Press release

Australia Plant-Based Food Market Projected to Reach USD 981.3 Million by 2033

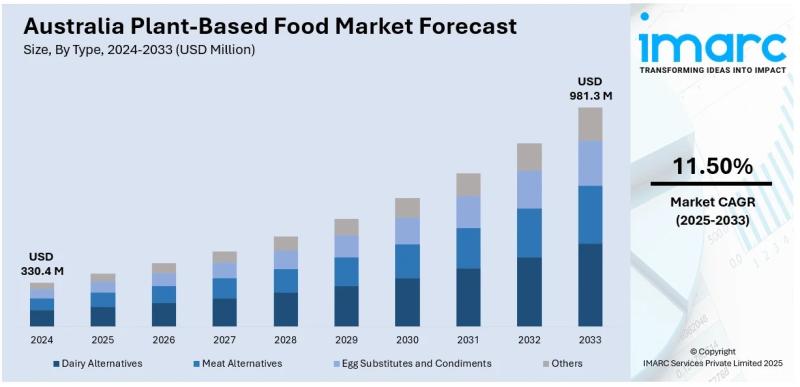

The latest report by IMARC Group, titled "Australia Plant-Based Food Market Report by Type (Dairy Alternatives, Meat Alternatives, Egg Substitutes and Condiments, Others), Source (Soy, Almond, Wheat, Others), Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Online Stores, Others), and Region 2025-2033," offers a comprehensive analysis of the Australia plant-based food market growth. The report includes competitor and regional analysis, along with a detailed breakdown of the market segmentation. The Australia plant-based food market size reached USD 330.4 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 981.3 Million by 2033, exhibiting a CAGR of 11.50% during 2025-2033.Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 330.4 Million

Market Forecast in 2033: USD 981.3 Million

Market Growth Rate (2025-2033): 11.50%

Australia Plant-Based Food Market Overview

Key drivers for the plant-based food market throughout Australia include an increase in flexitarian and vegan diets, changed attitudes towards health and sustainability, the rise of mainstream retail and e-commerce channels, increasing awareness of climate change's environmental impact, and increased consumer awareness of animal welfare. The plant-based food market in Australia grows because of some factors. Technology innovates in clean label and nutrient-improved foods, chefs creatively use Australian native food ingredients, and people shift to seeing plant-based foods as mainstream products for personal health and wellbeing, environmental sustainability, and animal welfare. Revolutionary plant-based foods change Australia's food scene from meat and dairy incorporating snacks, desserts, ready meals, and sauces. They focus on transparent sourcing and authentic Australian flavor and create affordable and accessible plant-based diets that appeal to diverse consumer segments.

Daily meal replacement, flexitarian protein supplementation, allergy-friendly alternatives, health-based dietary patterns, lifestyle-based ethical purchasing are some of the strong consumer fundamentals for plant-based food in Australia. Melbourne, Sydney and Brisbane have a discerning food culture. With multiculturalism and increasing emphasis on outdoor lifestyle wellness, conditions are right in Australia for a lifestyle around sustainability and also validating the animal welfare and environmental benefits of plant-based food. Around 2.5 million Australians (12.1% of adults) following vegetarian or vegan diets, supermarket plant-based sections, plant-based menu items in restaurants, and plant-based social-media influencers provide a positive environment that is in need of investment in new product development. This includes plant-based farming, sourcing indigenous and other botanical ingredients, expanded retail distribution and consumer education. With increased environmental and health consciousness of Australians, existing agricultural capacity for pulses, lentils and grains, Australia offers a growing market for new plant-based foods and alternative protein innovations that can help to diversify diets and alleviate environmental impact.

Request For Sample Report:

https://www.imarcgroup.com/australia-plant-based-food-market/requestsample

Australia Plant-Based Food Market Trends

• Clean-label nutrient enrichment: Growing consumer demand for transparency with products containing few familiar ingredients, avoiding artificial additives, and incorporating protein-rich legumes, grains, fortified blends enhancing nutritional content appealing to health-conscious flexitarian segments.

• Meal category diversification: Expanding product offerings beyond meat and dairy alternatives into snacks, desserts, ready meals, pasta sauces, condiments, and egg-free products integrating plant-based ingredients across daily eating routines facilitating mainstream adoption.

• Regional and online expansion: Strengthening distribution through regional retail channels and e-commerce platforms providing access to specialty products, allergen-friendly alternatives, and curated meal packages particularly serving lower-density areas with limited local availability.

• Indigenous ingredient integration: Rising utilization of native Australian botanicals including wattle seed, macadamia, lemon myrtle, quandong, and Davidson plum creating distinctive flavor profiles, cultural authenticity, and premium positioning differentiating Australian products globally.

• Multicultural fusion innovation: Expanding culinary creativity incorporating Asian, Pacific, European, and Indigenous influences developing plant-based laksa, banh mi, Greek dips, and native spice variations appealing to Australia's diverse cultural food preferences.

• Retail mainstream positioning: Growing supermarket dedicated plant-based sections, increased shelf space allocation, major chain expansion including Coles and Woolworths, and hospitality menu innovations normalizing plant-based consumption across demographic segments.

Market Drivers

• Environmental sustainability values: Implementation of conscious consumption choices driven by climate change concerns, bushfire awareness, reef conservation priorities, and agricultural environmental impact recognition particularly resonant in urban centers like Sydney, Melbourne, and Brisbane.

• Health and wellness emphasis: Growing adoption of plant-based diets supporting fitness, holistic wellbeing, yoga, meditation lifestyles particularly prevalent in coastal communities and health-focused suburbs with 55% of vegans/vegetarians adopting diets within past five years.

• Ethical animal welfare: Rising awareness about animal treatment, factory farming practices, and ethical food sourcing influencing consumer choices toward cruelty-free alternatives supported by national and local advocacy campaigns and social media activism.

• Culinary innovation advancement: Increasing chef experimentation, food startup creativity, and artisanal producer development creating authentic Australian plant-based products through Melbourne laneways, Sydney inner-city suburbs, and regional food festivals.

• Retail accessibility expansion: Growing mainstream supermarket commitment, health food specialty store growth, and dedicated plant-based ranges improving product visibility and consumer access across metropolitan and rural communities throughout Queensland and Western Australia.

• Policy and agricultural support: Strengthening government sustainability commitments, waste reduction initiatives, alternative protein innovation backing, and pulse/grain agricultural diversification supporting industry infrastructure and regional economic development.

Challenges and Opportunities

Challenges:

• Climate agricultural vulnerabilities involving drought, variable rainfall, bushfire risks affecting legume, pulse, native grain crops in NSW Riverina, Victoria Mallee, WA Wheatbelt regions creating supply instabilities, quality variations, and production cost increases

• Cultural food tradition resistance with strong meat-based meal identification particularly in farming communities and rural Queensland/Western Australia areas viewing plant-based alternatives as less satisfying or incompatible with barbecue traditions and social gatherings

• Regulatory labeling uncertainties regarding product naming conventions, "meat," "cheese," "milk" terminology use, and claims validation creating compliance risks, consumer confusion, and market entry hesitation particularly affecting regional specialty brands

• Flavor and texture perceptions involving consumer skepticism about taste satisfaction, cooking versatility, and meal completeness requiring significant culinary education, recipe demonstrations, and localized promotional investments changing established attitudes

• Premium pricing barriers limiting mass market penetration with plant-based products often commanding higher prices than conventional alternatives creating affordability concerns and restricting adoption among budget-conscious households and price-sensitive demographics

Opportunities:

• Indigenous botanical commercialization developing premium products featuring wattle seed, quandong, Davidson plum, macadamia, lemon myrtle creating unique Australian terroir, authentic cultural narratives, and differentiated global export positioning

• Regional tourism branding integrating plant-based foods into Margaret River, Tasmania, subtropical Queensland food trails creating place-based artisanal products, festival exposure, and tourist engagement translating to wider retail adoption

• Agricultural diversification support leveraging chickpea, lentil, lupin cultivation expansion in regional farming areas creating stable supply chains, local economic benefits, and export pathway opportunities to Asian markets demanding clean-label products

• Restaurant and café innovation partnerships developing plant-based menu innovations, food truck concepts, artisanal café offerings normalizing consumption through experiential dining, cooking demonstrations, and grassroots food culture movements

• Asia-Pacific export expansion utilizing Australia's agricultural reputation, established cold-chain logistics, trade agreements, and growing international demand for clean-label sustainably sourced plant-based innovations accessing premium global markets

Australia Plant-Based Food Market Segmentation

By Type:

• Dairy Alternatives

o Plant-Based Milk

Almond Milk

Soy Milk

Oat Milk

Coconut Milk

Macadamia Milk

Cashew Milk

o Plant-Based Cheese

Nut-Based Cheese

Soy Cheese

Cashew Cheese

Cultured Cheese

o Plant-Based Yogurt

o Plant-Based Butter

o Plant-Based Ice Cream

o Plant-Based Cream

• Meat Alternatives

o Plant-Based Burgers

o Plant-Based Sausages

o Plant-Based Mince

o Plant-Based Chicken

o Plant-Based Seafood

o Plant-Based Deli Slices

• Egg Substitutes and Condiments

o Egg Replacers

o Vegan Mayo

o Plant-Based Sauces

o Pasta Sauces

o Salad Dressings

o Spreads

• Others

o Plant-Based Snacks

o Plant-Based Desserts

o Plant-Based Ready Meals

o Plant-Based Protein Powder

o Plant-Based Bakery

o Plant-Based Beverages

By Source:

• Soy

o Soy Protein

o Textured Soy

o Soy Milk Base

o Tofu Products

o Tempeh

o Edamame

• Almond

o Almond Milk

o Almond Butter

o Almond Flour

o Almond-Based Cheese

o Almond Protein

o Almond Yogurt

• Wheat

o Wheat Protein (Seitan)

o Wheat-Based Meat

o Wheat Flour Products

o Gluten Products

o Bread Alternatives

o Pasta Alternatives

• Others

o Pea Protein

o Oat-Based Products

o Coconut-Based Items

o Chickpea Products

o Lentil-Based Foods

o Native Australian Botanicals

By Distribution Channel:

• Supermarkets and Hypermarkets

o Coles

o Woolworths

o Aldi

o IGA

o Major Chains

o Regional Supermarkets

• Convenience Stores

o Local Shops

o Petrol Stations

o Express Stores

o Corner Stores

o Quick-Access Outlets

o Neighborhood Markets

• Online Stores

o E-commerce Platforms

o Brand Websites

o Subscription Services

o Specialty Online Retailers

o Meal Kit Delivery

o Direct-to-Consumer

• Others

o Health Food Stores

o Farmers Markets

o Specialty Retailers

o Restaurants and Cafés

o Food Trucks

o Institutional Catering

By Region:

• Australia Capital Territory & New South Wales

• Victoria & Tasmania

• Queensland

• Northern Territory & Southern Australia

• Western Australia

Browse Full Report:

https://www.imarcgroup.com/australia-plant-based-food-market

Australia Plant-Based Food Market News (2024-2025)

• January 2025: Research revealed 2.5 million Australians (12.1% of adults) following vegetarian or vegan diets representing 50% increase over past decade with eastern states showing highest adoption rates demonstrating significant plant-based movement growth.

• September 2023: NEXT Foods launched plant-based pasta sauce range across 550 Coles supermarkets nationwide featuring locally produced pouches with plant-based meat in Carbonara and Bolognese variants demonstrating mainstream retail acceptance.

• April 2024: Else Nutrition entered Australian market with soy-free plant-based infant and toddler formula produced from almond, buckwheat, and tapioca providing clean-label options for health-conscious parents seeking alternatives.

• 2024-2025: Major supermarket chains Coles and Woolworths expanded dedicated plant-based sections increasing shelf space allocation, product variety, and category visibility facilitating mainstream consumer access across metropolitan and regional locations.

• 2024: Culinary innovation accelerated with chefs, food startups, and artisanal producers experimenting with indigenous Australian botanicals including wattle seed, macadamia, lemon myrtle creating distinctive authentic plant-based products appealing to local and international markets.

• 2023: Health emerged as primary motivation with 55% of Australian vegans and vegetarians adopting diets within past five years, while 29% of participants consuming dairy-free milk weekly and 11% of non-vegans considering full plant-based transition.

Key Highlights of the Report

• Market Performance (2019-2024)

• Market Outlook (2025-2033)

• Industry Catalysts and Challenges

• Segment-wise historical and future forecasts

• Competitive Landscape and Key Player Analysis

• Type, Source, and Distribution Channel Analysis

Ask analyst for your customized sample:

https://www.imarcgroup.com/request?type=report&id=32141&flag=F

Q&A Section

Q1: What drives growth in the Australia plant-based food market?

A1: Market growth is driven by environmental sustainability values addressing climate concerns and reef conservation particularly in urban centers, health and wellness emphasis supporting fitness and holistic lifestyles especially in coastal communities, ethical animal welfare awareness influencing cruelty-free consumption choices, culinary innovation advancement through chef experimentation and indigenous ingredient integration, retail accessibility expansion through mainstream supermarket commitment and dedicated sections, and policy and agricultural support promoting alternative protein innovation and pulse/grain diversification supporting industry infrastructure.

Q2: What are the latest trends in this market?

A2: Key trends include clean-label nutrient enrichment with transparent ingredients and protein-rich formulations, meal category diversification expanding beyond meat/dairy into snacks, desserts, and ready meals, regional and online expansion providing specialty product access through e-commerce, indigenous ingredient integration featuring wattle seed, macadamia, and lemon myrtle, multicultural fusion innovation incorporating Asian, Pacific, and Indigenous culinary influences, and retail mainstream positioning through dedicated supermarket sections and hospitality menu innovations normalizing consumption.

Q3: What challenges do companies face?

A3: Major challenges include climate agricultural vulnerabilities affecting crop supply in NSW, Victoria, and WA creating production instabilities, cultural food tradition resistance particularly in rural farming communities viewing alternatives as less satisfying, regulatory labeling uncertainties regarding product naming and claims validation creating compliance risks, flavor and texture perceptions requiring culinary education changing established attitudes, and premium pricing barriers limiting mass market penetration among budget-conscious households.

Q4: What opportunities are emerging?

A4: Emerging opportunities include indigenous botanical commercialization creating premium authentic products with unique Australian terroir, regional tourism branding integrating plant-based foods into Margaret River and Tasmania food trails, agricultural diversification support leveraging chickpea, lentil, and lupin cultivation expansion, restaurant and café innovation partnerships normalizing consumption through experiential dining, and Asia-Pacific export expansion utilizing Australia's agricultural reputation accessing premium global markets demanding clean-label products.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91-120-433-0800

United States: +1-201-971-6302

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses. IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Australia Plant-Based Food Market Projected to Reach USD 981.3 Million by 2033 here

News-ID: 4222275 • Views: …

More Releases from IMARC Group

Industrial Enzymes Manufacturing Plant DPR 2026: Cost Structure, Production Proc …

Setting up an industrial enzymes manufacturing plant involves strategic planning, substantial capital investment, and a comprehensive understanding of fermentation-based production technologies. These biological catalysts serve critical roles in detergents, food and beverages, animal feed, biofuels, pulp and paper, textiles, and wastewater treatment. Success requires careful site selection, efficient microbial fermentation processes, stringent quality assurance protocols, reliable raw material sourcing, and compliance with industrial and environmental regulations to ensure profitable and…

Fly Ash Bricks Manufacturing Plant DPR & Unit Setup Report 2026

Setting up a fly ash bricks manufacturing plant positions investors in one of the fastest-growing and most environmentally progressive segments of the construction materials value chain, backed by sustained global growth driven by the increased demand for environmentally friendly construction materials, the growing trend of sustainable construction, and increasing government support towards waste utilisation and green construction methods. As urbanization accelerates, infrastructure development intensifies, and regulatory frameworks increasingly mandate the…

ERW Steel Pipes Manufacturing Plant DPR 2026: Investment Cost, Demand Analysis & …

Setting up an ERW steel pipes manufacturing plant involves strategic planning, substantial capital investment, and a comprehensive understanding of production technologies. These high-strength, cost-effective pipes serve the oil and gas, construction, automotive, water transportation, and energy infrastructure sectors. Success requires careful site selection, advanced welding and precision manufacturing processes, stringent quality assurance protocols, reliable raw material sourcing, and compliance with industrial safety and environmental regulations to ensure profitable and sustainable…

Waste-to-Energy Plant DPR & Unit Setup - 2026: Demand Analysis and Project Cost

Setting up a Waste-to-Energy Plant positions investors in one of the most stable and essential segments of the renewable energy and waste management value chain, backed by sustained global growth driven by rising municipal solid waste generation, sustainable waste management requirements, increasing demand for renewable energy sources, and the dual-benefit advantages of waste reduction with energy production. As urbanization accelerates, waste volumes escalate toward 3.40 billion tons globally by 2050,…

More Releases for Australia

Derila Memory foam pillow Australia: Honest Reviews About Derila Australia

Derila is one of the best memory foam pillows sold in Australia today.

Priced at around 30 dollars (USD), derila is currently the most reviewed and the cheapest memory pillow available in Australia.

What is Derila? Is Derila Pillow the best in Australia? Keep reading to discover everything worth knowing about Derila Australia.

OVERVIEW

Recently, Memory foam pillow has been trending and there is a lot of brands to choose from. Which one is…

CeraCare Australia - Where to Buy Legit CeraCare Supplement in Australia?

CeraCare Australia - Ceracare is a glucose support supplement that proposes to augment cardiovascular prosperity and to stay aware of perfect glucose assimilation in Australia. CeraCare supplement is conceptualized and executed by a threesome – Christine, Dr. Jihn and Michael. It is a natural supplement that helps one stay aware of ideal glucose levels, cardiovascular prosperity, and glucose assimilation.

Take Advantage of 80% Discount Offer in Australia >> https://boostsxproaustralia.com/ceracare-new

The indications…

Glucofort Australia - Where to Buy Legit Glucofort Supplement in Australia?

Glucofort Australia - Glucofort is an efficient, all-natural progressive glucose support supplement in Australia. This formula is made out of 12 key ingredients, 7 nutrients, and minerals, and a little of Vanadium. This supplement upholds regulated glucose levels and glucose digestion. Glucofort prides itself as the most inventive supplements available in Oceania, accentuating its solidarity, wellbeing, and quality.

Take Advantage of 75% Discount Offer in Australia >> https://boostsxproaustralia.com/glucofort-new

Rather than simply…

Australia Agriculture Market, Australia Agriculture Industry, Australia Agricult …

Australia Agriculture has been as vital within the development of Australia, because it was within the United States. Australia's ancient dominance in wheat and sheep continues into the 21st century. Recently Australian agriculture has become more and more diversified. The considerable expanses of productive land have helped Australia to become a number one world exporter of grains, meats, and wool. Each grains (predominantly wheat and barley) and wool markets round…

Australia Conveyor Maintenance Analysis by Top Companies Habasit Australia Pty l …

Global Australia Conveyor Maintenance Market and Competitive Analysis

Know your current market situation! Not only a vital element for brand new products but also for current products given the ever-changing market dynamics. The study allows marketers to remain involved with current consumer trends and segments where they'll face a rapid market share drop. Discover who you actually compete against within the marketplace, with Market Share Analysis know market position, to push…

Australia Conveyor Maintenance Market Analysis By Manufacturers Rema Tip Top Aus …

A conveyor system is a common piece of mechanical handling device that moves materials/objects from one location. A conveyor is often lifeline to a company’s ability to effectively move its products in a timely manner. While it is used constantly in a manufacturing plant, proper maintenance from trained technicians can extend the lifespan of conveyor. Furthermore, conveyor maintenance is essential as it may be subjected to different types of failures…