Press release

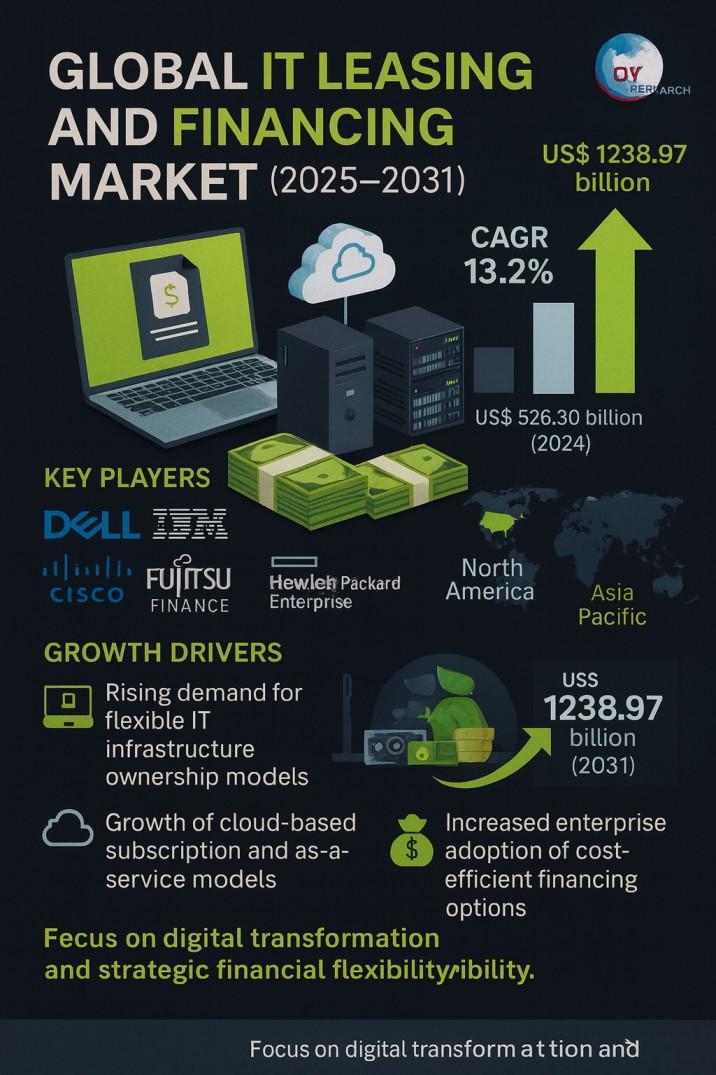

IT Leasing And Financing Market Poised to Surpass $1238.97 Billion by 2031 | Strong Demand Momentum

Los Angeles, United States - According to the latest market research study published by QY Research, the Global IT Leasing And Financing Market is poised for substantial growth over the forecast period 2025-2031. Valued at US$ 526.30 billion in 2024, the market is projected to reach US$ 1238.97 billion by 2031, expanding at a CAGR of 13.2%. This anticipated expansion is attributed to rising adoption across multiple industries, technological innovation, evolving consumer preferences, and strong demand in emerging economies. The study provides a comprehensive analysis of key drivers, growth trends, competitive dynamics, opportunities, and challenges shaping the future of the market.Download Exclusive PDF Sample: (Including Full TOC, Data Tables, Visual Charts) @ https://qyresearch.in/request-sample/service-software-global-it-leasing-and-financing-market-insights-industry-share-sales-projections-and-demand-outlook-2025-2031

The potential shifts in the 2025 U.S. tariff framework pose substantial volatility risks to global markets. This report provides a comprehensive assessment of recent tariff adjustments and international strategic countermeasures on IT Leasing And Financing, capital allocation patterns, regional economic interdependencies, and supply chain reconfigurations.

IT leasing and financing refers to the process of acquiring IT equipment, software, or services without purchasing them outright. Businesses can lease or finance these assets through various arrangements, which provide flexibility, cost management, and the ability to stay current with technology. IT leasing typically requires the flat monthly payments for the duration of lease agreement. IT finance is obtaining the use of IT equipment or others on a lease or rental basis. This avoids the need to invest capital in equipment but still allows the business to operate effectively in a short period of time.

Market Drivers and Challenges -

IT leasing and financing have become essential financial tools for businesses in today's rapidly evolving technological landscape. As companies face the challenge of keeping up with constant technological advancements, the cost of upgrading IT infrastructure can be prohibitive. IT leasing and financing provide a way to acquire the latest technology without large upfront capital expenditures, offering flexibility and helping businesses optimize their cash flow and technology utilization.

IT leasing offers companies a way to avoid substantial initial costs by spreading out the payments over the lease term. This allows businesses, especially small and medium-sized enterprises (SMEs), to access high-quality, up-to-date IT equipment without straining their budgets. At the end of the lease, companies can choose to continue the lease, purchase the equipment, or upgrade to newer technology, ensuring that their infrastructure remains modern and efficient.

On the other hand, IT financing encompasses various financial options such as installment payments, leasing, and financing agreements, allowing businesses to acquire equipment with future cash flow. This flexibility allows companies to manage their financial resources better, reducing the burden of large upfront payments and enabling them to focus on other areas of growth. With financing options, businesses can tailor their payment terms according to their financial capabilities, improving overall cash flow management.

In addition to financial benefits, IT leasing and financing can also accelerate technology upgrades. In industries where innovation happens quickly, having outdated hardware can hamper productivity and put businesses at a competitive disadvantage. Leasing and financing allow companies to keep their equipment up to date, ensuring they remain technologically competitive.

However, there are risks and challenges associated with leasing and financing. Over the long term, leasing costs and financing charges may add up, resulting in higher overall expenditures compared to a one-time purchase. Additionally, lease agreements may include restrictions, such as fixed lease terms or maintenance obligations, which businesses must carefully consider before committing. Furthermore, in the case of financing, failure to meet payment obligations could result in equipment repossession or credit issues.

Overall, IT leasing and financing provide businesses with flexible financial management options and enable them to stay ahead in terms of technology. As financial products evolve and technology continues to advance, IT leasing and financing will play an increasingly important role in helping businesses adapt to the challenges of the digital economy.

Why This Report is a Must-Have -

ᗒ Historical Analysis (2020-2024) & Forecasts (2025-2031): Gain a clear understanding of market trends and future growth potential.

ᗒ Comprehensive Market Segmentation: Detailed breakdown by Type, Application, and Region to identify lucrative opportunities.

ᗒ Competitive Landscape: Insights into key players, their market share, and strategic developments like mergers, acquisitions, and expansion plans.

ᗒ Drivers & Restraints: Understand the factors shaping the market's growth and the challenges that could impact your strategy.

ᗒ Expert Opinions & Market Dynamics: Benefit from expert analysis to navigate market risks and capitalize on emerging trends.

Detailed of IT Leasing And Financing Market Segmentation -

Segmentation By Type :-

Packaged Software

Server Systems

PCs & Smart Handhelds

Networking & Telco

Mainframes and Service

Others

Segmentation By Application -

Listed Companies

Small and Medium Companies

Government Agency

Others

This segmentation helps identify high-growth opportunities and niche segments for investors and businesses.

Regional Insights -

The report takes readers on a journey through four key regions: United States, Asia-Pacific, and EMEA. Key nations like the United States, Germany, the United Kingdom, China, Japan, South Korea, and more are thoroughly examined. The data is presented in a timeline from 2024 as the base year, with projections extending to 2031.

North America: United States, Canada, Mexico

Latin America: Brazil and other key markets

Asia Pacific: China, Japan, South Korea, India, ASEAN countries

Europe, Middle East & Africa (EMEA): Major European economies, GCC countries, and African nations

The report provides a region-wise breakdown of market share, consumption trends, and future prospects.

Competitive Landscape: -

Dell

IBM

GRENKE

3 Step IT

Lenovo

SHI

Cisco

PCM Leasing

CSI Leasing

Edianzu

Hypertec Direct

Fujitsu Finance

Hewlett Packard Enterprise

Verdant Finance

Request for Pre-Order Enquiry On This Exclusive Report @ https://qyresearch.in/pre-order-inquiry/service-software-global-it-leasing-and-financing-market-insights-industry-share-sales-projections-and-demand-outlook-2025-2031

This IT Leasing And Financing Market Research Report Contains Answers to your following Questions -

ᗒ Which Manufacturing Technology is Used for IT Leasing And Financing? What Developments Are Going On in That Technology? Which Trends Are Causing These Developments?

ᗒ Who Are the Global Key Players in This IT Leasing And Financing Market? What's Their Company Profile, Their Product Information, and Contact Information?

ᗒ What Was Global Market Status of IT Leasing And Financing Market? What Was Capacity, Production Value, Cost and PROFIT of IT Leasing And Financing Market?

ᗒ What Is Current Market Status of IT Leasing And Financing Industry? What's Market Competition in This Industry, Both Company, and Country Wise? What's Market Analysis of IT Leasing And Financing Market by Taking Applications and Types in Consideration?

ᗒ What Are Projections of Global IT Leasing And Financing Industry Considering Capacity, Production and Production Value? What Will Be the Estimation of Cost and Profit? What Will Be Market Share, Supply and Consumption? What about Import and Export?

ᗒ What Is IT Leasing And Financing Market Chain Analysis by Upstream Raw Materials and Downstream Industry?

ᗒ What Is Economic Impact On IT Leasing And Financing Industry? What are Global Macroeconomic Environment Analysis Results? What Are Global Macroeconomic Environment Development Trends?

ᗒ What Are Market Dynamics of IT Leasing And Financing Market? What Are Challenges and Opportunities?

ᗒ What Should Be Entry Strategies, Countermeasures to Economic Impact, Marketing Channels for IT Leasing And Financing Industry?

Table of Contents - Major Key Points:

1. Study Coverage

2. Executive Summary

3. Research Methodology

4. Global Production Analysis

5. Value Chain and Supply-Chain Analysis

6. IT Leasing And Financing Market Dynamics

7. Competition by Manufacturers

8. IT Leasing And Financing Market Segmentation, By Type

9. IT Leasing And Financing Market Segmentation, By Application

10. Regional Analysis

11. Corporate Profile

12. Conclusion...

Analyst Insights -

According to QY Research experts:

The global IT Leasing And Financing market is entering a transformative phase, where innovation, sustainability, and digital integration will define the future. Companies that invest in long-term strategies, regional expansion, and advanced solutions will emerge as market leaders. The next decade will witness significant disruptions, creating profitable opportunities for early adopters.

Why Clients Worldwide Rely on QY Research -

With over 71,000 global leading players - including Fortune Global 500 companies - trusting QY Research, we have established ourselves as a true authority in market intelligence. Our commitment to accuracy and depth is reflected in the fact that 95% of our clients return for repeat purchases, recognizing the reliability and actionable value of our insights.

More than 5,000 media outlets, stock-listed, and IPO-bound companies rely on QY Research data to shape strategies, strengthen investor confidence, and guide critical decisions. Backed by 18 years of expertise, a library of over 2 million reports, 20,000+ industry experts, and a global network spanning 160 countries, QY Research delivers comprehensive intelligence across industries and geographies.

Our proprietary 36-role interview validation system ensures every report undergoes rigorous multi-level verification, guaranteeing unmatched accuracy and credibility. With 1,000+ specialized databases, QY Research stands as a trusted partner in helping businesses, policymakers, and investors navigate dynamic markets with confidence.

About Us:

QYResearch established as a research firm in 2007 and have since grown into a trusted brand amongst many industries. Over the years, we have consistently worked toward delivering high-quality customized solutions for wide range of clients ranging from ICT to healthcare industries. With over 50,000 satisfied clients, spread over 80 countries, we have sincerely strived to deliver the best analytics through exhaustive research methodologies.

Contact Us:

Arshad Shaha | Marketing Executive

QY Research, INC.

315 Work Avenue, Raheja Woods,

Survey No. 222/1, Plot No. 25, 6th Floor,

Kayani Nagar, Yervada, Pune 411006, Maharashtra

Tel: +91-8669986909

Emails - arshad@qyrindia.com

Web - https://www.qyresearch.in

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release IT Leasing And Financing Market Poised to Surpass $1238.97 Billion by 2031 | Strong Demand Momentum here

News-ID: 4225074 • Views: …

More Releases from QYResearch.Inc

SiC MOSFET Chips (Devices) and Module Market Global Trends, Market Size, Segment …

Market Overview and Research Scope -

The global SiC MOSFET Chips (Devices) and Module Market is entering a high-growth phase as industries transition toward electrification, high-voltage platforms, and next-generation power electronics. Silicon carbide (SiC) MOSFET technology, with its wide bandgap characteristics and superior efficiency, is rapidly replacing traditional silicon-based power devices across automotive, renewable energy, and industrial sectors.

According to the latest market analysis, the industry is expected to grow from US$…

System In a Package (SIP) and 3D Packaging Market Global Analysis 2025: Size, Sh …

Market Overview and Research Scope -

QY Research Inc., A global market research and consulting firm, has announced the release of its latest 2026 report titled "System In a Package (SIP) and 3D Packaging - Global Market Share and Ranking, Overall Sales and Demand Forecast 2026-2032." The report provides a data-driven analysis of the global System In a Package (SIP) and 3D Packaging market, integrating historical insights from 2020-2025 with forward-looking…

RF Front-end Chip Market Size, Share, Growth Analysis, Industry Trends and Forec …

Market Overview and Research Scope -

The global RF Front-end Chip Market is witnessing robust growth driven by accelerating 5G rollouts, increasing smartphone penetration, and rising demand for high-speed wireless connectivity. According to the latest market analysis, the industry is expected to grow from US$ 36 billion in 2025 to US$ 96.22 billion by 2032, registering a CAGR of 15.3% over the forecast period.

RF front-end chips are critical components in wireless…

UVC Disinfection Robots Market Trends Accelerate with Projected 15.3% CAGR by 20 …

Market Overview and Research Scope -

The global UVC Disinfection Robots Market is experiencing sustained growth as healthcare facilities, transportation hubs, and commercial environments accelerate investments in automated infection prevention technologies. According to the latest industry analysis, the market is forecast to expand from US$ 909 million in 2025 to US$ 2.43 billion by 2032, reflecting a CAGR of 15.3% over the forecast period.

UVC disinfection robots utilize ultraviolet light in the…

More Releases for Leasing

Financial Leasing Market: A Compelling Long-Term Growth Story | Minsheng Financi …

The latest 94+ page survey report on Financial Leasing Market is released by HTF MI covering various players of the industry selected from global geographies like North America, US, Canada, Mexico, Europe, Germany, France, U.K., Italy, Russia, Nordic Countries, Benelux, Rest of Europe, Asia, China, Japan, South Korea, Southeast Asia, India, Rest of Asia, South America, Brazil, Argentina, Rest of South America, Middle East & Africa, Turkey, Israel, Saudi Arabia,…

Financial Leasing Market 2019 Global Major Players: CDB Leasing, ICBC Financial …

The Global Financial Leasing Industry, 2019-2024 Market Research Report is a professional and in-depth study on the current state of the Global Financial Leasing industry with a focus on the Global market. The report provides key statistics on the market status of the Financial Leasing manufacturers and is a valuable source of guidance and direction for companies and individuals interested in the industry.

The report displays significant strategies which are…

Financial Leasing Market 2017 Analysis – CDB Leasing, ICBC Financial Leasing C …

A financial lease is a method used by a business for acquisition of equipment with payment structured over time. To give proper definition, it can be expressed as an agreement wherein the lessor receives lease payments for the covering of ownership costs. Moreover, the lessor holds the responsibility of maintenance, taxes, and insurance.

In this report, RRI studies the present scenario (with the base year being 2017) and the growth prospects…

Financial Leasing Market Outlook to 2023 – CDB Leasing, ICBC Financial Leasing …

A financial lease is a method used by a business for acquisition of equipment with payment structured over time. To give proper definition, it can be expressed as an agreement wherein the lessor receives lease payments for the covering of ownership costs. Moreover, the lessor holds the responsibility of maintenance, taxes, and insurance.

Request for Sample of Global Financial Leasing Market 2018 Research Report: https://www.researchreportsinc.com/sample-request?id=177516

Over the next five years, RRI…

Financial Leasing Market Outlook to 2023 – CDB Leasing, ICBC Financial Leasing …

Oct 2018, New York USA (News) - A financial lease is a method used by a business for acquisition of equipment with payment structured over time. To give proper definition, it can be expressed as an agreement wherein the lessor receives lease payments for the covering of ownership costs. Moreover, the lessor holds the responsibility of maintenance, taxes, and insurance.

Request for Sample of Global Financial Leasing Market 2018 Research Report:…

Financial Leasing Market by Top Key Participant CDB Leasing, ICBC Financial Leas …

A financial lease is a method used by a business for acquisition of equipment with payment structured over time. To give proper definition, it can be expressed as an agreement wherein the lessor receives lease payments for the covering of ownership costs. Moreover, the lessor holds the responsibility of maintenance, taxes, and insurance.

Get Sample Copy of this Report @ https://www.researchbeam.com/global-financial-leasing-by-manufacturers-countries-type-and-application-forecast-to-2023-market/request-sample?utm_source=Anil

Scope of the Report:

This report studies the Financial Leasing market…