Press release

Australia Frozen Food Market Projected to Reach USD 8.2 Billion by 2033

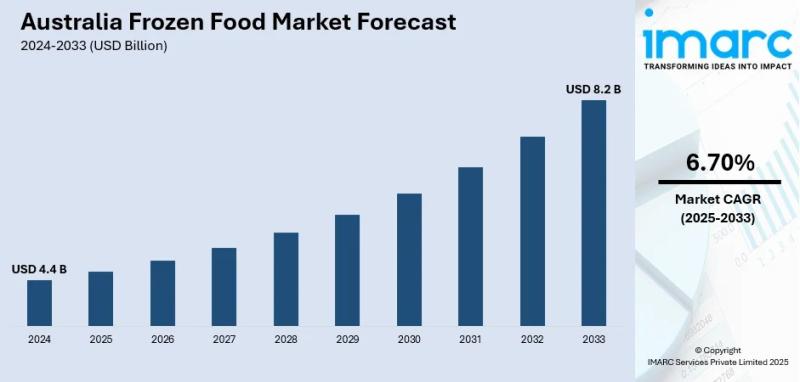

The latest report by IMARC Group, titled "Australia Frozen Food Market Report by Product (Frozen Vegetable Snacks (French Fries, Bites, Wedges and Smileys, Aloo Tikki, Nuggets, Others), Frozen Meat Products (Chicken, Fish, Pork, Mutton, Others), Frozen Vegetables and Fruits (Frozen Vegetables (Green Peas, Corn, Mixed Vegetables, Carrot, Cauliflower, Others), Frozen Fruits (Strawberries, Berries, Cherries, Others))), and Region 2025-2033," offers a comprehensive analysis of the Australia frozen food market growth. The report includes competitor and regional analysis, along with a detailed breakdown of the market segmentation. The Australia frozen food market size reached USD 4.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 8.2 Billion by 2033, exhibiting a CAGR of 6.70% during 2025-2033.Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 4.4 Billion

Market Forecast in 2033: USD 8.2 Billion

Market Growth Rate (2025-2033): 6.70%

Australia Frozen Food Market Overview

The Australia frozen food market is experiencing robust growth driven by changing lifestyle choices emphasizing convenience and time-saving solutions, advancing freezing and packaging technologies preserving nutritional content, expanding cold chain infrastructure ensuring product quality, rising food safety concerns favoring extended shelf life, and strengthening strategic collaborations between manufacturers and retailers. The market expansion is supported by technological innovations including Individual Quick Freezing (IQF) methods capturing 42% market share, cryogenic and rapid freezing techniques, sustainable packaging solutions, and increasing recognition of frozen foods as nutritionally valuable year-round options reducing food waste through portion control. Advanced frozen food solutions are transforming Australia's food consumption landscape through ready-to-cook formats dominating 63.27% market share, diverse seasonal product availability, improved taste and texture preservation, and sustainable waste reduction practices positioning frozen foods as mainstream dietary choices supporting busy urban lifestyles and health-conscious eating patterns.

Australia's frozen food foundation demonstrates strong consumer fundamentals across diverse applications including ready-to-eat meals, vegetables and fruits preservation, meat and seafood products, snacks and desserts, bakery goods, and convenience food solutions. The country's dual-income households, urbanization trends particularly in metropolitan centers, sophisticated cold chain logistics valued at USD 30.23 billion expanding to USD 74.38 billion by 2033, and commitment to food waste reduction through Australian Food Pact initiatives create substantial demand for frozen food products capable of delivering nutritional integrity, taste satisfaction, extended storage, and cooking flexibility. The proliferation of quick-freezing technologies, real-time temperature monitoring systems, recyclable packaging materials, and retail distribution expansion is creating favorable market conditions, requiring significant investments in refrigeration infrastructure, freezing equipment innovation, sustainable packaging development, and product quality assurance. Australia's health-conscious population combined with growing convenience preferences and environmental sustainability awareness makes it an increasingly important market for innovative frozen food development and comprehensive preserved food solutions supporting modern dietary requirements and lifestyle demands.

Request For Sample Report:

https://www.imarcgroup.com/australia-frozen-food-market/requestsample

Australia Frozen Food Market Trends

• Ready-to-cook dominance: Growing consumer preference for ready-to-cook formats capturing 63.27% market share balancing speed with customization, maintaining affordability below ready-to-eat options, and offering flexibility in preparation, nutritional control, and portion management appealing to cost-conscious households.

• IQF technology adoption: Increasing utilization of Individual Quick Freezing techniques rapidly freezing individual food pieces separately preventing clumping, retaining natural taste, texture, and nutrients, and producing fresher vibrant post-thaw quality particularly for vegetables, fruits, seafood, and prepared meals.

• Cold chain expansion: Strengthening infrastructure investment from USD 30.23 billion (2024) to projected USD 74.38 billion (2033) enabling sophisticated refrigeration systems, real-time temperature monitoring, reliable logistics coordination ensuring product quality throughout distribution networks.

• Sustainable packaging advancement: Rising adoption of recyclable materials, biodegradable options, waste minimization strategies, and eco-friendly solutions aligning with Australian Food Pact initiative targeting 50% food waste reduction by 2030 addressing 7.6 million tonnes annual waste.

• Health and wellness focus: Expanding product offerings featuring natural ingredients, lower sugar content (50% reduction examples), gluten-free options, plant-based varieties, and nutritional enhancements meeting health-conscious consumer demands for convenient nutritious meal solutions.

• Multicultural product development: Growing incorporation of diverse ethnic flavors, Asian fusion options, Mediterranean varieties, and indigenous Australian ingredients creating differentiated products appealing to Australia's multicultural demographics and evolving taste preferences.

Market Drivers

• Lifestyle convenience demand: Implementation of time-saving food solutions supporting busy urban lifestyles, dual-income households, work-life balance priorities, and fast-paced routines requiring minimal preparation, convenient storage, and reliable meal options reducing daily cooking time.

• Technological freezing advancement: Growing capabilities in quick-freezing methods, cryogenic freezing, rapid freezing techniques, and advanced packaging materials preserving nutritional content, maintaining taste quality, extending shelf life meeting consumer expectations for healthy flavorful convenience.

• Food safety consciousness: Increasing consumer confidence in frozen products offering perceived safety advantages, extended storage capabilities, reduced contamination risks, and reliable preservation compared to fresh alternatives particularly during supply chain disruptions or seasonal unavailability.

• Seasonal product accessibility: Expanding year-round availability of diverse seasonal fruits, vegetables, specialty items irrespective of natural harvest cycles providing consumers flexibility in meal planning, dietary variety, and access to nutritious options regardless of agricultural seasons.

• Waste reduction benefits: Strengthening environmental consciousness favoring portion-controlled frozen products enabling consumers to use only necessary amounts, minimizing food spoilage, reducing household waste, and supporting sustainable consumption patterns aligned with environmental values.

• Retail partnership expansion: Growing strategic collaborations between manufacturers including McCain Foods, Mars Australia, and major retailers including Woolworths, Coles strengthening distribution networks, increasing product visibility, improving accessibility across metropolitan and regional locations.

Challenges and Opportunities

Challenges:

• Quality perception issues involving historical consumer skepticism regarding frozen food inferiority compared to fresh alternatives requiring continued education, quality demonstrations, and technological advancement communications overcoming outdated taste and nutrition misconceptions

• Cold chain infrastructure costs including significant capital investments for refrigeration equipment, temperature-controlled logistics, monitoring systems, and energy consumption creating financial barriers particularly for small manufacturers and regional distribution expansion

• Price sensitivity concerns with frozen products often commanding premium prices compared to conventional alternatives creating affordability barriers among budget-conscious consumers and limiting mass market penetration particularly during economic uncertainties

• Packaging waste environmental impacts including plastic materials, non-recyclable components, and disposal challenges despite sustainability initiatives requiring ongoing innovation in biodegradable alternatives, recycled content integration, and circular economy approaches

• Competition from fresh and meal kit alternatives with growing farm-to-table movements, meal delivery services, and convenience store ready-meals creating competitive pressures requiring differentiation through quality, variety, and value propositions

Opportunities:

• Premium product development creating gourmet frozen meals, artisanal ingredients, chef-inspired recipes, indigenous Australian botanicals, and specialty dietary options (vegan, gluten-free, organic) commanding higher margins and appealing to sophisticated consumer segments

• E-commerce and subscription models leveraging online grocery growth, direct-to-consumer frozen food boxes, meal plan subscriptions, and contactless delivery services expanding market reach beyond traditional retail channels particularly post-pandemic

• Health-focused innovations developing functional frozen foods with enhanced nutritional profiles, superfoods integration, protein enrichment, micronutrient fortification, and clean-label formulations addressing wellness trends and dietary health priorities

• Regional market penetration expanding distribution beyond metropolitan centers into regional and rural areas with limited fresh food access, longer shopping cycles, and convenience requirements creating untapped consumer segments

• Export market potential leveraging Australia's food safety reputation, quality standards, unique indigenous ingredients, and established Asia-Pacific trade relationships accessing growing frozen food demand in neighboring markets particularly China, Japan, and Southeast Asia

Australia Frozen Food Market Segmentation

By Product:

• Frozen Vegetable Snacks

o French Fries

o Bites

o Wedges and Smileys

o Aloo Tikki

o Nuggets

o Others

• Frozen Meat Products

o Chicken

o Fish

o Pork

o Mutton

o Others

• Frozen Vegetables and Fruits

o Frozen Vegetables

Green Peas

Corn

Mixed Vegetables

Carrot

Cauliflower

Others

o Frozen Fruits

Strawberries

Berries (Raspberries, Blueberries, Blackberries)

Cherries

Others

By Region:

• Australia Capital Territory & New South Wales

• Victoria & Tasmania

• Queensland

• Northern Territory & Southern Australia

• Western Australia

Browse Full Report:

https://www.imarcgroup.com/australia-frozen-food-market

Australia Frozen Food Market News (2024-2025)

• January 2025: HyFun Foods, prominent Indian frozen potato exporter, partnered with Woolworths securing Rs 25 crore ($2.91 million) contract for 2025, distributing high-quality frozen potatoes across 1,000+ Woolworths outlets throughout Australia.

• September 2024: Frosty Fruits introduced lower-sugar Tropical variant featuring 50% less sugar, made from real fruit juice, with no artificial sweeteners, colors, or flavors addressing increasing Australian health consciousness regarding sugar consumption.

• 2024-2025: Ready-to-cook formats captured 63.27% frozen food market share balancing speed with customization, maintaining affordability, and offering preparation flexibility reflecting Australian consumer preferences for convenient meal solutions with cooking control.

• 2024: Individual Quick Freezing (IQF) technology achieved 42% market share demonstrating consumer preference for separately frozen food pieces retaining natural taste, texture, nutrients producing fresher vibrant quality post-thawing across vegetables, fruits, seafood.

• 2021-2025: Major Australian firms including Woolworths Group, McCain Foods, Coles, Mars Australia joined Australian Food Pact initiative targeting 50% food waste reduction by 2030 addressing 7.6 million tonnes annual waste through sustainable practices.

• 2024-2033: Cold chain packaging market expanded from USD 30.23 billion projecting USD 74.38 billion by 2033 reflecting growing temperature-sensitive product distribution demand with enhanced refrigeration systems, real-time monitoring, and reliable logistics.

Key Highlights of the Report

• Market Performance (2019-2024)

• Market Outlook (2025-2033)

• Industry Catalysts and Challenges

• Segment-wise historical and future forecasts

• Competitive Landscape and Key Player Analysis

• Product Analysis

Ask analyst for your customized sample:

https://www.imarcgroup.com/request?type=report&id=21993&flag=F

Q&A Section

Q1: What drives growth in the Australia frozen food market?

A1: Market growth is driven by lifestyle convenience demand supporting busy urban lifestyles and time-saving meal solutions, technological freezing advancement preserving nutritional content and taste quality through IQF and rapid freezing methods, food safety consciousness favoring extended storage and perceived safety advantages, seasonal product accessibility providing year-round availability irrespective of harvest cycles, waste reduction benefits enabling portion control and minimizing spoilage, and retail partnership expansion strengthening distribution and accessibility through Woolworths and Coles collaborations.

Q2: What are the latest trends in this market?

A2: Key trends include ready-to-cook dominance capturing 63.27% market share offering preparation flexibility and affordability, IQF technology adoption rapidly freezing individual pieces retaining natural quality, cold chain expansion investing USD 30.23B growing to USD 74.38B by 2033, sustainable packaging advancement using recyclable materials targeting 50% waste reduction by 2030, health and wellness focus offering lower sugar and plant-based options, and multicultural product development incorporating diverse ethnic flavors and indigenous Australian ingredients.

Q3: What challenges do companies face?

A3: Major challenges include quality perception issues requiring consumer education overcoming frozen food inferiority stereotypes, cold chain infrastructure costs involving significant refrigeration and logistics investments, price sensitivity concerns with premium pricing limiting affordability, packaging waste environmental impacts requiring biodegradable innovation, and competition from fresh and meal kit alternatives creating differentiation pressures in crowded convenience food markets.

Q4: What opportunities are emerging?

A4: Emerging opportunities include premium product development featuring gourmet meals and indigenous ingredients commanding higher margins, e-commerce and subscription models leveraging online grocery growth and direct-to-consumer delivery, health-focused innovations developing functional foods with enhanced nutrition and clean labels, regional market penetration expanding beyond metropolitan centers into underserved areas, and export market potential accessing Asia-Pacific frozen food demand leveraging Australia's quality reputation.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91-120-433-0800

United States: +1-201-971-6302

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses. IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Australia Frozen Food Market Projected to Reach USD 8.2 Billion by 2033 here

News-ID: 4228382 • Views: …

More Releases from IMARC Group

Taiwan Construction Market Size, Share, In-Depth Insights, Trends and Forecast 2 …

IMARC Group has recently released a new research study titled "Taiwan Construction Market Report by Sector (Residential, Commercial, Industrial, Infrastructure (Transportation), Energy and Utilities Construction), and Region 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Taiwan construction market size reached USD 37.4 Billion in 2025 and is projected to grow to USD 50.4…

Mexico Whiskey Market Size to Hit USD 1,468.1 Million by 2034: Trends & Forecast

IMARC Group has recently released a new research study titled "Mexico Whiskey Market Size, Share, Trends and Forecast by Product Type, Quality, Distribution Channel, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico whiskey market size reached USD 905.2 Million in 2025. It is projected to grow to USD 1,468.1 Million…

Mexico LED Lights Market 2026 : Industry Size to Reach USD 2,904.4 Million by 20 …

IMARC Group has recently released a new research study titled "Mexico LED Lights Market Size, Share, Trends and Forecast by Product Type, Application, Import and Domestic Manufacturing, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico LED lights market was valued at USD 1,466.9 million in 2025 and is projected to…

Mexico High-Brightness LED Market Size, Share, Latest Insights and Forecast 2025 …

IMARC Group has recently released a new research study titled "Mexico High-Brightness LED Market Size, Share, Trends and Forecast by Application, Distribution Channel, Indoor and Outdoor Application, End-Use Sector, and Region, 2025-2033" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico high-brightness LED market size reached USD 349.2 Million in 2024 and is…

More Releases for Australia

Derila Memory foam pillow Australia: Honest Reviews About Derila Australia

Derila is one of the best memory foam pillows sold in Australia today.

Priced at around 30 dollars (USD), derila is currently the most reviewed and the cheapest memory pillow available in Australia.

What is Derila? Is Derila Pillow the best in Australia? Keep reading to discover everything worth knowing about Derila Australia.

OVERVIEW

Recently, Memory foam pillow has been trending and there is a lot of brands to choose from. Which one is…

CeraCare Australia - Where to Buy Legit CeraCare Supplement in Australia?

CeraCare Australia - Ceracare is a glucose support supplement that proposes to augment cardiovascular prosperity and to stay aware of perfect glucose assimilation in Australia. CeraCare supplement is conceptualized and executed by a threesome – Christine, Dr. Jihn and Michael. It is a natural supplement that helps one stay aware of ideal glucose levels, cardiovascular prosperity, and glucose assimilation.

Take Advantage of 80% Discount Offer in Australia >> https://boostsxproaustralia.com/ceracare-new

The indications…

Glucofort Australia - Where to Buy Legit Glucofort Supplement in Australia?

Glucofort Australia - Glucofort is an efficient, all-natural progressive glucose support supplement in Australia. This formula is made out of 12 key ingredients, 7 nutrients, and minerals, and a little of Vanadium. This supplement upholds regulated glucose levels and glucose digestion. Glucofort prides itself as the most inventive supplements available in Oceania, accentuating its solidarity, wellbeing, and quality.

Take Advantage of 75% Discount Offer in Australia >> https://boostsxproaustralia.com/glucofort-new

Rather than simply…

Australia Agriculture Market, Australia Agriculture Industry, Australia Agricult …

Australia Agriculture has been as vital within the development of Australia, because it was within the United States. Australia's ancient dominance in wheat and sheep continues into the 21st century. Recently Australian agriculture has become more and more diversified. The considerable expanses of productive land have helped Australia to become a number one world exporter of grains, meats, and wool. Each grains (predominantly wheat and barley) and wool markets round…

Australia Conveyor Maintenance Analysis by Top Companies Habasit Australia Pty l …

Global Australia Conveyor Maintenance Market and Competitive Analysis

Know your current market situation! Not only a vital element for brand new products but also for current products given the ever-changing market dynamics. The study allows marketers to remain involved with current consumer trends and segments where they'll face a rapid market share drop. Discover who you actually compete against within the marketplace, with Market Share Analysis know market position, to push…

Australia Conveyor Maintenance Market Analysis By Manufacturers Rema Tip Top Aus …

A conveyor system is a common piece of mechanical handling device that moves materials/objects from one location. A conveyor is often lifeline to a company’s ability to effectively move its products in a timely manner. While it is used constantly in a manufacturing plant, proper maintenance from trained technicians can extend the lifespan of conveyor. Furthermore, conveyor maintenance is essential as it may be subjected to different types of failures…