Press release

Biosimilar Market Size, Share, Growth & Trends Report 2025-2033

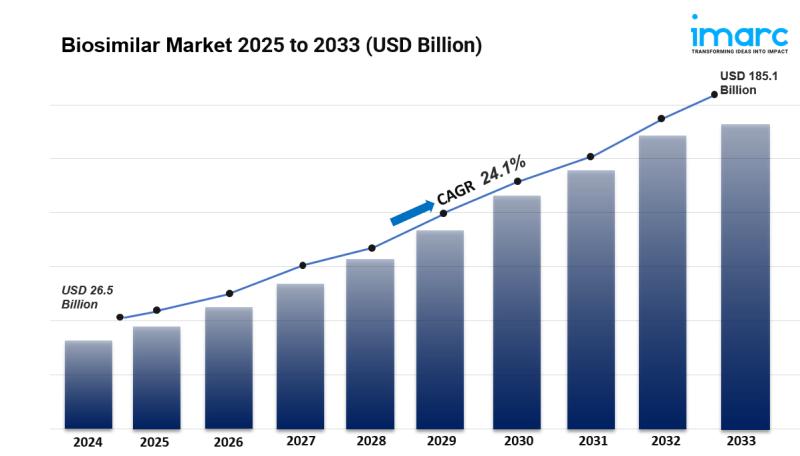

Biosimilar Market Size and Outlook 2025 to 2033:The global biosimilar market size was valued at USD 26.5 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 185.1 Billion by 2033, exhibiting a CAGR of 24.1% during 2025-2033. Europe currently dominates the market, holding a significant market share. The market is experiencing steady growth driven by the expiration of patents for major biological drugs, growing awareness about the efficacy and cost-effectiveness of biosimilars, the rising prevalence of chronic diseases worldwide, and continual advancements in biopharmaceutical manufacturing technologies.

Key Stats for Biosimilar Market:

• Biosimilar Market Value (2024): USD 26.5 Billion

• Biosimilar Market Value (2033): USD 185.1 Billion

• Biosimilar Market Forecast CAGR: 24.1%

• Leading Segment in Biosimilar Market in 2024: Infliximab (Molecule Type)

• Key Regions in Biosimilar Market: Europe, North America, Asia Pacific, Latin America, Middle East and Africa

• Top companies in Biosimilar Market: Sandoz International GmbH, Pfizer Inc., Teva Pharmaceutical Industries Limited, Celltrion Inc., Biocon Limited, Samsung Biologics, Amgen, Inc., Dr. Reddy's Laboratories Limited, Stada Arzneimittel Ag., etc.

Why is the Biosimilar Market Growing?

The biosimilar market is experiencing remarkable momentum, driven by a perfect storm of economic pressures, regulatory support, and healthcare innovation. At its core, this growth reflects a fundamental shift in how healthcare systems worldwide are approaching expensive biologic therapies-finding ways to make life-saving treatments accessible to more patients without compromising quality.

One of the most powerful drivers is the wave of patent expirations hitting blockbuster biologics. Major pharmaceutical companies like Bristol Myers Squibb, Merck, and Johnson & Johnson are facing a significant challenge, with tens of billions of dollars in sales at risk through 2030 as key patents expire. When these patents end, it opens the floodgates for biosimilar competition, often at substantially lower prices. This isn't just good for patients' wallets-it's transforming access to treatments that were previously out of reach for many.

The numbers tell a compelling story. Chronic diseases are responsible for 75% of all global deaths, creating urgent demand for affordable treatment options. Healthcare costs are skyrocketing, particularly for managing conditions like cancer, diabetes, and autoimmune disorders. A recent study by India's Postgraduate Institute of Medical Education and Research found that cancer treatment costs during outpatient consultations are substantially higher than hospitalization costs. Among 9,787 patients surveyed across seven cancer hospitals, diagnostics accounted for 36.4% of total expenditure, with medicines making up another 28%. Biosimilars offer a practical solution to this financial burden.

Request Customization: https://www.imarcgroup.com/request?type=report&id=497&flag=E

AI Impact on the Biosimilar Market:

Artificial intelligence is transforming the biosimilar industry in ways that extend far beyond simple automation. From drug development to manufacturing optimization and regulatory compliance, AI is helping companies bring biosimilars to market faster, more efficiently, and with greater confidence in quality and safety.

In the development phase, AI is accelerating the analytical comparability studies that are central to biosimilar approval. Machine learning algorithms can analyze complex molecular structures and predict how slight variations in manufacturing conditions might affect protein folding, glycosylation patterns, and other critical quality attributes. This predictive capability helps developers design more robust manufacturing processes from the start, reducing costly late-stage failures and speeding time to market.

Regulatory submissions are becoming more sophisticated with AI assistance. Natural language processing algorithms can help prepare comprehensive regulatory dossiers, ensuring that all required documentation is complete and properly structured. Some companies are using AI to predict potential regulatory questions based on analysis of previous submissions and feedback, allowing them to proactively address concerns.

Segmental Analysis:

Analysis by Molecule:

• Infliximab

• Insulin Glargine

• Epoetin Alfa

• Etanercept

• Filgrastim

• Somatropin

• Rituximab

• Follitropin Alfa

• Adalimumab

• Pegfilgrastim

• Trastuzumab

• Bevacizumab

• Others

Infliximab leads the biosimilar market, driven by its critical role in treating autoimmune diseases like rheumatoid arthritis and Crohn's disease. The patent expiration of Remicade, the original reference drug, opened the door for multiple biosimilar competitors, creating a dynamic market with improved pricing and access. Healthcare systems under pressure to manage rising treatment costs are actively adopting infliximab biosimilars, which offer comparable efficacy and safety at significantly lower prices. This molecule's dominance reflects broader market trends-when blockbuster biologics lose patent protection, biosimilar competition rapidly develops, benefiting patients and healthcare systems alike. The expanding pipeline of infliximab biosimilars, combined with supportive regulatory frameworks and growing physician confidence, continues driving adoption. Particularly in emerging markets where affordability is crucial, infliximab biosimilars are expanding access to advanced therapies that were previously beyond reach for many patients.

Analysis by Indication:

• Auto-Immune Diseases

• Blood Disorders

• Diabetes

• Oncology

• Growth Deficiency

• Female Infertility

• Others

Autoimmune diseases dominate the biosimilar market, reflecting the high prevalence of conditions like rheumatoid arthritis, psoriasis, inflammatory bowel disease, and ankylosing spondylitis. These chronic conditions affect millions globally and traditionally require expensive biologic treatments that patients must take for extended periods-often for life. Biosimilars have transformed the treatment landscape by making these therapies more affordable without sacrificing efficacy. The cost savings are substantial, improving both patient adherence and healthcare system sustainability. Regulatory support and mounting clinical evidence demonstrating biosimilar safety and effectiveness have boosted physician confidence in prescribing these alternatives. As more biosimilars enter the autoimmune space, competition intensifies, further driving down costs and expanding patient access. This segment exemplifies biosimilars' promise in addressing unmet medical needs while supporting long-term healthcare economic sustainability.

Analysis by Manufacturing Type:

• In-house Manufacturing

• Contract Manufacturing

In-house manufacturing leads the biosimilar market, reflecting the strategic importance of maintaining direct control over production quality, costs, and scalability. Biosimilar manufacturing is extraordinarily complex-involving living cell cultures, precise process control, and stringent quality standards. Companies with in-house facilities can respond quickly to market demands, optimize processes iteratively, and maintain the consistency critical for regulatory approval and market competitiveness. This approach reduces dependency on third-party manufacturers, lowering production costs and improving profit margins, which enables more competitive pricing. In-house capabilities also foster innovation, allowing companies to refine techniques and develop expertise applicable across their biosimilar portfolios. For companies serious about long-term leadership in biosimilars, investing in dedicated manufacturing infrastructure represents a strategic commitment that pays dividends through operational flexibility, quality assurance, and cost efficiency.

Analysis by Region:

• Europe

• North America

• Asia Pacific

• Latin America

• Middle East and Africa

Europe commands the global biosimilar market, benefiting from its pioneering regulatory framework established by the European Medicines Agency in 2005. This early start allowed European healthcare systems to gain extensive real-world experience with biosimilars before other regions, creating a mature market with high confidence levels among prescribers and patients. The region's supportive policy environment, combined with healthcare systems actively seeking cost-effective treatments, has driven steady biosimilar adoption across multiple therapy areas. National initiatives promoting biosimilar use, transparent pricing negotiations, and educational programs for healthcare professionals have all contributed to Europe's leadership position. The region's experience provides valuable lessons for other markets now accelerating their biosimilar programs, demonstrating that with appropriate regulatory frameworks, stakeholder education, and supportive policies, biosimilars can achieve substantial market penetration while maintaining high safety and efficacy standards.

Request to Get the Sample Report: https://www.imarcgroup.com/biosimilar-market/requestsample

What are the Drivers, Restraints, and Key Trends of the Biosimilar Market?

Market Drivers:

The biosimilar market is propelled by powerful economic and healthcare imperatives that are reshaping pharmaceutical landscapes globally. Rising healthcare costs are creating unsustainable pressures on government budgets, insurance systems, and patient finances. With the U.S. alone accounting for USD 4.3 trillion in healthcare spending, finding cost-effective alternatives to expensive biologics isn't just desirable-it's essential for system sustainability.

Patent expirations represent another major catalyst. The pharmaceutical industry is witnessing an unprecedented wave of blockbuster biologics losing patent protection, with major companies facing billions in potential revenue losses through 2030. Each patent expiration creates opportunities for biosimilar developers to enter markets with established demand and clinical evidence, reducing development risk while expanding patient access.

The prevalence of chronic diseases continues climbing, with these conditions responsible for 75% of global deaths. Cancer, diabetes, autoimmune disorders, and cardiovascular diseases require long-term treatment, often with expensive biologics. Biosimilars offer a sustainable path forward, making essential therapies accessible to broader patient populations without compromising treatment quality.

Regulatory frameworks have matured significantly, with agencies like the FDA and EMA establishing clear pathways for biosimilar approval. These frameworks balance the need for thorough safety and efficacy evaluation with recognition that biosimilars don't require the extensive clinical programs needed for novel drugs. Streamlined approval processes reduce development timelines and costs, accelerating market entry.

Market Restraints:

Manufacturing complexity remains a significant challenge. Unlike small-molecule generics, biosimilars involve producing large, complex proteins in living cell cultures. Minor variations in manufacturing conditions can potentially affect protein structure and function, requiring sophisticated analytical methods and rigorous process controls. This complexity creates barriers to entry and limits the number of companies capable of developing biosimilars successfully.

The limited availability of advanced analytical tools to comprehensively characterize biosimilars and demonstrate similarity to reference products poses ongoing challenges. While analytical technology has advanced considerably, completely characterizing large biologics and predicting how minor structural differences might affect clinical performance remains difficult. This analytical uncertainty can complicate regulatory submissions and extend development timelines.

Interchangeability designation in some markets, particularly the United States, requires additional clinical studies demonstrating that patients can switch between reference products and biosimilars multiple times without affecting safety or efficacy. These studies add cost and complexity to development programs, potentially delaying market entry and limiting biosimilar adoption.

Market Key Trends:

The biosimilar landscape is evolving rapidly, shaped by technological innovation, market dynamics, and shifting stakeholder priorities. One prominent trend is the increasing focus on high-value, high-complexity biosimilars. As the market matures, developers are targeting more challenging molecules with larger market potential, including monoclonal antibodies and fusion proteins used in oncology and immunology.

Vertical integration is becoming more common, with biosimilar developers acquiring or building manufacturing capabilities, distribution networks, and patient support services. This approach provides greater control over the value chain, improves margins, and enables more responsive market strategies.

Digital health integration is emerging as biosimilar companies recognize opportunities to differentiate through patient support programs, adherence monitoring, and outcomes tracking. Mobile apps, telemedicine consultations, and digital educational resources are enhancing the patient experience while generating valuable real-world evidence supporting biosimilar adoption.

Leading Players of Biosimilar Market:

According to IMARC Group's latest analysis, prominent companies shaping the global biosimilar landscape include:

• Sandoz International GmbH

• Pfizer Inc.

• Teva Pharmaceutical Industries Limited

• Celltrion Inc.

• Biocon Limited

• Samsung Biologics

• Amgen, Inc.

• Dr. Reddy's Laboratories Limited

• Stada Arzneimittel Ag.

These leading providers are expanding their footprint through strategic partnerships, acquisitions, robust manufacturing capabilities, and comprehensive market access programs to meet growing demand for affordable biologic alternatives across oncology, immunology, endocrinology, and other critical therapeutic areas.

Key Developments in Biosimilar Market:

• May 2024: Biocon Biologics received U.S. FDA approval for Yesafili, a biosimilar aflibercept, marking a significant entry into the ophthalmology market. Yesafili treats neovascular age-related macular degeneration and diabetic macular edema, offering patients and healthcare systems a cost-effective alternative to the reference biologic. This approval demonstrates Biocon's growing capabilities in developing complex biosimilars and expands patient access to critical eye disease treatments.

• January 2024: Sandoz completed its acquisition of CIMERLI (ranibizumab biosimilar) from Coherus BioSciences for USD 170 million, strengthening its ophthalmology portfolio in the U.S. market. The acquisition includes the biologics license application, product inventory, and specialized sales talent, positioning Sandoz as a comprehensive player in ophthalmic biosimilars. This strategic move reflects the growing importance of therapeutic area focus in biosimilar competition.

• January 2024: Sandoz launched Tyruko (natalizumab) in Germany, the first and only biosimilar for treating relapsing-remitting multiple sclerosis. This launch represents a significant milestone in expanding biosimilar access to neurological treatments, an area with limited biosimilar penetration. The development demonstrates that biosimilar technology is advancing into increasingly complex therapeutic areas previously dominated exclusively by originator biologics.

• 2024 Development: Samsung Bioepis and Sandoz expanded their ustekinumab biosimilar rollout across Germany and France, following the loss of exclusivity for Stelara. Multiple ustekinumab biosimilars entering the market simultaneously created dynamic competition and encouraged more favorable pricing strategies. This expansion is improving access to treatments for psoriasis, Crohn's disease, and ulcerative colitis across major European markets.

• 2024 Achievement: NHS England reported that switching patients to adalimumab biosimilars generated savings of GBP 100 million, which were redirected to innovative cancer therapies. This real-world success story demonstrates biosimilars' value proposition-not just reducing costs, but freeing healthcare resources for investment in novel treatments. The program's success is influencing biosimilar adoption strategies in healthcare systems globally.

• Recent Trend: Samsung Bioepis' market analysis revealed that oncology, ophthalmology, and pegfilgrastim biosimilars have gained significant market share, while immunology, filgrastim, epoetin alfa, and insulin glargine biosimilars have grown more gradually. These differential adoption rates reflect varying market dynamics, competitive intensity, prescriber confidence levels, and patient switching willingness across therapeutic areas, informing strategic decisions for biosimilar developers.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=497&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Biosimilar Market Size, Share, Growth & Trends Report 2025-2033 here

News-ID: 4223083 • Views: …

More Releases from IMARC Group

India Women Apparel Market Outlook 2026-2034: Fashion Trends, Industry Share & O …

According to IMARC Group's report titled "India Women Apparel Market Size, Share, Trends and Forecast by Product Type, Season, Distribution Channel, and Region, 2026-2034" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

India Women Apparel Market Outlook

The India women apparel market size was valued at USD 95.83 Billion in 2025 and is projected to reach USD 121.87 Billion by 2034, growing at…

India Women Apparel Market Outlook 2026-2034: Fashion Trends, Industry Share & O …

According to IMARC Group's report titled "India Women Apparel Market Size, Share, Trends and Forecast by Product Type, Season, Distribution Channel, and Region, 2026-2034" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

India Women Apparel Market Outlook

The India women apparel market size was valued at USD 95.83 Billion in 2025 and is projected to reach USD 121.87 Billion by 2034, growing at…

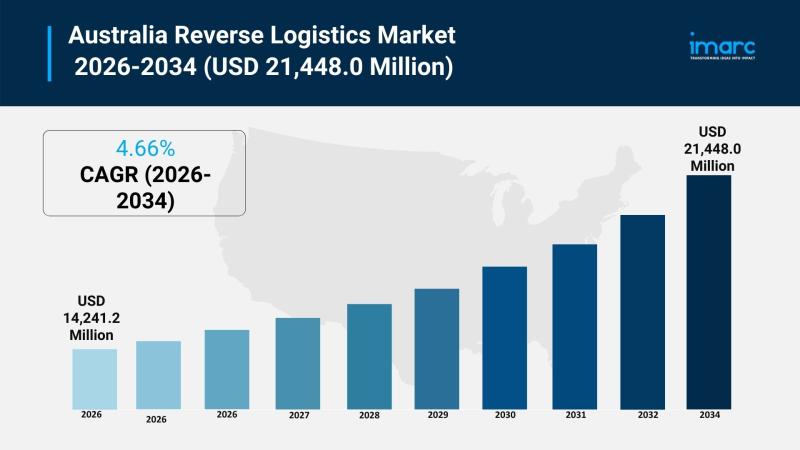

Australia Reverse Logistics Market Projected to Reach USD 21,448.0 Million by 20 …

Market Overview

The Australia reverse logistics market size reached USD 14,241.2 Million in 2025 and is projected to reach USD 21,448.0 Million by 2034, growing at a CAGR of 4.66% during 2026-2034. This expansion is driven by the rise in e-commerce platforms, environmental sustainability efforts, and the integration of advanced technologies in logistics operations. The market encompasses return types, services, end users, and regional segments across Australia. For more details, visit…

Global Hummus Market Report 2026-2034: Growth, Trends, Packaging, Channels & Reg …

The global hummus market size reached USD 4.7 Billion in 2025 and is anticipated to reach USD 9.1 Billion by 2034, reflecting a CAGR of 7.50% during the forecast period 2026-2034. This growth is driven by increasing lifestyle diseases, rising health-conscious consumers, and escalating demand for plant-based proteins. The popularity of hummus as a substitute for traditional condiments further supports market expansion.

Study Assumption Years

Base Year: 2025

Historical Period: 2020-2025

Forecast Period:…

More Releases for Biosimilar

Interchangeable Biosimilar Humira Market Share Driven by Biologic Therapy Adopti …

Interchangeable Biosimilar Humira Market

The global market for Interchangeable Biosimilar Humira was valued at US$ million in the year 2024 and is projected to reach a revised size of US$ million by 2031, growing at a CAGR of %during the forecast period

View sample report

https://reports.valuates.com/request/sample/QYRE-Auto-33I15005/Global_Interchangeable_Biosimilar_Humira_Market_Research_Report_2023

The Interchangeable Biosimilar Humira Market is experiencing significant market growth as healthcare providers and patients increasingly adopt biosimilar therapies for autoimmune and inflammatory conditions. Market trends indicate rising…

Key Trend Reshaping the Biosimilar Monoclonal Antibodies Market in 2025: Advance …

What Are the Projections for the Size and Growth Rate of the Biosimilar Monoclonal Antibodies Market?

In recent times, the biosimilar monoclonal antibodies sector has experienced a swift expansion. The market size, which stands at $8.04 billion in 2024, is projected to climb to $9.25 billion in 2025, marking a compound annual growth rate (CAGR) of 15.1%. Factors such as expired patents, an increased understanding of biosimilars, governmental strategies, heightened financial…

Key Trend Reshaping the Biosimilar Monoclonal Antibodies Market in 2025: Advance …

What Are the Projections for the Size and Growth Rate of the Biosimilar Monoclonal Antibodies Market?

In recent times, the biosimilar monoclonal antibodies sector has experienced a swift expansion. The market size, which stands at $8.04 billion in 2024, is projected to climb to $9.25 billion in 2025, marking a compound annual growth rate (CAGR) of 15.1%. Factors such as expired patents, an increased understanding of biosimilars, governmental strategies, heightened financial…

Biosimilar Market Treating More for Less: The Booming Infliximab Biosimilar Mark …

Infliximab Biosimilar Market worth $ XX Million by 2030 - Exclusive Report by InsightAce Analytic

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Infliximab Biosimilar Market- by Application (Crohn's Disease, Psoriatic Arthritis, Rheumatoid Arthritis, Ulcerative Colitis, Ankylosing Spondylitis, Plaque Psoriasis and Others), End User (Hospital Pharmacy, Retail Pharmacy, Online Pharmacy and Other Direct Distribution Channels), Trends, Industry Competition Analysis, Revenue and Forecast To 2030."

Get…

Biosimilar Monoclonal Antibodies Market

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the " "Global Biosimilar Monoclonal Antibodies Market by Product (infliximab, trastuzumab, rituximab, adalimumab, bevacizumab, cetuximab, ranibizumab, denosumab, eculizumab, and other pipeline products), Indication (oncology, inflammatory & autoimmune disorders, chronic diseases, blood disorders, and other indications), Clinical Trial/Pipeline Analysis, Future Trends, Industry Competition Analysis, Revenue and Forecast To 2031."

The Biosimilar Monoclonal Antibodies Market Size is valued at 5.02…

Infliximab Biosimilar Insight, 2022 | DelveInsight

DelveInsight's, "Infliximab Biosimilar Insight, 2022" report provides comprehensive insights about 35+ companies and 45+ marketed and pipeline drugs in Infliximab Biosimilars landscape. It covers the marketed and pipeline drug profiles, including clinical and nonclinical stage products. It also covers the therapeutics assessment by product type, stage, route of administration, and molecule type. It further highlights the inactive pipeline products in this space.

Interested to know more about the functioning of…