Press release

Steady Expansion Forecast for Insurance Fraud Detection Market, Projected to Reach $22.14 Billion by 2029

Use code ONLINE20 to get 20% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.Insurance Fraud Detection Market Size Valuation Forecast: What Will the Market Be Worth by 2025?

The sector of detecting insurance fraud has seen an intense expansion recently. It is projected to escalate from a value of $7.5 billion in 2024, reaching $9.05 billion in 2025, indicating a compound annual growth rate (CAGR) of 20.5%. The phenomenal growth witnessed in the past span can be credited to the increase in incidents of insurance fraud, intricate fraud structures, legal compliance needs, customer's desire for safety, and the global expansion of insurance markets.

Insurance Fraud Detection Market Size Forecast: What's the Projected Valuation by 2029?

The market size of insurance fraud detection is predicted to witness significant expansion in the upcoming years, expanding to $22.14 billion by 2029 at a compound annual growth rate (CAGR) of 25.1%. This predicted growth during the forecast period is largely due to global data sharing platforms, heightened regulatory focus on fraud prevention, measures to identify insider threats, improved identification verification, and ramped up cybersecurity measures. Some of the key trends that we expect to see during this forecast period include the emergence of advanced analytics and machine learning, partnerships with insurtech companies, an emphasis on real-time fraud prevention, a focus on digital identity verification, the utilization of geospatial data for risk evaluation, and strict adherence to regulatory compliance and reporting.

View the full report here:

https://www.thebusinessresearchcompany.com/report/insurance-fraud-detection-global-market-report

What Are the Drivers Transforming the Insurance Fraud Detection Market?

The surge in cyberattacks is anticipated to fuel the expansion of the insurance fraud detection market. A cyberattack, a potentially hazardous and deliberate act by an individual or an organization in a bid to infiltrate another party's data, poses a significant threat. Insurance companies are particularly appealing targets for these attacks, given their access to vast quantities of personal policyholder data. Compared to other sectors that primarily retain sensitive financial information, insurers commonly amass substantial volumes of confidential personal information. The Anti-Phishing Working Group, a US organization, noted in June 2022 that it had documented a total of 1,025,968 phishing attacks in the first quarter of 2022. This marked a 15% increase from the fourth quarter of 2021, which had 888,585 reported attacks. Consequently, this rise in cyberattacks is a key driving force behind the growth of the insurance fraud detection market.

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=6399&type=smp

What Long-Term Trends Will Define the Future of the Insurance Fraud Detection Market?

The emergence of advanced technology is a prevalent trend in the insurance fraud detection market. Numerous companies are introducing innovative solutions with enhanced technologies to better monitor and identify fraudulent insurance claims for their consumers. For example, in June 2024, Clara Analytics Inc., an American software firm, debuted CLARA Fraud. CLARA is a fraud detection instrument that uses AI and comprehensive data on workers' compensation to amplify the detection of dubious claims. It offers alerts and evidence-based reasons for SIU referrals, enabling claim experts to probe into potential fraud with lesser chances of false positives, thereby revealing fraudulent actions across millions of claims.

Which Segments in the Insurance Fraud Detection Market Offer the Most Profit Potential?

The insurance fraud detectionmarket covered in this report is segmented -

1) By Component: Solution, Services

2) By Organization Size: Small And Medium-Sized Enterprises (SMEs), Large Enterprises

3) By Deployment Type: On-Premises, Cloud

4) By Application: Claims Fraud, Identity Theft, Payment And Billing Fraud, Money Laundering

5) By End User: Insurance Companies, Agents And Brokers, Insurance Intermediaries, Other End Users

Subsegments:

1) By Solution: Fraud Analytics, Authentication Solutions, Governance, Risk, and Compliance (GRC) Solutions, Identity Verification Solutions, Predictive Analytics

2) By Services: Managed Services, Professional Services, Consulting Services, Training and Support Services, System Integration Services

Tailor your insights and customize the full report here:

https://www.thebusinessresearchcompany.com/customise?id=6399&type=smp

Which Firms Dominate the Insurance Fraud Detection Market by Market Share and Revenue in 2025?

Major companies operating in the insurance fraud detection market include ACI Worldwide Inc., BAE Systems PLC, BRIDGEi2i Analytics Solutions Pvt. Ltd., Datawalk Inc., DXC Technology Co., Experian PLC, Fair Isaac Corp., Fiserv Inc., FRISS Inc., International Business Machines Corporation, iovation Inc., Kount Inc., Relx Group, Oracle Corp., SAP SE, SAS Institute Inc., Scorto Inc., TransUnion LLC, Wipro Ltd., accenture* plc, Equifax Inc., Perceptiviti Inc,, Shift Technology S. A., Verisk Analytics, Inc., Mody Data Solution Pvt. Ltd., Pixalate, Inc., Skopenow Inc., Sigma Insights Inc., Fraud Guard LLC

Which Regions Offer the Highest Growth Potential in the Insurance Fraud Detection Market?

North America was the largest region in the insurance fraud detection market in 2024.Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the insurance fraud detection market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa

Purchase the full report today:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=6399

This Report Supports:

1.Business Leaders & Investors - To identify growth opportunities, assess risks, and guide strategic decisions.

2.Manufacturers & Suppliers - To understand market trends, customer demand, and competitive positioning.

3.Policy Makers & Regulators - To track industry developments and align regulatory frameworks.

4.Consultants & Analysts - To support market entry, expansion strategies, and client advisory work.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Saumya Sahey

Europe: +44 7882 955267,

Asia: +44 7882 955267 & +91 8897263534,

Americas: +1 310-496-7795

Email: saumyas@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Steady Expansion Forecast for Insurance Fraud Detection Market, Projected to Reach $22.14 Billion by 2029 here

News-ID: 4224194 • Views: …

More Releases from The Business Research Company

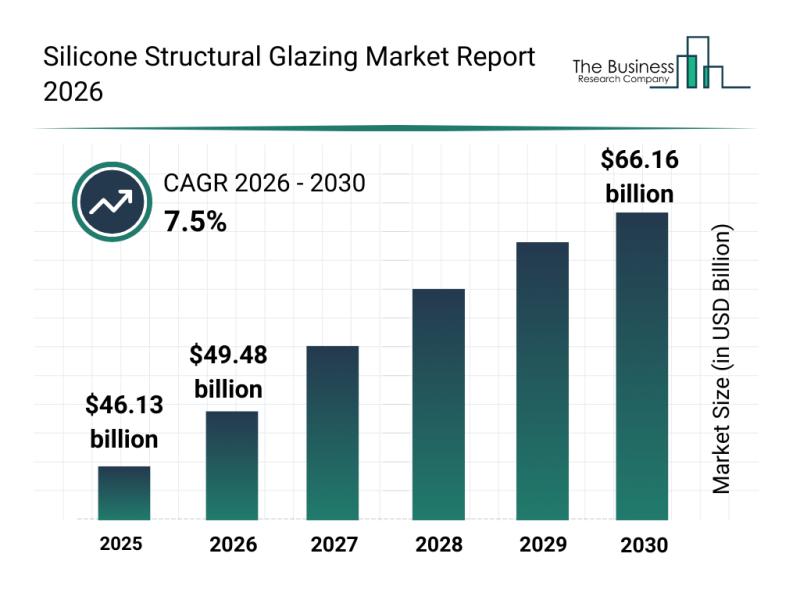

Leading Companies Solidify Their Presence in the Silicone Structural Glazing Mar …

The silicone structural glazing market is positioned for significant expansion in the coming years, driven by advances in building technology and increased environmental awareness. This sector is evolving rapidly as demand grows for more energy-efficient and aesthetically appealing architectural solutions. Let's explore the market's current size, key players, emerging trends, and the main segments that are shaping its future.

Silicone Structural Glazing Market Value Forecast Through 2030

The market for silicone…

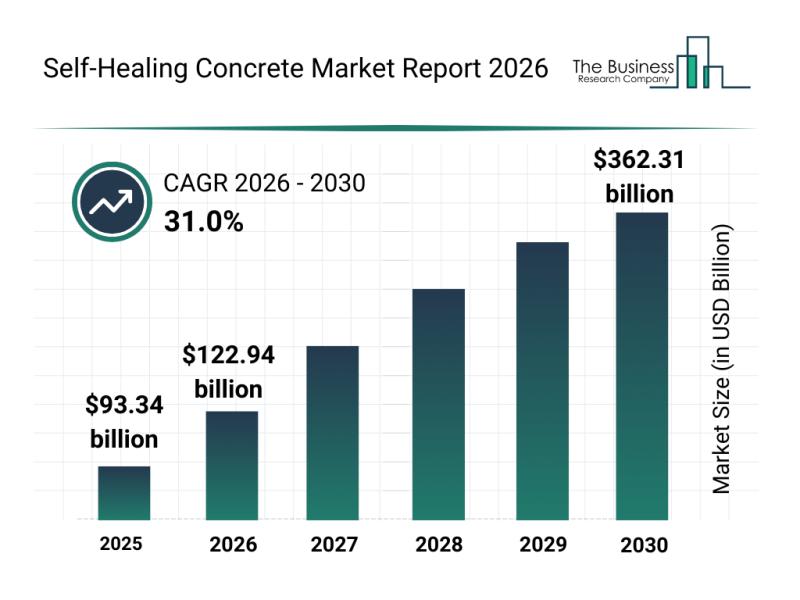

Future Prospects: Key Trends Shaping the Self-Healing Concrete Market up to 2030

The self-healing concrete market is capturing significant attention as innovations and sustainability demands rise in construction. This sector is set to experience remarkable growth due to advancements in materials and technology, shaping the future of durable and intelligent infrastructure solutions. Let's explore the market's size, key players, emerging trends, and segment outlook to understand its trajectory.

Projected Market Size and Growth Prospects for the Self-Healing Concrete Market

The self-healing concrete market…

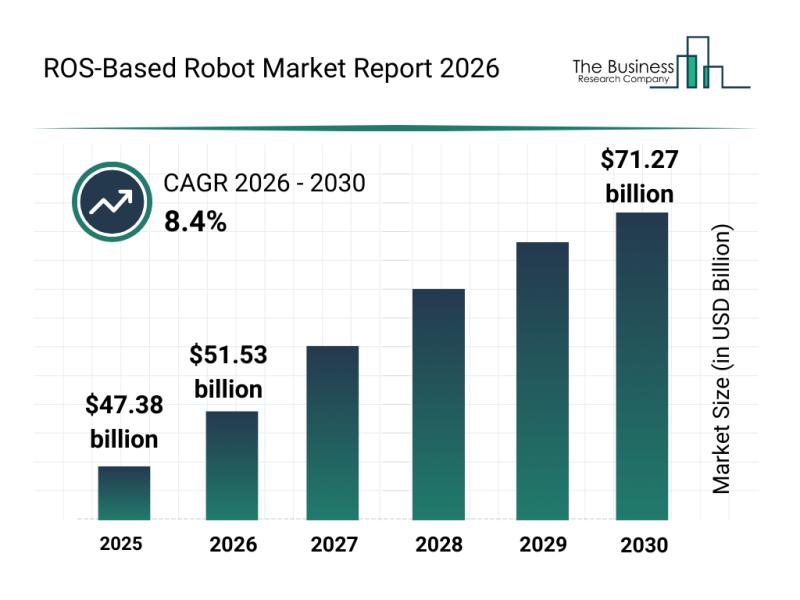

Analysis of Key Market Segments Driving the ROS-Based Robot Industry

The ROS-based robot market is positioned for substantial growth as robotics technology continues to advance rapidly. With increasing innovation in software, hardware, and AI integration, this sector is set to transform multiple industries by 2030. Below, we explore the market's future size, leading companies, key trends, and segmentation details to understand its evolving landscape.

Projected Market Size and Expansion of the ROS-Based Robot Market

The ROS-based robot market is anticipated to…

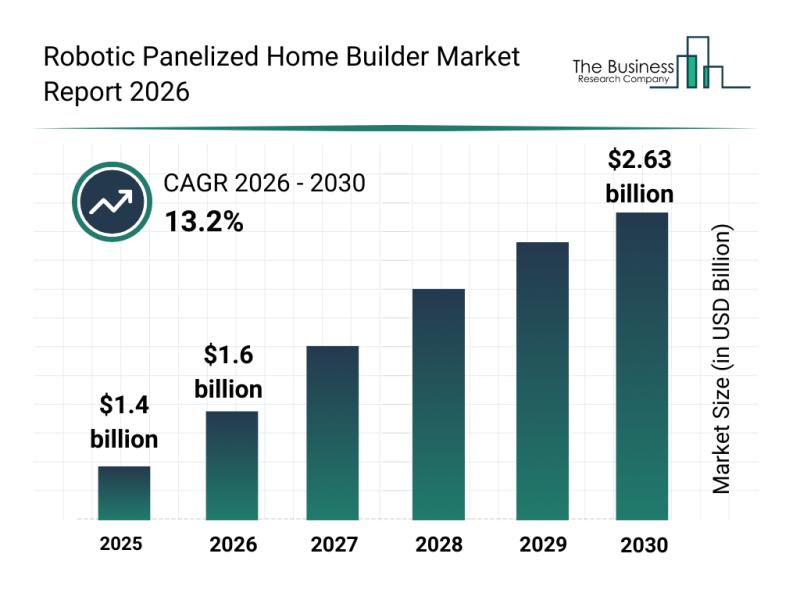

Global Trends Overview: The Rapid Evolution of the Robotic Panelized Home Builde …

The robotic panelized home builder market is positioned for impressive growth in the coming years as automation and robotics increasingly transform construction processes. Driven by technological advancements and expanding prefab housing projects, this market is set to reshape how homes are built with greater speed and efficiency. Let's explore the market's size, leading companies, emerging trends, and key segments that are shaping its future.

Strong Growth Forecast for the Robotic Panelized…

More Releases for Fraud

GrayCat PI Joins Global Effort to Spotlight Fraud During International Fraud Awa …

Image: https://www.abnewswire.com/upload/2025/11/dc16cdb8496c72daf00c6802941e27f3.jpg

International Fraud Awareness Week runs November 19-22, 2025 worldwide Oaxaca, Oaxaca, Mexico. $3.1 billion lost to fraud. That figure comes from Occupational Fraud 2024: A Report to the Nations, the latest study from the Association of Certified Fraud Examiners (ACFE), based on 1,921 occupational fraud cases worldwide. The report is available at https://legacy.acfe.com/report-to-the-nations/2024/.

Because fraud remains a persistent and costly threat, GrayCat PI has joined International Fraud Awareness Week [https://graycatpi.com/fraud-week-mexico-2025/],…

New York City Fraud Attorney Russ Kofman Releases Insightful Guide on Welfare Fr …

New York City fraud attorney Russ Kofman (https://www.lebedinkofman.com/are-you-being-investigated-for-welfare-fraud-in-nyc/) of Lebedin Kofman LLP has recently published an enlightening article addressing the complexities surrounding welfare fraud investigations in New York City. The article, aimed at individuals who may be under investigation for welfare fraud, offers crucial legal insight and guidance for navigating this challenging process.

Welfare fraud is no minor offense. It comprises various fraudulent acts to unlawfully obtain public assistance benefits. This…

Fraud Increased by 3% in 2021 - Says Shufti Pro's Global ID Fraud Report

AI-powered digital identity verification solution provider, Shufti Pro, revealed new data in its Global ID Fraud Report 2021 which shows insights from ample research of 11 months of verification. The report highlights the changing fraudulent activities and advanced manipulation techniques that the company faced in 2021. Experts from Shufti Pro have also made fraud predictions that will threaten the corporate sector in 2022.

The ceaseless increase in ID and…

IPTEGO Launching PALLADION Fraud Detection and Prevention for a Real-Time Protec …

IPTEGO presents PALLADION Fraud Detection & Prevention, an innovative protection for CSPs and their customers against toll fraud.

Berlin, Germany, February 08, 2012 -- IPTEGO presents PALLADION Fraud Detection & Prevention, an innovative protection for CSPs and their customers against toll fraud.

With PALLADION Fraud Detection & Prevention, IPTEGO provides an answer to a growing demand for more network security when it comes to toll fraud. Today’s Communication Service Providers (CSPs) are…

Online Fraud Prevention – Sentropi

Are security nightmares causing you sleepless nights? Are you worried about how secure your I.T infrastructure is? Sentropi aims to address these ever present security concerns with its uniquely different identification and tracking solution. Sentropi's innovative technology allows you to identify your users with pinpoint accuracy and lets you track fraudsters on any platform, any browser, any time and any where! Hunt down fraudsters by tracking down their computers rather…

Fight Private Placement Program Fraud - PPP Fraud!

Stand up to private placement program fraud!

To set an undertone for the following summary; logic begets logic. No trading platforms nor programs, whether public or private have the freedom of complete exclusion from regulatory oversight, licensing, and governance.

Our firm has significant interest in a few platforms, as principals. There are indeed private financial offerings which have historically delivered very significant performance using "Institutional Leverage, Traders, Risk Management, Clearing & Execution"…