Press release

Aequifin Highlights Litigation Financing as a Leading Alternative Investment Asset Class for Investors

Image: https://www.abnewswire.com/upload/2025/10/1f7109bbfe350e845ed59c9d6ef106ba.jpg1. Litigation funding: alternative investments independent of the markets

One of the main advantages of this market is its low correlation with traditional markets. Performance does not depend on market forecasts of stock prices or interest rate but primarily on the outcome of legally assessed cases. These are typically clearly structured proceedings with transparent risk assessments and defined amounts in dispute. For investors, this means high transparency, calculable risks, and attractive return potential - especially in the case of a successful outcome where a multiple of the invested capital can be achieved.

Attractive multiples provide the opportunity to considerably reduce risks. With a balanced portfolio it is even possible to achieve double digit returns if 50% of the cases are lost or have a negative return.

Since financing costs are much lower than the value of cases this asset class has similarities to derivative instruments in traditional capital markets.

According to the Preqin study [https://www.private-banking-magazin.de/preqin-china-private-equity-studie-markt-fuer-alternative-investments/?viewall] Future of Alternatives 2029, global assets under management in alternative investments are expected to grow to approximately 29.2 trillion US dollars by the end of 2029. This corresponds to an average annual growth rate of 9.7 percent - a clear indication of the rising importance of non-traditional investment strategies.

Democratization of Alternative Investments

While such asset classes were once almost exclusively reserved for institutional investors, new platform models like AEQUIFIN are now opening access to affluent private investors as well. They enable investments in litigation funding starting from comparatively moderate amounts, combined with intelligent risk diversification across multiple cases.

Transparency and Direct Participation as Key Differentiators

Unlike many fund structures, participation via AEQUIFIN [https://www.aequifin.com/en/registration] is direct and case-specific. Investors gain access to the legal context, the calculated litigation budget, and the estimated prospects of success - all clearly prepared in standardized data rooms. This creates a high level of transparency and traceability, making it easier for both institutional and private investors to evaluate each opportunity.

2. Litigation Funding as a High-Yield Alternative Investment

The basic idea behind litigation funding is as simple as it is effective. Investors provide capital for selected legal disputes and, in the event of a successful outcome, receive a contractually agreed share of the awarded proceeds. For plaintiffs, this offers the opportunity to pursue legal claims without bearing the full financial risk. For investors, it opens access to market-independent sources of return with an asymmetric risk-return profile.

While the litigation funder participates in the awarded amount if the case is successful, they bear the full financial loss in the event of an unfavorable outcome. The investment is therefore based on a "no win no fee" structure, which requires both strict case selection and disciplined risk management.

For corporations which are considering to pursue a lawsuit litigation funding is a risk control instrument. If a case is published on a transparent platform and no offer of funders can be obtained, that could be an indication that risks of a potential lawsuit are too high.

Market-Independent Diversification with Clear Frameworks

A key advantage for investors lies in the low correlation to traditional capital markets. Legal proceedings are not subject to the same fluctuations caused by stock prices, interest rate policies, or geopolitical events as equities or bonds. Litigation funding therefore offers an attractive opportunity for portfolio diversification, especially during volatile market phases.

In addition, the capital commitment is comparatively short. While investments in private equity or infrastructure are often tied up for seven to ten years, funded legal cases can be resolved within six to 24 months. This creates liquidity advantages and enhances the predictability of capital allocation.

The AEQUIFIN platform as the gateway for the litigation finance market

The AEQUIFIN Platform translates the theoretical advantages of litigation funding into a practicable, sponsor-centric offering by operating an online marketplace that seamlessly matches funding needs with sponsor capital.

The financiers on the platform-referred to as sponsors-can efficiently finance and monetize a wide range of case types-with particular emphasis on banking & capital markets, patents and corporate disputes-while preserving alignment through participation in the financial outcome of funded claims.

Risk is managed through transparent case-level data, standardized term sheets and portfolio diversification tools that let sponsors compare pricing and assessed chances of success before committing capital.

Co-financing is facilitated via an innovative bidding process, and all transactions are handled quickly and comprehensively through AEQUIFIN's infrastructure and an independent trustee arrangement.

As proof of concept, the marketplace has already successfully financed initial cases with a combined claim value exceeding 25 million, and AEQUIFIN will soon make larger cases available for sponsor participation.

For those seeking market-independent, impact-oriented exposure to alternative returns, this streamlined, transparent access to the world of litigation funding is available exclusively on the AEQUIFIN platform. A key advantage for investors lies in the low correlation to traditional capital markets. Legal proceedings are not sub.

Find Out About AEQUIFIN Current CASES [https://www.aequifin.com/en/overview]

Media Contact

Company Name: AEQUIFIN

Contact Person: Ludwig Zoller

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=aequifin-highlights-litigation-financing-as-a-leading-alternative-investment-asset-class-for-investors]

Address:Bavariafilmplatz 7, Grunwald

City: Munich Bayern 82031

Country: Germany

Website: https://www.aequifin.com/

Legal Disclaimer: Information contained on this page is provided by an independent third-party content provider. ABNewswire makes no warranties or responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you are affiliated with this article or have any complaints or copyright issues related to this article and would like it to be removed, please contact retract@swscontact.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Aequifin Highlights Litigation Financing as a Leading Alternative Investment Asset Class for Investors here

News-ID: 4223756 • Views: …

More Releases from ABNewswire

Sure Way Cash introduces online loan service for installment loans up to $10,000

Chicago, IL - Sure Way Cash [https://www.surewaycash.com/] today announced the launch of its online loan connector service that allows U.S. residents to check installment loan options up to $10,000 through a secure request process without a hard credit check.

The platform is designed for borrowers who may have bad credit, limited credit history, or prior loan denials and want to explore loan options without upfront fees or obligation. Users can submit…

Otter Public Relations Awarded in the Excellence in Workplace Culture Award for …

ST. PETERSBURG, Fla. - Feb 23, 2026 - Otter Public Relations [https://otterpr.com/]was proudly awarded Excellence in Workplace Culture for Small Businesses for 2025.

Otter PR, founded by Scott Bartnick and Jay Feldman, is one of the nation's most highly rated and awarded PR firms. With over 300 years of combined experience, Otter PR is known for results-driven campaigns and securing valuable media coverage. Otter PR's team of publicists, writers, marketers, and…

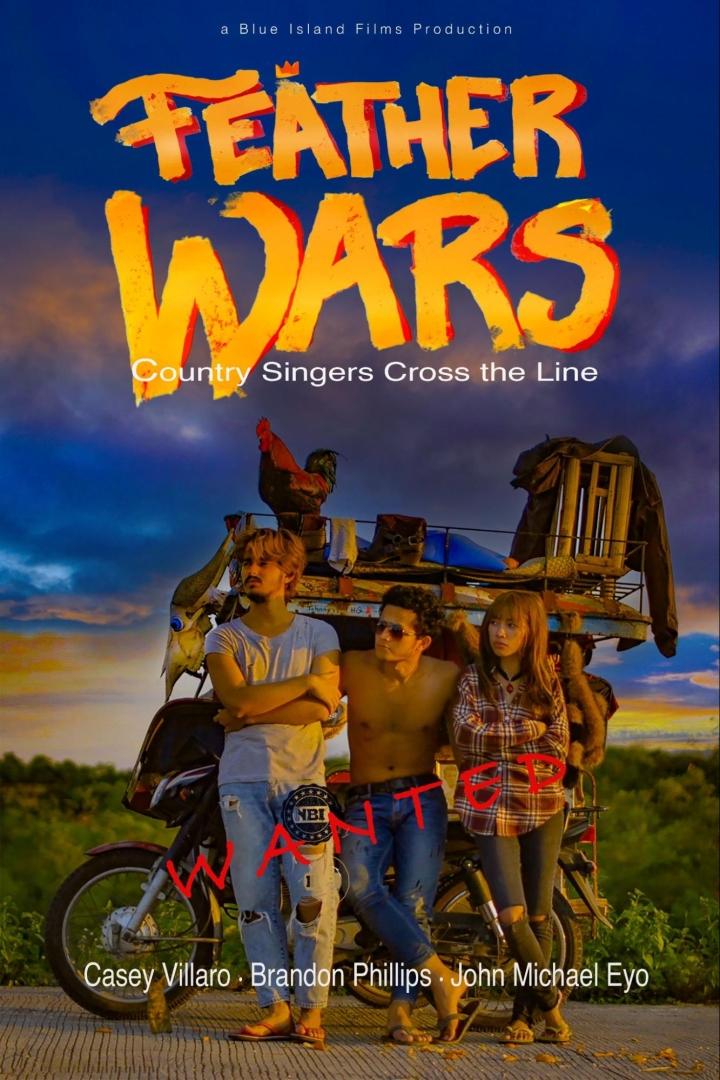

Philippine Coming-of-Age Film "Feather Wars" (2025) Wraps Production in Bohol, S …

Feather Wars is a 140-minute Filipino coming-of-age adventure comedy filmed in Bohol. Directed by Tim Fitzharris and produced by Jesse Fitzharris, it follows two teen musicians fleeing their abusive stepfather, funding their escape through underground cockfighting scams. Blending dark comedy, music, and family drama, the film highlights Filipino culture and earned international screenplay recognition before completing production in 2025.

BOHOL, PHILIPPINES - The Philippine independent film Feather Wars, a 140-minute coming-of-age…

BPOSeats Launches Flexible, Fully-Managed Office Solutions to Help BPOs and Star …

BPOSeats.com introduces plug-and-play office spaces designed for BPO companies, startups, and remote teams seeking cost-efficient, scalable, and fully managed workspace solutions across the Philippines.

Philippines - February 23, 2026 - BPOSeats.com, a leading provider of fully-managed office and seat leasing solutions, announces its continued expansion in supporting BPO companies, startups, and remote teams with flexible, scalable office infrastructure across the Philippines.

As businesses increasingly prioritize agility and cost efficiency, traditional long-term office…