Press release

The Buy-Now-Pay-Later Market Rides The Online Payment Wave: The Driving Engine Behind Buy Now Pay Later Market Evolution in 2025

Use code ONLINE20 to get 20% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.Buy Now Pay Later Market Size Growth Forecast: What to Expect by 2025?

Over the past several years, there has been a significant expansion in the size of the buy now pay later market. It is projected to increase from $231.51 billion in 2024 to $342.13 billion in 2025 with a compound annual growth rate (CAGR) of 47.8%. The previous growth was driven by several factors including the rise of e-commerce and online shopping, consumer's preference for flexible payment options, the growth of digital wallets and mobile payments, the expanding millennial and gen z consumer base, and competition among companies providing payment services.

How Will the Buy Now Pay Later Market Size Evolve and Grow by 2029?

Expectations are high for the buy now pay later market, with projected exponential expansion in the coming years. The market value is estimated to increase to $1432.18 billion by 2029, representing an impressive 43.0% compound annual growth rate (CAGR). This projected growth through the forecast period is largely due to several factors including the broadening of BNPL services into physical retail, surge in global e-commerce, implementation by longstanding retailers, focus on responsible lending and customer protection, and the emergence of embedded finance and BNPL as a service. Key trends anticipated over the forecast period encompass integration with point-of-sale systems, the tailoring of BNPL deals, partnerships between BNPL providers and merchants, incorporation into loyalty programs, and regulatory advancements in the BNPL sector.

View the full report here:

https://www.thebusinessresearchcompany.com/report/buy-now-pay-later-global-market-report

What Drivers Are Propelling the Growth of Buy Now Pay Later Market Forward?

The expansion of the buy-now-pay-later market is anticipated to be fueled by a rise in the use of online payment options. Online payments include payments made for goods or services purchased online or in-person. The buy now, pay later scheme allows customers to make minor purchases both online and in person, and then pay quickly. For instance, UK Finance, a financial services firm based in the UK, reported that in 2022, remote banking was still popular in the UK, with 86% of adults employing at least one form of remote banking. This includes online banking through a computer, mobile banking via smartphone or tablet apps, and phone banking services. Therefore, the growing use of online payment methods is boosting the expansion of the buy-now-pay-later market.

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=7652&type=smp

Which Emerging Trends Are Transforming the Buy Now Pay Later Market in 2025?

The emergence of advanced technology is becoming a prominent trend in the buy-now-pay-later market. Main players in the market are focusing on providing customers with innovative digital services to maintain their footing in this industry. For example, in January 2022, Temenos, a software and apps company based in Switzerland, rolled out Temenos Banking Cloud, which is the first of its kind, AI-operated buy-now-pay-later banking service in the market. It is anticipated that this product, through its alternative credit offerings, will provide additional revenue streams to banks and fintechs, aid in their market expansion, and cement their relationships with both customers and business associates. With the provision of insight into automated decision-making processes and matching BNPL customers with appropriate loan offers based on their historical data, Temenos' BNPL service helps banks create lending programs utilizing their patented, transparent AI technology. Hence, the advancement of technology is propelling the growth of the buy-now-pay-later market.

What Are the Key Segments in the Buy Now Pay Later Market?

The buy now pay latermarket covered in this report is segmented -

1) By Channel: Online, POS

2) By Enterprise Size: Large Enterprises, Small and Medium Enterprises

3) By End Use: Consumer Electronics, Fashion and Garment, Healthcare, Leisure and Entertainment, Retail, Others End-User

Subsegments:

1) By Online: E-commerce Platforms, Mobile Apps, Online Marketplaces

2) By Point of Sale (POS): In-store Retail, Restaurant And Hospitality, Service-Based Businesses

Tailor your insights and customize the full report here:

https://www.thebusinessresearchcompany.com/customise?id=7652&type=smp

Who Are the Key Players Shaping the Buy Now Pay Later Market's Competitive Landscape?

Major companies operating in the buy now pay later market include Paytm Postpaid, PayPal Holdings Inc., Affirm Inc., Klarna Inc., Splitit Ltd., Sezzle Inc., Perpay Inc., Openpay, Quadpay Inc., LatitudePay, Laybuy Group Holdings Limited, Payl8r (Social Money Ltd. ), ePayLater, Zest Money, Lazypay, Afterpay Ltd., Zip Co Ltd., FuturePay Inc., Bread Finance, PayBright, Zebit Inc., Uplift, ViaBill, Sunbit, Katapult, Credova, Acima Credit, Progressive Leasing, Flexiti Financial, LendCare, PayTomorrow, Payzer, QuickFee, SmartPay Leasing, SplitPay, Zibby

What Geographic Markets Are Powering Growth in the Buy Now Pay Later Market?

North America was the largest region in the buy now, pay later market in 2024.Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the buy now pay later market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa

Purchase the full report today:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=7652

This Report Supports:

1.Business Leaders & Investors - To identify growth opportunities, assess risks, and guide strategic decisions.

2.Manufacturers & Suppliers - To understand market trends, customer demand, and competitive positioning.

3.Policy Makers & Regulators - To track industry developments and align regulatory frameworks.

4.Consultants & Analysts - To support market entry, expansion strategies, and client advisory work.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Saumya Sahey

Europe: +44 7882 955267,

Asia: +44 7882 955267 & +91 8897263534,

Americas: +1 310-496-7795

Email: saumyas@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release The Buy-Now-Pay-Later Market Rides The Online Payment Wave: The Driving Engine Behind Buy Now Pay Later Market Evolution in 2025 here

News-ID: 4222295 • Views: …

More Releases from The Business Research Company

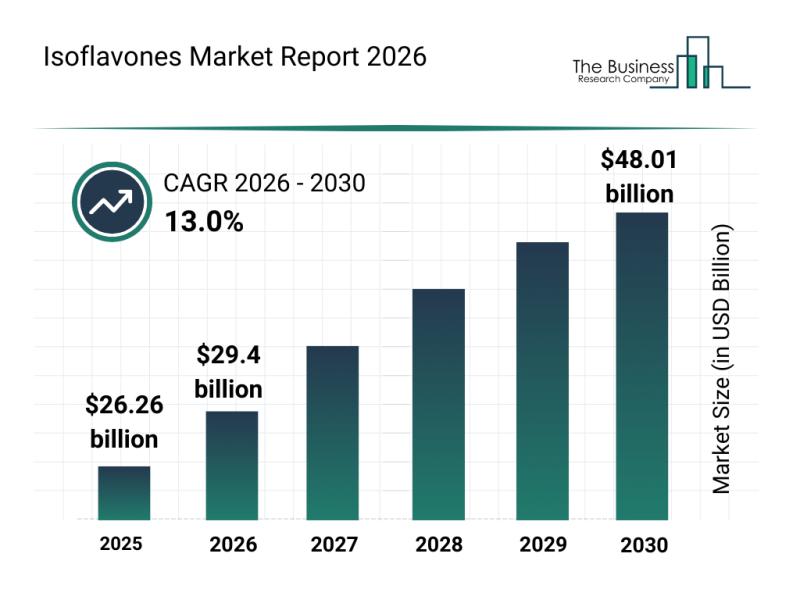

Segment Analysis and Major Growth Areas in the Isoflavones Market

The isoflavones market is poised for remarkable growth over the coming years, driven by increasing consumer awareness and expanding applications across various industries. With rising interest in health supplements and natural ingredients, this market is attracting significant attention from manufacturers and investors alike. Let's delve into the market's size, key players, emerging trends, and segment breakdowns shaping its trajectory.

Projected Market Size and Growth Outlook for Isoflavones

The isoflavones market…

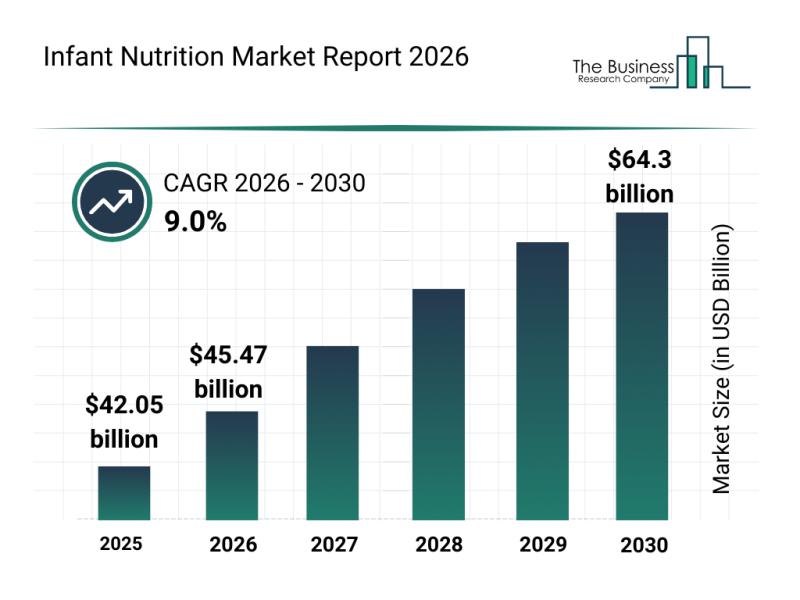

Key Strategic Developments and Emerging Changes Shaping the Infant Nutrition Mar …

The infant nutrition market is on track for substantial expansion in the coming years, driven by evolving consumer preferences and advancements in product offerings. As parents increasingly seek high-quality nutrition solutions tailored to their babies' needs, the sector is poised for remarkable growth through innovative products and diverse distribution channels. Let's explore the market's size projections, key players, emerging trends, and segment breakdowns shaping this dynamic industry.

Projected Growth Trajectory and…

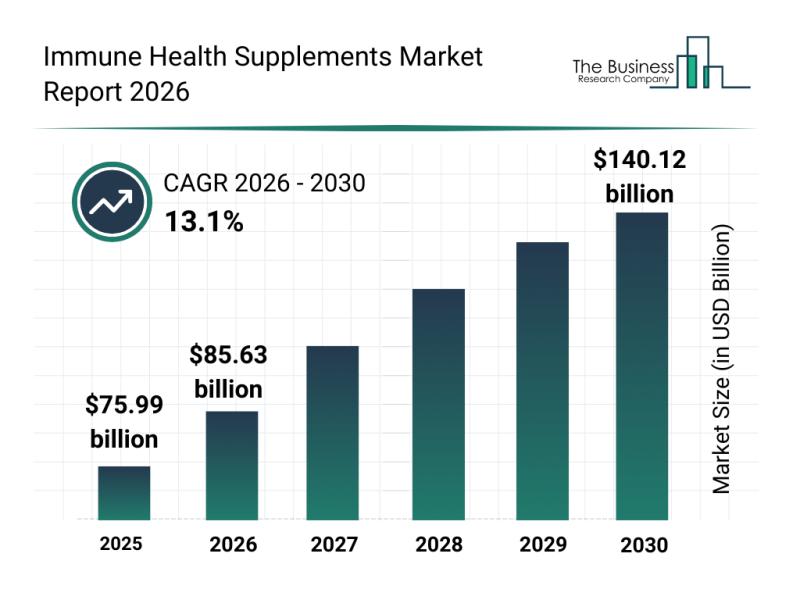

Leading Companies Advancing Innovation and Growth in the Immune Health Supplemen …

The immune health supplements sector is gaining significant traction as consumers increasingly prioritize wellness and preventive care. With a growing interest in personalized nutrition and plant-based options, this market is set to expand rapidly. Let's explore the expected market size, key players, emerging trends, and segmentation that define the future of immune health supplements.

Projected Expansion of the Immune Health Supplements Market by 2030

The immune health supplements market is…

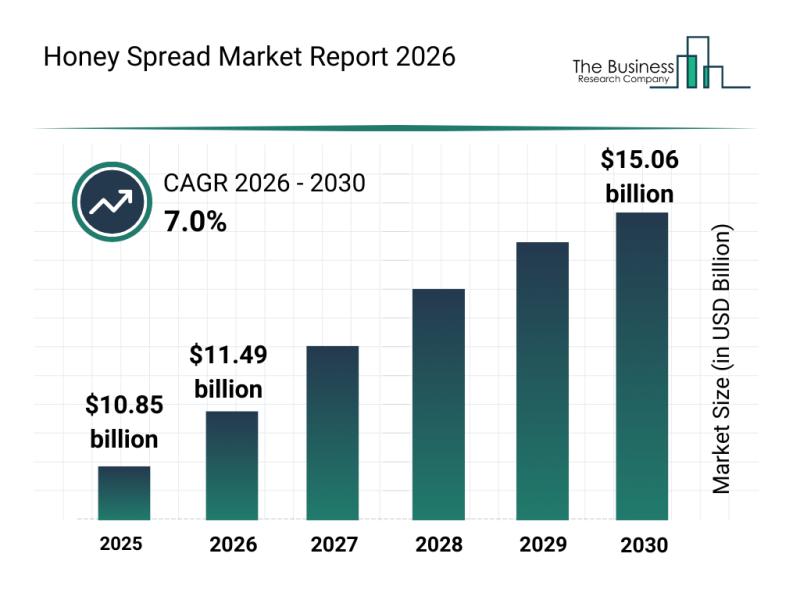

Honey Spread Market Overview: Major Segments, Strategic Developments, and Leadin …

The honey spread market is gaining significant momentum as consumers increasingly seek healthier and more flavorful alternatives to traditional spreads. Growing awareness around natural ingredients and sustainability, combined with e-commerce expansion and innovative product offerings, is set to shape the future of this sector. Below, we explore the market's size, key players, emerging trends, and segmentation to provide a comprehensive outlook through 2030.

Robust Expansion Expected in the Honey Spread Market…

More Releases for Pay

Digital Wallets Market to See Thriving Worldwide | PayPal • Apple Pay • Goog …

The latest study by Coherent Market Insights, titled "Digital Wallets Market Size, Share & Trends Forecast 2026-2033," offers an in-depth analysis of the global and regional dynamics shaping this rapidly evolving industry. This comprehensive report highlights the competitive landscape, key market segments, value chain analysis, and emerging technological and regulatory trends expected between 2026 and 2033. The report provides actionable insights for business leaders, policymakers, investors, and new market entrants…

Mobile Payment Market to See Thriving Worldwide| Apple Pay • Google Pay • Sa …

Latest Report, titled Mobile Payment Market 2025-2032 Trends, Share, Size, Growth, Opportunity and Forecast 2025-2032, by Coherent Market Insights offers a comprehensive analysis of the industry, which comprises insights on the market analysis. As part of our Black Friday Limited-Time Discount, this premium research report is now available at up to 60% off, offering an exceptional opportunity for businesses, analysts, and stakeholders to access high-value insights at a significantly reduced…

Proximity Payment Market is Going to Boom | Major Giants Apple Pay, Google Pay, …

HTF MI just released the Global Proximity Payment Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

𝐌𝐚𝐣𝐨𝐫 Giants in Proximity Payment Market are:

Apple Pay, Google Pay, Samsung…

Unified Payments Interface (UPI) Market Is Booming Worldwide | Google Pay, Amazo …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2028. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Unified Payments Interface (UPI) Market May See a Big Move | Major Giants Samsun …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2027. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Samsung Pay Market is Booming Worldwide with Samsung Pay, Apple Pay, Google Pay

HTF Market Intelligence released a new research report of 23 pages on title 'Samsung Pay - Competitor Profile' with detailed analysis, forecast and strategies. The study covers key regions that includes North America, LATAM, United States, GCC, Southeast Asia, Europe, APAC, United Kingdom, India or China etc and important players such as Samsung Pay, Apple Pay, Google Pay, Alipay, Tenpay, Samsung Electronics, Visa, Mastercard.

Request a sample report @ https://www.htfmarketreport.com/sample-report/3587660-samsung-pay-competitor-profile

Summary

Samsung…