Press release

How the 4% Tax Depreciation Rule Can Save UAE Real Estate Investors Money

Real estate in the UAE has always been a popular investment choice, but with Corporate Tax UAE now imminent, investors are thinking more carefully about how they can reduce their taxable profits. One powerful tool available to them is the 4% tax depreciation rule, whereby property owners can consider depreciation an expense and reduce the profit amount subject to tax.In this blog, we will explain what the 4% depreciation rule is, why it matters for investors, and how working with professional corporate tax consultants https://vatregistrationuae.com/corporate-tax-consultant-uae/ can maximize these benefits.

What Is the 4% Tax Depreciation Rule in the UAE?

The 4% depreciation rule is the default rate of depreciation allowed for buildings and real estate under the UAE's corporate tax framework. In simple terms, companies and property investors can deduct 4% of the property value annually as an expense in computing taxable income.

Example:

- When a building with a value of AED 10 million is owned by an investor, then the investor can deduct AED 400,000 annually as depreciation.

- This deduction reduces the taxable profit, which lowers the overall corporation tax liability.

This is especially important under Corporate Tax UAE, as every reduction in taxable income translates into real tax savings.

Why Does Depreciation Important for Real Estate Investors?

Depreciation is more than just an accounting entry; it is a legal way of reducing tax. Here is why it is important:

- Reduces Taxable Income: Depreciation directly reduces profits that are subject to corporate taxation.

- Improves Cash Flow: Less tax liability means investors keep more cash for reinvestment.

- Recognizes Asset Wear and Tear: Properties naturally lose value over time; depreciation accounts for that in financial records.

- Boosts ROI: When combined with other tax planning strategies, depreciation can significantly improve return on investment.

For investors facing corporate tax in UAE, ignoring depreciation means paying more tax than necessary.

How Is the 4% Depreciation Rule Calculated?

The calculation is straightforward:

- Determine the building cost (excluding land).

- Apply an annual 4% depreciation rate.

- Deduct the arrived amount from taxable income.

Example:

Property purchase price: AED 20 million

Land value: AED 5 million (non-depreciable)

Building value: AED 15 million

Annual depreciation = AED 15 million × 4% = AED 600,000

That AED 600,000 is deducted each year, which directly decreases the corporate tax payable.

Who Can Benefit from the 4% Depreciation Rule?

The rule applies mostly to:

- Real estate developers with rental portfolios.

- Commercial property-owning corporate investors.

- Businesses owning their offices or warehouses.

- Free zone companies that invest in real estate and must comply some corporate tax requirements.

Through the application of the depreciation rule, these investors align with FTA corporate tax rules and reduce their liability at the same time.

What Are the Conditions for Claiming Depreciation?

Simple a rule as it seems, there are requirements to keep in mind:

- Only buildings, but not land, are depreciable.

- The property must be utilized for business or investment purposes.

- There must be adequate accounting records according to IFRS.

- The depreciation must be applied consistently on a yearly basis.

Professional corporate tax consultants in the UAE can help businesses ensure appropriate application of the rule and prevention of compliance problems.

How Much Can Investors Actually Save With This Rule?

Let us look at a straightforward example:

Annual rental income: AED 5 million

Other expenses (maintenance, staff, etc.): AED 1 million

Net income before depreciation: AED 4 million

Less depreciation (AED 600,000)

Adjusted taxable income: AED 3.4 million

Corporate tax at 9% = AED 306,000

Without depreciation, tax would have been AED 360,000. That's a saving of AED 54,000 per year, just by claiming depreciation.

Over 10 years, that's more than half a million dirhams saved.

How Does the 4% Rule Fit into UAE Corporate Tax Planning?

Depreciation is only a part of a general tax strategy. The other facets include:

- Maximizing expenses that can be deducted.

- Investment in real estate held in entities.

- Addressing financing costs properly.

- Exit and disposal of property planning to minimize taxable gains.

Cumulatively, these approaches allow companies and investors to fulfill corporate tax UAE obligations without paying too much.

Can Free Zone Companies Use the Depreciation Rule?

Yes, but with conditions. Companies in the free zone can qualify for a 0% tax rate on certain eligible income. However, if they earn income beyond those privileges, they must apply regular corporate tax UAE concepts.

In such cases, depreciation can reduce the taxable figure, maximizing the benefit of free zone operations.

Why Hire Corporate Tax Consultants for Depreciation Planning?

While the rule itself is simple, mistakes in applying it can result in penalties or disallowed deductions. Corporate tax consultants provide value by:

- Correctly categorizing assets and land v. buildings.

- Preparing IFRS-compliant books of account.

- Identifying other deductions that investors would miss.

- Advising on free zone v. mainland implications.

- Preparing accurate corporate tax returns to the FTA.

By using professionals, investors not only avoid costs but also stay on the right side of the law.

What If You Don't Claim Depreciation?

Failing to claim depreciation has two consequences:

Higher Tax Liability: Investors will be taxed on more profit.

Savings Lost: You cannot retrospectively claim depreciation once a year is closed off.

This is why firms have to be proactive with their accountants or tax professionals to apply the 4% rule annually.

Conclusion

The 4% tax depreciation rule is the simplest yet most power full tool available for UAE real estate investors. By reducing taxable income, it saves companies from paying too much corporate tax.

Yet UAE corporate tax compliance is complex, and inattention to detail can be costly. So, the most efficient way to maximize your tax savings, ensure compliance, and optimize long-term investment returns is to engage experienced corporate tax consultants.

If you are a business or investor in the UAE who wants to optimize your tax position, the time to act is now. Talk to our tax agents https://vatregistrationuae.com/tax-consultant-in-uae/ today to maximize the 4% depreciation rule and other measures under the UAE's evolving corporate tax environment.

FAQs

1. Will the 4% rule for depreciation also apply to land, or just for buildings?

It applies only to the building aspect of the property. Land itself is not depreciable because it does not depreciate over time. You cannot depreciate it, so you have to take it out of the building cost when you use the 4% rule.

2. I'm an individual investor, not a corporation. Can I claim depreciation?

Yes, you can. As long as the property is used for business or investment, and suitable records are kept, individual investors themselves are not prohibited from applying the 4% depreciation rule either, just companies.

3. How much money would I actually save with this rule?

It will vary based on your property's value. For example, if your building is AED 15 million, you would be eligible to claim AED 600,000 a year. On a tax of 9%, that's approximately AED 54,000 saved every year which adds up really quickly over time.

4. What if I forget to account for depreciation in one year of tax?

Unluckily, as soon as the year's gone, you can't claim it retrospectively. If you don't claim depreciation in that year, you simply lose out and end up paying more tax than you need to.

5. Do I absolutely require corporate tax consultants to handle depreciation?

It's highly recommended. Although the 4% rule sounds simple on paper, it's simple to get it wrong like failing to split land and building values properly. A good corporate tax advisor will keep you in compliance and avoid you losing savings

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release How the 4% Tax Depreciation Rule Can Save UAE Real Estate Investors Money here

News-ID: 4223801 • Views: …

More Releases from Publiera

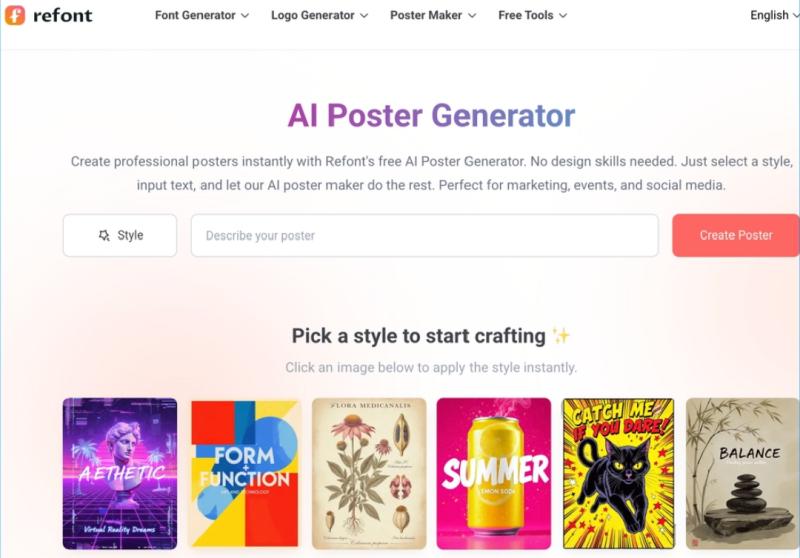

Tired of the Design Bottleneck? How I Finally Found a Practical AI Poster Genera …

If you're anything like me, you've probably spent more hours than you'd like to admit fighting with design software. We've all been there: you have a killer idea for a promotion, a social post, or a brand announcement, but by the time you've messed around with layers, alignment, and hunting for stock photos, the inspiration is gone-and so is half your afternoon.

I've tried the early wave of generative AI tools,…

Comparing Laser Cutting Vs. Waterjet Cutting: Choosing The Right Method For Your …

Choosing between laser cutting and waterjet cutting can feel tricky.

Laser cutters are precise and fast, while waterjets handle thick or

heat-sensitive materials like glass with ease.

This guide breaks down their key differences, pros, cons, and tips to

help you decide. Keep reading to find the right fit for your project!

Key Differences Between Laser Cutting and Waterjet Cutting

Laser cutting https://1cutfab.com/pages/laser-cutting-services uses intense light to slice through materials, while

waterjet cutting relies on high-pressure water…

Beyond the Mirror: How a Makeup Artist Course Teaches You to See Faces Different …

Makeup artistry is so much more than applying products - it's about

understanding form, texture, colour and individual expression. A

well‐designed makeup artist course teaches aspiring artists to look

deeper: to see faces not as blank canvases, but as unique landscapes

full of potential.

This transformation - from seeing faces as images in a mirror to

understanding them as expressive, three‐dimensional forms - is central

to professional makeup artistry. A structured course builds this

perception through technical training,…

Why Stunning Wildlife Photos Start With Education, Not Equipment

When most people picture wildlife photography, they imagine a photographer hiding behind a giant lens, waiting for a perfect moment. It's easy to fall into the trap of believing that breathtaking wildlife photos are all about gear - the most expensive camera body, the longest zoom lens, the newest accessories. But in truth, the foundation of impactful wildlife photography isn't equipment - it's education.

A wildlife photography course teaches not just…

More Releases for AED

NKN MEDIA RAISES AED 35 MILLION, PLANS TO RAISE ANOTHER AED 50 MILLION FOR AGGRE …

NKN Media, a leading integrated media powerhouse, has successfully raised AED 35 million and is all set to raise another AED 50 million to accelerate its global expansion and develop IPs.

Celebrating five years in Dubai, NKN Media has further cemented its position as a key player in the region's media and events landscape. Following the resounding success of the Dubai Property Expo, which saw strong engagement in Singapore, the company…

AEDLAND: Offering Accessible and Affordable AED Supplies

Know more about the importance of having extra AED batteries

People purchase Automated External Defibrillators (AEDs) for several reasons. Primarily, it is a vital tool for saving lives. In cases of sudden cardiac arrest, immediate defibrillation can significantly increase the chances of survival. AEDs are also becoming more accessible and affordable, making them a practical investment for individuals, businesses, and communities. AEDLAND is a trusted machine distributor and they also offer…

Extended Reality at AED Studios in Belgium

Starting in September, AED Studios in Lint (Belgium) will offer TV, film and event producers the opportunity to use a high-tech XR studio. Extended reality (XR) is the umbrella term for virtual reality (VR), augmented reality (AR), mixed reality (MR) and other immersive technologies. At the XR studio, the physical and digital worlds are perfectly connected, allowing for new, expanded and unique possibilities for audiovisual productions.

The XR Studio is…

World First in Air Disinfection at AED Studios

Willebroek, Belgium, Jul 01, 2020 -- Glenn Roggeman, CEO of AED Group, launched the first UVC luminaires under the AED private label Luxibel as early as April. The system was further developed for larger spaces with an audience where air circulation needs to be taken into account. Roggeman used his knowledge of aerodynamics that he gained during his training as a helicopter pilot. 'The main advantage of this system is…

Dunkin’ Donuts Raises Aed 40,000 For Children’s Charity

Gesture in support of Sharjah City for Humanitarian Services Special Needs Kids

As part of its ongoing commitment to community welfare and to extend a helping hand to the differently-abled, Dunkin’ Donuts recently presented a cheque for AED 40,000 to the Sharjah City for Humanitarian Services (SCHS) – a charity set up to support children with special needs. The amount was raised through a special promotion organised by the coffee…

AED Brands Introduces a Free AED Resource Center

AED Brands, an authorized automated external defibrillator dealer, today announced their newest web site addition, the AED Resource Center. This free resource for AED information contains five sections of AED facts and knowledge that will help educate and inform lay people and medical professionals alike about automated external defibrillators and their importance in treating sudden cardiac arrest (SCA). The five sections in the AED Resource Center are:

• AED Market Guides

• Recent AED…