Press release

Petroleum Coke Market Size, Share, Growth & Forecast Report 2025-2033

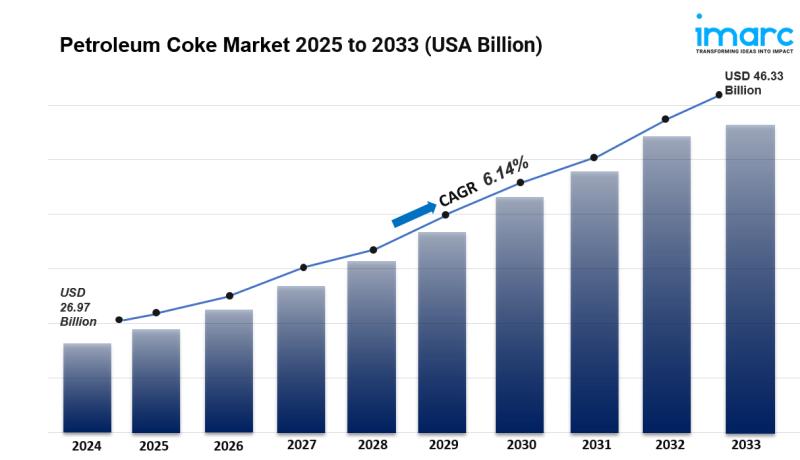

Petroleum Coke Market Size and Outlook 2025 to 2033:The global petroleum coke market size was valued at USD 26.97 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 46.33 Billion by 2033, exhibiting a CAGR of 6.14% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of over 45.1% in 2024. The market is experiencing steady growth driven by the increasing demand from the aluminum industry, the expanding power generation sectors, and the rising use of petroleum coke market share as a cost-effective fuel alternative in various industries.

Key Stats for Petroleum Coke Market:

• Petroleum Coke Market Value (2024): USD 26.97 Billion

• Petroleum Coke Market Value (2033): USD 46.33 Billion

• Petroleum Coke Market Forecast CAGR: 6.14%

• Leading Segment in Petroleum Coke Market in 2024: Fuel Grade Coke (50.9%)

• Key Regions in Petroleum Coke Market: Asia Pacific, Europe, North America, Latin America, Middle East and Africa

• Top companies in Petroleum Coke Market: Aminco Resources, BP p.l.c, Chevron Corporation, DYM Resources, Indian Oil Corporation Ltd., Marathon Petroleum LP, Petroleum Coke Industries Company, Phillips 66 Company, Reliance Industries Limited, Renelux Commodities PC, Valero, etc.

Why is the Petroleum Coke Market Growing?

The petroleum coke market is experiencing robust growth due to several converging factors that are reshaping industrial fuel consumption globally. Industries are increasingly turning to petroleum coke-commonly known as petcoke-because it offers exceptional energy value at competitive prices. This byproduct of oil refining has become indispensable for sectors that require high-temperature processes and consistent energy output.

What's particularly interesting is how developing economies are driving much of this demand. Countries like China, India, and Brazil are making massive investments in manufacturing and infrastructure, and they need affordable, reliable fuels to power their growth. Petcoke fits the bill perfectly. It's being used extensively in cement kilns and power plants, where its high energy content delivers real operational advantages.

The aluminum and steel industries represent another major growth driver. As these sectors expand to meet global demand-think automotive lightweighting and construction booms-they're consuming more petcoke in their production processes. The material's high carbon content makes it especially valuable for manufacturing anodes used in aluminum smelting.

What sets this market apart is the practical economics. According to the U.S. Energy Information Administration, the United States produced approximately 46 million tons of petroleum coke annually from 2014 to 2023. Remarkably, about 90% of U.S. production was exported, reflecting strong international demand driven by petcoke's high heat content and cost advantages.

The construction boom in emerging markets is also playing a significant role. With urbanization accelerating across Asia and the Middle East, cement production is surging. Brazil provides a telling example-with 87.4% of its 203.1 million people living in urban areas, construction demand is putting pressure on cement manufacturers to find efficient, cost-effective fuels. Petcoke delivers on both counts.

Energy consumption patterns are shifting too. In the United States, electricity consumption reached a record 4.07 trillion kilowatt-hours, representing a 14-fold increase since 1950. This growing energy appetite creates opportunities for high-calorific-value fuels like petroleum coke in power generation applications.

India's agricultural sector is contributing to demand in unexpected ways. The country's organic food market is projected to grow from USD 386.32 million to approximately USD 9.1 billion, driven by sustainable farming practices. This growth is boosting demand for petroleum coke-based fertilizers, which enhance crop productivity while supporting eco-friendly agriculture.

The market is also benefiting from technological improvements in refining processes. Advances are making it possible to produce cleaner-burning petroleum coke with lower sulfur content, addressing environmental concerns while maintaining the material's fundamental economic advantages. This is particularly important as industries work to balance cost efficiency with increasingly stringent emission standards.

Request for a sample copy of this report: https://www.imarcgroup.com/petroleum-coke-market/requestsample

AI Impact on the Petroleum Coke Market:

Artificial intelligence is quietly transforming how petroleum coke is produced, managed, and utilized across the refining industry. While the changes might not grab headlines, they're delivering meaningful improvements in efficiency, quality, and environmental performance.

In refining operations, AI-powered systems are optimizing the coking process itself. These intelligent systems analyze real-time data from multiple sources-temperature sensors, pressure gauges, feedstock characteristics-and make instant adjustments to maximize yield and quality. The result? Refineries are producing more consistent petroleum coke while reducing waste and energy consumption.

Predictive maintenance is another area where AI is making a real difference. Industry data shows that oil and gas executives report a 27% improvement in production uptime through AI-based predictive equipment maintenance. For coking units, which operate under extreme conditions, this translates directly to reduced downtime and lower maintenance costs. The AI systems can detect subtle patterns that indicate potential equipment failures days or weeks before they occur, allowing for planned maintenance rather than disruptive breakdowns.

Quality control is becoming more sophisticated with AI integration. Machine learning algorithms analyze the chemical composition and physical properties of petroleum coke in real-time, ensuring that products meet exact specifications for different industrial applications. This is particularly valuable because aluminum smelters, cement manufacturers, and power generators each have specific requirements. Getting the product right the first time eliminates costly reprocessing and reduces customer complaints.

Digital twins-virtual replicas of physical refining processes-are helping operators test different scenarios and optimize operations without disrupting actual production. Refineries can simulate how changes in crude oil feedstock or processing parameters will affect petroleum coke output and quality. This capability is especially valuable given the volatility in crude oil markets and the need to quickly adapt to changing market conditions.

AI is also optimizing logistics and supply chain management. Intelligent systems help refineries forecast demand more accurately, optimize inventory levels, and coordinate shipments more efficiently. Given that the U.S. exports 90% of its petroleum coke production, these logistical improvements directly impact profitability and customer satisfaction.

Environmental compliance is getting a boost from AI too. Advanced monitoring systems track emissions in real-time and automatically adjust processes to stay within regulatory limits. Some refineries are using AI to optimize the production of low-sulfur petroleum coke, which commands premium prices due to stricter environmental regulations in many markets.

Segmental Analysis:

Analysis by Type:

• Fuel Grade Coke

• Calcined Coke

Fuel grade coke dominates the market, capturing 50.9% share. Its strong performance reflects widespread adoption in power generation and energy-intensive industries. The material's high calorific value-typically ranging from 8,000 to 8,500 kcal/kg-makes it an attractive alternative to conventional fuels. Power plants, particularly in emerging economies where energy demand is surging, rely heavily on fuel-grade coke. Cement manufacturers also favor this grade because it provides consistent energy output for their kilns, helping maintain stable production schedules. The segment's dominance is reinforced by the ongoing expansion of energy infrastructure in developing regions, where reliable and economical fuel sources are essential for supporting rapid industrialization.

Analysis by Application:

• Power Plants

• Cement Kilns

• Steel

• Aluminum

• Fertilizer

• Others

Aluminum leads the application segment with a commanding 37.81% market share. This dominance stems from the material's critical role in producing carbon anodes for aluminum smelting. Calcined petroleum coke is particularly essential here-its high carbon content and minimal impurities make it indispensable for maintaining efficient, cost-effective aluminum production. The global push toward lightweight materials in automotive and construction applications is driving aluminum demand higher, which in turn boosts petroleum coke consumption. India's primary aluminum production, for instance, grew 1.2% year-over-year in recent quarters, reflecting broader industry trends. What makes this segment particularly resilient is aluminum's recyclability and versatility, which align well with sustainability initiatives while maintaining strong industrial demand.

Analysis by Device:

• Asia Pacific

• Europe

• North America

• Latin America

• Middle East and Africa

Asia-Pacific commands 45.1% of the global market, driven by the region's manufacturing intensity and energy requirements. The region's dominance isn't accidental-it reflects fundamental economic trends including rapid urbanization, infrastructure development, and industrial expansion. China and India are at the forefront, with their cement, steel, and power generation sectors consuming massive quantities of petroleum coke. The region's extensive refining capabilities ensure steady supply, while growing domestic demand keeps the market dynamic. North America holds strong as well, with the United States accounting for 69% of the regional market. The U.S. position is unique because while domestic consumption is significant, the country's role as a major exporter shapes global trade patterns. Saudi Arabia's construction sector, with over 5,200 active projects worth USD 819 billion, illustrates how regional development drives petroleum coke demand across multiple applications.

What are the Drivers, Restraints, and Key Trends of the Petroleum Coke Market?

Market Drivers:

The petroleum coke market benefits from several powerful tailwinds that are reshaping industrial fuel consumption. The expansion of smartphone adoption and wearable technology-while seemingly unrelated-reflects broader digitalization trends that are modernizing refining operations and supply chain management. More directly, rising health awareness and demand for personalized solutions are driving growth in sectors that consume petroleum coke as an input material.

The shift toward home-based activities and hybrid work models has accelerated digital adoption across industries, including those that produce and consume petroleum coke. This digital transformation enables better demand forecasting, inventory management, and logistics optimization. The manufacturing sector in the United States contributes 10.70% of national output, with petroleum coke playing a vital role in energy-intensive production processes.

India's cement production provides a concrete example of market momentum-output increased 1.9% year-over-year in recent months, directly boosting petroleum coke demand. The subscription-based business models emerging in various industries are creating more predictable revenue streams, which helps refineries plan production more effectively.

Younger demographics' preference for digital solutions is transforming how petroleum coke is bought, sold, and traded. Online platforms and digital marketplaces are making the industry more accessible and transparent, connecting buyers and sellers more efficiently than traditional methods.

Market Restraints:

Data privacy and security concerns are becoming increasingly relevant as the industry digitalizes. Refineries and trading companies are collecting more operational and commercial data, raising questions about protection and appropriate use. While this might seem abstract, it affects how companies share information and collaborate across supply chains.

Limited internet access and smartphone penetration in certain developing regions can restrict market transparency and efficient trading. This digital divide creates inefficiencies in price discovery and supply chain coordination, particularly in markets that could benefit most from petroleum coke's cost advantages.

Competition between free and paid digital platforms in commodity trading is affecting how petroleum coke is marketed and sold. Smaller producers and traders may struggle to compete with larger players who can afford premium marketplace subscriptions and advanced analytics tools.

Safety concerns related to handling and application remain relevant. Without proper guidance and supervision, industrial users may face challenges in optimizing petroleum coke utilization, potentially leading to suboptimal performance or operational issues.

Request Customization: https://www.imarcgroup.com/request?type=report&id=2592&flag=E

Market Key Trends:

Artificial intelligence and machine learning are revolutionizing how the petroleum coke industry operates. These technologies enable personalized recommendations for optimal application methods, real-time performance tracking, and predictive analytics that help users achieve better outcomes.

Integration with wearable devices and IoT sensors in industrial settings is enhancing real-time monitoring of petroleum coke combustion and utilization. These smart systems provide instant feedback on performance, helping operators optimize fuel mix and reduce waste.

Hybrid models are gaining traction, combining traditional in-person technical support with remote monitoring and digital consultation services. This approach gives customers access to expertise whenever they need it, regardless of location.

Gamification features are emerging in training programs, helping industrial users learn best practices for petroleum coke application through interactive challenges and simulations. Social community engagement among industry professionals is growing, with peer networks sharing insights and optimization strategies.

The holistic wellness trend is manifesting in the petroleum coke industry as a broader focus on sustainable operations. Companies are looking beyond simple fuel efficiency to consider environmental impact, community relations, and long-term sustainability. This includes investments in cleaner technologies, emission reduction initiatives, and responsible sourcing practices.

Leading Players of Petroleum Coke Market:

According to IMARC Group's latest analysis, prominent companies shaping the global petroleum coke landscape include:

• Aminco Resources

• BP p.l.c

• Chevron Corporation

• DYM Resources

• Indian Oil Corporation Ltd.

• Marathon Petroleum LP

• Petroleum Coke Industries Company

• Phillips 66 Company

• Reliance Industries Limited

• Renelux Commodities PC

• Valero

These leading providers are expanding their footprint through strategic partnerships, enhanced production capabilities, and advanced operational platforms to meet growing industrial, manufacturing, and energy demands in emerging applications like clean energy transitions, advanced materials, and sustainable manufacturing.

Key Developments in Petroleum Coke Market:

• January 2025: ExxonMobil announced a 20% expansion of its petroleum coke production capacity at U.S. refineries to meet rising demand from cement and power generation sectors. The company produced 12 million tons of petcoke using advanced coking technologies, reflecting confidence in long-term market growth and the material's continued relevance in industrial applications.

• 2024 Development: The calcined petroleum coke segment witnessed increased investments in advanced calcination processes and improved product grades. Industry players are emphasizing responsible sourcing and sustainable production methods, responding to customer demands for materials that meet both performance and environmental standards. These developments are helping position petroleum coke as a viable option in transitioning energy markets.

• 2024 Market Trend: The surge in electric vehicle adoption and renewable energy infrastructure expansion drove significant investments in petroleum coke mining and processing. Companies are actively exploring new applications for petroleum coke in battery production supply chains and advanced materials manufacturing, diversifying the traditional market beyond conventional fuel applications.

• Ongoing Development: Major refineries are implementing AI-powered closed-loop neural network technologies specifically designed for optimizing petroleum coke production. These systems enable real-time process adjustments, improve product consistency, and reduce energy consumption during the coking process. The technology represents a significant step forward in making petroleum coke production more efficient and environmentally responsible.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Speak To An Analyst: https://www.imarcgroup.com/request?type=report&id=2592&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Petroleum Coke Market Size, Share, Growth & Forecast Report 2025-2033 here

News-ID: 4223396 • Views: …

More Releases from IMARC Group

Methyl Cyclohexane Production Plant DPR 2026: CapEx/OpEx Analysis with Profitabi …

Setting up a methyl cyclohexane production plant positions investors within a strategically important segment of the global petrochemical and specialty chemicals industry, supported by rising demand across fuel blending, chemical intermediates, and hydrogen storage applications. Methyl cyclohexane is widely used as a solvent, a precursor in organic synthesis, and increasingly as a liquid organic hydrogen carrier in clean energy systems. Its role in supporting energy transport, advanced chemical processing, and…

Dacarbazine Production Plant DPR & Unit Setup 2026: Machinery Cost, Business Pla …

Setting up a dacarbazine production plant positions investors within a strategically important segment of the global agrochemical and industrial chemicals industry, driven by increasing demand for high-efficiency fertilizers, water-soluble nutrient formulations, and specialty industrial applications. As modern farming practices advance, precision agriculture expands, and the need for balanced nitrogen and phosphorus fertilization grows, dacarbazine continues to gain traction across horticulture, fertigation systems, and drip irrigation networks worldwide. Rising food production…

Industrial Adhesive Manufacturing Plant DPR 2026: Investment Cost, Market Growth …

Setting up an industrial adhesive manufacturing plant positions investors within a vital and high-demand segment of the global specialty chemicals industry, supported by expanding applications across construction, automotive, packaging, electronics, woodworking, and aerospace sectors. Industrial adhesives play a critical role in modern manufacturing by enabling strong, durable bonding solutions that enhance structural integrity, reduce mechanical fastening requirements, and improve production efficiency.

As industries shift toward lightweight materials, advanced composites, and automated…

Denim Fabric Manufacturing Plant DPR & Unit Setup 2026: Machinery Cost, CapEx/Op …

Setting up a denim fabric manufacturing industry is witnessing robust growth driven by the increasing demand from the apparel and fashion industry, growing preference for durable and versatile textiles, and the rising popularity of casual and workwear clothing across global markets. At the heart of this expansion lies a critical textile material-denim fabric. As fashion and lifestyle markets continue to evolve, establishing a denim fabric manufacturing plant presents a strategically…

More Releases for Coke

Foundry Coke Market Size, Revenue Status and Industry Outlook During 2020 to 202 …

The report discusses many vital industry facets that influence Global Foundry Coke industry acutely which includes extensive study of competitive edge, latest technological advancements, region-wise industry environment, contemporary market and manufacturing trends, leading market contenders, and current consumption tendency of the end user. The report also oversees market size, market share, growth rate, revenue, and CAGR reported previously along with its forecast estimation.

Request sample copy of this report at

https://www.marketinsightsreports.com/reports/1031956177/global-foundry-coke-market-insights-forecast-to-2025/inquiry?source=label&Mode=21

Foundry Coke…

Global Foundry Coke Market : Impact Of Existing And Emerging Market Trends By To …

Albany, NY, 30th April : Recent research and the current scenario as well as future market potential of "Global Foundry Coke Market 2019 by Manufacturers, Regions, Type and Application, Forecast to 2024" globally.

Foundry Coke is mainly used in blast furnace and used for copper, lead, zinc, titanium, antimony, mercury and other non-ferrous metal smelting blast furnace, reductant, play a thermite and stock column skeleton function. It is a source of…

Foundry Coke Market to Witness Huge Growth by 2025| ABC Coke , ERP Compliant Cok …

HTF MI released a new market study on Global Foundry Coke Market with 100+ market data Tables, Pie Chat, Graphs & Figures spread through Pages and easy to understand detailed analysis. At present, the market is developing its presence. The Research report presents a complete assessment of the Market and contains a future trend, current growth factors, attentive opinions, facts, and industry validated market data. The research study provides estimates…

Foundry Coke Market Report 2018 Companies included ABC Coke (Drummond ), ERP Com …

We have recently published this report and it is available for immediate purchase. For inquiry Email us on: jasonsmith@marketreportscompany.com *********

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for the year 2018 to 2025, etc. The report also provides…

Foundry Coke Market Report 2018 Companies included ABC Coke (Drummond ), ERP Com …

We have recently published this report and it is available for immediate purchase. For inquiry Email us on: jasonsmith@marketreportscompany.com *********

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for the year 2018 to 2025, etc. The report also provides detailed…

Foundry Coke Market Key growth Analysis on ABC Coke (Drummond ),ERP Compliant Co …

Market Study Report adds 2018-2023 global Foundry Coke Market report that offers an exhaustive coverage of the industry with brief analysis, data charts, figures, statistics that help take business decisions, company profiles and more.

The Foundry Coke Market Report gives a clear picture of the current situation of the market which covers global industry analysis, size, share, growth, trends, key statistics and forecast Till 2023. The report on global Foundry…