Press release

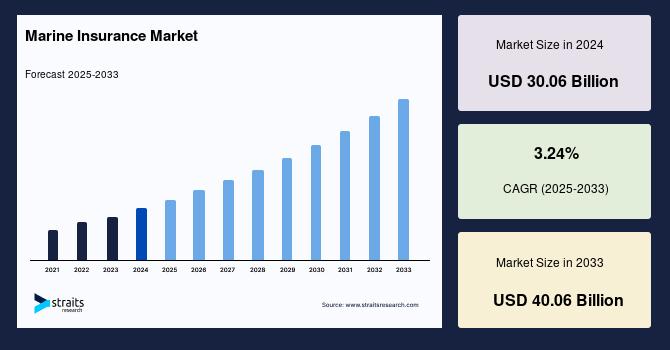

Marine Insurance Market Size Expected to Reach USD 40.06 Billion by 2033, Growing at a CAGR of 3.24%

Marine Insurance Market Outlook:Marine insurance is specifically designed to provide coverage to ship owners to mitigate the risks of unfortunate incidents or accidents that damage the property or environment and cause loss of life. It is planned to trim down the fiscal trouncing incurred by a policyholder at some point in an accident, natural disaster, or other misfortune. This kind of insurance is comprehensively practiced to cover risks like cross-border divergences, climate vulnerabilities, encounters with pirates, and other hazards correlated with these conditions. Such incidents tend to cause substantial economic loss for ship and cargo owners. Furthermore, marine insurance offers transporters colossal flexibility when deciding coverage fitting to deal with their needs. It covers personalized provisions of the cargo and ship owners in the market.

According to Straits Research, the global marine insurance market size was valued at USD 30.06 billion in 2024 and is projected to reach USD 40.06 billion by 2033, growing at a CAGR of 3.24% during the forecast period (2025 to 2033).

Download the Sample Pages of this Report for Better Understanding @ https://straitsresearch.com/report/marine-insurance-market/request-sample

Market Dynamics

Growing Awareness and Demand and Speedy Execution of Analytics and Telematics to Drive the Global Marine Insurance Market

Because marine insurance covers nearly all linked risks, it is needed globally. In addition to covering the risk, maritime insurance facilitates the execution of trade actions. Uniglobal, a renowned knowledge-sharing organization, estimates that around 85% of worldwide trade is conducted over the ocean and that thousands of cargo ships operate daily. This significantly contributes to the global economy. Moreover, ship owners, cargo owners, and charterers are quickly confronted with significant losses, such as damage to ships, cargo vessels, and terminals, resulting from massive maritime commercial operations.

Consequently, managing these risks and losses in the marine industry becomes difficult. Therefore, maritime insurance plays a crucial role in mitigating these losses. As a result of these colossal losses and the heightened vigilance of goods in warehouses, ports, and transit, there is a global demand for marine insurance.

Telematics technology is very significant in the marine field as it helps cargo and ships get information concerning real-time tracking and monitoring of telematics information regarding the movement of insured vessels. On the other hand, analytics embedded in the system help in the computational analysis of data. Additionally, an accomplishment of telematics and analytics endows the capability to correctly examine existing and upcoming risks in the marine business. Furthermore, it permits underwriters to understand the level of risk, identify the contributing elements in the losses, and consequently resolve marine insurance claims. Hence, these primary advantages and highly developed solutions delivered by telematics and analytics drive the marine insurance market growth.

IoT Integration by Insurance Providers to Create Global Marine Insurance Market Opportunities

Important industry participants continuously integrate IoT technology into their existing marine insurance product lines to enhance their offerings. This system aids in loss forecasting, oversees preclusion losses, and facilitates claims processing. This technology is a significant investment for insurers due to its ability to monitor engine performance, CO2 emissions, navigation, and cargo supply chains. This expedites streamlined support for maritime insurance immediately. Consequently, incorporating IoT in marine insurance by many industry participants is anticipated to propel market expansion throughout the forecast period.

Marine Insurance Market Segmentation

By Coverage

Cargo Insurance

Hull & Machinery Insurance

Marine Liability Insurance

Offshore Energy Insurance

By Distribution Channel

Wholesalers

Retail Brokers

Others

By End-user

Ship Owners

Traders

Get Detailed Market Segmentation @ https://straitsresearch.com/report/marine-insurance-market/segmentation

Key Highlights

Based on the coverage, the cargo insurance segment will hold the largest share and grow at a CAGR of 3.36% by 2033.

Based on the distribution channel, the wholesalers' section will have the most significant shareholding, growing at a CAGR of 2.46% by 2033.

Based on the end-user, the section of traders holds supremacy in the market and is expected to grow at a CAGR of 4.25%.

Based on regional analysis, Europe will likely command the regional market and develop at a CAGR of 2.42%.

Competitive Players

Allianz

American International Group, Inc.

Aon plc

Arthur J. Gallagher & Co.

AXA

Chubb

Lloyd's

Lockton Companies

Marsh LLC

Zurich

To Visit Here For Grab More Insights @ https://straitsresearch.com/report/marine-insurance-market

Regional Insights

Europe will likely command the regional market and develop at a CAGR of 2.42%. Europe relies heavily on the maritime industry for economic output and employment. The marine sector provides an estimated nine million jobs in countries such as the United Kingdom, Germany, and France. Therefore, marine insurance is essential for ship owners transporting goods by sea to mitigate business risks.

Several ships and cargo owners in this region obtain marine insurance to protect themselves against liabilities related to the cargo they care for and handle. Therefore, marine insurance provides cargo ship owners with freight liability insurance to cover such duties in Europe. In addition, marine companies are responsible for transporting goods that require insurance to cover loss or damage during transit, whether delivered domestically or internationally. Experts in maritime insurance and seasoned risk managers provide guidance, information, and assistance to customers while they are abroad. These are some of Europe's most significant market trends.

The Asia-Pacific is forecasted to hold the second largest share by 2033, developing at a CAGR of 4.26%. The region's demand for marine insurance has increased due to the increased movement of goods between imports, exports, and distribution centers, and the expansion of international trade ties. In addition to risk management alternatives for logistics, commercial hulls, ports, cargo terminals, and supply chains, marine insurance provides options for equipment, machinery, and property liabilities. As a result, the demand for marine insurance is growing in the Asia-Pacific area.

The rise of the Asia-Pacific industry is fueled by shipping businesses and carriers' increased reliance on marine insurance. The expansion of marine insurance players operating throughout the region due to heightened rivalry among insurance providers is a significant factor behind the growth of the marine insurance market. In addition, the Indian Insurance Regulators and Development Authority (IRDAI) founded a protection and indemnity (P&I) club in the maritime insurance market in 2021. The Indian National Ship Owners Association (INSA) and the authorities worked together on the project, enabling the nation's marine insurance market to expand. Since it provides protection and indemnity insurance for ship owners, it is projected that this would contribute to the growth of the marine insurance market.

Recent Developments

In May 2022, Marsh LLC launched a renewable energy facility to mitigate risks associated with mid-scale solar and battery energy storage systems.

In June 2022, Lockton launched the Ransomware Playbook, which helps organizations, their leadership, and risk professionals understand the nature of ransomware threats and provides solutions to mitigate them.

Inquiry Before Buying @ https://straitsresearch.com/buy-now/marine-insurance-market

List of Related Reports:

Reinsurance Market Size: https://straitsresearch.com/report/reinsurance-market

Specialty Insurance Market Size: https://straitsresearch.com/report/specialty-insurance-market

Insurance Analytics Market Size: https://straitsresearch.com/report/insurance-analytics-market

Insurance Third Party Administration Market Size: https://straitsresearch.com/report/insurance-third-party-administration-market

Term Insurance Market Size: https://straitsresearch.com/report/term-insurance-market

Contact Us:

Email: sales@straitsresearch.com

Tel: +1 646 905 0080 (U.S.), +44 203 695 0070 (U.K.)

Website: https://straitsresearch.com

About Us:

StraitsResearch.com is a leading market research and market intelligence organization, specializing in research, analytics, and advisory services, along with providing business insights & market research reports.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Marine Insurance Market Size Expected to Reach USD 40.06 Billion by 2033, Growing at a CAGR of 3.24% here

News-ID: 4231081 • Views: …

More Releases from Straits Research

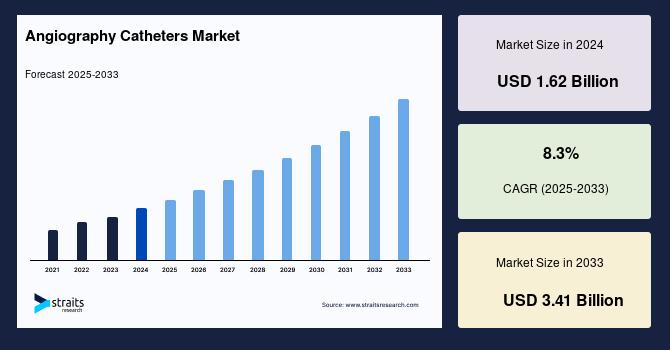

Angiography Catheters Market Size to Reach USD 3.41 Billion by 2033, Driven by R …

The global angiography catheters market is experiencing strong momentum, driven by the growing burden of cardiovascular diseases (CVDs), rising preference for minimally invasive diagnostic and interventional procedures, and ongoing innovations in catheter-based imaging technologies. Industry estimates indicate that the market is expected to expand from USD 1.8 billion in 2025 to USD 3.41 billion by 2033, progressing at a compound annual growth rate (CAGR) of 8.3% over the forecast period.

Angiography…

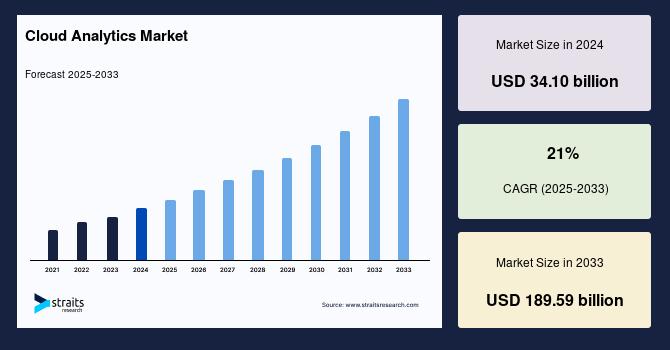

Cloud Analytics Market Size Set to Surge to USD 189.59 Billion by 2033 | Massive …

The global cloud analytics market is poised for exceptional growth as organisations leverage the power of the cloud to collect, analyse and visualise large volumes of data for actionable business insights. According to recent research, The global cloud analytics market size was worth USD 34.10 billion in 2024 and is estimated to reach an expected value of USD 189.59 billion by 2033, growing at a CAGR of 21% during the…

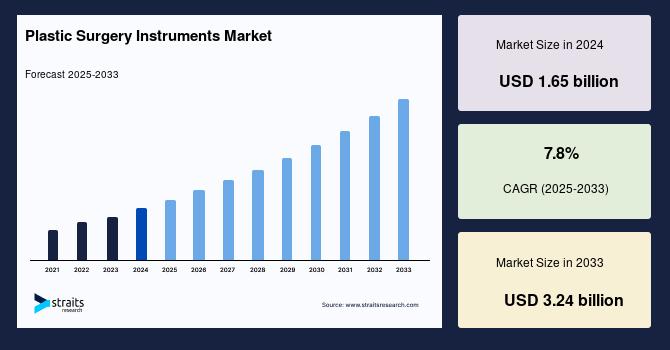

Plastic Surgery Instruments Market Size to Reach USD 3.24 Billion by 2033 | Glob …

The global plastic surgery instruments market is witnessing robust expansion, driven by the rising demand for cosmetic and reconstructive surgeries worldwide. According to a new study by Straits Research, the market size is estimated at USD 1.78 billion in 2025 and is projected to reach USD 3.24 billion by 2033, reflecting a compound annual growth rate (CAGR) of 7.8% during the forecast period (2025-2033).

The rising popularity of aesthetic enhancement procedures…

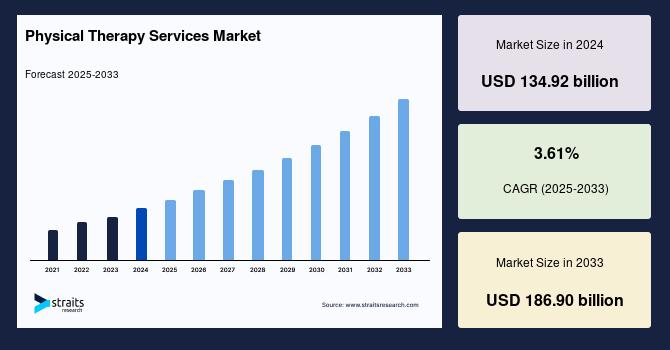

Physical Therapy Services Market Outlook 2025-2033: Rise of Home-Based Care and …

The global physical therapy services market is witnessing significant expansion, fueled by the growing prevalence of chronic diseases, increasing sports-related injuries, and technological innovations such as tele-rehabilitation and AI-based therapy platforms. According to Straits Research, the global market size is estimated at USD 140.69 billion in 2025 and is projected to reach USD 186.90 billion by 2033, exhibiting a steady CAGR of 3.61% during the forecast period.

Read the full report…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…