Press release

Australia Industrial Robotics Market 2025 | Worth USD 1,848.9 Million by 2033

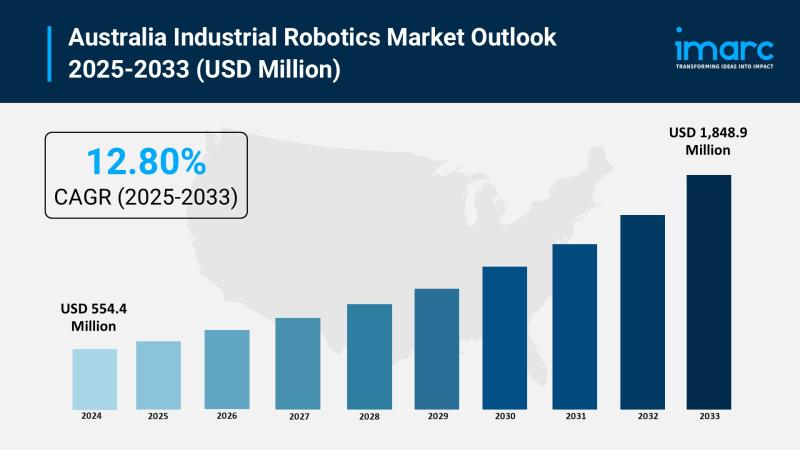

The latest report by IMARC Group, "Australia Industrial Robotics Market Size, Share, Trends and Forecast by Type, Function, End Use Industry, and Region, 2025-2033," provides an in-depth analysis of the Australia industrial robotics market. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Australia industrial robotics market size reached USD 554.4 million in 2024 and is projected to grow to USD 1,848.9 million by 2033, exhibiting a robust growth rate of 12.80% during the forecast period.Report Attributes and Key Statistics:

Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 554.4 Million

Market Forecast in 2033: USD 1,848.9 Million

Growth Rate (2025-2033): 12.80%

Australia Industrial Robotics Market Overview:

The Australia industrial robotics market is experiencing robust growth driven by National Robotics Strategy unveiled June 2024 targeting AUD 170-600 billion annual GDP contribution by 2030 with 50-150% productivity growth, rising labor costs and workforce shortages propelling automation adoption across manufacturing sectors, and collaborative robots enhancing SME operational efficiency up to 50% in food processing. AUD 15 billion National Reconstruction Fund and Industry Growth Program support deployment. Government regulatory frameworks planned by 2026 for delivery robots position robotics as strategic priority transforming industrial operations and addressing demographic challenges.

Request For Sample Report: https://www.imarcgroup.com/australia-industrial-robotics-market/requestsample

Australia Industrial Robotics Market Trends:

Australia industrial robotics market trends include National Robotics Strategy implemented June 2024 establishing framework for world-leading development, manufacturing, and responsible technology use targeting AUD 170-600 billion annual GDP addition by 2030 with 50-150% productivity increase. Collaborative robot adoption accelerates with SMEs achieving 50% operational efficiency gains particularly in food processing and packaging eliminating caged environments enabling safe human-robot collaboration. Delivery robot regulatory frameworks planned by 2026 with pilot projects including "Ari" developed by Monash University for controlled campus and mall environments. SwarmFarm Robotics secured USD 30 million Series B funding expanding autonomous agricultural robots into North America. Industry 4.0 integration advances with AI-powered predictive maintenance and real-time data analytics. Mining sector leads automation with autonomous drilling, inspection, and transportation. Regional pilot programs support agriculture and resource extraction adoption.

Australia Industrial Robotics Market Drivers:

Australia industrial robotics market drivers include National Robotics Strategy launched June 2024 projecting AUD 170-600 billion annual GDP contribution by 2030 with 50-150% productivity growth supported by AUD 15 billion National Reconstruction Fund targeted industry investments. Collaborative robots enhancing SME efficiency up to 50% in food processing confirmed early 2025 democratizing automation without expensive safety barriers. SwarmFarm Robotics raised USD 30 million Series B 2025 scaling autonomous farm-bots expanding North America operations. Labor shortages intensifying with aging workforce and skills gaps particularly affecting manufacturing, mining, agriculture, and logistics requiring automation solutions. Mining sector expansion in Western Australia and Queensland deploying autonomous drilling and inspection technologies. Government Industry 4.0 initiatives including Advanced Robotics for Manufacturing Hub Queensland facilitating testing and implementation. Sensor and AI technology advancements enabling predictive maintenance. Rising operational costs driving productivity investments. COVID-19 legacy highlighting manual labor vulnerabilities accelerating robotic technology adoption.

Market Challenges:

• High Upfront Costs limiting SME access to advanced robotics systems and capital requirements

• Skills Shortages restricting qualified personnel for installation, operation, and maintenance

• Legacy Infrastructure complicating integration with existing equipment requiring costly retrofits

• Geographic Remoteness increasing import logistics costs and component availability challenges

• Workforce Resistance creating adoption barriers in traditional manufacturing sectors

• Regulatory Uncertainty affecting autonomous robot deployment particularly delivery applications

• ROI Uncertainty deterring SME investments despite government incentives and subsidies

Market Opportunities:

• Agricultural Automation deploying autonomous tractors and harvesting robots addressing labor shortages

• Food Processing implementing cobots for packaging, sorting, and quality control operations

• Warehousing Logistics integrating AGVs and robotic picking for e-commerce fulfillment

• Mining Expansion supplying autonomous equipment for remote dangerous operations

• Local Manufacturing developing Australian-designed solutions reducing import dependency

• SME Financing providing accessible leasing and subscription models lowering entry barriers

• Regional Programs expanding subsidies for agriculture and resource extraction automation

Browse the full report with TOC and List of Figures: https://www.imarcgroup.com/australia-industrial-robotics-market

Australia Industrial Robotics Market Segmentation:

By Type:

• Articulated Robots

• Cartesian Robots

• SCARA Robots

• Cylindrical Robots

• Parallel Robots

• Others

By Function:

• Soldering and Welding

• Materials Handling

• Assembling and Disassembling

• Painting and Dispensing

• Milling, Cutting and Processing

• Others

By End Use Industry:

• Automotive

• Electrical and Electronics

• Chemical, Rubber and Plastics

• Machinery and Metals

• Food and Beverages

• Precision and Optics

• Pharmaceutical

• Others

By Regional Distribution:

• Australian Capital Territory & New South Wales

• Victoria & Tasmania

• Queensland

• Northern Territory & South Australia

• Western Australia

Australia Industrial Robotics Market News:

September-October 2025: Industry conference scheduled September 29 - October 1, 2025, focused on "Lowering Barriers to Entry in Adopting Robotics" addressing automation adoption challenges and democratizing access to robotics technology for Australian manufacturers and SMEs.

September 2025: Robotic Automation showcased cutting-edge AMRs and palletising solutions at CeMAT Australia demonstrating latest mobile robot technology and automated material handling systems supporting warehouse logistics and manufacturing efficiency improvements.

August 2025: Market analysis confirmed Australia industrial robotics projected to reach USD 1,848.9 million by 2033 at 12.80% CAGR with early 2025 SME cobot adoption in food processing achieving 50% operational efficiency gains driving widespread market expansion.

May 2025: Government planned delivery robot regulatory frameworks by 2026 addressing current legal gray area with autonomous ground robots with pilot projects including "Ari" developed by Monash University students designed for controlled campus and mall environments with temperature-controlled compartments.

Key Highlights of the Report:

• Market analysis projecting growth from USD 554.4 million (2024) to USD 1,848.9 million (2033) with 12.80% CAGR

• National Robotics Strategy launched June 2024 targeting AUD 170-600 billion annual GDP contribution by 2030

• AUD 15 billion National Reconstruction Fund supporting robotics industry transformation

• Cobots enhancing SME efficiency up to 50% in food processing confirmed early 2025

• SwarmFarm Robotics securing USD 30 million Series B funding in 2025

• Articulated robots dominating type segment with versatile manufacturing applications

• NSW and Victoria leading regional distribution with highest industrial concentration

Frequently Asked Questions (FAQs):

Q1: What are the primary factors driving Australia industrial robotics market growth to USD 1,848.9 million by 2033?

A1: The market is driven by National Robotics Strategy launched June 2024 projecting AUD 170-600 billion annual GDP contribution by 2030 with 50-150% productivity growth supported by AUD 15 billion National Reconstruction Fund, collaborative robots enhancing SME operational efficiency up to 50% in food processing confirmed early 2025 democratizing automation access, and SwarmFarm Robotics raising USD 30 million Series B 2025 expanding autonomous agricultural robots. Labor shortages with aging workforce, mining sector autonomous technology deployment, and Industry 4.0 government initiatives including ARM Hub Queensland contribute to the 12.80% growth rate.

Q2: How are government strategy and cobot adoption transforming the Australia industrial robotics landscape?

A2: National Robotics Strategy unveiled June 2024 establishes framework for world-leading robotics development, manufacturing, and responsible use with AUD 15 billion National Reconstruction Fund providing targeted investments and Industry Growth Program assisting SMEs. Collaborative robots adoption accelerates with SMEs achieving 50% operational efficiency gains in food processing eliminating expensive safety barriers enabling safe human-robot collaboration. Delivery robot regulatory frameworks planned by 2026 addressing autonomous deployment. Industry 4.0 initiatives advance AI-powered predictive maintenance and real-time analytics. These developments position government support and democratized automation as fundamental transformation drivers supporting productivity and competitiveness.

Q3: What opportunities exist for industrial robotics stakeholders in emerging Australia market segments?

A3: Stakeholders can capitalize on agricultural automation deploying autonomous tractors and harvesting robots addressing seasonal labor shortages, food processing implementing cobots for packaging and quality control, and warehousing logistics integrating AGVs and robotic picking for e-commerce fulfillment. Mining expansion supplying autonomous equipment for remote dangerous operations, local manufacturing developing Australian-designed solutions reducing import dependency, and SME financing providing accessible leasing models lowering entry barriers represent significant opportunities alongside regional programs expanding subsidies for agriculture and resource extraction automation supporting national food security and resource competitiveness objectives.

Note: If you require specific information not currently within the scope of the report, we can provide it as part of the customization.

Ask an analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=33291&flag=C

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: Sales@imarcgroup.com

Tel. No.: (D) +91 120 433 0800

Americas: +1 201-971-6302

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Australia Industrial Robotics Market 2025 | Worth USD 1,848.9 Million by 2033 here

News-ID: 4228486 • Views: …

More Releases from IMARC Group

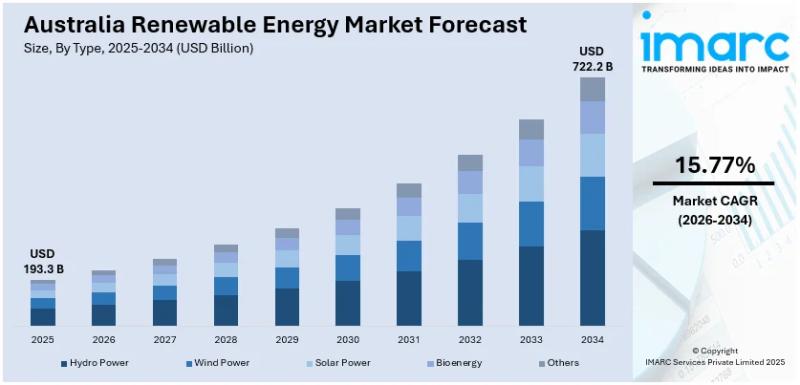

Australia Renewable Energy Market Projected to Reach USD 722.2 Billion by 2034

Market Overview

The Australia renewable energy market size reached USD 193.3 Billion in 2025 and is forecast to expand to USD 722.2 Billion by 2034. The market will grow at a compound annual growth rate of 15.77% during the forecast period of 2026-2034. This growth is primarily driven by advances in energy storage and smart grid technologies, which enhance renewables' integration into the country's energy infrastructure. Renewable sources including solar, wind,…

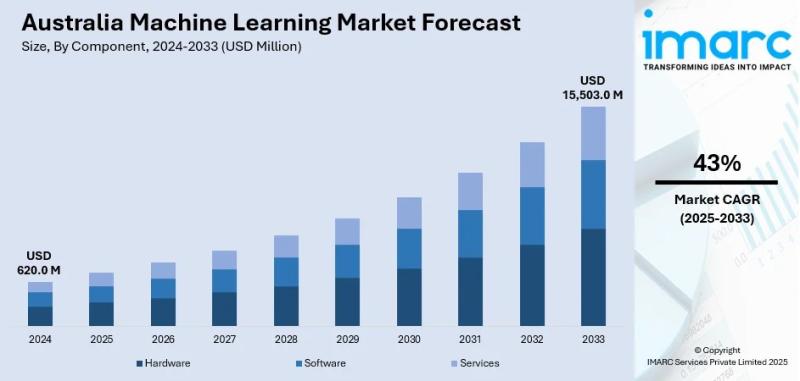

Australia Machine Learning Market 2026 | Worth USD 15,503.0 Million by 2034

Market Overview

The Australia machine learning market size was USD 620.0 Million in 2024 and is projected to reach USD 15,503.0 Million by 2033, demonstrating a robust growth rate of 43% during the forecast period of 2025-2033. Growth is driven by increasing usage of machine learning in healthcare diagnostics, financial fraud detection, and e-commerce personalization. Government support through AI funding and a strong startup ecosystem further boost adoption. Additionally, the rollout…

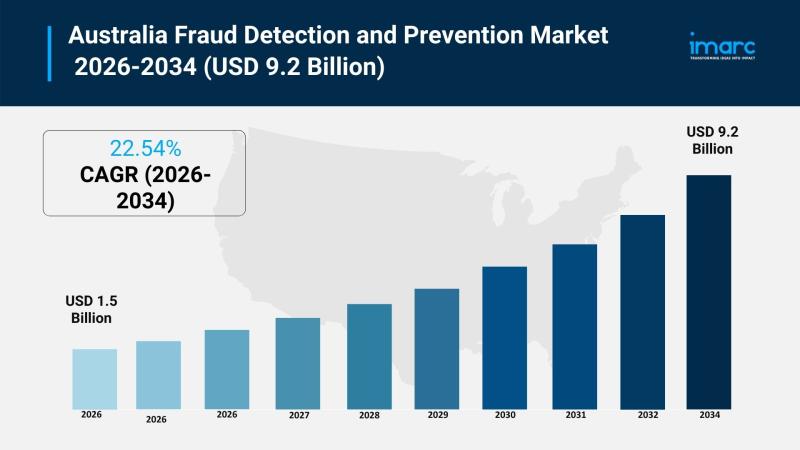

Australia Fraud Detection and Prevention Market 2026 | Worth USD 9.2 Billion by …

Market Overview

The Australia fraud detection and prevention market size reached USD 1.5 Billion in 2025. It is expected to grow significantly to USD 9.2 Billion by 2034, driven by a 22.54% growth rate during the forecast period of 2026-2034. This growth is largely fueled by increasing cyber fraud, evolving regulatory compliance, continuous growth in digital payments, a thriving e-commerce sector, and higher demand for remote transactions that promote sophisticated security…

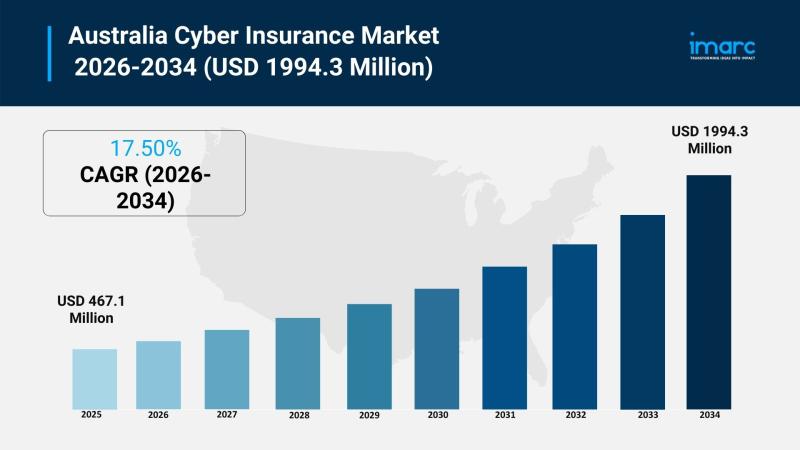

Australia Cyber Insurance Market Projected to Reach USD 1994.3 Million by 2034

Market Overview

The Australia Cyber Insurance Market reached a market size of USD 467.1 Million in 2025 and is projected to grow to USD 1,994.3 Million by 2034. This expansion is driven by increasing demand for tailored cyber protection solutions for mobile workforces, strong insurer-capacity partnerships, and advanced digital risk management tools supporting sectors like SMEs, corporate travel, and cloud-reliant businesses. The forecast period from 2026 to 2034 is expected to…

More Releases for Australia

Derila Memory foam pillow Australia: Honest Reviews About Derila Australia

Derila is one of the best memory foam pillows sold in Australia today.

Priced at around 30 dollars (USD), derila is currently the most reviewed and the cheapest memory pillow available in Australia.

What is Derila? Is Derila Pillow the best in Australia? Keep reading to discover everything worth knowing about Derila Australia.

OVERVIEW

Recently, Memory foam pillow has been trending and there is a lot of brands to choose from. Which one is…

CeraCare Australia - Where to Buy Legit CeraCare Supplement in Australia?

CeraCare Australia - Ceracare is a glucose support supplement that proposes to augment cardiovascular prosperity and to stay aware of perfect glucose assimilation in Australia. CeraCare supplement is conceptualized and executed by a threesome – Christine, Dr. Jihn and Michael. It is a natural supplement that helps one stay aware of ideal glucose levels, cardiovascular prosperity, and glucose assimilation.

Take Advantage of 80% Discount Offer in Australia >> https://boostsxproaustralia.com/ceracare-new

The indications…

Glucofort Australia - Where to Buy Legit Glucofort Supplement in Australia?

Glucofort Australia - Glucofort is an efficient, all-natural progressive glucose support supplement in Australia. This formula is made out of 12 key ingredients, 7 nutrients, and minerals, and a little of Vanadium. This supplement upholds regulated glucose levels and glucose digestion. Glucofort prides itself as the most inventive supplements available in Oceania, accentuating its solidarity, wellbeing, and quality.

Take Advantage of 75% Discount Offer in Australia >> https://boostsxproaustralia.com/glucofort-new

Rather than simply…

Australia Agriculture Market, Australia Agriculture Industry, Australia Agricult …

Australia Agriculture has been as vital within the development of Australia, because it was within the United States. Australia's ancient dominance in wheat and sheep continues into the 21st century. Recently Australian agriculture has become more and more diversified. The considerable expanses of productive land have helped Australia to become a number one world exporter of grains, meats, and wool. Each grains (predominantly wheat and barley) and wool markets round…

Australia Conveyor Maintenance Analysis by Top Companies Habasit Australia Pty l …

Global Australia Conveyor Maintenance Market and Competitive Analysis

Know your current market situation! Not only a vital element for brand new products but also for current products given the ever-changing market dynamics. The study allows marketers to remain involved with current consumer trends and segments where they'll face a rapid market share drop. Discover who you actually compete against within the marketplace, with Market Share Analysis know market position, to push…

Australia Conveyor Maintenance Market Analysis By Manufacturers Rema Tip Top Aus …

A conveyor system is a common piece of mechanical handling device that moves materials/objects from one location. A conveyor is often lifeline to a company’s ability to effectively move its products in a timely manner. While it is used constantly in a manufacturing plant, proper maintenance from trained technicians can extend the lifespan of conveyor. Furthermore, conveyor maintenance is essential as it may be subjected to different types of failures…