Press release

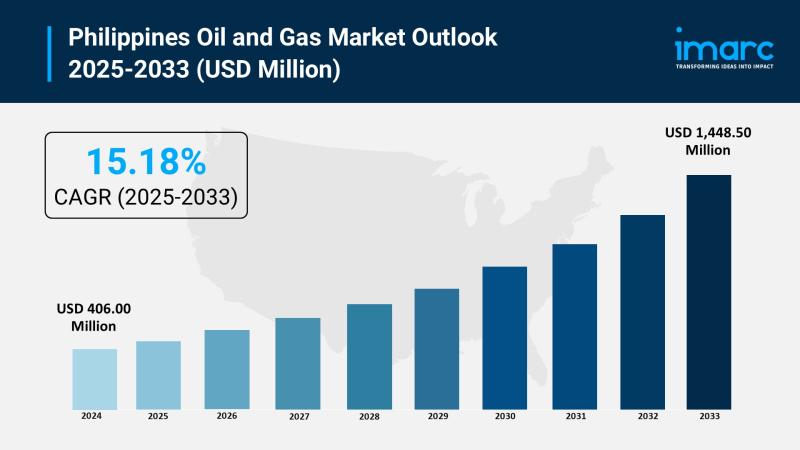

Philippines Oil and Gas Market 2025 | Worth USD 1,448.50 Million by 2033 | Exhibit a 15.18% CAGR

The latest report by IMARC Group, "Philippines Oil and Gas Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033," provides an in-depth analysis of the Philippines oil and gas market. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Philippines oil and gas market size reached USD 406.00 Million in 2024 and is projected to grow to USD 1,448.50 Million by 2033, exhibiting a robust growth rate of 15.18% during the forecast period.Report Attributes and Key Statistics:

Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 406.00 Million

Market Forecast in 2033: USD 1,448.50 Million

Growth Rate (2025-2033): 15.18%

Philippines Oil and Gas Market Overview:

The Philippines oil and gas market is experiencing robust expansion driven by LNG imports accelerating to address Malampaya gas field depletion which supplied 40% of Luzon's power needs. Government and private sector building LNG receiving terminals, pipelines, and storage facilities attracting international players from Japan, South Korea, and Australia signaling strong foreign investment. Natural gas accounting for 22% of power generation mix with 46% sourced from imported LNG. Upstream exploration program revisited to reduce dependency on external supply with Department of Energy promoting offshore basins exploration including West Philippine Sea believed to hold significant untapped reserves positioning oil and gas sector as critical energy security driver.

Request For Sample Report: https://www.imarcgroup.com/philippines-oil-gas-market/requestsample

Philippines Oil and Gas Market Trends:

Philippines oil and gas market trends include LNG infrastructure development accelerating with seven terminals at various construction stages representing 36.5 million tonnes per annum import capacity. January 2025 Philippine Natural Gas Industry Development Act approval providing regulatory framework supporting industry growth. Country's first operational LNG terminal in Batangas receiving 19 cargoes in 2024 all procured on spot market. March 2025 Vitol signing Philippines' first long-term LNG supply agreement for 0.8 mtpa over ten years marking transition from spot to contract-based procurement. LNG demand estimated rising from 1.7GW in 2023 to 11.3GW by 2040. Malampaya gas field expected depleting by 2027 creating urgency for alternative supply sources. Energy transition positioning natural gas as bridge fuel complementing renewable energy expansion while maintaining baseload power generation.

Philippines Oil and Gas Market Drivers:

Philippines oil and gas market drivers include rising domestic energy demand with economic growth achieving 5.6% GDP as Asia Pacific top performer driving power consumption. Government support for upstream exploration offering flexible service contracts, simplified approval processes, and clearer profit-sharing rules restoring investor confidence. Foreign investment in offshore reserves with companies from China, Europe, and Southeast Asia expressing interest. LNG import projects including USD 3.3 billion integrated facility joint venture between Meralco PowerGen, Aboitiz Power, and San Miguel Global Power. Modernization of refining facilities and infrastructure expansion securing energy supply. Department of Energy aggregation process combining indigenous and imported gas purchases lowering costs ensuring supply stability. Natural gas as reliable transition fuel maintaining baseload capacity stabilizing grid supporting renewable energy integration driving market growth.

Market Challenges:

• Malampaya Depletion domestic gas field expected to run dry by 2027 requiring import dependence

• Price Volatility global LNG price swings affecting local industries and household energy costs

• Geopolitical Disputes maritime issues in West Philippine Sea impacting exploration activities

• Infrastructure Delays grid connection limitations and permitting challenges slowing terminal projects

• Import Dependency reliance on foreign LNG exposing country to supply chain disruptions

• Regulatory Complexity bureaucratic hurdles dampening investor confidence in upstream sector

• Environmental Concerns balancing fossil fuel development with climate mitigation commitments

• Competition Asian buyers competing for LNG cargoes in tight global market conditions

Market Opportunities:

• Upstream Exploration developing untapped offshore reserves in West Philippine Sea and Sulu Sea

• LNG Terminal Expansion building additional receiving facilities targeting 10.72 MTPA capacity

• Long-Term Contracts transitioning from spot market to index-based pricing securing stable supply

• U.S. LNG Imports establishing supply agreements with American exporters diversifying sources

• Gas-to-Power Projects developing 29.9 GW planned gas expansion second-largest in Southeast Asia

• Renewable Integration utilizing natural gas as flexible bridge fuel supporting intermittent renewables

• Regional LNG Hub positioning Philippines as Southeast Asian liquefied natural gas distribution center

• Technology Transfer partnering with international operators enhancing domestic technical capabilities

Browse the full report with TOC and List of Figures: https://www.imarcgroup.com/philippines-oil-gas-market

Philippines Oil and Gas Market Segmentation:

By Type:

• Upstream

• Midstream

• Downstream

By Application:

• Offshore

• Onshore

By Regional Distribution:

• Luzon

• Visayas

• Mindanao

Philippines Oil and Gas Market News:

September 2025: First Gen secured permit from Energy Department to operate and maintain interim offshore LNG terminal in Batangas valid for 25 years. Permit allows operation for own use with partnership with Tokyo Gas of Japan representing initial phase of FGEN LNG Terminal certified as energy project of national significance supporting introduction of more natural gas plant generation offering flexible power to support intermittent renewable energy integration.

August 2025: Department of Energy through Oil Industry Management Bureau announced One-Stop-Shop in Palawan from August 11-15 streamlining licensing for liquefied petroleum gas retailers, dealers, and gasoline station owners. Applicants with complete documents secured License to Operate and Certificate of Compliance same day reducing travel costs and processing delays supporting small and medium operators in provinces enhancing market accessibility.

March 2025: Global energy trading house Vitol signed Philippines' first long-term LNG supply agreement with Philippines LNG Terminal for supply of 0.8 million tonnes per annum over ten years. Deal marked transition from spot market procurement to contract-based supply providing price stability and supply security. Philippines LNG Terminal together with FGEN Batangas FSRU received 19 LNG cargoes in 2024 supporting power generation needs across Luzon region.

Key Highlights of the Report:

• Market analysis projecting growth from USD 406.00 million (2024) to USD 1,448.50 million (2033) with 15.18% CAGR

• LNG infrastructure development with seven terminals under construction representing 36.5 MTPA capacity

• January 2025 Philippine Natural Gas Industry Development Act approval providing regulatory framework

• March 2025 Vitol signing first long-term LNG supply agreement for 0.8 mtpa over ten years

• Malampaya gas field depletion by 2027 driving urgency for imported LNG alternative sources

• Natural gas accounting for 22% of power generation with 46% from imported LNG

• Upstream segment dominating type category with exploration activities in offshore basins

• Luzon leading regional distribution with highest concentration of power generation demand

Frequently Asked Questions (FAQs):

Q1: What are the primary factors driving Philippines oil and gas market growth to USD 1,448.50 million by 2033?

A1: The market is driven by rising domestic energy demand with economic growth achieving 5.6% GDP as Asia Pacific top performer, government support for upstream exploration offering flexible service contracts and simplified approval processes, and foreign investment in offshore reserves with companies from China, Europe, and Southeast Asia expressing interest. LNG import projects including USD 3.3 billion integrated facility joint venture between major power companies, modernization of refining facilities and infrastructure expansion, and natural gas as reliable transition fuel maintaining baseload capacity stabilizing grid supporting renewable energy integration support the 15.18% growth rate addressing Malampaya depletion and energy security objectives.

Q2: How are LNG infrastructure development and regulatory frameworks transforming the Philippines oil and gas landscape?

A2: Seven LNG terminals at various construction stages representing 36.5 million tonnes per annum import capacity supporting power generation needs with January 2025 Philippine Natural Gas Industry Development Act providing comprehensive regulatory framework. March 2025 Vitol signing first long-term supply agreement for 0.8 mtpa over ten years marking transition from spot to contract-based procurement. Country's first operational Batangas terminal received 19 cargoes in 2024. Department of Energy aggregation process combining indigenous and imported gas purchases lowering costs ensuring supply stability. These developments position LNG infrastructure and regulatory support as fundamental drivers supporting energy transition and supply security as Malampaya field depletes by 2027.

Q3: What opportunities exist for oil and gas stakeholders in emerging Philippines market segments?

A3: Stakeholders can capitalize on upstream exploration developing untapped offshore reserves in West Philippine Sea and Sulu Sea, LNG terminal expansion building additional receiving facilities targeting 10.72 MTPA capacity, and long-term contracts transitioning from spot market to index-based pricing securing stable supply. U.S. LNG imports establishing supply agreements diversifying sources, gas-to-power projects developing 29.9 GW planned expansion second-largest in Southeast Asia, and renewable integration utilizing natural gas as flexible bridge fuel represent significant opportunities alongside regional LNG hub positioning Philippines as Southeast Asian distribution center and technology transfer partnering with international operators supporting market growth energy security and economic development objectives.

Note: If you require specific information not currently within the scope of the report, we can provide it as part of the customization.

Ask an analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=42130&flag=C

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: Sales@imarcgroup.com

Tel. No.: (D) +91 120 433 0800

Americas: +1 201-971-6302

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Philippines Oil and Gas Market 2025 | Worth USD 1,448.50 Million by 2033 | Exhibit a 15.18% CAGR here

News-ID: 4232260 • Views: …

More Releases from IMARC Group

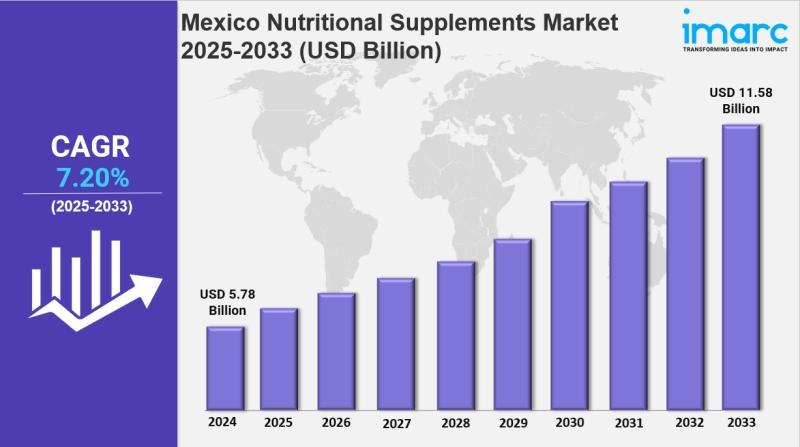

Mexico Nutritional Supplements Market Size, Growth, Latest Trends and Forecast 2 …

IMARC Group has recently released a new research study titled "Mexico Nutritional Supplements Market Size, Share, Trends and Forecast by Product Type, Form, Distribution Channel, Consumer Group, and Region, 2025-2033" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico nutritional supplements market size was valued at USD 5.78 Billion in 2024. It is…

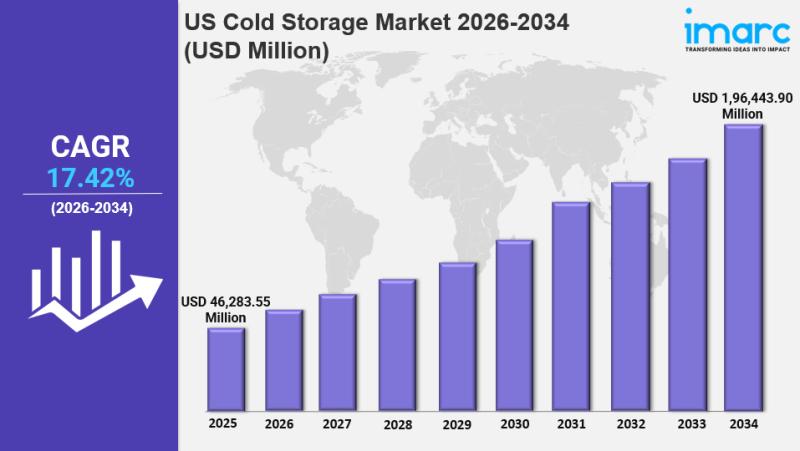

US Cold Storage Market Size, Trends, Growth and Forecast 2026-2034

IMARC Group has recently released a new research study titled "US Cold Storage Market Size, Share, Trends and Forecast by Warehouse Type, Construction Type, Temperature Type, Application, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The US cold storage market size reached USD 46,283.55 Million in 2025 and is projected to grow…

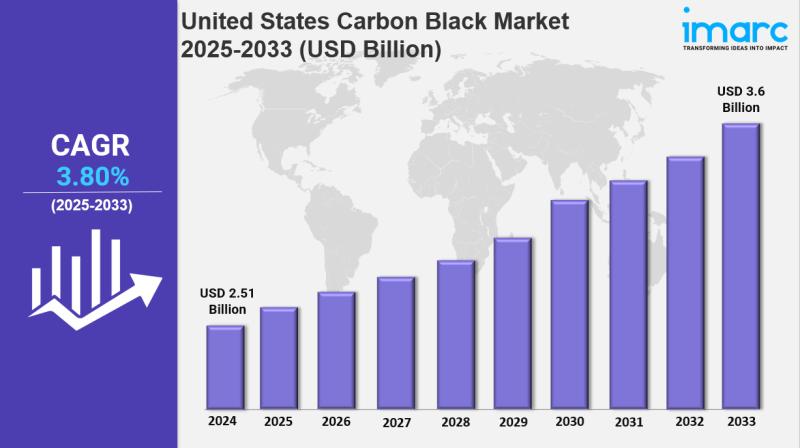

United States Carbon Black Market Size, Trends, Growth and Forecast 2025-2033

IMARC Group has recently released a new research study titled "United States Carbon Black Market Size, Share, Trends and Forecast by Type, Grade, Application, and Region, 2025-2033" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The United States carbon black market size was valued at USD 2.51 Billion in 2024 and is projected to…

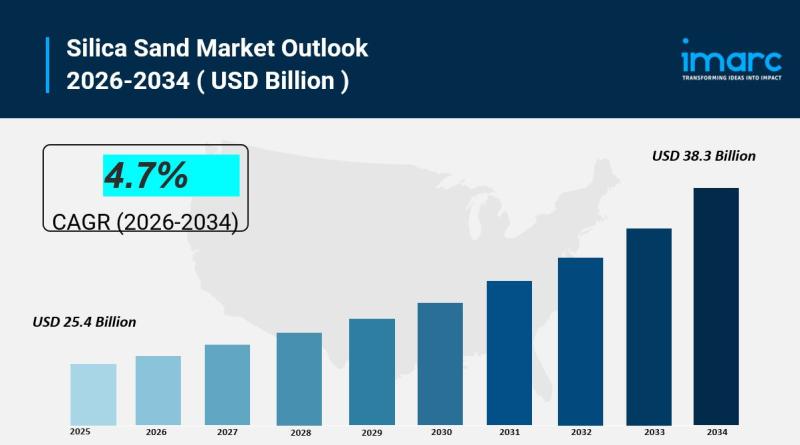

Silica Sand Market is Projected to Reach USD 38.3 Billion by 2034 | At CAGR 4.7%

Silica Sand Market Overview:

The global Silica Sand Market was valued at USD 25.4 Billion in 2025 and is forecast to reach USD 38.3 Billion by 2034, growing at a CAGR of 4.7% during 2026-2034. This growth is driven by increasing demand from the construction and glass manufacturing industries, continual advancements in hydraulic fracturing technology in oil and gas extraction, and rapid changes in environmental and regulatory landscapes.

The silica sand market…

More Releases for LNG

LNG Bunkering Market Growth, Trends & Opportunities 2025 | Top key players - Tre …

LNG Bunkering Market, as analyzed in the study by DataM Intelligence, presents a detailed overview of the industry with in-depth insights, historical data, and key statistics. The report thoroughly examines market dynamics, competitive strategies, and major players, highlighting their product lines, pricing structures, financials, growth plans, and regional outreach.

The Global LNG Bunkering Market is expected to grow at a CAGR of 66.4% during the forecasting period (2024-2031).

Get a Free Sample…

Mea Floating Lng Power Vessel Market Emerging Trends and Growth Prospects 2034 | …

On April 8, 2025, Exactitude Consultancy., Ltd. released a research report titled "Mea Floating Lng Power Vessel Market". In-depth research has been compiled to provide the most up-to-date information on key aspects of the worldwide market. This research report covers major aspects of the Mea Floating Lng Power Vessel Market including drivers, restraints, historical and current trends, regulatory scenarios, and technological advancements. It provides the industry overview with growth analysis…

What's Driving the LNG Bunkering Market Trends? Key Companies are Skangass AS., …

A research report on 'LNG Bunkering Market' Added by DEC Research features a succinct analysis on the latest market trends. The report also includes detailed abstracts about statistics, revenue forecasts and market valuation, which additionally highlights its status in the competitive landscape and growth trends accepted by major industry players.

Request a sample of this research report @ https://www.decresearch.com/request-sample/detail/702

The size of LNG Bunkering Market was registered at USD 800 Million in…

LNG Bunkering Market Key Players Polskie LNG, Eagle LNG, ENN Energy, EVOL LNG, F …

The LNG Bunkering Market report add detailed competitive landscape of the global market. It includes company, market share analysis, product portfolio of the major industry participants. The report provides detailed segmentation of the LNG Bunkering industry based on product segment, technology, end user segment and region.

As per a recent news snippet, the Caribbean is one of the most lucrative regions for LNG bunkering market, as the shipping sector seeks compliance…

LNG Bunkering Industry to surpass $12bn by 2024:ENGIE,Polskie LNG,Eagle LNG, ENN …

LNG Bunkering Market size is set to exceed USD 12 billion by 2024.Growing demand for cleaner fuel coupled with strict emission regulations to reduce the airborne emissions predominantly in North America and Europe will stimulate LNG bunkering market. In 2015, International Maritime Organization (IMO) introduced Tier III norms to curb NOx emissions from marine vessels among Emission Control Areas (ECAs) under maritime boundaries.

Request for a sample copy of this…

Global Liquefied Natural Gas (LNG) Market 2018-22 : LNG bunkering, progressing L …

ResearchMoz presents Professional and In-depth Study of "Global Liquefied Natural Gas (LNG) Market: Industry Analysis & Outlook (2018-2022)" with coming years Industries Trends, Projections of Global Growth, Major Key Player and Case Study, Review, Share, Size, Effect.

' '

Liquefied Natural Gas (LNG) is a liquid form of natural gas, which is composed mainly of methane and other gases such as Ethane, Propane, Butane and Nitrogen. LNG liquefaction is a procedure…