Press release

GST Payments Increase 2025 - What Canadians Need to Know

On July 4, 2025, the Canada Revenue Agency (CRA) rolled out the first increased GST/HST payment of the new benefit year. Millions of eligible Canadian taxpayers, including temporary residents, international students, and refugees, saw the boosted credit land in their accounts in the form of GST payments [https://immigrationnewscanada.ca/new-gst-payment-dates-2025-2026/], offering some relief against rising living costs.This non-taxable payment is designed to offset the impact of goods and services tax (GST) and harmonized sales tax (HST). While the increase provides help for households, experts note that with inflation and climbing rent, groceries, and utilities, the credit only eases the pressure slightly.

What Is the GST Payment?

The GST/HST credit is a tax-free quarterly payment from the CRA. It helps low- and moderate-income Canadians manage the sales taxes they pay daily, from groceries to gas.

Compared to taxable income, these credits are not added to yearly earnings, so every dollar stays in your pocket. Payments are based on your 2024 tax return, with adjustments for income, marital status, and dependent children.

Who Is Eligible for the GST/HST Payments in 2025?

Eligibility depends on several factors:

* Residency: You must be a Canadian resident for tax purposes the month before and at the start of the month when the CRA issues the payment. Permanent residents, newcomers, and temporary residents with valid permits (after 18 months in Canada) all qualify.

* Age: You must be at least 19, unless you have a spouse/common-law partner or are a parent living with your child.

* Income: Eligibility is income-tested, with benefits phasing out at higher income levels.

Example: A single individual with adjusted family net income (AFNI) below ~$27,000 could qualify for the full benefit.

How Much Is the New GST Payment in 2025?

For the 2025-2026 benefit year (July 2025 to June 2026), the CRA increased the GST/HST credit amounts by 2.7% to match inflation.

Maximum annual credits are:

* Single individual: $533

* Married or common-law couple: $698

* Per child under 19: $184

A married couple with two children could receive up to $1,066 annually, split into quarterly payments.

GST Payment Dates 2025-2026

The CRA will issue GST/HST credits on the following confirmed dates:

* July 4, 2025

* October 3, 2025

* January 5, 2026

* April 3, 2026

Payments usually arrive by direct deposit within a few business days. Cheques may take longer.

How to Apply for the GST/HST Payment

For most Canadians, the credit is automatic if you filed your 2024 tax return. The CRA uses your return to calculate eligibility and amounts.

Newcomers must apply manually in their first year:

* If you do not have children, complete Form RC151.

* If you have children, complete Form RC66 and RC66SCH.

Temporary residents need valid permits that cover at least 18 months. Filing taxes is mandatory, even with no income, to receive payments.

Other CRA Benefits in July 2025

The July 2025 payment cycle also delivered:

* Canada Child Benefit (CCB): July 18

* Advanced Canada Workers Benefit (ACWB): July 11

* Ontario Trillium Benefit (OTB): July 10

* CPP and OAS payments: July 29

Together, these CRA benefits provided an important mid-summer boost for households across Canada.

The July 4, 2025, GST payments marked the start of the new benefit year. With credits of up to $533 for singles, $698 for couples, and $184 per child, this program continues to offer meaningful support for low- and moderate-income households.

By filing your taxes on time, keeping your CRA account updated, and enrolling in direct deposit, you can ensure you receive every payment on schedule. Stay tuned for the next round of GST/HST credits, set for October 3, 2025. For more information, do follow Immigration News Canada [https://immigrationnewscanada.ca/].

Media Contact

Company Name: Immigration news Canada

Contact Person: Kamal Deep Singh

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=gst-payments-increase-2025-what-canadians-need-to-know]

Phone: 647-853-1717

Country: Canada

Website: https://immigrationnewscanada.ca

Legal Disclaimer: Information contained on this page is provided by an independent third-party content provider. ABNewswire makes no warranties or responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you are affiliated with this article or have any complaints or copyright issues related to this article and would like it to be removed, please contact retract@swscontact.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release GST Payments Increase 2025 - What Canadians Need to Know here

News-ID: 4221786 • Views: …

More Releases from ABNewswire

SEO Guru Atlanta Has Appointed Senior Google Ads Manager to Strengthen the Paid …

SEO Guru Atlanta announced the hiring of a Senior Google Ads Manager to support the continued growth of its paid media division. As demand for integrated SEO and Google Ads strategies increases, the new addition strengthens campaign oversight, conversion optimization, and performance scaling. The move reinforces the agency's commitment to data-driven execution, measurable results, and long-term client success across competitive industries.

Atlanta, GA - February 24, 2026 - SEO Guru Atlanta,…

C MAC PRODUCTIONS Presents Damon Williams Live: "Laugh Until It Hurt!" at Legend …

Bakersfield, CA - C MAC PRODUCTIONS is proud to present an unforgettable night of comedy with legendary stand-up comedian Damon Williams at Legends Lounge & Event Center on Friday, April 10, 2026, from 8:00 PM to 10:00 PM.

With over 30 years in the entertainment industry, Damon Williams is a Chicago-born comedian, actor, writer, and producer known for his sharp wit, commanding stage presence, and ability to connect with audiences of…

Ta Oneira Strengthens Its Boutique English Immersion Programmes for Adults in Go …

Ta Oneira, a boutique English learning project based in Gozo, Malta, continues to develop its small-group English immersion programmes for adults who want to communicate confidently in real-life situations. The programmes focus on engagement, conversation, and personalised learning rather than traditional classroom instruction. Ta Oneira welcomes adult learners and professionals from across Europe seeking a more human, lifestyle-oriented learning experience.

Gozo, Malta - February 24th, 2026 - Ta Oneira, a boutique…

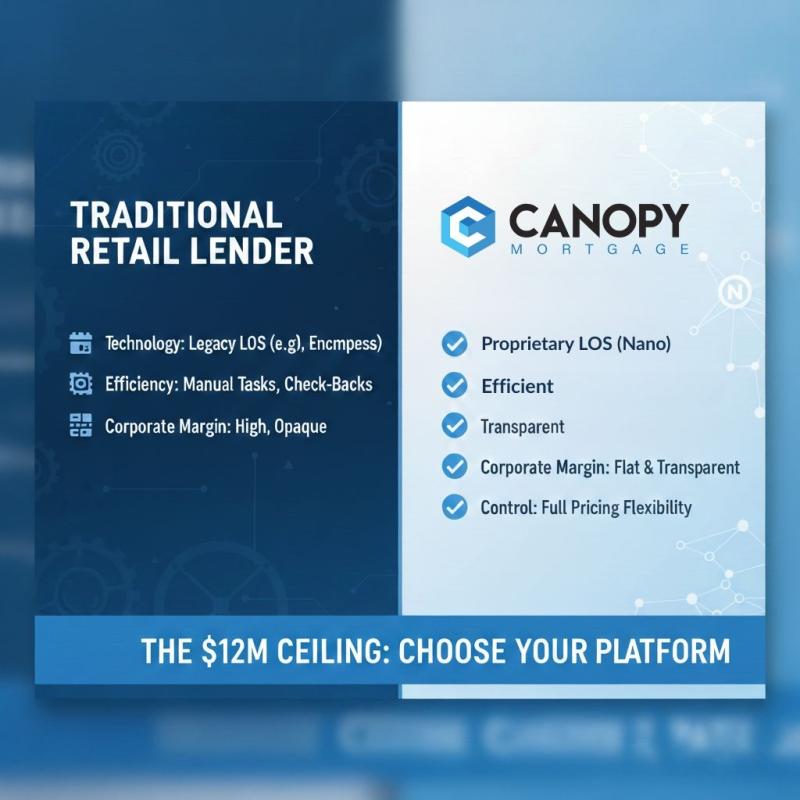

The $12M Ceiling: Why High-Volume Loan Officers are Switching to Canopy Mortgage

For loan officers producing $12M+ annually, traditional retail lending structures often become a bottleneck. It's not just about compensation-it's about the drag of legacy mortgage technology and bloated corporate layers. At Canopy Mortgage, we've replaced the "hidden tax" of retail lending with a proprietary ecosystem designed for the modern producer.

The Hidden Tax of Legacy Retail Lending

Most top producers in traditional environments are paying for inefficiencies they didn't create. These "Legacy…

More Releases for GST

Smart GST Calc Unveils New and Improved Australian GST Calculator

Smart GST Calc Unveils New and Improved Australian GST Calculator

[Karachi, Sindh, 23.11.2024] - Smart GST Calc, a trusted name in simplifying tax calculations for businesses and individuals, is excited to announce the release of the latest version of its Australian GST Calculator. The enhanced tool, available at SmartGSTCalc.com, delivers unparalleled accuracy, speed, and ease of use, making GST calculations simpler than ever before.

With the evolving demands of modern businesses and…

The Impact of GST on Small Businesses

With the motive of 'One Nation, One Taxation', the Government of India introduced the Goods and Service Tax (GST) on 01 July 2017. It was a revolutionary move that transformed India's indirect taxation system by providing a unified approach to taxation for businesses. Since small and medium enterprises (SMEs) contribute to around 50% of industrial production and 45% of total exports, GST has had a mixed impact on these…

GST Loans for MSMEs: Eligibility and Process

MSMEs are big contributors to the Indian economy, they contribute over 45% of the total manufacturing output and 35% of India's GDP. Needless to say, their impact on the Indian economy is very significant and supporting the MSME sector is going to help India's overall development. The Indian Government, especially after the COVID-19 pandemic, initiated various schemes that will help ease the financial burden on these micro, small and medium…

LLP Registration | Trademark Registration | GST Registration

legalsalah.com provides online services for LLP Registration, Income-Tax Filing, Registration for Private Limited Company, GST Registration and others in Short time. Legal Salah is pioneer in providing best legal and lawyer advice since last 5 years.

he company aims for excluding the mediators from between the disadvantaged and the professional and saving the time of former whilst the procedure. The Company came up with the idea of Legal Salah-…

eZee Hospitality Solutions Get GST Ready For India

As the Indian government rolls out the held up GST bill, the hospitality industry buckles up for new regulations and tax reforms, making way towards a better economy.

Earlier this month, India became one of the 160 countries in the world to have implemented Goods and Service Tax bill. Effective from 1st of July, the single indirect tax will subsume almost all the current indirect taxes in India.

With a…

Seminar on “Implementation of GST in Insurance Industry”

The Goods and Services Tax (GST) is a ground-breaking reform for the Indian economy's indirect tax regime. GST will change the tax architecture between the state and the centre.

The Goods and Services Tax(GST) is a value added tax that will replace all the indirect taxes levied on goods and services by the government, both central and states, once it is implemented.

The basic idea of this taxation reform is to create…