Press release

Global organochlorine pesticides Market is projected to reach the value of $500 Billion by 2030.

In 2024, the Global organochlorine pesticides Market was valued at $380.76 Billion, and is projected to reach a market size of $500 Billion by 2030. Over the forecast period of 2025-2030, market is projected to grow at a CAGR of 5.6%.According to the report published by Virtue Market Research The organochlorine pesticides market is an important segment of the global agricultural industry. These chemicals have been used for decades to control pests and protect crops. Understanding the key factors driving this market helps reveal how it is evolving in response to both long-term challenges and short-term developments. This article explores a significant long-term market driver, the impact of COVID-19, a current short-term driver, a notable opportunity, and a key trend in the organochlorine pesticides industry.

Request Sample Copy of this Report @ https://virtuemarketresearch.com/report/organochlorine-pesticides-market/request-sample

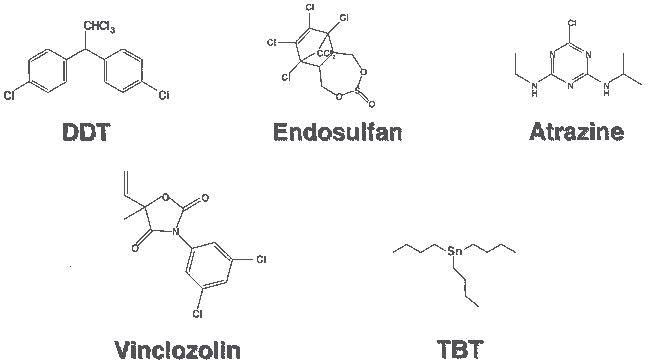

One major long-term market driver for the organochlorine pesticides industry is the continuous need for effective pest control in agriculture. Farmers and agricultural businesses rely on these chemicals to protect their crops from pests and diseases. Organochlorine pesticides, like DDT and Lindane, have been used for many years because they are effective at killing a wide range of insects that harm crops. The constant demand for these pesticides comes from the need to maintain high crop yields and ensure food security for the growing global population. As pests evolve and become resistant to older methods, there is a persistent need for reliable solutions to manage these challenges.

The COVID-19 pandemic has also had a noticeable impact on the organochlorine pesticides market. During the pandemic, disruptions in global supply chains affected many industries, including agriculture. Lockdowns and restrictions led to delays in the production and distribution of pesticides. Many manufacturers faced challenges in sourcing raw materials and shipping finished products. This situation temporarily slowed down the growth of the organochlorine pesticides market. However, as the world starts to recover from the pandemic, there is a gradual return to normalcy in the agricultural sector. The focus on increasing agricultural productivity and ensuring food security has led to a renewed emphasis on effective pest control solutions, including organochlorine pesticides.

A current short-term market driver for the organochlorine pesticides industry is the increasing awareness of crop protection and food security. Recently, there has been a surge in efforts to boost agricultural productivity to meet the demands of a growing global population. Farmers are seeking effective ways to protect their crops from pests and diseases to ensure a stable food supply. This has led to a short-term increase in the demand for organochlorine pesticides as farmers look for reliable products to manage pest problems and maximize their crop yields.

An important opportunity in the organochlorine pesticides market is the development of new, more environmentally friendly pesticides. With increasing awareness of environmental issues, there is a growing demand for pesticides that have less impact on the environment. Companies in the industry have the chance to innovate and develop new organochlorine pesticides that are effective but also safer for the environment. This opportunity allows companies to meet regulatory requirements and address the concerns of consumers who are looking for sustainable agricultural practices.

One significant trend in the organochlorine pesticides industry is the shift towards more regulated and controlled use of these chemicals. Over the years, there has been a growing emphasis on the safe use of pesticides due to concerns about their environmental and health impacts. Governments and environmental agencies have introduced stricter regulations to ensure that pesticides are used in ways that are safe for people and the environment. This trend towards regulation is shaping the market, as companies must adapt to new rules and focus on developing products that meet these higher standards.

Segmentation Analysis:

The global organochlorine pesticides Market segmentation includes:

By Product: Conventional Chemicals, Herbicides, Fungicides, Insecticides

Bio-pesticides- Bio Control Agents, Plant-Incorporated Protectants

In the global organochlorine pesticides market, insecticides are the largest segment. These chemicals are essential in agriculture for controlling pests that damage crops and reduce yields. The substantial share of insecticides in the market is due to their effectiveness in managing a wide range of insects that threaten agricultural productivity. Insecticides like DDT and Lindane have historically been dominant due to their potent effects against pests. Despite stringent regulations and the development of alternative solutions, insecticides remain critical for managing pest populations, making them the largest product category in the organochlorine pesticides market.

The fastest-growing segment in the organochlorine pesticides market is bio-pesticides. This growth is driven by increasing environmental awareness and the demand for sustainable agricultural practices. Bio-pesticides, which include natural products such as plant extracts and microbial agents, are experiencing rapid expansion due to their eco-friendly nature compared to traditional chemical pesticides. This segment is anticipated to expand at a robust annual growth rate of 10.1% as consumers and agricultural stakeholders shift towards greener alternatives to conventional organochlorine pesticides.

By End User: Row Crops, Fruits & Vegetables, Turfs & Ornamentals, Horticulture, Other Crop Types

In the end-user segment of the organochlorine pesticides market, row crops represent the largest share. Row crops, which include major agricultural products such as corn, soybeans, and wheat, utilize a significant portion of the pesticides produced worldwide. Approximately 32% of the global insecticides are used for row crops due to their large-scale cultivation and high economic value. The extensive use of organochlorine pesticides in row crops is driven by the need to protect these crops from various pests and diseases, which can otherwise lead to substantial yield losses.

The fastest-growing segment among end-users of organochlorine pesticides is fruits and vegetables. This growth is attributed to the increasing demand for fresh produce and the need to manage pests that affect these high-value crops. As global awareness of healthy eating and dietary choices rises, the cultivation of fruits and vegetables has expanded, leading to a higher use of pesticides in this sector. The growth in the fruits and vegetables segment reflects both the increasing consumption of these products and the ongoing efforts to maintain their quality through effective pest control measures.

Read More @https://virtuemarketresearch.com/report/organochlorine-pesticides-market

Read More @https://virtuemarketresearch.com/report/organochlorine-pesticides-market

Regional Analysis:

In terms of geography, China is the largest market for organochlorine pesticides. In 2021, China accounted for about 44% of the global revenue from pesticide sales. The country's vast agricultural sector and large population contribute significantly to the demand for pesticides. China's position as the largest market is due to its extensive crop production activities and the high demand for pest control solutions to support its food supply chain. Local manufacturers in China benefit from government support and favorable industry policies, which bolster the country's dominant role in the global organochlorine pesticides market.

The Asia-Pacific region is the fastest-growing region in the organochlorine pesticides market. This growth is driven by rapid industrialization, increased agricultural activities, and the rising need for pest management solutions across a diverse range of crops. The region's expanding agricultural sector and growing population fuel the demand for effective pest control products. Countries in Asia-Pacific are increasingly adopting both traditional and innovative pest control methods, which contributes to the region's high growth rate in the organochlorine pesticides market.

Latest Industry Developments:

Emphasis on Sustainable and Eco-Friendly Pesticides

Companies in the organochlorine pesticides market are increasingly focusing on developing and marketing more sustainable and environmentally friendly products. This trend is driven by growing environmental awareness among consumers and stricter regulations imposed by governments worldwide. Recent developments include the advancement of new formulations and the introduction of innovative organochlorine-based products designed to minimize environmental impact. Companies are investing in research and development to create pesticides that are effective against pests while also addressing concerns about environmental degradation. This shift towards sustainability is expected to attract eco-conscious customers and strengthen market positions in a competitive industry.

Strategic Partnerships and Collaborations for Market Expansion

Another significant trend is the formation of strategic partnerships and collaborations aimed at expanding market reach and enhancing product offerings. Companies are actively seeking alliances with research institutions, agricultural technology firms, and other industry players to leverage combined expertise and resources. For example, recent collaborations focus on co-developing advanced organochlorine pesticides and exploring new applications for these chemicals. Such partnerships help companies access new markets, share research costs, and accelerate product development processes. By working together with other entities, companies can expand their market presence and drive growth through joint ventures and collaborative research efforts.

Investment in Advanced Production Technologies

Companies are also investing in advanced production technologies to improve the efficiency and effectiveness of organochlorine pesticide manufacturing processes. This trend includes the adoption of state-of-the-art equipment and technologies to enhance production capabilities, reduce costs, and ensure consistent product quality. Recent investments in automation, digitalization, and process optimization are enabling companies to increase production volumes and streamline operations. These technological advancements help companies meet rising demand, achieve economies of scale, and maintain a competitive edge in the market. By focusing on production efficiency, companies can improve their profitability and strengthen their market position.

customize the Full Report Based on Your Requirements @https://virtuemarketresearch.com/report/organochlorine-pesticides-market/customization

CONTACT US :

Virtue Market Research

Kumar Plaza, #103, SRPF Rd, Ramtekadi, Pune, Maharashtra 411013, India

E-mail: megha@virtuemarketresearch.com

Phone: +1-917 436 1025

ABOUT US :

Virtue Market Research is a strategic management firm helping companies to tackle most of their strategic issues and make informed decisions for their future growth. We offer syndicated reports and consulting services. Our reports are designed to provide insights on the constant flux in the global demand-supply gap of markets.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global organochlorine pesticides Market is projected to reach the value of $500 Billion by 2030. here

News-ID: 4229604 • Views: …

More Releases from Virtue Market Research

Global Probiotic Soap and Detergent Market is projected to reach the value of US …

According to the report published by Virtue Market Research in Global Probiotic Soap and Detergent Market was valued at USD 6.75 Million in 2024 and is projected to reach a market size of USD 16.1 Million by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 15.6%.

Request Sample Copy of this Report @ https://virtuemarketresearch.com/report/probiotic-soaps-and-detergent-market/request-sample

The long-term growth of the probiotic…

The Global Polyester Soft Toys Market is expected to reach USD 12.33 billion by …

According to the report published by Virtue Market Research in Global Polyester Soft Toys Market was valued at USD 9.3 billion in 2024 and will grow at a CAGR of 5.8% from 2025 to 2030. The market is expected to reach USD 12.33 billion by 2030.

Request Sample Copy of this Report @ https://virtuemarketresearch.com/report/polyester-soft-toys-market/request-sample

The polyester soft toys market has evolved into a vibrant and competitive industry shaped by changing consumer habits,…

Global Pet Ball Launcher Market is projected to reach the value of USD 3.93 Bill …

According to the report published by Virtue Market Research in Global Pet Ball Launcher Market was valued at USD 2.8 Billion in 2024 and is projected to reach a market size of USD 3.93 Billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 5.8%.

Request Sample Copy of this Report @ https://virtuemarketresearch.com/report/pet-ball-launcher-market/request-sample

One of the major long-term drivers…

Global Organotin Compounds Market is projected to reach the value of USD 2.97 Bi …

According to the report published by Virtue Market Research in Global Organotin Compounds Market was valued at USD 2.2 Billion and is projected to reach a market size of USD 2.97 Billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 5.1%.

Request Sample Copy of this Report @ https://virtuemarketresearch.com/report/organotin-compounds-market/request-sample

One of the major long-term drivers of the organotin…

More Releases for Companies

Top Indian Handicrafts Companies [2025] : Leading Brands and Manufacturing Compa …

Market Dynamics of Top Indian Handicrafts Companies 2025

Industry Expansion:

The Indian handicrafts industry has witnessed remarkable growth, supported by rising global demand for handmade products, government export promotion initiatives, and increasing consumer preference for sustainable and authentic designs. Companies like Fabindia, Jaipur Rugs, and Craftsvilla have gained strong market positions, with Fabindia leading in ethnic lifestyle products and Jaipur Rugs focusing on artisan-driven global appeal. Small and mid-sized enterprises across states…

saudi arabia construction company,engineering consultant companies in saudi arab …

AK Group

Al Judee Holding

Al Shatii Projects Contracting Co

Al Suroor United Group

Al Yamama Company

Alesayi Development Company (ADCO)

Alfanar

Almeer Saudi Technical Services Co

Alrabiah Consultants And Engineers

Alshalawi holding

Arabian Consulting Engineering Centre (ACEC)

Asas Dar

Assad Said for Contracting Co Ltd

Battoyor Holding Company

https://gzwatches.cn/

Free engineering construction consultation

Email: nolan@toolcabinetrolling.com

Bechtel

Bin Dayel Contracting

Construction Technical Services Arabia (CTSA)

Contracting Construction Enterprises

Dar Al Riyadh

ETE Buildings & Engineering

East Consulting Engineering Center

El Seif Engineering Contracting Company

FCC Company

JNCO

Masar Consulting Engineer

Nesma Partners

RAM Contracting

STFA Investment Holding Group

Saipem

Salini Impregilo S.P.A

Saudi…

List of engineering companies in UAE, List of Engineering Contracting companies …

ABU Hussain Co LLC

ACCL International

AE 7 LLC

AECOM

AL Faisaliyah Contracting LLC

AL Reyami Group

AL Rostamani Group Of Companies

ALEC

https://szwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

ALSA Engineering & Construction Company

AMB Hertel

ANC Holdings LLC

Abu Dhabi Construction Company (ADCC)

Afreen Building Materials Trading Co LLC

Al Ahd General Contracting LLC - AGCM

Al Ahli Holding Group

Al Asab General Transport & Contracting Establishment

Al Fara'a General Contracting

Al Futtaim Carillion

Al Hussain General Contracting

Al Marwan Group Holding

Al Naboodah Construction Group LLC

Al Nasr Contracting Company L.L.C

Al Rakha…

List of China's top engineering companies, list of China's engineering consultin …

1. China National Nuclear Corporation Limited

2. China Aerospace Science and Technology Corporation Limited

https://african-digest.com/

Free engineering consultation

Email:nolan@wholsale9.com

3. China Aerospace Science and Industry Corporation Limited

4. Aviation Industry Corporation of China LTD

5. China State Shipbuilding Corporation Limited

6. China North Industries Group Co., LTD

7. China Ordnance Equipment Group Co. LTD

8. China Electronics Technology Group Co., LTD

9. Aero Engine Group Corporation of China LTD

10. China Rongtong Asset Management Group Co. LTD

11. China National Petroleum Corporation Limited

12.…

List of China engineering companies, list of European engineering companies, lis …

ACS ACTIVIDADES DE CONSTRUCCIÓN Y SERVICIOS SA, Madrid, Spain†

HOCHTIEF AG, Essen, Germany†

https://oberlodropship.com/

Free engineering consultation

Email:nolan@wholsale9.com

VINCI, Rueil-Malmaison, France†

CHINA COMMUNICATIONS CONSTRUCTION GROUP LTD., Beijing, China†

BOUYGUES, Paris, France†

STRABAG SE, Vienna, Austria†

POWER CONSTRUCTION CORP. OF CHINA, Beijing, China†

SKANSKA AB, Stockholm, Sweden†

CHINA STATE CONSTRUCTION ENGINEERING CORP. LTD., Beijing, China†

FERROVIAL, Madrid, Spain†

CHINA RAILWAY CONSTRUCTION CORP. LTD., Beijing, China†

FLUOR, Irving, Texas, U.S.A.†

CHINA RAILWAY GROUP LTD., Beijing, China†

SAIPEM SPA, San Donato Milanese, Italy†

EIFFAGE, Velizy-Villacoublay, France†

HYUNDAI ENGINEERING & CONSTRUCTION CO.…

US Residential Construction Companies Database (49,000 companies)

We are delighted to announce the addition of the US Residential Construction Companies Database to our catalogue, containing nearly 50,000 residential construction companies in the United States.

US Residential Construction Companies Database (49,000 companies) is an Excel spreadsheet containing a list of the largest Residential Construction Companies in the United States. The combined list includes the largest residential construction companies within each of 49 states. This database contains the leading companies…