Press release

Candle Manufacturing Plant Project Report 2025

The candle industry has become one of the fastest-growing segments in the home décor and fragrance sector, supported by increasing consumer demand across global markets. Setting up a candle manufacturing plant requires more than just infrastructure; it involves strategic planning, investment, efficient equipment, and strong market awareness. This article presents an overview of candle manufacturing plants, covering setup, processing stages, market trends, investment considerations, and operational requirements.What About Candles?

Candles hold a significant position in the global home fragrance and décor market due to their aesthetic appeal, aromatic properties, and emotional connection to ambiance and relaxation. They are versatile products valued for creating atmosphere, providing fragrance, offering decorative elements, and serving religious, ceremonial, and therapeutic purposes. Candles are available in diverse forms including container candles, pillar candles, taper candles, votives, tea lights, and specialty shapes, made from various waxes such as paraffin, soy, beeswax, palm, and coconut. Modern consumers appreciate candles for their ability to enhance wellness experiences, complement interior design, and provide moments of calm in busy lifestyles. The growing popularity of candles in both residential and commercial settings has driven demand for premium, artisanal, and customized products featuring natural waxes, essential oil fragrances, clean-burning wicks, and sustainable packaging. Product transparency, natural ingredients, non-toxic formulations, and eco-friendly production are becoming increasingly important, as consumers, retailers, and regulators emphasize health-conscious choices, environmental responsibility, and cruelty-free manufacturing practices in the candle industry.

Request a Sample Report: https://www.imarcgroup.com/candle-manufacturing-plant-project-report/requestsample

What is Driving the Candle Market?

The candle market is primarily driven by growing consumer focus on home wellness, self-care rituals, and creating comfortable living spaces, particularly accelerated by increased time spent at home during recent years. The premiumization trend in home fragrance is boosting demand for luxury candles featuring sophisticated scent profiles, natural ingredients, and designer packaging. The gifting culture and celebrations across various occasions including birthdays, holidays, weddings, and housewarmings position candles as popular gift items with strong seasonal demand peaks. Aromatherapy and wellness trends are driving interest in candles infused with essential oils and therapeutic fragrances that promote relaxation, stress relief, and mood enhancement.

The shift toward natural and sustainable products is increasing demand for soy, beeswax, and coconut wax candles as eco-conscious alternatives to traditional paraffin products. Social media influence, particularly Instagram and Pinterest, has transformed candles into lifestyle products with strong visual appeal, driving brand engagement and impulse purchases. The hospitality industry including hotels, spas, restaurants, and event venues uses candles extensively for ambiance creation, representing a substantial B2B market segment. Religious and ceremonial uses across various cultures maintain steady baseline demand for traditional candle formats. Additionally, the rise of small-batch artisanal producers and the maker movement have expanded market diversity and consumer choice. E-commerce growth and direct-to-consumer brands have lowered entry barriers and expanded market reach. Rising disposable incomes in emerging markets, urbanization, and growing middle-class populations in Asia-Pacific, Latin America, and Middle East regions continue to support long-term market expansion for candle products.

Understanding Candle Manufacturing

• Candle manufacturing refers to converting raw materials (wax, wicks, fragrances, dyes) into finished candles through melting, blending, molding or pouring, and finishing processes.

• Manufacturing activities include wax melting and temperature control, fragrance and dye blending at specific temperatures, wick preparation and positioning, pouring into containers or molds, cooling and solidification, demolding (for molded candles), trimming and finishing, quality inspection for appearance and burn performance, labeling, and packaging for retail or wholesale distribution.

• Candle quality depends on achieving specifications for proper wax formulation, optimal fragrance load (typically 6-12%), even color distribution, centered and appropriately sized wicks, smooth surfaces without cracks or frosting, consistent burn performance with minimal soot and tunneling, and attractive presentation.

• Efficiency in the process ensures consistent product quality, compliance with safety regulations and labeling requirements, optimal material usage to minimize waste, and the ability to meet diverse market requirements from mass-market value candles to luxury artisanal products with premium ingredients and sophisticated packaging.

Key Components of a Business Plan

• Executive Summary: Outlines vision, mission, and business objectives.

• Market Research: Identifies demand patterns, consumer behavior, and competitive players.

• Operational Strategy: Includes plant design, capacity, workflow, and quality assurance measures.

• Marketing and Sales Plan: Defines distribution channels, branding, and positioning in domestic and export markets.

• Financial Planning: Covers projected investments, cost structures, and revenue expectations.

• Risk Assessment: Evaluates potential challenges such as raw material supply, regulatory compliance, and market fluctuations.

Capital Investment Overview

CapEx (Capital Expenditure):

• Land acquisition, plant construction, utilities setup, and equipment purchase.

• One-time costs associated with establishing infrastructure and ensuring processing efficiency.

• Defines long-term productivity and competitiveness.

OpEx (Operating Expenditure):

• Recurring costs including labor, utilities, packaging, storage, and transportation.

• Raw material procurement and regular equipment maintenance.

• Compliance with safety certifications, hygiene practices, and quality control standards.

Buy Report Now: https://www.imarcgroup.com/checkout?id=22027&method=1911

Machinery and Equipment Requirements

Primary Equipment:

• Wax melting tanks or kettles with temperature control systems (jacketed or direct heating).

• Blending and mixing equipment for combining wax, fragrance, and dyes.

• Pouring stations or automated pouring machines for container candles.

• Molding equipment and mold release systems for pillar and shaped candles.

• Wick cutting and centering devices for consistent wick placement.

• Cooling tunnels or temperature-controlled rooms for proper solidification.

• Demolding equipment for releasing candles from molds.

• Trimming and finishing equipment for wick and surface preparation.

• Labeling machines for product information and branding.

• Shrink-wrapping or packaging equipment for finished products.

Supporting Equipment:

• Fragrance and dye storage with temperature control.

• Scales and measuring equipment for precise formulation.

• Thermometers and temperature monitoring systems.

• Wick holders and positioning tools.

• Quality testing equipment including burn test stations.

• Storage racks for raw materials and finished goods.

• Material handling equipment including trolleys and workbenches.

• Ventilation systems for fragrance and vapor management.

• Fire safety equipment including extinguishers and suppression systems.

Operating Costs

• Procurement of wax (paraffin, soy, beeswax, palm, coconut, or blends) from refineries or specialty suppliers.

• Fragrance oils (synthetic or natural/essential oils) from fragrance houses.

• Candle dyes and colorants in liquid, chip, or block forms.

• Wicks (cotton, wood, or specialty wicks) with appropriate sizes for different candle types.

• Containers (glass jars, tins, ceramic vessels) for container candles.

• Molds for pillar, votive, and specialty shaped candles.

• Labor salaries, training, and workforce management including production workers and quality control staff.

• Utilities such as electricity or gas for melting equipment, climate control for production areas.

• Maintenance and servicing of machinery and equipment.

• Packaging materials including boxes, labels, wrapping, tissue paper, ribbons, shipping materials.

• Transportation and distribution logistics.

• Certification, compliance, and quality assurance activities including safety testing.

• Marketing materials and product photography for e-commerce and retail.

Raw Materials

• Main Raw Material: Candle wax including paraffin wax (petroleum-based), soy wax (from soybean oil), beeswax (from honeycomb), palm wax (from palm oil), coconut wax, or proprietary blends designed for specific candle types and burn characteristics.

• Fragrance Oils: Synthetic fragrance oils or natural essential oils in hundreds of scent options, typically used at 6-12% concentration by weight.

• Dyes and Colorants: Liquid dyes, dye chips, or powder colorants specifically formulated for candle wax compatibility.

• Wicks: Cotton wicks (flat, square, or cored), wooden wicks, or specialty wicks in various sizes matched to candle diameter and wax type.

• Containers and Molds: Glass jars and vessels in various sizes and styles, metal tins, ceramic containers, silicone or metal molds for shaped candles.

• Packaging Materials: Retail boxes, labels with safety information and branding, protective wrapping, tissue paper, decorative elements, shipping boxes.

• Auxiliary Materials: Wick centering devices, adhesive tabs or glue dots for wick attachment, mold release agents, cleaning supplies.

• Supply Considerations: Consistency of wax quality and melting point specifications, fragrance oil safety and IFRA compliance, reliable supplier relationships for specialty materials, inventory management for seasonal scent rotations, and adherence to sustainable sourcing practices including RSPO certification for palm products, non-GMO soy, and ethically sourced beeswax.

Ask Analyst for Customized Report: https://www.imarcgroup.com/request?type=report&id=22027&flag=C

Frequently Asked Questions (FAQs)

1. What is the first step in setting up a candle manufacturing plant?

The process begins with developing a comprehensive business plan, securing appropriate manufacturing space with adequate ventilation and fire safety measures, obtaining necessary business licenses and compliance certifications, establishing relationships with wax and fragrance suppliers, and defining your product line and target market segments.

2. Why is quality control considered critical?

Quality control ensures that candles meet safety standards, burn properly without excessive soot or tunneling, deliver consistent fragrance throw, maintain aesthetic appeal, and comply with labeling regulations, which directly impacts customer satisfaction, repeat purchases, brand reputation, and regulatory compliance.

3. Can candle manufacturing plants focus only on domestic markets?

Yes, though many plants also target exports, as international markets, particularly in North America, Europe, and Middle East, show strong demand for quality candles including specialty, luxury, and artisanal products that meet regional preferences and regulatory requirements.

4. How does automation benefit candle manufacturing?

Automation improves production consistency, increases output capacity, reduces labor costs, ensures precise temperature and fragrance dosing, minimizes human error in wick placement, and enables scalability for growing businesses while maintaining quality standards.

5. Is backward integration into wax production necessary?

Not mandatory; virtually all candle manufacturers purchase refined waxes from specialized suppliers or petrochemical companies, as wax refining requires completely different infrastructure, expertise, and scale economics than candle manufacturing operations.

About Us:

IMARC is a global market research company offering comprehensive services to support businesses at every stage of growth, including market entry, competitive intelligence, procurement research, regulatory approvals, factory setup, company incorporation, and recruitment. Specializing in factory setup solutions, we provide detailed financial cost modeling to assess the feasibility and financial viability of establishing new manufacturing plants globally. Our models cover capital expenditure (CAPEX) for land acquisition, infrastructure, and equipment installation while also evaluating factory layout and design's impact on operational efficiency, energy use, and productivity. Our holistic approach offers valuable insights into industry trends, competitor strategies, and emerging technologies, enabling businesses to optimize operations, control costs, and drive long-term growth.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: (+1-201971-6302)

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Candle Manufacturing Plant Project Report 2025 here

News-ID: 4223114 • Views: …

More Releases from IMARC Group

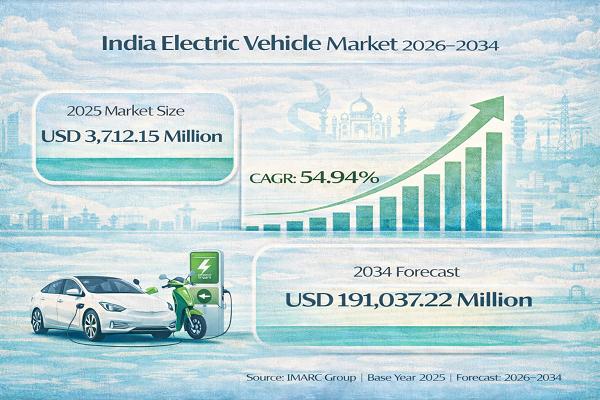

India Electric Vehicle Market Set to Reach USD 191,037.22 Million by 2034, Expan …

India Electric Vehicle Market : Report Introduction

According to IMARC Group's report titled "India Electric Vehicle Market Size, Share, Trends and Forecast by Vehicle Type, Price Category, Propulsion Type, and Region, 2026-2034" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

Free Sample Download PDF (Exclusive Offer on Corporate Email) : https://www.imarcgroup.com/india-electric-vehicle-market/requestsample

India Electric Vehicle Market Overview

The India electric vehicle market size was valued at…

United States Revenue Cycle Management Market Size, Trends, Growth and Forecast …

IMARC Group has recently released a new research study titled "United States Revenue Cycle Management Market Size, Share, Trends and Forecast by Type, Component, Deployment, End User, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Connect with a Research Analyst Now:

https://www.imarcgroup.com/united-states-revenue-cycle-management-market/requestsample

United States Revenue Cycle Management Market Summary:

The United States revenue cycle…

LED Chip Manufacturing Plant Cost Report 2026: Demand Analysis, CapEx/OpEx & ROI …

Setting up an LED chip manufacturing plant involves strategic planning, substantial capital investment, and comprehensive understanding of semiconductor fabrication technologies. These high-performance components power everything from general illumination and displays to automotive lighting and consumer electronics. Success requires careful site selection, advanced epitaxial growth processes, sophisticated cleanroom facilities, reliable raw material sourcing, and compliance with stringent quality and environmental regulations to ensure profitable and sustainable operations.

IMARC Group's report, "LED Chip…

Eyewear Manufacturing Plant DPR & Unit Setup - 2026: Machinery Cost, CapEx/OpEx, …

Setting up an eyewear manufacturing plant positions investors within a strategically important segment of the global optical and fashion accessories industry, driven by increasing demand for vision correction solutions, rising awareness of eye health, and growing fashion consciousness. As modern lifestyles advance, digital device usage expands, and the need for protective and corrective eyewear grows, eyewear continues to gain traction across prescription glasses, sunglasses, safety eyewear, and fashion accessories worldwide.…

More Releases for Candle

Animal Wax Candle Market Is Booming Worldwide | Bolsius, Colonial Candle, Vollma …

Latest Study on Industrial Growth of Animal Wax Candle Market 2023-2028. A detailed study accumulated to offer Latest insights about acute features of the Animal Wax Candle market. The report contains different market predictions related to revenue size, production, CAGR, Consumption, gross margin, price, and other substantial factors. While emphasizing the key driving and restraining forces for this market, the report also offers a complete study of the future trends…

Candle Market: The Yankee Candle Co. Inc, Colonial Candle, White Barn Candles, S …

A new market research report on the Global Candle market has introduced by KD Market Insights. The report is dedicated to in-depth industry analysis of the global Candle market. The Global Candle analysis is broken down on different segmentation levels including Market By Candle Type, By Sales Channel, By Price.

The candle finds a range of applications in our lives. The candles have been used for heat, light, keeping time…

Global Candle Market Size Estimated to Observe Significant Growth by 2019 Blyth …

The research study on Global Candle Market organizes the overall perspective of the Candle industry. This incorporates upcoming flow of the Candle market together with an extensive analysis of recent industry statistics. It describes the Candle market size as well as factors controlling market growth. Likewise, the report explains various challenges which affect Candle market expansion. The report reviews economic prominence of the Candle industry around the globe. The report offers…

Global Candle Market Research Report 2017 - Blyth, Bolsius, Colonial Candle, Can …

This report studies Candle in Global market, especially in North America, Europe, China, Japan, Southeast Asia and India, focuses on top manufacturers in global market, with capacity, production, price, revenue and market share for each manufacturer, covering

Jarden Corp (Yankee Candle)

Blyth

Bolsius

Colonial Candle

Candle-lite

S.C. Johnson & Son

Gies

Vollmar

Chesapeake Bay Candle

Kingking

Talent

Pintian Wax

Zhong Nam

Langley/Emprire Candle

Allite

Everlight

Lancaster Colony

Armadilla Wax Works

Dianne's Custom Candles

Fill the form for an exclusive sample of this report @ http://www.qyresearchreports.com/sample/sample.php?rep_id=906876&type=E

Market Segment by Regions, this report…

Global Candle Market 2017-2022 - Jarden, Blyth, Bolsius, Colonial Candle, Candle …

Global Candle Market Research Report by Type, Manufacturers, Application, Type, and Regions, Forecast till year 2022

Scope of Candle Market:

A market study based on the "Candle Market" across the globe, recently added to the repository of Market Research, is titled ‘Global Candle Market 2017’. The research report analyses the historical as well as present performance of the worldwide Candle industry, and makes predictions on the future status of Candle market…

Global Wall-mounted Candle Holders Market 2017 - Bath & Body Works, CraftsOfEgy …

The worldwide Wall-mounted Candle Holders Market report launched by Market.biz focuses on a complete and accurate study of Wall-mounted Candle Holders industry. Global Wall-mounted Candle Holders Market 2017 report is fundamentally concentrated on current scenario of Wall-mounted Candle Holders market. This comprehensive research document will improve the efficiency of the Wall-mounted Candle Holders market during the forecast period from 2017 to 2022.

The Wall-mounted Candle Holders industry report covers different aspects…