Press release

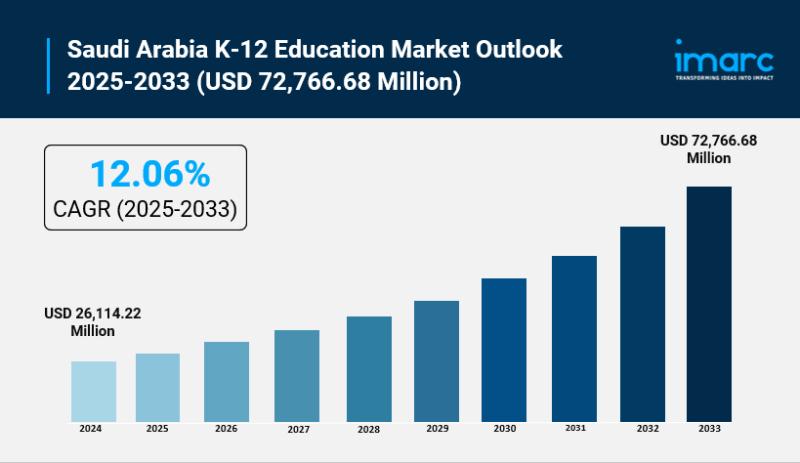

Saudi Arabia K-12 Education Market Size to Hit $72,766.68 Million by 2033, With CAGR 12.06%

Saudi Arabia K-12 Education Market OverviewMarket Size in 2024: USD 26,114.22 Million

Market Size in 2033: USD 72,766.68 Million

Market Growth Rate 2025-2033: 12.06%

According to IMARC Group's latest research publication, "Saudi Arabia K-12 Education Market Size, Share, Trends and Forecast by School Type, Learning Mode, Grade Level, and Region, 2025-2033", The Saudi Arabia K-12 education market size reached USD 26,114.22 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 72,766.68 Million by 2033, exhibiting a growth rate (CAGR) of 12.06% during 2025-2033.

Download a sample PDF of this report: https://www.imarcgroup.com/saudi-arabia-k-12-education-market/requestsample

How AI is Reshaping the Future of Saudi Arabia K-12 Education Market

● AI-driven personalized learning platforms improve student engagement by adapting lessons to individual needs, benefiting over 40% of K-12 students in Saudi schools.

● Government-backed AI programs support teacher training, enabling educators to use data insights for targeted interventions and boosting teaching effectiveness significantly.

● AI-powered assessment tools reduce grading time by 50%, providing instant feedback and allowing teachers to focus more on student interaction and support.

● Virtual tutors and chatbots handle up to 60% of student queries outside classroom hours, enhancing learning continuity and reducing drop-out rates.

● AI analytics monitor student well-being and engagement, helping schools identify at-risk students early and tailor counseling services more effectively.

Saudi Arabia K-12 Education Market Trends & Drivers:

● The Saudi Arabia K-12 education market is growing strongly due to government reforms under Vision 2030 aimed at modernizing education and diversifying the economy. Significant investments are being made in infrastructure, teacher training, and curriculum development, shifting towards digital learning and STEM education. The Ministry of Education's initiatives include the Mustaqbalhum app, which connects parents to real-time student progress across 22,000 schools. This focus on quality improvement and technology integration is setting new standards and expanding demand for both public and private schools, elevating education accessibility and effectiveness.

● The rising middle class and increasing disposable incomes are fueling demand for high-quality private and international schools in Saudi Arabia. About 17-18% of Saudi children now attend private K-12 schools, with international curricula like British and American gaining popularity. Parents are willing to invest more for smaller class sizes, bilingual education, and advanced learning technologies. This trend is prompting expansion of private institutions and attracting global education players. Public spending also complements these shifts by enhancing regulatory frameworks and supporting private sector growth, widening educational choices for families.

● EdTech adoption and digital learning solutions are transforming the K-12 education landscape in Saudi Arabia. Schools are increasingly incorporating learning management systems, interactive content, and personalized digital tools supported by the Tatweer program and national efforts for smart classrooms. Accelerating internet infrastructure and government encouragement for technology use improve educational outcomes and student engagement. The integration of AI for adaptive learning and progress tracking is a key trend, catering to heterogeneous classrooms and enabling tailored instruction. This digital shift is making education more agile, inclusive, and future-ready across urban and rural areas.

Ask analyst of customized report: https://www.imarcgroup.com/request?type=report&id=36393&flag=E

Saudi Arabia K-12 Education Industry Segmentation:

The report has segmented the market into the following categories:

Application Insights:

● Elementary School (K-5)

● Middle School (6-8)

● High School (9-12)

Institution Insights:

● Public

● Private

Delivery Mode Insights:

● Online

● Offline

Regional Insights:

● Northern and Central Region

● Western Region

● Eastern Region

● Southern Region

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Recent News and Developments in Saudi Arabia K-12 Education Market

● October 2025: New government initiative uses AI analytics to identify and assist at-risk students, enhancing counseling and reducing dropout rates significantly.

● September 2025: Virtual tutoring services integrated with national education portals, handling 60% of after-hours student queries to support continuous learning.

● August 2025: Saudi Ministry of Education launched AI-powered personalized learning platforms, improving engagement for over 40% of K-12 students nationwide.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Saudi Arabia K-12 Education Market Size to Hit $72,766.68 Million by 2033, With CAGR 12.06% here

News-ID: 4222405 • Views: …

More Releases from IMARC Group

Biosimilar Market Size, Share, Industry Trends and Forecast 2026-2034

IMARC Group, a leading market research company, has recently released a report titled "Biosimilar Market Size, Share, Trends and Forecast by Molecule, Indication, Manufacturing Type, and Region, 2026-2034." The study provides a detailed analysis of the industry, including the global biosimilar market size, trends, share and growth forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Biosimilar Market Key Highlights:

• The Biosimilar Market is…

Cost of Setting Up a PET Bottle Manufacturing Plant & DPR 2026

The global PET bottle industry is experiencing sustained growth propelled by rising packaged beverage consumption, pharmaceutical packaging expansion, increasing demand for ready-to-drink products, and the lightweight, recyclable advantages of PET packaging. As urbanization accelerates, consumer lifestyles shift toward convenience packaging, and regulatory frameworks increasingly mandate recyclable materials, establishing a PET bottle manufacturing plant positions investors in one of the most stable and essential segments of the consumer packaging value chain.

IMARC…

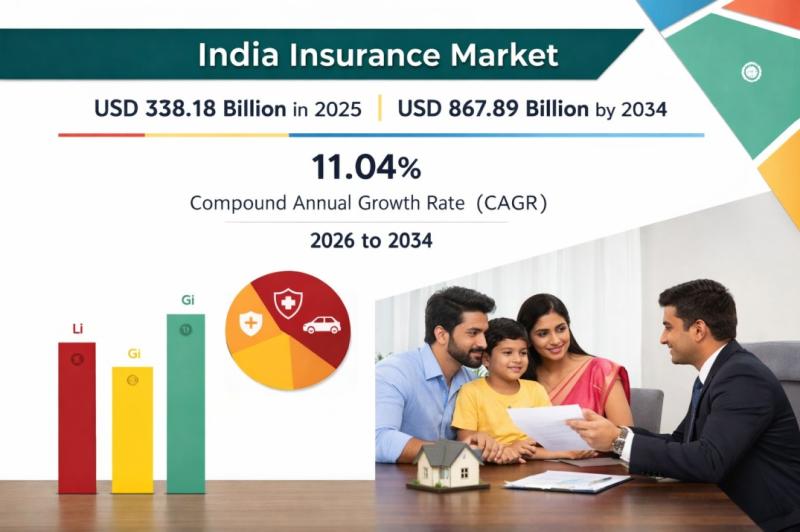

India Insurance Market Forecast 2026: Industry Size, Expansion & Future Scope 20 …

India Insurance Market Overview 2026-2034

According to IMARC Group's report titled India Insurance Market Size, Share, Trends and Forecast by Type of Product, Distribution Channel, End User, and Region, 2026-2034 the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

The India insurance market size was valued at USD 338.18 Billion in 2025 and is projected to reach USD 867.89 Billion by 2034, growing at…

Global Diammonium Phosphate (DAP) Prices January 2026: Asia Gains, Europe Steady …

What is Diammonium Phosphate (DAP)?

Diammonium Phosphate (DAP) is a widely used phosphorus-based fertilizer crucial for global agriculture. Monitoring Diammonium Phosphate (DAP) prices helps manufacturers, distributors, and buyers make informed procurement decisions and manage costs amid fluctuating demand and supply conditions.

Global Price Overview

The global Diammonium Phosphate (DAP) market shows moderate stability with regional supply differences affecting prices. The Diammonium Phosphate (DAP) price trend has remained mixed, while the price index and…

More Releases for Saudi

Saudi Wakala Offers Efficient and Reliable Saudi Visa Stamping Services

Saudi Wakala, a renowned agency specializing in Saudi visa stamping services, is proud to announce its commitment to providing swift and reliable visa processing for travelers to Saudi Arabia. Located in New Delhi, Saudi Wakala has established itself as a trusted partner for individuals and businesses requiring efficient visa stamping services.

Efficient Visa Processing

Understanding the complexities and time-sensitivity associated with visa stamping, Saudi Wakala offers a streamlined process managed by an…

saudi construction company,TOP saudi arabia construction companies list,civil co …

Abdul Ali Al-Ajmi Company

Advanced Support Company

Al Ashbelya Engineering

Al-Dour Engineering Contracting Est.

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Alfanar

Arabian Tile Co. Ltd. (ARTIC)

Assad Said for Contracting Co Ltd

Automated Buildings Company

Bazy Trading and Contracting

Bin Dayel Contracting

Cercon

City Cement Company

Dar Al Majd

EG & G Middle East

East Consulting Engineering Center

El Seif Engineering Contracting Company

El Seif Engineering Contracting Company

Engineering Development Co for Contracting

FCC Company

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Jones Engineering Group

Masar Consulting Engineer

Meinhardt Arabia

Mohammed M. Al Rashid Co. (MARCO)

Qureshi Telecom Contracting &…

Saudi Arabia Agriculture Market, Saudi Arabia Agriculture Industry, Saudi Arabia …

Saudi Arabia Agriculture is focussed on the spread of dates, dairy farm merchandise, eggs, fish, poultry, vegetables, and flowers to markets round the creation because it has attained its own potency within the production of such merchandise. The private sector additionally plays a role within the nation's agriculture, because the government offers long-term interest-free loans and inexpensive water, fuel, electricity, and duty-free imports of raw materials and machinery. Over the past…

Saudi Arabia Pharmaceutical Market | pharmaceutical companies in saudi arabia, p …

In order to study the various trends and patterns prevailing in the concerned market, Market Research Reports Search Engine (MRRSE) has included a new report titled “Saudi Arabia Pharmaceutical Market” to its wide online database. This research assessment offers a clear insight about the influential factors that are expected to transform the global market in the near future.

The report examines Saudi Arabia pharmaceutical market for the period 2016–2026. The primary…

Saudi Arabia Airport Privatization Sector Saudi Arabia Airport Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

Saudi Arabia Aviation Industry Overview

Privatization in Saudi Arabia

Saudi Arabia Civil Aviation Regulatory Authority

3.1 General Authority of Civil Aviation (GACA)

3.2 International Air Transport Association

Saudi…

Saudi Arabia Mutual Fund Sector Saudi Arabia Mutual Fund Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

1. Saudi Arabia Financial Sector Overview

2. Saudi Arabia Stock Market and Exchange Overview

3. Saudi Arabia Mutual Fund Market Overview

4. Saudi Arabia Mutual Fund Program and Managers

4.1 Fund Managers and Companies

4.2 Types of Mutual Funds

5. Saudi Arabia Mutual Fund Asset Allocation

5.1 Market Overview

5.2 Mutual Fund Market Indicators

…