Press release

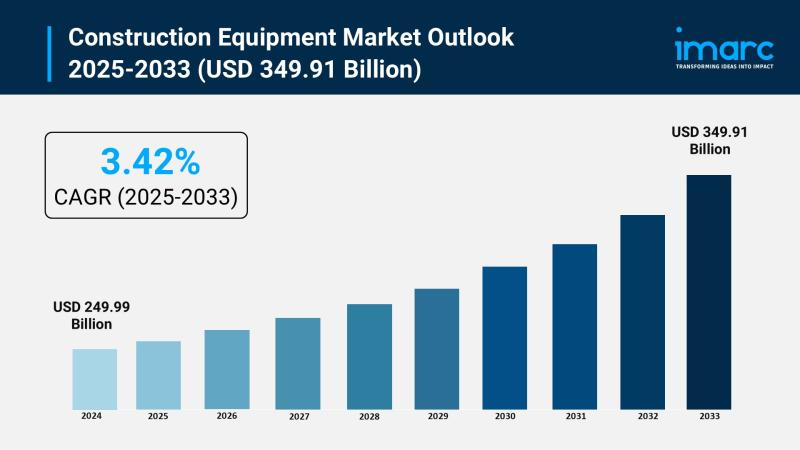

Construction Equipment Market Size to Reach USD 349.91 Billion by 2033 | With a 3.42% CAGR

Market Overview:According to IMARC Group's latest research publication, "Construction Equipment Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The global construction equipment market size was valued at USD 249.99 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 349.91 Billion by 2033, exhibiting a growth rate (CAGR) of 3.42% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

How AI is Reshaping the Future of Construction Equipment Market

● AI-powered predictive maintenance systems reduce equipment downtime by 20-25%, with telematics monitoring engine performance, fuel consumption, and component wear in real-time across construction fleets.

● Autonomous construction vehicles like Komatsu's self-driving dump trucks boost operational efficiency by 20%, while AI-guided excavators optimize digging patterns and reduce fuel consumption by 15%.

● Machine learning algorithms analyze project data to optimize equipment deployment, with 35% of large construction firms using AI-driven fleet management systems to reduce idle time and improve utilization rates.

● AI-enhanced safety systems prevent accidents through collision avoidance technology, reducing workplace injuries by 30% as sensors detect obstacles and automatically halt equipment operations.

● Computer vision and AI enable automated quality control, with smart systems inspecting grading accuracy and material placement, cutting rework costs by 18% and improving project timelines by 12%.

Download a sample PDF of this report: https://www.imarcgroup.com/construction-equipment-market/requestsample

Key Trends in the Construction Equipment Market

● Electrification Revolution: Electric and hybrid construction equipment sales surged 12-20% in 2023, driven by stringent emission regulations and sustainability goals. Volvo CE and Liebherr lead with zero-emission excavators and loaders, reducing carbon footprints by 40% while cutting fuel costs by 50%. Battery technology advancements enable 8-hour operation cycles, making electric machinery viable for major projects.

● Autonomous and Smart Machinery Adoption: Autonomous equipment deployment increased 25% in mining and construction sectors. GPS-enabled machines, IoT sensors, and AI-driven controls enhance precision by 30%, with Caterpillar's autonomous dozers operating 24/7. Smart equipment integration reduces labor costs by 20% while improving safety through collision-avoidance systems.

● Equipment Rental Market Expansion: Rental services grew 15-20% annually as contractors prioritize flexibility and cost efficiency. Small and medium-sized firms prefer renting over purchasing, with rental revenues reaching USD 120 billion globally. Companies like United Rentals expand fleets with latest technology, offering telematics-equipped machinery for optimized project management.

● Infrastructure Megaprojects Driving Demand: Government initiatives like the USD 1.2 trillion U.S. Infrastructure Bill and Saudi Arabia's USD 100 billion Vision 2030 program fuel equipment demand. Over 4,600 bridge projects and 69,000 miles of road repairs in the U.S. alone require excavators, bulldozers, and pavers, boosting market growth by 8-12% annually.

● Compact Equipment for Urban Construction: Compact machinery sales jumped 18% in 2023 as urban projects demand space-efficient equipment. Mini excavators, skid steer loaders, and compact wheel loaders dominate metropolitan construction sites. European markets lead adoption with 22% growth, supporting smart city developments and infrastructure modernization in congested areas.

Growth Factors in the Construction Equipment Market

● Massive Infrastructure Investments: Global infrastructure spending reached USD 6.3 trillion in 2023, with governments allocating substantial budgets for roads, bridges, and airports. The World Bank committed USD 14.86 billion to climate-resilient projects through 177 initiatives. China's construction output exceeded USD 4.5 trillion, while India budgeted USD 120 billion for infrastructure, tripling 2019 levels and driving excavator and crane demand.

● Rapid Urbanization Acceleration: China's urbanization rate reached 66.2% in 2023, up from below 20% in 1980, with projections of 255 million new urban dwellers by 2050. India will add 416 million city residents, requiring massive residential, commercial, and transit infrastructure. Emerging economies reshape skylines with high-rise buildings and metro systems, creating sustained equipment demand across Asia Pacific and Latin America.

● Equipment Replacement Cycles: Construction machinery typically serves 10-15 years before efficiency declines and maintenance costs escalate. Replacement demand drives 30-35% of annual sales as firms upgrade to fuel-efficient, technologically advanced equipment. Kobelco's 2024 launch of the SK80 Excavator under India's Make in India initiative exemplifies manufacturers introducing updated models with enhanced features and lower emissions.

● Stringent Environmental Regulations: EPA emission standards for nonroad diesel engines force industry shift toward sustainable solutions. The European Green Deal invested USD 1.04 billion in R&D for green construction technologies in 2023. Electric and hybrid machinery reduces NOx and particulate emissions by 60-70%, with manufacturers like Volvo and Caterpillar launching eco-friendly fleets to comply with regulations.

● Technological Innovation Integration: GPS, IoT sensors, and telematics systems enable remote monitoring and predictive maintenance, reducing downtime by 25%. Automation addresses labor shortages with robotic bricklaying and concrete pouring systems. Digital technologies improve productivity by 20-30%, with construction firms investing USD 15 billion annually in smart equipment upgrades to enhance operational efficiency and safety standards.

Ask analyst of customized report: https://www.imarcgroup.com/request?type=report&id=4107&flag=E

Leading Companies Operating in the Global Construction Equipment Industry:

● AB Volvo

● Caterpillar Inc.

● CNH Industrial N.V.

● Deere & Company

● Doosan Infracore

● Hitachi Construction Machinery

● Komatsu Ltd.

● Liebherr-International AG

Construction Equipment Market Report Segmentation:

Breakup By Solution Type:

● Products

● Services

Products account for the majority of shares due to their essential role in various construction activities including earthmoving, material handling, and concrete work.

Breakup By Equipment Type:

● Heavy Construction Equipment

● Compact Construction Equipment

Heavy construction equipment dominates the market as it encompasses machinery designed for heavy-duty tasks in large-scale construction projects.

Breakup By Type:

● Loader

● Cranes

● Forklift

● Excavator

● Dozers

● Others

Loaders represent the leading segment as they are versatile machines used for material handling and earthmoving tasks across multiple applications.

Breakup By Application:

● Excavation and Mining

● Lifting and Material Handling

● Earth Moving

● Transportation

● Others

Earthmoving equipment is the leading segment as it is essential for various construction projects, from digging foundations to creating trenches for utilities.

Breakup By Industry:

● Oil and Gas

● Construction and Infrastructure

● Manufacturing

● Mining

● Others

Construction and infrastructure is the leading segment as it encompasses a wide range of projects including residential buildings, roads, bridges, airports, and utilities.

Breakup By Region:

● North America (United States, Canada)

● Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

● Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

● Latin America (Brazil, Mexico, Others)

● Middle East and Africa

Asia Pacific enjoys the leading position with over 43.8% market share, driven by rapid urbanization, infrastructure development, and massive construction activities in China and India.

Recent News and Developments in Construction Equipment Market

● August 2024: Kobelco Construction Equipment India launched the SK80 Excavator under India's 'Make in India' initiative, featuring enhanced fuel efficiency and cutting-edge technology to meet growing domestic demand.

● 2024: Major cities including New York City, San Diego, Los Angeles, Montreal, and Philadelphia launched the North America Electric Construction Coalition to accelerate adoption of zero-emission construction equipment.

● 2023-2024: Caterpillar and Deere & Company expanded production of electric and autonomous equipment, with Caterpillar introducing next-generation electric excavators achieving 50% reduction in operating costs compared to diesel models.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201-971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Construction Equipment Market Size to Reach USD 349.91 Billion by 2033 | With a 3.42% CAGR here

News-ID: 4224486 • Views: …

More Releases from IMARC Group

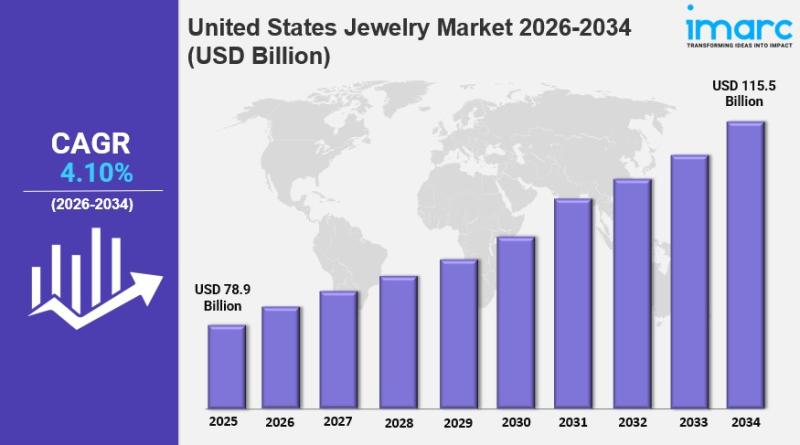

United States Jewelry Market Size, Share, Industry Overview, Growth and Forecast …

IMARC Group has recently released a new research study titled "United States Jewelry Market Report by Product (Necklace, Ring, Earrings, Bracelet, and Others), Material (Gold, Platinum, Diamond, and Others), and Region 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

United States Jewelry Market Overview

The United States jewelry market size reached USD 78.9 Billion in 2025.…

United States Air Freight Market Size, Share, Industry Trends, Growth and Foreca …

IMARC Group has recently released a new research study titled "United States Air Freight Market Size, Share, Trends and Forecast by Service, Destination, End User, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

United States Air Freight Market Overview

The United States air freight market size was valued at USD 64.06 Billion in 2025.…

Mexico Medical Tourism Market 2026 : Industry Size to Reach USD 10.6 Billion by …

IMARC Group has recently released a new research study titled "Mexico Medical Tourism Market Size, Share, Trends and Forecast by Type, Treatment Type, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Mexico Medical Tourism Market Overview

The Mexico medical tourism market size reached USD 2.1 Billion in 2025. Looking forward, the market is projected…

Saudi Arabia Pilates & Yoga Studios Market Size to Surpass USD 3.6 Billion by 20 …

Saudi Arabia Pilates & Yoga Studios Market Overview

Market Size in 2024: USD 1.6 Billion

Market Forecast in 2033: USD 3.6 Billion

Market Growth Rate 2025-2033: 8.20%

According to IMARC Group's latest research publication, "Saudi Arabia Pilates & Yoga Studios Market Size, Share, Trends and Forecast by Activity Type, Application, and Region, 2025-2033", the Saudi Arabia pilates & yoga studios market size reached USD 1.6 Billion in 2024. Looking forward, IMARC Group expects the…

More Releases for Construction

Off-site Construction Market: Revolutionizing Construction

In the dynamic landscape of the construction industry, off-site construction has emerged as a game-changer, set to transform the way we build. The market, valued at USD 249.15 billion in 2022, is poised for a remarkable growth spurt, projecting a 5.8% increase in revenue to reach a staggering USD 369.72 billion by 2029.

Know More About The Report:

https://www.maximizemarketresearch.com/market-report/off-site-construction-market/169386/

Unlocking Off-site Construction: A Holistic Overview

Off-site construction isn't just a building method; it's a…

Future Prospects of Data Center Construction Market by 2029 - Whiting-Turner Con …

Datacenter physical facility in an enterprise is designed to share IT operations and equipment to store, process, and disseminate data and applications.

The construction process refers to activities involved in the designing, planning, and construction of a facility. Datacenter costs comprise IT infrastructure, power distribution and cooling solutions, and several miscellaneous expenses.

Get Sample Report with Latest Industry Trends Analysis:

https://a2zmarketresearch.com/sample-request/674529

The top companies in this report include:

Whiting-Turner Contracting, Turner Construction, Holder…

Data Center Construction Market Analysis to 2028: Industry Growth, Size, Trends …

The Data Center Construction market report focused on the industry dynamics, including market growth elements. The report also identifies limitations and chances for high segments of market growth. Our world-renowned analyst team conducts a study that is a result of extensive primary and secondary research. The growth of the market is forecast with complex algorithms such as regression analysis, end-user analysis, etc. PESTEL analyses are the factors that influence global…

Residential Construction Market Is Booming Worldwide | Hindustan Construction, S …

A new research document is added in HTF MI database of 384 pages, titled as 'Residential Construction Global Industry Guide - Market Summary, Competitive Analysis and Forecast to 2025' with detailed analysis, Competitive landscape, forecast and strategies. Latest analysis highlights high growth emerging players and leaders by market share that are currently attracting exceptional attention. The identification of hot and emerging players is completed by profiling 50+ Industry…

Data Center Construction Market Next Big Thing 2026 | DPR Construction, Holder C …

Global data center construction market is projected to register a CAGR of 11.1% in the forecast period of 2019 to 2026.Global Data Center Construction Market By Infrastructure Type (electrical Infrastructure, mechanical infrastructure, general infrastructure), Data Center Type (Tier I, Tier II, Tier III, Tier IV), Organization Size (small organization, medium organization, large organization), Vertical (Banking, financial services and insurance, IT & Telecommunications, Government & Defense, Healthcare, Retail Colocation, Power &…

Data Center Construction Market Next Big Thing 2026 | DPR Construction, Holder C …

Global data center construction market is projected to register a CAGR of 11.1% in the forecast period of 2019 to 2026.Global Data Center Construction Market By Infrastructure Type (electrical Infrastructure, mechanical infrastructure, general infrastructure), Data Center Type (Tier I, Tier II, Tier III, Tier IV), Organization Size (small organization, medium organization, large organization), Vertical (Banking, financial services and insurance, IT & Telecommunications, Government & Defense, Healthcare, Retail Colocation, Power &…