Press release

Cloud Computing's Influence On The Thriving Digital Insurance Platform Market: Critical Driver Shaping the Global Digital Insurance Platform Market in 2025

Use code ONLINE20 to get 20% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.Digital Insurance Platform Market Size Valuation Forecast: What Will the Market Be Worth by 2025?

The market size of the digital insurance platform has experienced significant growth over the past few years. Its growth is expected to progress from a value of $137.75 billion in 2024 to an estimated $152.78 billion in 2025, indicating a Compound Annual Growth Rate (CAGR) of 10.9%. Factors that have contributed to this growth in the past include customer preference for flawless digital interfaces, regulatory modifications prompting digital transformation, the international expansion of insurance services, the rise of new distribution pathways, as well as operational effectiveness and cost cutting.

Digital Insurance Platform Market Size Forecast: What's the Projected Valuation by 2029?

The forthcoming years are set to witness substantial expansion in the digital insurance platform market, with predictions indicating it will reach an astonishing $265.5 billion by the year 2029, boasting a compound annual growth rate (CAGR) of 14.8%. This progress in the forecasted period is largely a result of an intensified focus on customer involvement, the emergence of usage-based insurance models, broader digital ecosystems, attention towards climate and environmental concerns, and growing anxiety about cybersecurity. Significant trends expected to shape this period include alliances with insurtech startups, integrations with IoT devices, enhancements in blockchain technology, the appliance of artificial intelligence for automatization, and the introduction of on-demand insurance models.

View the full report here:

https://www.thebusinessresearchcompany.com/report/digital-insurance-platform-global-market-report

What Are the Drivers Transforming the Digital Insurance Platform Market?

The escalation in the use of cloud computing is poised to drive the progression of the digital insurance platform market. Cloud computing is essentially a technology that provides customers with access to storage areas, files, applications, and databases through various devices connected to the internet, such as desktops, laptops, tablets, and sensors. These cloud services are advantageous to the digital insurance platform market as they analyze and store data at a place distinct from their clients. For instance, in April 2024, the European Commission, a government entity based in Belgium, stated that 77.6% of prominent businesses used cloud computing services in 2023, a growth of 6 percentage points from 2021. As for enterprises of medium size, 59% accessed cloud services in 2023, a rise from 53% in 2021. Small businesses also saw a spike in cloud usage, with the rate jumping up by 3.8 percentage points and hitting 41.7% in the same timeframe. Hence, the rising acceptance of the cloud is propelling the expansion of the digital insurance platform market.

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=10264&type=smp

What Long-Term Trends Will Define the Future of the Digital Insurance Platform Market?

The ascent of technological progress is a central trend emerging in the digital insurance platform market. Premier businesses active in this industry are embracing new technologies to maintain their market standing. To exemplify, Sapiens International Corporation, a dynamic software solutions enterprise based in Israel, launched an intelligent insurance platform powered by AI in June 2024. This innovative, integrated, cloud-native solution is set to bolster insurer capabilities. The aim of this platform is to refine operational procedures and enhance decision-making processes within different insurance sectors. Given the escalating pressure on insurers to boost efficiency and customer service, tools such as the Sapiens Insurance Platform are anticipated to be vital in achieving these targets.

Which Segments in the Digital Insurance Platform Market Offer the Most Profit Potential?

The digital insurance platformmarket covered in this report is segmented -

1) By Deployment: Cloud, On-Premise

2) By Professional Service: Consulting, Implementation, Support And Maintenance

3) By Organization Size: Large Enterprises, Small And Medium Enterprises

4) By Application: Automotive And Transportation, Home And Commercial Buildings, Life And Health, Business And Enterprise, Consumer Electronics, Industrial Machines, Travel

5) By End-User: Insurance Companies, Third-Party Administrators And Brokers, Aggregators

Subsegments:

1) By Cloud: Public Cloud, Private Cloud, Hybrid Cloud, On-Premise

2) By On-Premise Software Solutions: On-Premise Software Solutions, Custom On-Premise Deployments

Tailor your insights and customize the full report here:

https://www.thebusinessresearchcompany.com/customise?id=10264&type=smp

Which Firms Dominate the Digital Insurance Platform Market by Market Share and Revenue in 2025?

Major companies operating in the digital insurance platform market include International Business Machines Corporation, Microsoft Corp., Infosys Ltd., Pegasystems Inc., Oracle Corp., accenture* Inc., Tata Consultancy Services Limited, Cognizant Technology Solutions Corp., Majesco Inc., DXC Technology Co., Appian Corp., Mindtree Ltd., Prima Solutions SA, SAP SE, EIS Software Limited, Fineos Corporation Ltd., Inzura Limited, Cogitate Technology Solutions Inc., OutSystems Inc., PolicyBazaar.com, PolicyGenius Inc., PolicyPal Network Technology Co. Ltd., PolicyX.com, Quantemplate Technologies Inc., Root Insurance Company, Slice Labs Inc., Trov Inc., Wefox Group GmbH, Zego Insurance Services Limited, Acko General Insurance Limited, Cover Genius Pty. Ltd., Shift Technology Inc.

Which Regions Offer the Highest Growth Potential in the Digital Insurance Platform Market?

North America was the largest region in the digital insurance platform market in 2024. Asia-Pacific is expected to be the fastest-growing region in the global digital insurance platform market during the forecast period. The regions covered in the digital insurance platform market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa

Purchase the full report today:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=10264

This Report Supports:

1.Business Leaders & Investors - To identify growth opportunities, assess risks, and guide strategic decisions.

2.Manufacturers & Suppliers - To understand market trends, customer demand, and competitive positioning.

3.Policy Makers & Regulators - To track industry developments and align regulatory frameworks.

4.Consultants & Analysts - To support market entry, expansion strategies, and client advisory work.

Speak With Our Expert:

Saumya Sahay,

Americas: +1 310-496-7795,

Asia: +44 7882 955267 & +91 8897263534,

Europe: +44 7882 955267,

Email: saumyas@tbrc.info

The Business Research Company - www.thebusinessresearchcompany.com

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Cloud Computing's Influence On The Thriving Digital Insurance Platform Market: Critical Driver Shaping the Global Digital Insurance Platform Market in 2025 here

News-ID: 4228691 • Views: …

More Releases from The Business Research Company

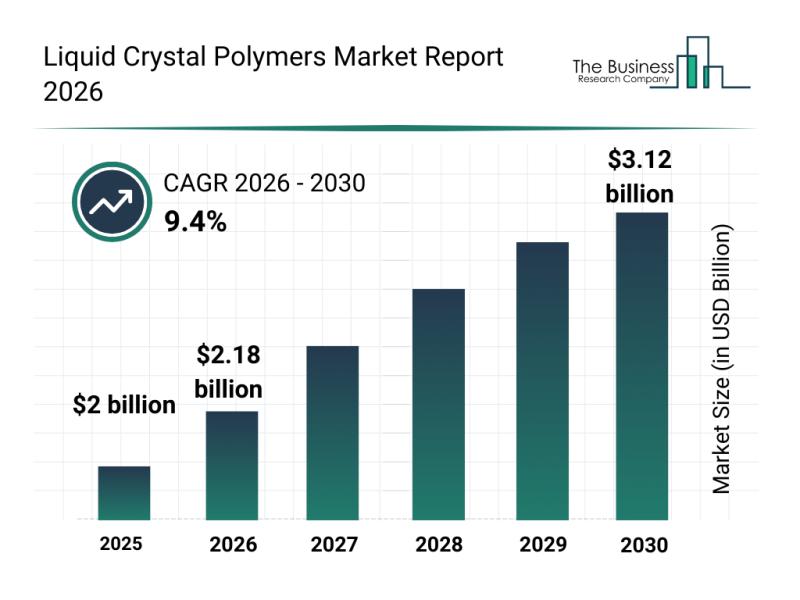

Leading Companies Fueling Growth and Innovation in the Liquid Crystal Polymers M …

The liquid crystal polymers market is poised for significant expansion in the coming years, driven by rising demand across multiple high-tech sectors. As industries increasingly adopt these advanced materials for their superior properties, the market outlook appears robust. Let's explore the market's size predictions, key players, emerging trends, and detailed segmentation to understand the future trajectory of liquid crystal polymers.

Forecasted Expansion of the Liquid Crystal Polymers Market by 2030 …

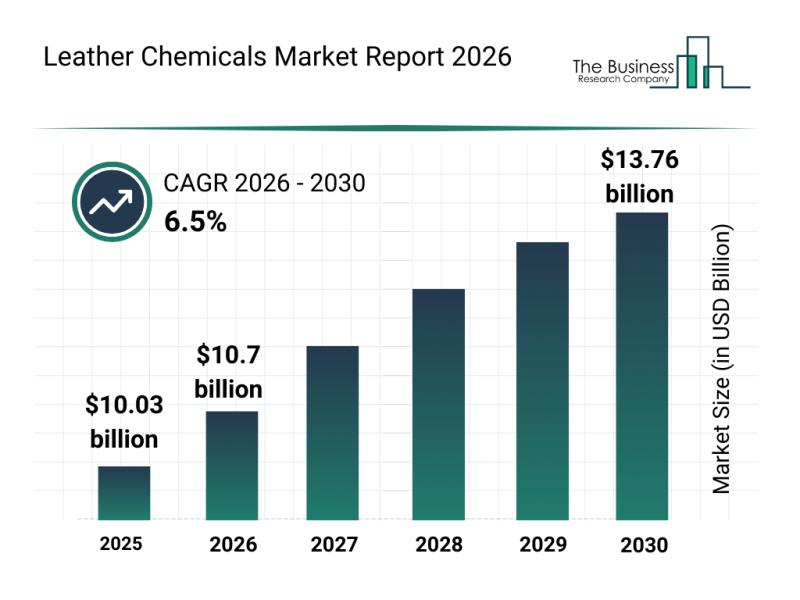

Leather Chemicals Market Overview: Major Segments, Strategic Developments, and L …

The leather chemicals industry is set for significant growth as it adapts to evolving environmental standards and increasing demand within related markets. With sustainability and efficiency becoming key priorities, innovations and strategic collaborations are paving the way for new advancements. Below is an in-depth examination of the projected market size, leading companies, emerging trends, and detailed segment analysis shaping the future of leather chemicals.

Expected Market Size and Growth Outlook for…

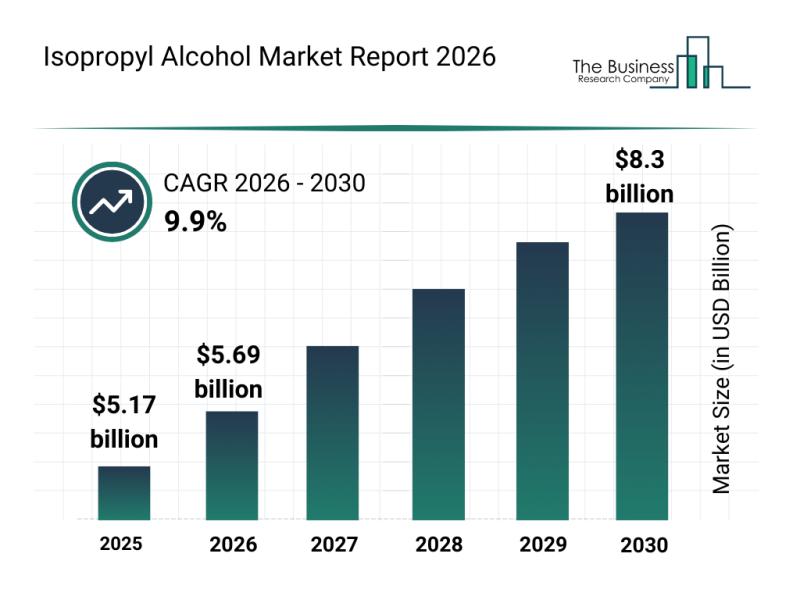

Analysis of Segments and Major Growth Areas in the Isopropyl Alcohol Market

The isopropyl alcohol market is positioned for significant expansion as demand continues to grow across various sectors. Increasing investments in healthcare, rising sanitation needs, and the expansion of specialty chemical manufacturing are some of the key factors driving market growth. Let's explore the market valuation, leading players, emerging trends, and segment details that define this evolving industry.

Expected Growth Trajectory of the Isopropyl Alcohol Market

The isopropyl alcohol market is…

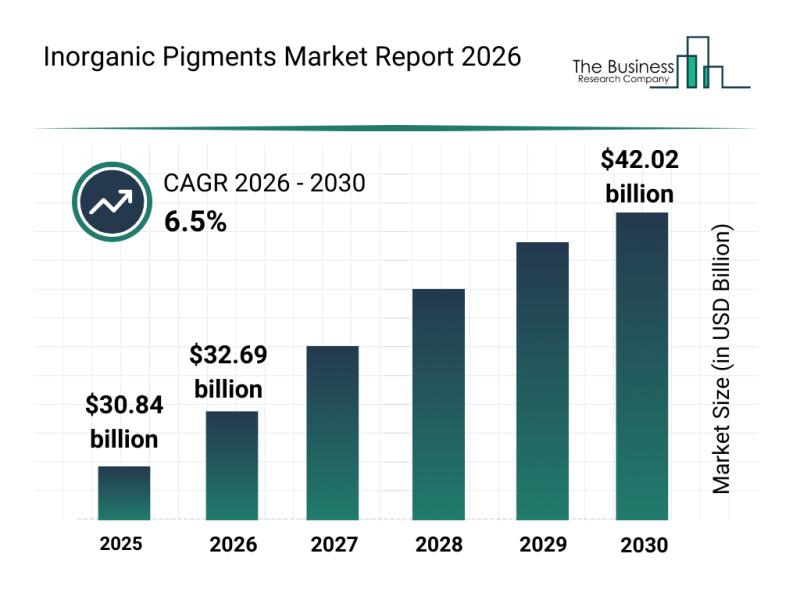

Key Strategic Developments and Emerging Changes Shaping the Inorganic Pigments M …

The inorganic pigments market is poised for significant expansion as industries increasingly seek sustainable and high-performance coloring solutions. With a growing emphasis on eco-friendly products and advanced applications, this market is set to evolve considerably by 2030. Let's explore the market size projections, leading companies, emerging trends, and key segments shaping the inorganic pigments landscape.

Projected Growth Trajectory of the Inorganic Pigments Market

The inorganic pigments market is expected to…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…