense.

The Impact of Rental Duration on Insurance Costs

The duration of your car rental can significantly influence the cost of insurance, often varying more than most travelers anticipate. Rental agencies typically structure their pricing to encourage longer rentals with appealing daily rates, yet this doesn't always translate to savings on insurance. In many cases, travelers find that increasing the rental period results in a steep rise in insurance premiums, primarily due to perceived risk factors over longer durations.

Insurance policies are calculated based on the probability of incidents occurring and extended use naturally increases that probability, leading to higher premiums. Some agencies also leverage a tiered rate system for insurance, where the per-day cost decreases slightly over more extended periods, but not significantly. This means substantial insurance cost differences over short versus long-term rentals, typically benefiting the agency financially rather than the customer.

Moreover, additional terms and conditions often apply to long-term rentals, with some agencies enforcing stricter policies or higher deposit requirements, which can offset the perceived savings from lower base rates.

By planning carefully and considering third-party insurance options like CarInsuRent, you can mitigate these costs. CarInsuRent offers flexible plans that cater specifically to the rental duration without the steep increases seen with agency-provided options. This allows you to benefit from extended rental periods without facing escalating insurance costs, making it a practical choice for longer journeys. Preparing in advance and selecting tailored coverage based on your actual needs helps maintain affordability throughout your travels, regardless of the length of your rental.

When Add-Ons Inflate the Bill

Add-ons can significantly inflate your rental car insurance bill, often catching travelers off guard with their cumulative costs. These extras can include GPS systems, additional driver fees, child safety seats, or enhanced insurance coverage, all of which might seem reasonably priced individually but quickly add up. Many travelers find themselves paying for features they don't truly need, especially when they're presented at the rental desk amidst the rush to begin their journey.

One frequent add-on that boosts costs is the loss-damage waiver (LDW) or collision damage waiver (CDW), marketed as essential protection despite overlapping coverage many travelers may already possess through their personal insurance or credit card benefits.

Moreover, these add-ons are strategically pitched as necessary for peace of mind, even though travelers might be unaware of existing protections they already hold. This lack of awareness leads to an overinflated bill filled with redundant or avoidable charges. [Case Study: Typical cost breakdown with add-ons]

To avoid such pitfalls, it's crucial to assess your needs in advance and decline unnecessary extras during the booking process. Exploring third-party insurance options like CarInsuRent can help circumvent the pricey agency insurance add-ons, providing customized, cost-effective coverage. This proactive approach ensures you're only paying for essential services and protection, keeping your rental expenses in check and more predictable.

By intentionally evaluating your rental requirements and potential overlap with existing coverage, you can make informed decisions that avoid the financial pitfalls associated with impulsive add-on purchases, leading to a more streamlined and economical rental experience.

Comparing CarInsuRent with Traditional Coverage Options

Credit Card Coverage vs. CarInsuRent

When comparing credit card coverage to CarInsuRent's offerings, you'll find notable differences in scope and flexibility. Credit card rental insurance often acts as secondary coverage, which means it steps in only after your personal auto insurance has been exhausted. While convenient, this can lead to increased premiums on your primary policy if claims are made. Moreover, limitations exist regarding the types of vehicles and countries covered, which might not suit every traveler's needs.

CarInsuRent, on the other hand, provides a primary insurance option, meaning it covers eligible damages or losses upfront, without impacting your personal insurance. This separation is beneficial for travelers who wish to avoid involving their personal policies. CarInsuRent also offers broader coverage without the geographical or vehicle-type restrictions often seen with credit cards.

Furthermore, CarInsuRent customizes coverage options, allowing travelers to select precisely the protection they need, enhancing affordability and relevance. In contrast, credit card coverage usually comes as a one-size-fits-all deal, with inflexible terms.

For those seeking comprehensive, unrestricted, and primary coverage, CarInsuRent stands out as a superior choice compared to the often limited scope of credit card insurance. It provides peace of mind with direct, hassle-free claims processes and customizable options that align closely with individual travel needs, ensuring you're getting the maximum protection without excess cost or complicating your personal insurance landscape. This makes it an excellent alternative for travelers who prioritize comprehensive coverage with flexibility.

Agency-Provided Insurance vs. CarInsuRent

When weighing agency-provided insurance against CarInsuRent, several key distinctions emerge that can influence your decision. Agency insurance is often positioned as a comprehensive solution at the point of rental, but it comes with higher premiums and the potential for unnecessary add-ons. This convenience, however, can be misleading due to the inflated costs that stem from the agency's overhead and profit margins.

Conversely, CarInsuRent offers a more economical approach by cutting out intermediaries and focusing on digital solutions https://www.openpr.com/news/4181987/consumer-behavior-and-preferences-in-purchasing-car-insurance to deliver lower-cost coverage directly to you. Their model reduces the markups and hidden fees commonplace in agency insurance, resulting in a direct 60% cost reduction on average.

Another advantage is CarInsuRent's flexibility. They allow you to tailor coverage precisely to your needs, rather than adhering to the rigid, pre-packaged options rental agencies offer. This customization not only lowers costs but enhances the relevance of the coverage, meeting travelers' specific needs without forcing them to pay for undesired extras.

Finally, claim processes with CarInsuRent are streamlined and transparent, often much simpler than navigating the complexities of agency policy claims. This hassle-free experience ensures that you can handle any incidents with ease, without the bureaucratic difficulties typical of rental agencies.

Overall, CarInsuRent stands out for its cost efficiency, flexibility, and user-friendly claims process, making it an excellent choice for travelers looking to optimize insurance costs without sacrificing coverage quality. This makes CarInsuRent a sound decision for those prioritizing budget-friendly travel solutions alongside comprehensive protection.

Tips for Maximizing Your Rental Car Insurance Savings

Activate Credit Card Benefits Properly

Activating credit card benefits for rental car insurance requires a few strategic steps to ensure you're adequately covered. First, verify your credit card's rental insurance policy details, such as eligible countries, vehicle types, and coverage limits, by checking the fine print or contacting customer service. Understanding these parameters helps prevent coverage gaps during your travels.

To activate these benefits, ensure you use the credit card that offers the insurance to pay for the entire car rental transaction. Partial payments with different cards or methods may invalidate the coverage. It's also critical to decline the rental agency's collision coverage at the desk, as accepting it can void your credit card benefits.

Many credit cards require you to report any damages or loss promptly, so familiarize yourself with the reporting procedures before your trip. Knowing the correct process and contact information ensures swift action in the event of an incident.

By properly activating your credit card's rental insurance benefits, you equip yourself with a powerful, often no-cost coverage option, minimizing the financial and logistical burdens of unexpected car rental incidents. This proactive step not only safeguards your journey but also keeps rental expenses in check, allowing you to enjoy your travels with greater peace of mind. Taking the time to understand and correctly utilize this benefit can result in substantial savings and effective coverage, reinforcing the value of your existing credit card services.

Assessing Your Existing Personal Coverage

Before opting for rental car insurance, it's crucial to assess your existing personal auto insurance policy to understand what coverage you already have. Many personal auto insurance policies extend coverage to rental vehicles, potentially including liability, collision, and comprehensive coverage. However, these terms can vary, so reviewing the policy details or consulting with your insurance provider is essential for clarity.

Determine if your policy covers incidents like theft or damage while driving a rental car, and note any deductible that applies. Knowing your deductible helps weigh the cost vs. benefit if an incident occurs. Additionally, verify if your policy limits extend to rental cars, especially when traveling abroad, as international rentals may not be covered.

Consider any potential increases in premiums if you file a claim through your personal policy, as this might offset any savings. If your existing coverage suffices, you can decline the rental agency's offers confidently.

By thoroughly assessing your auto insurance policy, you make a well-informed decision on whether supplementary coverage like CarInsuRent is necessary. This diligence not only identifies cost-saving opportunities but solidifies your confidence in the coverage you choose to rely on during your trip. With a clear understanding of your existing coverage, you can avoid redundant expenditures and ensure optimal protection while traveling, making your rental experience both economical and secure.

99 Wall Street, New York, NY 10005, United States

Saasweber is a knowledge based company and provide high quality informative contents.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Study Reveals 73% of Travelers Overpay for Rental Car Insurance, CarInsuRent Offers 60% Cost Reduction here

News-ID: 4232801 • Views: …

More Releases from Saasweber

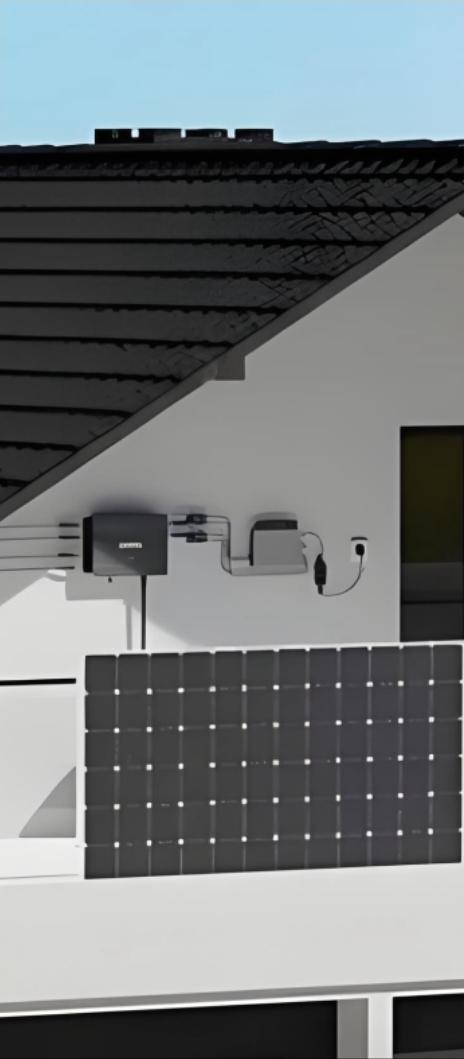

A Complete Guide to Balcony Solar Systems: Racking, Electrical Systems & Key Req …

Balcony photovoltaics (PV) are having a moment. Let's walk through the racking systems, electrical components, and what you need for installation to get a full picture of this green technology.

Balcony PV https://cn-cob.com/cases-detail/cncob-residential-balcony-power-plant-plug-in-solar-generator represents the shift of solar from a custom project to a standardized product-think of it like any modern appliance. It's more than just a product; it embodies a new approach to energy consumption.

Racking Systems for Balcony PV

Types of…

The Rising Power of Artificial Intelligence in Modern Digital Marketing

Artificial intelligence has become one of the most transformative

technologies in the digital world, reshaping how businesses attract, engage, and retain customers. Among the most impactful applications is AI analytics, a data-driven approach that empowers marketers to understand consumer behavior, optimize campaigns, and make smarter decisions. As competition intensifies online, companies are seeking innovative ways to stand out, and AI-driven insights are at the center of this shift. For SEO…

Why Strategic Content Distribution Is Becoming the Hidden Powerhouse of SEO in 2 …

In 2025, SEO is no longer just a technical discipline. The brands taking the lead are those that understand a pivotal shift: search engines now reward authority, not just optimization. This change has pushed companies to rethink how they build visibility, leaning heavily on strategic content distribution and digital PR as core components of their SEO ecosystems.

One of the major drivers of this evolution is the increasing sophistication of search…

The most reliable Mercedes models and their repair needs

Mercedes has a strong reputation for reliability. Not all models live up to this reputation equally, but certain vehicles consistently prove themselves over years and miles.

Most reliable models: C-Class, E-Class, GLC

The C-Class sedans from 2015-2019 show excellent reliability records. These models use proven powertrains, well-debugged electronics, durable interior components. Common issues are minor, fixes are straightforward, parts remain reasonably priced.

E-Class models from the W213 generation handle daily use well. The…

More Releases for Car

Car Washing Services Market Is Booming So Rapidly with Mister Car Wash, Zips Car …

The Car Washing Services Market has been fragmented based on the productivity of several companies; therefore, each segment and its sub-segments are analyzed in the research report. Furthermore, the report offers 360 views on historical and upcoming growth based on volume, value, production, and consumption. Moreover, it classifies depend on sub-segments, key segments as per the significant regions and offers an in-depth analysis on the competitive edge of the market.…

Car Wash Service Market Boosting the Growth Worldwide: Auto Bell Car Wash, Miste …

The latest study released on the Global Car Wash Service Market by AMA Research evaluates market size, trend, and forecast to 2027. The Car Wash Service market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Key…

Car Rental Services Market Forecast to 2028 Covid-19 Impact and Global Analysis …

Car rental services are a process of hiring/renting a car for a limited period from a rental company. Various companies like Uber Technologies, Europcar rent the vehicles for a short period ranging from few hours to weeks. The different types of cars rented by the company include Luxury Car, executive car, and economical car among others. Additionally, vehicle renting agencies also offer other products such as insurance, entertainment systems, and…

Car Rentals Market Growth Strategies and Innovative Technology Transformation by …

Worldwide Market Reports has announced the addition of the "Car Rentals Market Report 2020-2027 Production, Sales And Consumption Status And Prospects Professional Research", The report classifies the global Car Rentals Market in a precise manner to offer detailed insights about the aspects responsible for augmenting as well as restraining market growth.

The emergence of own-brand digital ordering platform has been trending in the global Car Rentals market. Car Rentals such as…

Luxury Car Leasing Market Competitors Analysis By German Rent A Car, ANI Technol …

�'Global Luxury Car Leasing Market Research Report' the report is complete with an elaborate research undertaken by prominent analysts and a detailed analysis of the global industry place. The Luxury Car Leasing report is fragmented in several features which include manufacturers, region, type, application, market status, market share, growth rate, future trends, market drivers, opportunities, challenges, emerging trends, risks, entry barriers, sales channels, and distributors which are again elaborated in…

Car Wash Market is Thriving Worldwide 2026 | Super Star Car Wash, Autobell Car W …

This Car Wash Market research report offers you an array of insights about Automotive industry and business solutions that will support to stay ahead of the competition. Systematic investment analysis is also underlined in this Car Wash Market report which forecasts impending opportunities for the market players.This market report is the outcome of persistent efforts lead by knowledgeable forecasters, innovative analysts and brilliant researchers who carries out detailed and diligent…