Press release

Australia Distributed Energy Market Projected to Reach USD 19.9 Billion by 2033

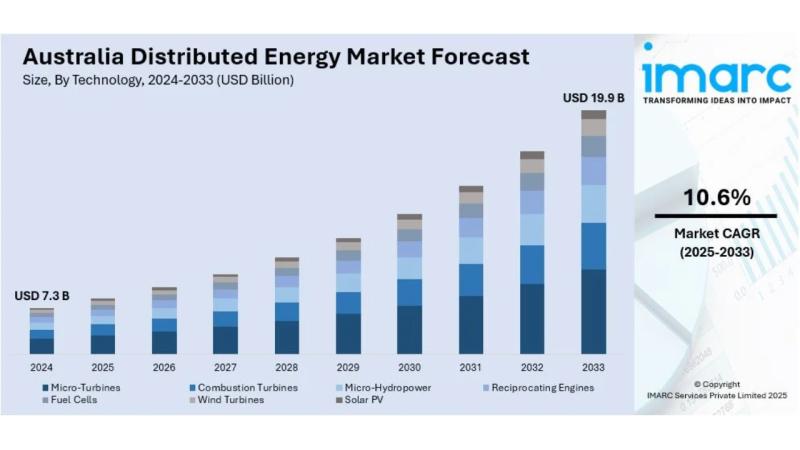

The latest report by IMARC Group, titled "Australia Distributed Energy Market Report by Technology (Micro-Turbines, Combustion Turbines, Micro-Hydropower, Reciprocating Engines, Fuel Cells, Wind Turbines, Solar PV), End Use Industry (Residential, Commercial, Industrial), and Region 2025-2033," offers a comprehensive analysis of the Australia distributed energy market growth. The report includes competitor and regional analysis, along with a detailed breakdown of the market segmentation. The Australia distributed energy market size reached USD 7.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 19.9 Billion by 2033, exhibiting a CAGR of 10.6% during 2025-2033.Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 7.3 Billion

Market Forecast in 2033: USD 19.9 Billion

Market Growth Rate (2025-2033): 10.6%

Australia Distributed Energy Market Overview

The Australia distributed energy market is experiencing robust expansion driven by rising electricity prices prompting self-reliant energy solutions, government incentives and supportive renewable energy policies, falling renewable technology costs making solar and storage affordable, increasing adoption of rooftop solar and battery storage driven by energy independence demand, grid modernization initiatives supporting distributed resource integration, and virtual power plants with peer-to-peer trading accelerating decentralization. The market expansion is supported by regulatory reforms promoting renewable integration and energy flexibility, microgrid deployment in remote communities, corporate decarbonization and ESG goal alignment, smart home and IoT ecosystem integration, and Australian Energy Market Operator DER roadmap implementation. Enhanced energy management capabilities through dynamic pricing, real-time monitoring, and blockchain-enabled trading platforms are positioning Australia's distributed energy market for sustained growth and energy system transformation leadership.

Australia's distributed energy industry demonstrates global leadership in rooftop solar adoption with renewable energy generation reaching 325 PJ (33% of electricity generation) in 2022-23, dominated by solar energy climbing 21% to 151 PJ reflecting substantial household and business investment. The market maintains critical importance in energy transition with 28,262 solar batteries installed in 2024 (4.9% increase) bringing hybrid systems to 121,551 units (3% of solar users) supporting grid resilience and consumer energy autonomy. The proliferation of virtual power plants aggregating distributed resources, peer-to-peer energy trading platforms, microgrid solutions for remote areas, and smart grid technologies is creating favorable market conditions, requiring substantial investments in grid modernization, digital infrastructure, and regulatory framework development. Australia's strategic focus on decentralized generation, combined with supportive state rebate programs in New South Wales, Victoria, and South Australia, makes it an increasingly dynamic market for distributed energy innovation and clean energy transition acceleration.

Request For Sample Report:

https://www.imarcgroup.com/australia-distributed-energy-market/requestsample

Australia Distributed Energy Market Trends

• Rooftop solar installation acceleration: Massive growth in residential and commercial solar PV systems driven by declining costs, government incentives, and rising electricity prices with solar energy reaching 151 PJ (21% increase) dominating renewable generation expansion.

• Virtual power plants and P2P trading expansion: Growing deployment of VPPs aggregating distributed resources providing grid stability while blockchain-enabled peer-to-peer platforms enable direct energy trading reducing transmission losses and promoting local sharing.

• Battery storage adoption surge: Significant uptake with 28,262 solar batteries installed in 2024 (4.9% increase) enabling excess solar storage, peak demand management, and grid resilience enhancement supporting energy independence goals.

• Energy grid decentralization transition: Fundamental shift from centralized generation to consumer-driven distributed systems reducing transmission losses, grid congestion, and enabling greater energy autonomy and local control.

• Smart home and IoT integration: Convergence of distributed energy with smart technology enabling real-time monitoring, automated consumption optimization, and enhanced control over energy flows supporting cost reduction.

• Microgrid deployment in remote areas: Expanding implementation of localized renewable-powered microgrids providing sustainable electricity solutions for off-grid communities reducing diesel generator dependence and improving energy access.

Market Drivers

• Rising electricity prices: Notable energy bill increases from wholesale market volatility, network costs, and fossil fuel constraints prompting households and businesses to explore cost-effective solar and hybrid system alternatives.

• Government incentive programs: Comprehensive federal and state support through upfront rebates, low-interest loans, and grants including Victoria's Solar Homes Scheme and South Australia's Home Battery Scheme reducing adoption barriers.

• Falling renewable technology costs: Declining prices for solar PV systems and battery storage making distributed energy economically attractive with improved efficiency, lifespans, and integration capabilities supporting widespread adoption.

• Energy independence demand: Consumer preference for self-reliant energy solutions reducing dependence on grid-supplied electricity, controlling energy costs, and achieving resilience during outages and market price fluctuations.

• DER roadmap implementation: Australian Energy Market Operator and Energy Security Board comprehensive integration plans transitioning power system to dynamic two-way network supporting consumer participation and grid flexibility.

• Corporate ESG alignment: Business investment in distributed energy systems meeting sustainability targets, reducing carbon emissions, demonstrating climate responsibility, and supporting green building certifications and compliance frameworks.

Challenges and Opportunities

Challenges:

• Grid integration and technical limitations with traditional infrastructure struggling to accommodate reverse energy flow, voltage instability, and inconsistent inputs from distributed resources requiring substantial smart grid technology investment

• Regulatory complexity and policy gaps with fragmented state regulations, varying standards, frequent feed-in tariff changes, and absence of cohesive national energy policy creating uncertainty deterring investment

• Consumer education and trust barriers with technical jargon, confusing system options, unclear ROI timelines, and skepticism about reliability limiting adoption particularly among less tech-savvy demographics

• Network infrastructure constraints with aging grid systems lacking real-time visibility and coordination capabilities complicating demand forecasting, grid balancing, and quality maintenance across distributed resources

• Interoperability challenges with diverse technology platforms, equipment manufacturers, and communication protocols requiring standardization efforts and compatibility solutions for seamless system integration

Opportunities:

• Microgrid expansion in remote communities providing sustainable localized solutions for off-grid regions combining solar, wind, and storage reducing diesel generator costs while enhancing energy sovereignty

• Corporate decarbonization market targeting businesses investing in on-site solar, storage, and load management supporting ESG goals while reducing operational costs and demonstrating environmental leadership

• Smart home integration advancement leveraging IoT ecosystems enabling predictive maintenance, load forecasting, automated optimization, and enhanced grid responsiveness supporting consumer-centric energy management

• Virtual power plant scaling aggregating residential and commercial distributed resources providing grid services, ancillary support, and revenue-sharing opportunities for participants while enhancing system reliability

• Grid modernization investment deploying advanced digital meters, real-time monitoring, automated controls, and dynamic pricing mechanisms enabling flexible, efficient, and data-driven energy systems

Australia Distributed Energy Market Segmentation

By Technology:

• Micro-Turbines

• Combustion Turbines

• Micro-Hydropower

• Reciprocating Engines

• Fuel Cells

• Wind Turbines

• Solar PV

By End Use Industry:

• Residential

• Commercial

• Industrial

By Region:

• Australia Capital Territory & New South Wales

• Victoria & Tasmania

• Queensland

• Northern Territory & Southern Australia

• Western Australia

Browse Full Report:

https://www.imarcgroup.com/australia-distributed-energy-market

Australia Distributed Energy Market News (2024-2025)

• 2024: Solar battery installations reached 28,262 units (4.9% increase from 2023) bringing total hybrid systems to 121,551 (3% of solar users) with New South Wales, Victoria, and South Australia leading growth supported by state rebate programs.

• 2022-23: Renewable energy generation increased to 325 PJ (33% of electricity generation) with solar energy dominating growth climbing 21% to 151 PJ as net energy consumption rose 2% to 23,294 PJ demonstrating solar sector expansion.

• 2024: Virtual power plant deployment accelerated with companies leading large-scale projects aggregating distributed resources providing grid stability and financial incentives while regulatory reforms enabled flexible market participation.

• 2024: Australian Energy Market Operator and Energy Security Board advanced DER integration roadmap transitioning power system to two-way network incorporating solar, batteries, EVs, and demand-responsive appliances.

• 2024: Government support strengthened through expanded rebate programs including Victoria's Solar Homes Scheme and South Australia's Home Battery Scheme alongside grid modernization investments enhancing digital infrastructure and smart meter deployment.

Key Highlights of the Report

• Market Performance (2019-2024)

• Market Outlook (2025-2033)

• Industry Catalysts and Challenges

• Segment-wise historical and future forecasts

• Competitive Landscape and Key Player Analysis

• Technology and End Use Industry Analysis

Ask analyst for your customized sample:

https://www.imarcgroup.com/request?type=report&id=33062&flag=F

Q&A Section

Q1: What drives growth in the Australia distributed energy market?

A1: Market growth is driven by rising electricity prices prompting cost-effective alternatives, government incentive programs providing financial support, falling renewable technology costs improving affordability, energy independence demand reducing grid dependence, DER roadmap implementation enabling system integration, and corporate ESG alignment supporting sustainability investments.

Q2: What are the latest trends in this market?

A2: Key trends include rooftop solar installation acceleration with 21% annual growth, virtual power plants and P2P trading expansion aggregating resources, battery storage adoption surge with 28,262 units installed, energy grid decentralization transition from centralized generation, smart home and IoT integration enabling optimization, and microgrid deployment in remote areas.

Q3: What challenges do companies face?

A3: Major challenges include grid integration and technical limitations with aging infrastructure, regulatory complexity and policy gaps creating investment uncertainty, consumer education and trust barriers limiting adoption, network infrastructure constraints affecting coordination, and interoperability challenges requiring standardization across diverse platforms.

Q4: What opportunities are emerging?

A4: Emerging opportunities include microgrid expansion providing remote community solutions, corporate decarbonization market supporting ESG-focused investments, smart home integration advancement leveraging IoT capabilities, virtual power plant scaling aggregating distributed resources, and grid modernization investment deploying advanced digital infrastructure.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91-120-433-0800

United States: +1-201-971-6302

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses. IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Australia Distributed Energy Market Projected to Reach USD 19.9 Billion by 2033 here

News-ID: 4228470 • Views: …

More Releases from IMARC Group

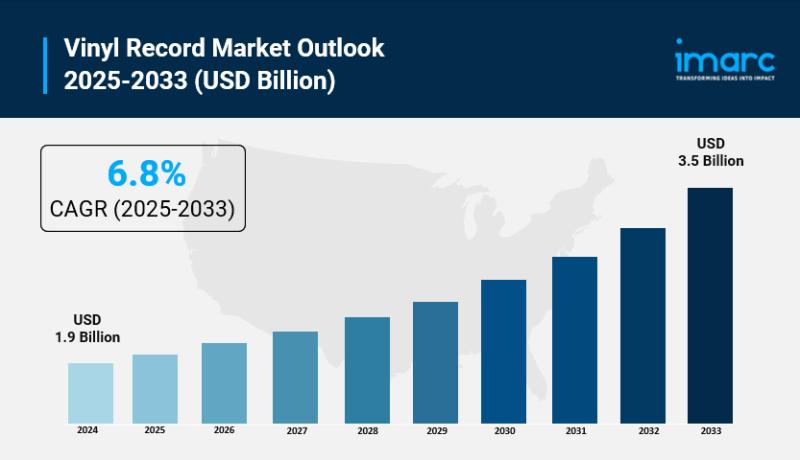

Vinyl Record Market Size to Reach USD 3.5 Billion by 2033 | With a 6.8% CAGR

Market Overview:

According to IMARC Group's latest research publication, "Vinyl Record Market Report by Product (LP/EP Vinyl Records, Single Vinyl Records), Feature (Colored, Gatefold, Picture), Gender (Men, Women), Age Group (13-17, 18-25, 26-35, 36-50, Above 50), Application (Private, Commercial), Distribution Channel (Supermarkets and Hypermarkets, Independent Retailers, Online Stores, and Others), and Region 2025-2033", The global vinyl record market size reached USD 1.9 Billion in 2024. Looking forward, IMARC Group expects the…

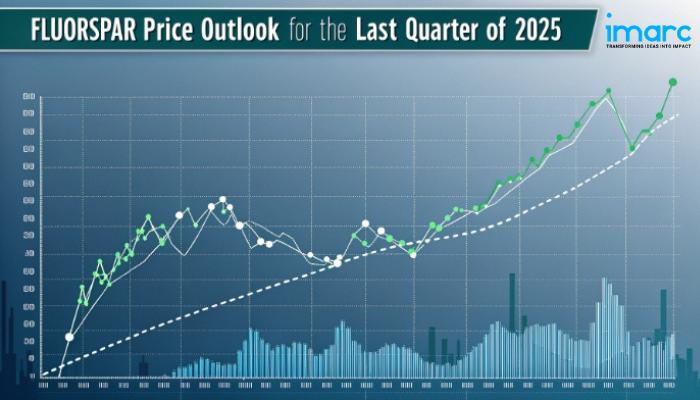

North America Fluorspar Prices Rise in Q4 2025: USA at USD 484/MT, Canada Peaks …

North America Fluorspar Prices Movement Q4 2025:

Fluorspar Prices in USA:

In Q4 2025, fluorspar prices in the USA averaged USD 484 per metric ton. Stable demand from aluminum production and chemical manufacturing supported price levels. Domestic mining operations maintained consistent output, while transportation and energy costs influenced overall supply. Moderate industrial activity and inventory management helped prevent significant price fluctuations across the regional market.

Get the Real-Time Prices Analysis: https://www.imarcgroup.com/fluorspar-pricing-report/requestsample

Note: The analysis…

Brazil Hybrid Electric Vehicle Market: Growth Dynamics, Consumer Shifts, and Com …

The Brazil hybrid electric vehicle market size was 348.75 Thousand Units in 2025 and is forecasted to reach 2,551.74 Thousand Units by 2034, reflecting a CAGR of 24.75% during 2026-2034. This robust expansion is fueled by increasing environmental awareness, rising fuel costs, and government policies aimed at emission reduction. Advances in battery technology and flex-fuel hybrid variants leveraging Brazil's ethanol resources also contribute to market growth.

Sample Request Link: https://www.imarcgroup.com/brazil-hybrid-electric-vehicle-market/requestsample

Study Assumption…

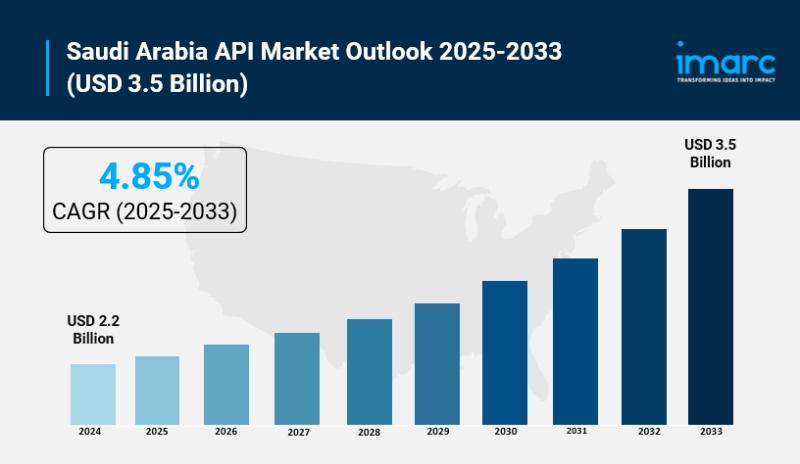

Saudi Arabia API Market Size to Expand USD 3.5 Billion by 2033 at a CAGR of 4.85 …

Saudi Arabia API Market Overview

Market Size in 2024: USD 2.2 Billion

Market Forecast in 2033: USD 3.5 Billion

Market Growth Rate 2025-2033: 4.85%

According to IMARC Group's latest research publication, "Saudi Arabia API Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The Saudi Arabia API market size reached USD 2.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.5 Billion by 2033, exhibiting a growth rate…

More Releases for Australia

Derila Memory foam pillow Australia: Honest Reviews About Derila Australia

Derila is one of the best memory foam pillows sold in Australia today.

Priced at around 30 dollars (USD), derila is currently the most reviewed and the cheapest memory pillow available in Australia.

What is Derila? Is Derila Pillow the best in Australia? Keep reading to discover everything worth knowing about Derila Australia.

OVERVIEW

Recently, Memory foam pillow has been trending and there is a lot of brands to choose from. Which one is…

CeraCare Australia - Where to Buy Legit CeraCare Supplement in Australia?

CeraCare Australia - Ceracare is a glucose support supplement that proposes to augment cardiovascular prosperity and to stay aware of perfect glucose assimilation in Australia. CeraCare supplement is conceptualized and executed by a threesome – Christine, Dr. Jihn and Michael. It is a natural supplement that helps one stay aware of ideal glucose levels, cardiovascular prosperity, and glucose assimilation.

Take Advantage of 80% Discount Offer in Australia >> https://boostsxproaustralia.com/ceracare-new

The indications…

Glucofort Australia - Where to Buy Legit Glucofort Supplement in Australia?

Glucofort Australia - Glucofort is an efficient, all-natural progressive glucose support supplement in Australia. This formula is made out of 12 key ingredients, 7 nutrients, and minerals, and a little of Vanadium. This supplement upholds regulated glucose levels and glucose digestion. Glucofort prides itself as the most inventive supplements available in Oceania, accentuating its solidarity, wellbeing, and quality.

Take Advantage of 75% Discount Offer in Australia >> https://boostsxproaustralia.com/glucofort-new

Rather than simply…

Australia Agriculture Market, Australia Agriculture Industry, Australia Agricult …

Australia Agriculture has been as vital within the development of Australia, because it was within the United States. Australia's ancient dominance in wheat and sheep continues into the 21st century. Recently Australian agriculture has become more and more diversified. The considerable expanses of productive land have helped Australia to become a number one world exporter of grains, meats, and wool. Each grains (predominantly wheat and barley) and wool markets round…

Australia Conveyor Maintenance Analysis by Top Companies Habasit Australia Pty l …

Global Australia Conveyor Maintenance Market and Competitive Analysis

Know your current market situation! Not only a vital element for brand new products but also for current products given the ever-changing market dynamics. The study allows marketers to remain involved with current consumer trends and segments where they'll face a rapid market share drop. Discover who you actually compete against within the marketplace, with Market Share Analysis know market position, to push…

Australia Conveyor Maintenance Market Analysis By Manufacturers Rema Tip Top Aus …

A conveyor system is a common piece of mechanical handling device that moves materials/objects from one location. A conveyor is often lifeline to a company’s ability to effectively move its products in a timely manner. While it is used constantly in a manufacturing plant, proper maintenance from trained technicians can extend the lifespan of conveyor. Furthermore, conveyor maintenance is essential as it may be subjected to different types of failures…