Press release

Construction Polyurethane Adhesives Market to Reach USD 8,204 Million by 2031 Top 20 Company Globally

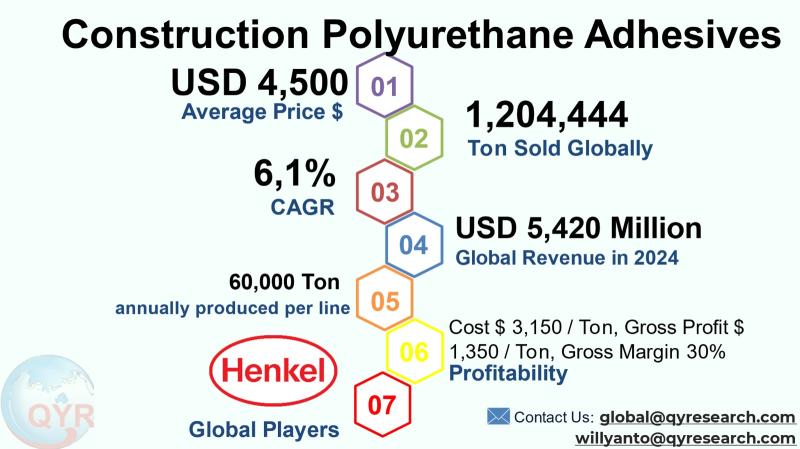

Construction polyurethane adhesives are high-performance bonding materials used across building and infrastructure projects for tasks such as panel bonding, flooring installation, façade systems, joint sealing and structural gluing of dissimilar substrates (concrete, metal, stone, timber, composites). Their appeal in construction stems from strong initial tack, high durability, elasticity to accommodate thermal and structural movement, moisture and chemical resistance, and suitability for both one-component moisture-curing systems and two-component systems where high structural strength is required. The construction segment typically demands formulation variants tuned for open time, cure speed, paintability and compliance with low-VOC and regulatory requirements; in many Asian and Southeast Asian projects, local price sensitivity and tropical performance (humidity, heat) shape formulation and logistics choices.The global construction polyurethane adhesives market size is valued at USD 5,420 million in 2024 with a CAGR of 6.1% through 2031reaching market size USD 8,204 million by 2031. An average selling price of USD 4,500 per ton, the implied total units sold globally in 2024 are 1,204,444 tons. With a stated factory gross margin of 30%, the factory gross profit per unit is USD 1,350 and the cost of goods sold (COGS) per unit is USD 3,150. A breakdown of the COGS is: raw materials, direct labor, manufacturing overhead & energy, packaging & consumables and quality/testing & waste. A single line full machine capacity production is around 60,000 tons per line per year. Downstream demand is concentrated in construction (including infrastructure and commercial construction), DIY/retail & renovation, industrial & manufacturing, automotive/transportation applications tied to construction projects and other specialized uses.

Latest Trends and Technological Developments

Manufacturers are accelerating product launches and local manufacturing investments to improve lead times, meet sustainability targets and adapt to regional performance requirements. Sika announced a targeted rollout of rapid-set construction adhesive and EIFS bonding solutions (SikaWall®-3000 Rapid Bond) intended to reduce installation times; that launch was publicized in May 2025. Henkel and other major players have been public about plant modernizations and product portfolio sustainability work throughout 2024 to 2025, including investments to improve low-emission and energy performance at adhesive facilities; global press coverage noted Henkels revenue and strategic moves in Q1 2025 as part of that activity. Sika also reported a series of local-for-local manufacturing investments in mid-2025 to expand capacity in China and other regions, reflecting the broader supply-chain shift toward regional production. Across the industry there is clear momentum behind low-VOC, water-borne and hybrid polyurethane formulations, primerless systems that reduce onsite steps, and faster cure chemistries that shorten project critical paths; several vendors have highlighted these themes in product announcements and trade coverage during 2024 to 2025.

Asia remains the single largest growth engine for construction PU adhesives, driven by sustained infrastructure investment, urbanization, large-scale housing programmes and rising adoption of modern construction methods (prefab, EIFS, curtain walls). China and India dominate volume demand in absolute terms, while Southeast Asian markets (Vietnam, Philippines, Thailand, Malaysia, Indonesia) show above-average growth due to infrastructure projects, industrial parks and growing commercial real estate pipelines. In China and India, local producers and multinationals compete on price and technical support; multinationals are responding with local production and technical service hubs to shorten lead times and provide formulation support for humid-climate performance. The Asia focus also means suppliers must manage raw material feedstock volatility (polyols and isocyanates) and regulatory shifts around emissions and safety.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart)

https://www.qyresearch.com/sample/5183780

Construction Polyurethane Adhesives by Type:

Liquid Type

Paste Type

Tape Type

Construction Polyurethane Adhesives by Features:

Fast Curing Adhesives

Eco Friendly Adhesives

Moisture Resistant Adhesives

Fire Retardant Adhesives

Others

Construction Polyurethane Adhesives by Material:

One Component Polyurethane Adhesives

Two Component Polyurethane Adhesives

Hybrid Polyurethane Formulations

Water Borne Polyurethane Adhesives

Others

Construction Polyurethane Adhesives by Application:

Residential

Commercial

Industrial

Global Top 20 Key Companies in the Construction Polyurethane Adhesives Market

Henkel

H.B. Fuller

Sika

DOW CORNING

Bostik

LORD Corp.

Wacker Chemie AG

ITW

3M

Huntsman

ThreeBond

Avery Dennison

Ashland

Franklin International

Momentive

Dymax

Dap

Permabond

Beijing Comens

Chengdu Guibao

Regional Insights

Southeast Asias adhesives & sealants market has been expanding briskly with projected multi-percent CAGR rates, supported by national infrastructure and housing programmes and by growth in the regional construction chemicals sector. Research providers estimate Southeast Asia adhesives & sealants markets to be growing at a CAGR above ~6% in the mid-2020s, and construction chemicals which include adhesives are receiving heightened investment. Indonesia is a standout within ASEAN due to very large planned infrastructure investments (national projects, new capital development and renewables/energy projects) and a sizable domestic construction market; government infrastructure spending and public projects continue to underpin robust demand for construction consumables including adhesives. Market analysts have documented Indonesias strong construction market trajectory in 20242025 and note that local demand conditions support both international suppliers and regional manufacturers establishing local lines. For ASEAN suppliers and distributors, success factors include competitive landed cost, local technical support for installers, rapid supply of cartridge formats for retail and bulk supply for contractors, and alignment with local VOC and building-material standards.

The construction polyurethane adhesives industry faces several challenges: feedstock volatility (polyol and isocyanate raw material price swings) that compresses margins or forces frequent price adjustments; regulatory pressure for lower VOCs and improved worker safety that necessitates R&D and reformulation; competition from lower-cost water-based and hybrid polymer technologies in price-sensitive segments; and the operational complexity of balancing global R&D with local production and service footprints. In Asia and ASEAN specifically, logistics and tariff variability, localized technical expectations (substrate compatibility under tropical climates), and price sensitivity in certain markets make channel strategy and local partnerships essential.

To capture sustained value, manufacturers should pursue a three-pronged strategy: invest in regional manufacturing (local-for-local) to reduce lead times and lower landed costs, deepen technical support services (onsite training for contractors and applicators) to lock in specification preference, and accelerate development of low-VOC, fast-cure and humidity-tolerant formulations that meet both regulatory and installer needs. For distributors and investors, differentiation can be achieved by combining competitive pricing with inventory availability, technical training, and bundled system solutions (adhesive + primer + sealant) for specific construction segments like façade, flooring and precast assembly.

Product Models

Construction polyurethane adhesives are versatile bonding materials widely used in structural, flooring, panel, and insulation applications due to their excellent strength, flexibility, and resistance to moisture and temperature variations.

Liquid types are commonly used for large-area bonding and coating. Notable products include:

SikaBond®-T55 - Sika AG: A one-component liquid polyurethane adhesive for bonding wood flooring, offering strong elastic bonding and excellent acoustic performance.

Loctite® U-09FL - Henkel: A two-component liquid adhesive designed for metal, composite, and plastic bonding in construction and industrial assembly.

Dow Betaseal 1965 - Dow: Designed for glass bonding in structural glazing and façade applications.

Tremco Illbruck PU700 - Tremco: High-strength liquid adhesive suitable for subfloor and panel bonding applications.

Soudal PU Construct - Soudal: Fast-setting adhesive used for structural timber bonding and concrete repair.

Paste types are ideal for gap-filling and vertical applications. Examples include:

Soudaflex 40FC - Soudal: Flexible polyurethane paste adhesive used for concrete expansion joints and flooring.

Titebond® PU Premium Construction Adhesive - Franklin International: Heavy-duty polyurethane paste ideal for general construction bonding.

Huntsman I-Bond 900 Series - Huntsman: High-strength paste adhesive suitable for panel lamination and assembly lines.

Mapei Ultrabond P990 1K - Mapei: Single-component paste adhesive for wooden flooring and subfloor systems.

Selleys Liquid Nails® Polyurethane - Selleys: Weather-resistant polyurethane paste for bonding wood, metal, and masonry surfaces.

Tape types provide clean, instant adhesion without curing time.. Notable products include:

Saint-Gobain Norbond® V2800 - Saint-Gobain: Durable polyurethane foam tape for mounting windows and metal façades.

3F Tape PU Series - 3F GmbH: Polyurethane foam adhesive tape offering vibration dampening and long-term adhesion.

Wacker® PU Tape 3200 - Wacker Chemie AG: Elastic polyurethane adhesive tape for thermal insulation systems and metal composite bonding.

Huntsman Adcote 812A Tape - Huntsman: Solvent-based polyurethane tape providing high tack and resistance for glass and composite bonding.

Ashland Purelam PU Series - Ashland: Thermoplastic polyurethane adhesive tape with strong moisture barrier properties for structural laminates.

Construction polyurethane adhesives are positioned for steady, mid-single-digit to low-double-digit growth through the remainder of the decade as construction activity in Asia and Southeast Asia expands and as installers and specifiers increasingly demand higher-performance, faster-curing, and lower-emission formulations. Success in the region requires combining competitively priced products with local production, technical support and portfolio differentiation around sustainability and on-site efficiency.

Investor Analysis

This report provides investors with three classes of actionable insight. First, market sizing and unit economics (USD 5,420M baseline, USD 4,500/ton, implied 1,204,444 tons, factory gross margin 30%) give a transparent way to model revenue and margin scenarios for M&A or greenfield investments. Second, the regional view (strong Asia & ASEAN demand, Indonesia infrastructure momentum) identifies where incremental plant capacity and targeted sales investments will likely produce the highest ROI, especially when paired with local technical services to win specifications. Third, the technology and regulatory trends (low-VOC, primerless, rapid-set chemistries) signal where R&D and product-line capital should be allocated to protect market share and command premium pricing. Investors evaluating manufacturers, toll producers or distributors can use the factory economics and estimated line throughput to size capital needs and payback timelines, and to stress-test sensitivity to feedstock price movements and pricing discipline across competitor sets.

Request for Pre-Order Enquiry On This Report

https://www.qyresearch.com/customize/5183780

5 Reasons to Buy This Report

To obtain a regionally focused view (Asia & Southeast Asia) of demand drivers and supply dynamics for construction polyurethane adhesives.

To access unit-level economics (price, implied units, COGS breakdown, factory margin) useful for modeling manufacturing investments and valuations.

To review the latest product and capacity developments from major vendors.

To understand competitive positioning and the top global players, enabling targeted partnership, distribution or M&A scouting.

To get strategic recommendations for capturing growth in ASEAN markets, including operational and product priorities for investors and operators.

5 Key Questions Answered

What is the 2024 market size and implied unit volume for construction polyurethane adhesives?

What are typical factory economics (COGS per unit, gross profit per unit and a representative COGS breakdown)?

Which product and technology trends (low-VOC, fast cure, primerless systems) are shaping R&D and product launches through 2025?

How do Asia and ASEAN differ in demand drivers and what makes Indonesia strategically important for capacity and distribution?

Who are the leading global suppliers and what evidence is there of capacity expansion or local investment in 20242025?

Chapter Outline

Chapter 1: Introduces the report scope of the report, executive summary of different market segments (by region, product type, application, etc), including the market size of each market segment, future development potential, and so on. It offers a high-level view of the current state of the market and its likely evolution in the short to mid-term, and long term.

Chapter 2: key insights, key emerging trends, etc.

Chapter 3: Manufacturers competitive analysis, detailed analysis of the product manufacturers competitive landscape, price, sales and revenue market share, latest development plan, merger, and acquisition information, etc.

Chapter 4: Provides profiles of key players, introducing the basic situation of the main companies in the market in detail, including product sales, revenue, price, gross margin, product introduction, recent development, etc.

Chapter 5 & 6: Sales, revenue of the product in regional level and country level. It provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and market size of each country in the world.

Chapter 7: Provides the analysis of various market segments by Type, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments.

Chapter 8: Provides the analysis of various market segments by Application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

Chapter 9: Analysis of industrial chain, including the upstream and downstream of the industry.

Chapter 10: The main points and conclusions of the report.

Related Report Recommendation

Polyurethane Construction Adhesive- Global Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031

https://www.qyresearch.com/reports/3562095/polyurethane-construction-adhesive

Global Polyurethane Construction Adhesive Market Research Report 2025

https://www.qyresearch.com/reports/3555657/polyurethane-construction-adhesive

Global Construction Polyurethane Adhesives Market Outlook, InDepth Analysis & Forecast to 2031

https://www.qyresearch.com/reports/5183782/construction-polyurethane-adhesives

Construction Polyurethane Adhesives - Global Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031

https://www.qyresearch.com/reports/5183781/construction-polyurethane-adhesives

Global Construction Polyurethane Adhesives Market Research Report 2025

https://www.qyresearch.com/reports/5183780/construction-polyurethane-adhesives

Global Construction Adhesive Market Research Report 2025

https://www.qyresearch.com/reports/3468836/construction-adhesive

Global Construction Butyl Adhesive Market Research Report 2025

https://www.qyresearch.com/reports/4934024/construction-butyl-adhesive

Global Rigid Construction Adhesive Market Research Report 2025

https://www.qyresearch.com/reports/3560018/rigid-construction-adhesive

Global Brick Construction Adhesive Market Research Report 2025

https://www.qyresearch.com/reports/3458083/brick-construction-adhesive

Global Construction Epoxy Adhesives Market Research Report 2025

https://www.qyresearch.com/reports/5055927/construction-epoxy-adhesives

Contact Information:

Tel: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About QY Research

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Construction Polyurethane Adhesives Market to Reach USD 8,204 Million by 2031 Top 20 Company Globally here

News-ID: 4227868 • Views: …

More Releases from QY Research

High Margins, High Growth: Inside the Global Luxury Beauty Opportunity

Luxury beauty encompasses premium skincare, cosmetics, fragrance, haircare, dermo-cosmetics, and prestige personal care products positioned with superior ingredients, branding, exclusivity, and high ASPs.

Core value drivers include brand heritage, innovation in active ingredients, dermatological efficacy, sustainability claims, and experiential retail.

Consumers increasingly view luxury beauty as self-care + wellness investment, not discretionary spending alone.

Distribution mix: specialty beauty retail, department stores, travel retail, e-commerce, brand boutiques, medical aesthetic clinics.

Global Market Snapshot

Market size (2025):…

Security Seals Market 20252032: Smart Tech, Recurring Revenue, and Investor Upsi …

Single use security seals are tamper-evident mechanical or plastic locking devices designed for one-time application to secure containers, trucks, meters, ballot boxes, airline carts, cash bags, and logistics assets

Core function: theft deterrence, chain-of-custody control, compliance with customs, transport, and regulated industries

Widely used in logistics, utilities, aviation catering, banking, postal, healthcare, and e-commerce fulfillment

Market characterized by high volume, low ASP consumables with recurring replacement demand

Global Overview

Global market size (2025): USD 352…

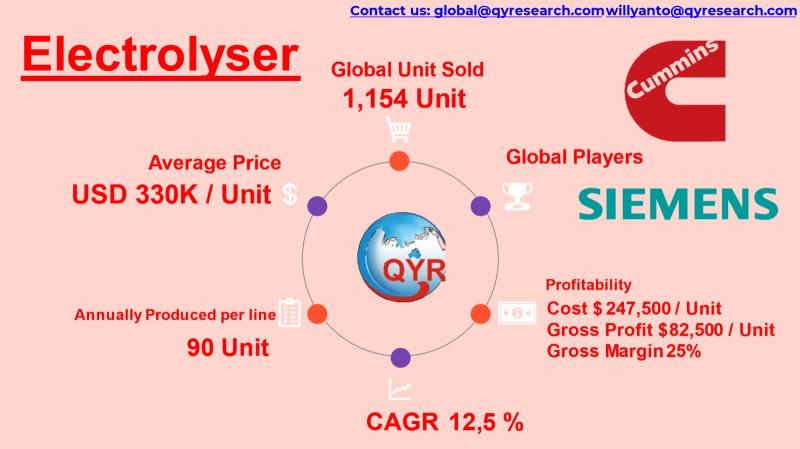

Hydrogen Infrastructure Surge: Why Electrolysers Are the Next Energy Investment …

Electrolyser systems are core equipment for producing green hydrogen through water electrolysis, converting electricity (increasingly renewable) into hydrogen and oxygen.

The industry underpins decarbonization across refining, fertilizers, steelmaking, mobility, and grid storage, making electrolysers a critical enabling technology for the global energy transition.

Technology categories include alkaline (AEL), proton exchange membrane (PEM), and solid oxide (SOEC), each optimized for different cost, efficiency, and operating profiles.

Global Market Overview

Global market size (2025): USD 381…

Top 30 Indonesian Dairy Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)

PT Indofood Sukses Makmur Tbk (INDF)

PT Indofood CBP Sukses Makmur Tbk (ICBP)

PT Ultrajaya Milk Industry & Trading Company Tbk (ULTJ)

PT Cisarua Mountain Dairy Tbk (CMRY)

PT Diamond Food Indonesia Tbk (DMND)

PT Mulya Boga Raya Tbk

PT Campina Ice Cream Industry Tbk

PT Kurniamitra Duta Sentosa Tbk

PT Greenfields Indonesia

PT Indolakto (subsidiary/brand under Indofood)

PT Ultra Jaya Frozen Foods (group affiliate)

PT Heilala Dairy Indonesia (export arm/processing)

PT Diamond Milk Products (non-listed…

More Releases for Adhesive

Shaping the Flock Adhesive Market in 2025: Innovative Adhesive Tape Solutions Dr …

How Is the Chondroplasty Market Projected to Grow, and What Is Its Market Size?

The chondroplasty market has seen strong growth in recent years. It will increase from $13.77 billion in 2024 to $14.68 billion in 2025 at a CAGR of 6.5%. This growth is attributed to the rise in sports-related injuries, patient preference for non-total joint replacement procedures, advances in postoperative care, healthcare provider training, and an increasing incidence of…

Bio-Based Hot Melt Adhesive Market Insights: Redefining Adhesive Solutions

According to the report published by Virtue Market Research, in 2022, the Global Bio-Based Hot Melt Adhesive Market was valued at $10.15 billion, and is projected to reach a market size of $15 billion by 2030. Over the forecast period of 2023-2030, market is projected to grow at a CAGR of 4.5%.

Read More @ https://virtuemarketresearch.com/report/bio-based-hot-melt-adhesive-market

The Bio-Based Hot Melt Adhesive market is a realm of innovation and sustainability, marked by enduring…

Iron Supplement Market Product Type (2-Octyl Cyanoacrylate Adhesive, N-Butyl Cya …

Iron is one of the most important nutritional requirements of the human body as it plays an important role in managing many vital biological processes. Growing health concerns among consumers and widening applications of iron supplements are among the major growth drivers for iron supplements demand.

Download Sample PDF at https://www.theinsightpartners.com/sample/TIPRE00021200/?utm_source=OpenPR&utm_medium=10379

Key Players Analysis:

• Nature Made

• Nature's Bounty

• Solgar

• Rainbow Light

• NOW Foods

• Amway

• Garden of Life

• Spring Valley

• GNC

• Fergon

The report covers key developments in the Iron Supplement Market as…

Lens bonding adhesive solutions from DeepMaterial optical bonding adhesive manuf …

Lens bonding adhesive solutions from DeepMaterial optical bonding adhesive manufacturers

Today, gadgets are changing incredibly. This calls for the best bonding option and the elimination of mechanical fasteners. The introduction of adhesives has made it possible to achieve lightweight gadgets that have made our lives even better.

In camera modules, there is a need for lens-bonding adhesives. The lens is an important camera component, and it is needed for the proper functioning…

Cyanoacrylate Adhesive Market Outlook to 2026 - 3M, AdCo, Adhesive Technologies

The Cyanoacrylate Adhesive Market report includes overview, which interprets value chain structure, industrial environment, regional analysis, applications, market size, and forecast. The report provides an overall analysis of the market based on types, applications, regions, and for the forecast period from 2020 to 2026. It also offers investment opportunities and probable threats in the market based on an intelligent analysis.

This report focuses on the Global Cyanoacrylate Adhesive Market trends, future…

Adhesive Equipments Market by Product Type (Adhesive Pump Systems, Adhesive Melt …

GLOBAL ADHESIVE EQUIPMENTS MARKET was valued at USD 30.56 Billion in the year 2017. Global Adhesive Equipment Market is further estimated to grow at a CAGR of 5.13% from 2018 to reach USD 41.26 Billion by the year 2023. Asia-Pacific region holds the highest market share in 2017 and also considered as the fastest growing market in the forecasted period. At a country level, developed markets like China holds the…