Press release

United States Crypto asset management market 2025 | Industry Developments, Future Growth, Share & Industry Insights | Crypto Finance Group, BitGo, Coinbase, FMR LLC, Bakkt, Paxos Trust Company

Crypto asset management market reached US$ 1.74 billion in 2023, with a rise to US$ 1.89 billion in 2024, and is expected to reach US$ 15.87 billion by 2033, growing at a CAGR of 26.67% during the forecast period 2025-2033.DataM Intelligence has published a new research report on "Crypto Asset Management Market Size 2025". The report explores comprehensive and insightful Information about various key factors like Regional Growth, Segmentation, CAGR, Business Revenue Status of Top Key Players and Drivers. The purpose of this report is to provide a telescopic view of the current market size by value and volume, opportunities, and development status.

Get a Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://datamintelligence.com/download-sample/crypto-asset-management-market?sg

Key Players: Gemini Trust Company, LLC, Crypto Finance Group, BitGo, Coinbase, FMR LLC, Bakkt, Paxos Trust Company, LLC, Sygnum, Ledger SAS., Anchorage Digital.

United States - Industry Developments:

✅ Fifth Third Bank Acquires Comerica - On October 6, Fifth Third announced a $10.9 billion all-stock acquisition of Comerica, expanding its footprint in high-growth U.S. markets and enhancing its wealth and asset management capabilities.

✅ S&P Launches Digital Markets 50 Index - On October 9, S&P Dow Jones Indices unveiled the S&P Digital Markets 50, a diversified index combining 15 major cryptocurrencies and 35 crypto-related stocks, accessible via tokenized shares on Dinari's dShares platform.

✅ CoinShares Goes Public via SPAC - On September 7, CoinShares announced a $1.2 billion SPAC merger with Vine Hill Capital, marking its U.S. Nasdaq debut and aiming to expand its digital asset management footprint.

Japan - Industry Developments:

✅ PayPay Acquires 40% Stake in Binance Japan - On October 9, SoftBank's PayPay purchased a 40% stake in Binance Japan, enabling seamless crypto transactions via PayPay Money and signaling a shift toward digital finance in Japan.

✅ SBI Securities and Tokio Marine Launch Digital Private Equity Tokens - On September 26, SBI Securities and Tokio Marine introduced Japan's first digital private equity tokens, allowing retail investors to invest in tokenized private equity with a minimum of ¥1 million.

✅ DFDV and Superteam Japan Launch Solana Treasury Project - On October 9, DFDV and Superteam Japan launched Japan's first Solana Treasury Project, aiming to enhance digital asset adoption and infrastructure in the region.

South Korea - Industry Developments:

✅ Parataxis Korea Launches Bitcoin Fund Management Strategy - On September 16, Parataxis Korea initiated its Bitcoin fund management strategy, marking a significant move in the country's crypto asset management landscape.

✅ Crypto.com Acquires Licenses via Two Acquisitions - On August 10, Crypto.com gained new licenses in South Korea through the acquisitions of payment service provider PnLink and virtual asset service provider OK-BIT, expanding its regulatory presence.

✅ BlockFesta Explores Korea's Digital Asset Future - On September 24, BlockFesta discussed the potential launch of Bitcoin spot ETFs in Korea by late 2025, coinciding with institutional preparations by the Financial Supervisory Service and Korea Exchange.

Europe - Industry Developments:

✅ BlackRock Launches Bitcoin ETP in Europe - On March 25, BlackRock introduced its first Bitcoin exchange-traded product (ETP) in Europe, domiciled in Switzerland and listed in Paris, Amsterdam, and Frankfurt, expanding its crypto offerings in the region.

✅ L&G Intensifies Focus on European ETFs - On October 8, L&G's fund management division announced plans to double down on European ETFs, aiming to expand its presence in the competitive market after experiencing $3.6 billion in outflows in 2024.

✅ AXA Investment Managers and BNP Paribas Asset Management Merger - In early 2025, AXA Investment Managers and BNP Paribas Asset Management agreed to a $5.5 billion merger, consolidating their positions in the European asset management market.

Growth Forecast Projected:

The Global Crypto Asset Management Market is anticipated to rise at a considerable rate during the forecast period, between 2025 and 2032. In 2024, the market is growing at a steady rate, and with the rising adoption of strategies by key players, the market is expected to rise over the projected horizon.

Research Process:

Both primary and secondary data sources have been used in the global Crypto Asset Management Market research report. During the research process, a wide range of industry-affecting factors are examined, including governmental regulations, market conditions, competitive levels, historical data, market situation, technological advancements, upcoming developments, in related businesses, as well as market volatility, prospects, potential barriers, and challenges.

Buy Now & Unlock 360° Market Intelligence: https://www.datamintelligence.com/buy-now-page?report=crypto-asset-management-market?sg

Key Segments:

By Type (Cryptocurrencies, Stablecoins, Tokenized Assets, NFTs, DeFi Assets)

By Solutions (Custodial Solutions, Wallet Management, Portfolio Management, Fund Management)

By Deployment (On-Premises, Cloud-based), By Application (Web-based, Mobile-based)

By End-User (Individual, Retail Investors, Institutional Investors, Enterprises)

By Region (North America, Europe, Asia-Pacific, South America, and the Middle East & Africa)

Regional Analysis for Market:

⇥ North America (U.S., Canada, Mexico)

⇥ Europe (U.K., Italy, Germany, Russia, France, Spain, The Netherlands and Rest of Europe)

⇥ Asia-Pacific (India, Japan, China, South Korea, Australia, Indonesia Rest of Asia Pacific)

⇥ South America (Colombia, Brazil, Argentina, Rest of South America)

⇥ Middle East & Africa (Saudi Arabia, U.A.E., South Africa, Rest of Middle East & Africa)

Benefits of the Report:

Chapter 1: Sets the stage by outlining the report's coverage, summarizing key market segments by region, product type, and application. Presents a snapshot of market sizes, growth potential across segments, and anticipated industry evolution both short and long term.

Chapter 2: Highlights pivotal market insights and uncovers the most significant emerging trends driving change within the industry.

Chapter 3: Offers an in-depth look at the competitive landscape among Crypto Asset Management producers, including revenue shares, strategic moves, and recent mergers and acquisitions.

Chapter 4: Presents comprehensive profiles of the market's key players, delving into details such as revenue, profit margins, product portfolios, and company milestones.

Chapters 5 & 6: Analyze Crypto Asset Management revenue at both regional and country levels, providing quantitative breakdowns of market sizes, growth opportunities, and development prospects worldwide.

Chapter 7: Focuses on different market segments by type, examining their individual sizes and potential, guiding readers toward high-impact, untapped market areas.

Chapter 8: Explores segmentation by application, evaluating industry growth potential in various downstream markets and pinpointing promising sectors for expansion.

Chapter 9: Provides a thorough review of the industry's supply chain mapping out both upstream and downstream activities.

Chapter 10: Concludes with a summary of the report's key findings and highlights the most critical takeaways for industry stakeholders.

Get Customization in the report as per your requirements: https://datamintelligence.com/customize/crypto-asset-management-market?sg

FAQ's

Q1: What is the current size of the Crypto Asset Management Market?

A: The Crypto Asset Management Market stood at US$ 1.89 billion in 2024 and is set to experience remarkable growth, reaching US$ 15.87 billion by 2033

Q2: How fast is the Crypto Asset Management Market growing?

A: The Market is on an impressive growth trajectory, expected to expand at a CAGR of 26.67% from 2025 to 2033

Have any Query? Talk to our Expert @ https://www.datamintelligence.com/enquiry/crypto-asset-management-market?sg

Power your decisions with real-time competitor tracking, strategic forecasts, and global investment insights all in one place.

Have a look at our Subscription Dashboard: https://www.youtube.com/watch?v=x5oEiqEqTWg

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release United States Crypto asset management market 2025 | Industry Developments, Future Growth, Share & Industry Insights | Crypto Finance Group, BitGo, Coinbase, FMR LLC, Bakkt, Paxos Trust Company here

News-ID: 4221103 • Views: …

More Releases from DataM Intelligence 4 Market Research LLP

Japan Data Center Cooling Market (2026-2033) | Top Companies 2026 - Vertiv Group …

Market Size and Growth

Japan's data center cooling market is expected to grow steadily over the coming years, driven by rising data center capacity, cloud adoption, and advanced cooling technology deployment.

Download Free Custom Research: https://www.datamintelligence.com/custom-research?kbdc

• ICT Leadership: Japan hosts major ICT players like Sony, Panasonic, Fujitsu, NEC, and Toshiba, driving the country's digital infrastructure growth.

• Cloud Adoption: PaaS and IaaS see rapid uptake due to low CAPEX and flexible, on-demand usage.

•…

Cardiac Arrhythmia Monitoring Devices Market (2026): North America Holds 38% Mar …

Market Size and Growth

Cardiac Arrhythmia Monitoring Devices market is estimated to grow at a CAGR of 5.65% during the forecast period 2024-2031.

United States: Recent Industry Developments

✅ February 2026: Abbott launched the next-gen continuous cardiac rhythm monitoring device with AI-enabled arrhythmia detection.

✅ January 2026: Medtronic expanded its remote cardiac monitoring services to improve patient follow-up and reduce hospital visits.

✅ December 2025: iRhythm Technologies received FDA clearance for enhanced Zio XT patch…

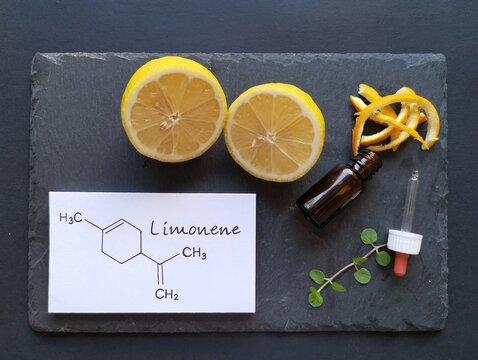

D-Limonene Industry Growth & Market Forecast (2026-2033) for Flavor, Fragrance & …

Market Size and Growth

D-Limonene Market is estimated to reach at a CAGR of 4.4% within the forecast period 2026-2033.

United States: Recent Industry Developments

✅ February 2026: U.S.-based citrus processors expanded D-Limonene extraction capacity to meet rising demand from bio-based solvent manufacturers.

✅ January 2026: Specialty chemical companies introduced high-purity D-Limonene grades for use in eco-friendly cleaning products and industrial degreasers.

✅ December 2025: Growth in natural flavor applications drove new supply agreements between…

Photorejuvenation Devices Market Report (2026) | Growth Analysis, Competitive La …

Market Size and Growth

Photorejuvenation market is growing at a CAGR of 7.2% during the forecast period (2024-2031).

United States: Recent Industry Developments

✅ February 2026: Cutera launched next-generation photorejuvenation systems with enhanced IPL technology for skin revitalization.

✅ January 2026: Cynosure introduced AI-assisted devices for precise photorejuvenation targeting hyperpigmentation and fine lines.

✅ December 2025: FDA approved new photorejuvenation lasers with reduced downtime and improved patient comfort.

Download Free Sample PDF Report (Get Higher Priority…

More Releases for Crypto

Next 100x Crypto Analysis: ZKP Crypto & Mutuum Finance Compete for Best Presale …

The crypto market stands at a turning point. Bitcoin's 21 Week EMA has moved below its 50 Week EMA, a rare bearish signal last seen in April 2022 before a long bear market phase. Bitcoin is trading near $78,800. Additional strain came from inflation data released this morning, which shifted expectations away from a pause in rate policy and toward possible hikes.

Ethereum continues to lag around $2,300 and remains…

Top 10 Crypto Watchlist: Apeing's Upcoming Crypto Presale

Crypto Watchlist: 10 Altcoins Gain Momentum as Apeing's Upcoming Crypto Presale Climbs Search Rankings

The market never announces its turning points. One week feels unstoppable, the next feels empty. Charts still exist, indicators still flash, and opinions still flood timelines. Yet when fear creeps in, action disappears. People wait. They hesitate. They promise themselves clarity will arrive tomorrow.

That pause is where most losses begin. Crypto does not reward comfort. It rewards…

Top 10 Crypto Watchlist: Apeing's Upcoming Crypto Presale

Crypto Watchlist: 10 Altcoins Gain Momentum as Apeing's Upcoming Crypto Presale Climbs Search Rankings

The market never announces its turning points. One week feels unstoppable, the next feels empty. Charts still exist, indicators still flash, and opinions still flood timelines. Yet when fear creeps in, action disappears. People wait. They hesitate. They promise themselves clarity will arrive tomorrow.

That pause is where most losses begin. Crypto does not reward comfort.…

7 Breakthrough Crypto Stars: $APEING Dominates 1000x Crypto

Time is running out for anyone serious about catching the next 1000x crypto rocket. Apeing ($APEING) https://www.apeing.com/ is making waves for early movers, offering whitelist access that could define who wins big and who watches from the sidelines. This isn't a drill. Phase 1 entry is still open, and history has proven that hesitation is the kryptonite of crypto gains. Savvy investors and meme-lovers alike are already strategizing their moves,…

Crypto Asset Management Service Market Next Big Thing | Barracuda, Crypto Financ …

Latest Study on Industrial Growth of Crypto Asset Management Service Market 2023-2028. A detailed study accumulated to offer Latest insights about acute features of the Crypto Asset Management Service market. The report contains different market predictions related to revenue size, production, CAGR, Consumption, gross margin, price, and other substantial factors. While emphasizing the key driving and restraining forces for this market, the report also offers a complete study of the…

Crypto Consulting Services Market Key Players: Crypto Greeks, Crypto Consulting …

The crypto consulting services market refers to the industry that provides advice, guidance, and support to individuals and organizations that are involved in the cryptocurrency and blockchain space. This market has emerged in response to the increasing demand for expertise in this area, as more and more people are becoming interested in cryptocurrencies and blockchain technology.

Download a FREE Sample Report at https://www.reportsnreports.com/contacts/requestsample.aspx?name=6994775

The below companies that are profiled have been…