Press release

India Waste Plastic Recycling Market Trends, Growth, and Forecast 2025-2033

Market Overview:According to IMARC Group's latest research publication, "India Waste Plastic Recycling Market Size, Share, Trends and Forecast by Treatment, Material, Application, Recycling Process, and Region, 2025-2033", the India waste plastic recycling market size reached 10.9 Million Tons in 2024. Looking forward, the market is expected to reach 25.4 Million Tons by 2033, exhibiting a growth rate (CAGR) of 9.37% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Grab a sample PDF of this report: https://www.imarcgroup.com/india-waste-plastic-recycling-market/requestsample

Our report includes:

● Market Dynamics

● Market Trends and Market Outlook

● Competitive Analysis

● Industry Segmentation

● Strategic Recommendations

Growth Factors in the India Waste Plastic Recycling Market

● Packaging Industry's Appetite for Recycled Plastic Driving Massive Demand

India's waste plastic recycling market is experiencing remarkable momentum, and the packaging sector is leading this charge. With the country generating around 26,000 tonnes of plastic waste daily, the urgency to recycle has never been more critical. What's really interesting is how the food and beverage packaging industry has become a major consumer of recycled plastics. The working population is expanding rapidly, and with it comes surging demand for ready-to-eat meals and convenience foods-all of which require packaging. But here's where it gets fascinating: packaging companies aren't just using any plastic anymore. They're actively seeking out recycled materials to meet both regulatory requirements and consumer expectations. Major brands across India are making commitments to incorporate recycled content into their packaging, creating a steady, reliable demand stream for recyclers.

Think about the sheer volume-every beverage bottle, every takeaway container, every cosmetic package represents potential feedstock for the recycling industry. The shift isn't just happening in premium segments either. From neighborhood grocery stores to e-commerce giants, everyone's moving toward recyclable and recycled packaging solutions. What makes this particularly sustainable is that recycled plastic production consumes significantly less energy compared to virgin plastic manufacturing, making it economically attractive for manufacturers while simultaneously addressing environmental concerns. The government's ban on single-use plastics has further accelerated this transition, forcing industries to rethink their entire packaging strategy around recyclable and recycled materials.

● Government Push and Regulatory Framework Creating Favorable Conditions

The Government of India has put waste plastic recycling front and center in its environmental agenda, and the results are showing. The Plastic Waste Management Rules have been progressively strengthened, with recent amendments in 2024 specifically targeting microplastics and setting stricter criteria for biodegradable plastics. But policy isn't just about restrictions-it's about creating opportunities. The Department of Science and Technology has launched multiple initiatives supporting recycling technology development and deployment. What's particularly noteworthy is how the government is promoting co-processing in cement industries as an environmentally friendly disposal method. Regular training sessions are being conducted for State Pollution Control Board officers and cement industry personnel to boost co-processing adoption, which currently dominates the treatment segment. The Ministry of Environment has been working on Extended Producer Responsibility frameworks, making manufacturers accountable for the lifecycle of their plastic products.

This creates a built-in incentive structure for recycling. Local governments are establishing plastic waste collection centers, implementing door-to-door collection systems, and setting up community bins to improve waste segregation at source. Financial incentives and regulatory frameworks are making it easier for startups and established players alike to enter the recycling space. The government's commitment to achieving ambitious recycling targets-moving from current recycling rates toward much higher percentages-means infrastructure development is receiving priority attention. Budget allocations specifically targeting circular economy initiatives are translating into tangible support for recycling facilities across the country.

● Infrastructure Expansion and Technology Adoption Boosting Processing Capacity

The physical infrastructure for plastic waste recycling in India is undergoing a transformation that's impressive in both scale and sophistication. Companies are making substantial investments in processing facilities, and the numbers tell a compelling story. Take Deluxe Recycling's recent expansion in Gujarat-they've just inaugurated what's being called India's largest multi-layered plastic recycling facility, doubling their capacity from 13,000 tonnes annually to 27,000 tonnes. This isn't an isolated case; it's part of a broader pattern of capacity additions across the country. Gravita India, one of the key market players, reported stellar performance with revenue jumping over 29% driven by strong growth in their plastic segment. These companies aren't just expanding capacity-they're upgrading technology to handle more complex recycling challenges.

Mechanical recycling, which accounts for the largest share of the recycling process segment, is becoming more sophisticated with better sorting and processing equipment. The advantage of mechanical recycling is clear: it's less energy-intensive and emits significantly less carbon dioxide compared to other methods. Material Recovery Facilities are being established in major cities-Mumbai alone has two operational MRFs that managed over 1,600 metric tons of plastic waste recently through dedicated programs. The automotive industry is creating additional demand by increasingly using recycled plastics for auto parts and components, providing another reliable outlet for recycled material. International financing is flowing into the sector too, with organizations like the U.S. Development Finance Corporation backing Indian recycling companies to triple their production capacity. The circular economy model is gaining real traction, with reverse logistics systems being developed to ensure efficient collection and transportation of plastic waste to processing facilities.

Key Trends in the India Waste Plastic Recycling Market

● North India's Dominance and Emerging Regional Dynamics

North India has established itself as the clear leader in India's waste plastic recycling landscape, and several factors explain this regional dominance. The region's massive population base creates substantial plastic waste generation, while simultaneously hosting numerous recycling facilities to process this waste. Delhi, as a major urban center and commercial hub, generates enormous quantities of plastic waste from both residential and commercial sources. The presence of developed industrial corridors in states like Uttar Pradesh and Haryana provides ready markets for recycled plastic pellets and products. What's particularly interesting about North India's position is how awareness about plastic's environmental impact has penetrated deeper into society here. Consumer consciousness is translating into better waste segregation practices, which is crucial because the quality of recycled plastic depends heavily on proper sorting at the source. The expansion of e-commerce operations across

North India is creating dual effects-while it generates packaging waste, it also creates demand for recycled packaging materials as these companies embrace sustainability commitments. Distribution channels for recycled products are well-established in this region, making it easier for recyclers to reach end-users. West and Central India, however, is showing impressive growth momentum, driven particularly by Maharashtra's industrial base and Gujarat's manufacturing sector. The western region benefits from proximity to ports, facilitating both waste import for recycling and export of recycled products. South India's technology hubs and manufacturing presence create steady demand for engineering plastics and recycled materials. East India, while currently representing a smaller share, offers significant growth potential as infrastructure develops and awareness increases.

● Co-Processing Emerging as the Preferred Treatment Method

The treatment segment reveals fascinating insights into how India is handling its plastic waste, and co-processing has emerged as the dominant approach. Unlike landfilling or incineration, co-processing-particularly in cement kilns-offers significant environmental advantages. Cement industries can utilize plastic waste as alternative fuel, replacing fossil fuels while simultaneously disposing of waste without leaving residue. The temperatures in cement kilns are high enough to completely break down plastic materials, and the process generates no additional ash or waste requiring further disposal. This makes it more sustainable compared to traditional disposal methods that either take up land space or create air pollution. The government's active promotion of co-processing through training programs is accelerating adoption rates.

Regular capacity-building initiatives are being conducted to educate industry personnel about best practices and operational protocols. What makes co-processing particularly attractive for cement manufacturers is the economic benefit-using plastic waste as fuel reduces their energy costs while helping them meet corporate sustainability targets. The regulatory environment is supportive, with State Pollution Control Boards actively encouraging this practice. However, the market isn't one-dimensional. Mechanical recycling remains crucial for plastics that can be reprocessed into new products, and this segment continues to receive investment and attention. Pyrolysis technology is gaining traction for certain plastic types that aren't suitable for mechanical recycling, converting them into fuel oils and other useful products. The treatment landscape is becoming more sophisticated, with different plastic waste streams being directed toward the most appropriate processing method based on material type, contamination level, and end-use requirements.

● PVC Leading Material Segment with Diverse Application Portfolio

The material composition of recycled plastics in India presents an interesting picture, with Poly Vinyl Chloride (PVC) accounting for the largest market share. PVC's dominance isn't accidental-it reflects the material's versatility and recyclability characteristics. PVC can be processed into an incredibly diverse range of products, from short-term packaging applications to long-life construction materials. Food packaging, beverage bottles, medical devices, textile components-PVC appears across multiple industries. But the real value proposition for recyclers lies in long-life applications: pipes, window frames, cable insulation, floor coverings, and roofing sheets. These construction and infrastructure applications consume substantial volumes of recycled PVC, providing stable demand for recyclers. The construction boom across India creates natural synergy with PVC recycling-as building activity intensifies, demand for PVC products increases, and recyclers benefit. Low-Density

Polyethylene (LDPE) and High-Density Polyethylene (HDPE) represent significant segments too, driven primarily by packaging applications. These materials are commonly found in shopping bags, food wraps, and containers, making them abundant in the waste stream. Polyethylene Terephthalate (PET), familiar to everyone as beverage bottle material, has well-established recycling chains due to its high value and ease of collection. Polypropylene (PP) usage in packaging and automotive applications creates steady recycling opportunities. What's evolving is the ability to handle multi-layer plastics-traditionally considered difficult to recycle due to different plastic types being bonded together. New facilities are being established specifically to tackle these complex materials, expanding the range of plastics that can be effectively recycled. The material mix in the waste stream is also changing as single-use plastic bans eliminate certain items while increasing others, requiring recyclers to adapt their processing capabilities continuously.

● Packaging Applications Dominate with Construction and Automotive Showing Promise

The application breakdown of recycled plastics reveals where processed material ultimately ends up, and packaging clearly leads the pack. This dominance makes perfect sense when you consider packaging's characteristics-high volume, relatively short use cycles, and increasing regulatory pressure to incorporate recycled content. Cosmetics manufacturers, pharmaceutical companies, and food producers are all increasing their usage of recycled plastic packaging to meet sustainability commitments and consumer expectations. Innovation in packaging is driving further opportunities-companies are developing new packaging formats that maintain product protection and visual appeal while using higher percentages of recycled content. Advanced recycling technologies can now handle contaminated film plastics and rigid plastics that previously went to landfills, expanding the feedstock available for packaging applications. But packaging isn't the only game in town. Construction applications are showing substantial potential, particularly as India undertakes massive infrastructure development.

Recycled plastics are being used in building materials, road construction, and various other civil engineering applications. The textile industry represents another significant opportunity-synthetic fabrics can incorporate recycled plastic fibers, and this segment is growing as fashion brands embrace circular economy principles. Automotive applications are particularly exciting because they combine volume with value. Car manufacturers are increasingly using recycled plastics for interior components, under-hood applications, and various other parts. The automotive industry's quality requirements push recyclers to maintain high standards, which in turn improves overall market quality. What ties these applications together is the growing recognition that recycled plastic isn't an inferior substitute-when properly processed, it performs comparably to virgin material while offering cost and sustainability advantages.

Leading Companies Operating in the India Waste Plastic Recycling Market:

● A1 Impex

● Addonn Polycomponds Private Limited

● GD Plast

● Gravita India Limited

● Jairam Plastic Industries

● Key Exports

● Luckystar International Pvt. Ltd.

● Manjushree Technopack Limited (AI Lenarco Midco Limited)

● Parkash Plastic

● Polyraw Enterprises

● R.B. Polymers

● Yadav Infrapolymers Private Limited

India Waste Plastic Recycling Market Report Segmentation:

Breakup by Treatment:

● Co-Processing

● Heat Compression

● Pyrolysis

● Landfill

● Incineration

● Others

Breakup by Material:

● Poly Vinyl Chloride (PVC)

● Low-Density Polyethylene (LDPE)

● High-Density Polyethylene (HDPE)

● Polyethylene Terephthalate (PET)

● Polypropylene (PP)

● Acrylonitrile Butadiene Styrene (ABS)

● Others

Breakup by Application:

● Packaging

● Construction

● Textile

● Automotive

● Others

Breakup by Recycling Process:

● Mechanical

● Others

Regional Insights:

● North India

● West and Central India

● South India

● East India

● Research Methodology:

The report employs a comprehensive research methodology, combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

Get Your Customized Market Report Instantly: https://www.imarcgroup.com/request?type=report&id=5056&flag=E

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91-120-433-0800

United States: +1-201-971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release India Waste Plastic Recycling Market Trends, Growth, and Forecast 2025-2033 here

News-ID: 4223103 • Views: …

More Releases from IMARC Group

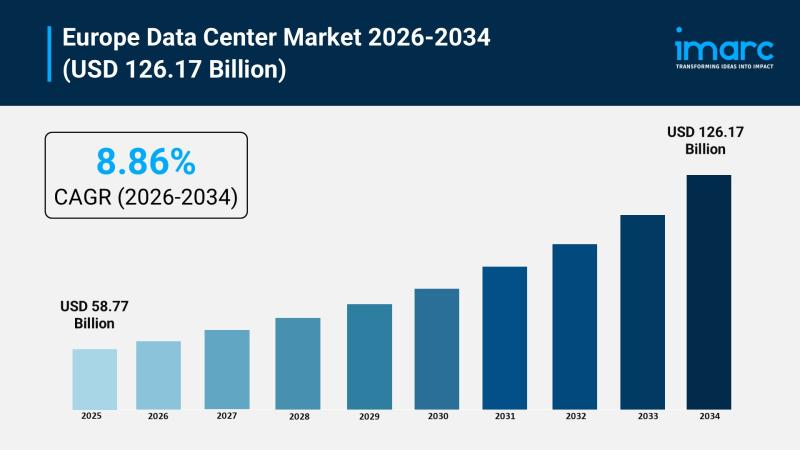

IMARC Group Forecasts 8.86% CAGR for Europe Data Center Market Amidst AI and Clo …

The Europe data center market is experiencing a critical phase of infrastructure evolution, having reached a valuation of USD 58.77 Billion in 2025. Propelled by the accelerating digitalization of the region's economy and sovereign cloud ambitions, the market is projected to reach USD 126.17 Billion by 2034. This growth trajectory represents a solid Compound Annual Growth Rate (CAGR) of 8.86% during the forecast period of 2026-2034.

Key Market Trends &…

Hot Sauce Manufacturing Plant DPR & Unit Setup - 2026: Demand Analysis and Proje …

Setting up a hot sauce manufacturing plant positions investors within one of the fastest-growing and flavor-driven segments of the global condiment industry, fueled by rising consumer appetite for spicy, bold, and ethnic flavors, increasing demand for clean-label and premium condiment products, and expanding utilization of hot sauce across food service, retail, and food processing applications. Made primarily from chili peppers, vinegar, salt, and complementary flavoring ingredients, hot sauce is recognized…

Glyoxylic Acid Prices Q4 2025: US Stable While Europe Remains High Price Trend

The Glyoxylic Acid Price Trend Analysis indicates dynamic shifts in global supply-demand balance, feedstock volatility, and regional trade flows. In 2026, Glyoxylic Acid Prices are reflecting fluctuations in raw material costs and downstream demand from pharmaceuticals, cosmetics, and agrochemicals. Market participants closely track the Glyoxylic Acid price index and forecast data to understand pricing momentum, risk exposure, and procurement strategies across key global regions.

Glyoxylic Acid Current Glyoxylic Acid Price Movements:

Recent…

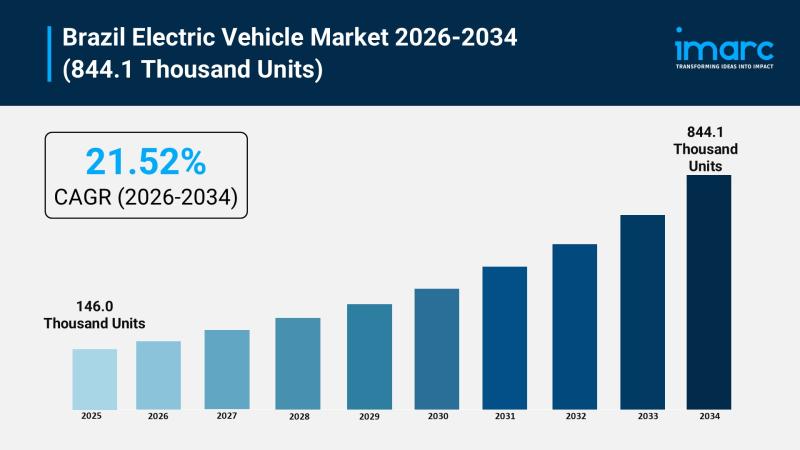

IMARC Group Forecasts 21.52% CAGR for Brazil EV Market as BYD and GWM Ramp Up Lo …

The Brazil electric vehicle (EV) market is currently witnessing an unprecedented surge, having reached a volume of 146.0 Thousand Units in 2025. Fueled by a combination of stringent environmental policies and a strategic shift toward domestic production by global automakers, the market is projected to reach 844.1 Thousand Units by 2034. This rapid expansion represents a robust Compound Annual Growth Rate (CAGR) of 21.52% during the forecast period of 2026-2034.

Key…

More Releases for India

India Smart Air Purifier Market Set to Witness Significant Growth by 2035 | Phil …

India smart air purifier market was valued at $125.8 million in 2024 and is projected to reach $298.7 million by 2035, growing at a CAGR of 8.3% during the forecast period (2025-2035).

India Smart Air Purifier Market Overview

The Indian smart air purifier market is experiencing significant growth, driven by increasing concerns over air pollution and its impact on health. Consumers are increasingly adopting smart air purifiers equipped with advanced features…

Ayurvedic Service Market is Flourishing Like Never Before | Patanjali Ayurved Li …

RnM newly added a research report on the Ayurvedic Service market, which represents a study for the period from 2020 to 2026.

The research study provides a near look at the market scenario and dynamics impacting its growth. This report highlights the crucial developments along with other events happening in the market which are marking on the growth and opening doors for future growth in the coming years. Additionally, the…

Pasta Market Report 2018 Companies included Bambino (India), Nestle (USA), Field …

We have recently published this report and it is available for immediate purchase. For inquiry Email us on: jasonsmith@marketreportscompany.com

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for the year 2018 to 2025, etc. The report also provides detailed segmentation on the…

Interior Designers India, Designers and Architects India, Interior Design Consul …

Synergy Corporate Interiors Pvt. Ltd. are offer Designers and Architects India Our architects, designers are working an national and international client base. The final design output is then integrated with the various technical and engineering aspects and taken into production. The expression is also individualistic, based on the communication of the correct corporate identity. Our designers, engineers and architects perform any plan successfully combine handy knowledge with creative ideas into…

Domain Registration India, Web Hosting India, VPS Hosting India , SSL Certificat …

All the Domain Registration services are at affordable price and assure you for the 100% quality.

India Internet offers cheap domain name registration for many domain extensions available. We are a full-service web site solutions provider. We offer a full range of web services including domain registration India, Web Hosting India, Web design, SEO marketing and etc.

We offer different standard and different Windows .NET low-cost, full-featured, all-inclusive web hosting and domain…

Domain Registration India, Web Hosting India, Payment Gateway India

Indiainternet.in is a Quality Web Hosting Company India, provide all web related support and Web hosting services like linux web hosting, windows web hosting, web hosting packages, domain registration in india, Corporate email solution, business email hosting, payment gateway integration, SSL with supports like free php, cgi, asp, free msaccess, free cdonts, free webmail, web based control panel, unlimited ftp access, unlimited data transfer.

During the domain registration process, you will…