Press release

India Rubber Crawler Market Trends, Growth, and Forecast 2025-2033

Market Overview:According to IMARC Group's latest research publication, "India Rubber Crawler Market Size, Share, Trends and Forecast by Equipment Type, Material, Demand Category, End Use, and Region, 2025-2033", the India rubber crawler market size reached USD 100.5 Million in 2024. Looking forward, the market is expected to reach USD 176.6 Million by 2033, exhibiting a growth rate (CAGR) of 5.80% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Grab a sample PDF of this report: https://www.imarcgroup.com/india-rubber-crawler-market/requestsample

Our report includes:

● Market Dynamics

● Market Trends and Market Outlook

● Competitive Analysis

● Industry Segmentation

● Strategic Recommendations

Growth Factors in the India Rubber Crawler Market

Agriculture Sector Transformation Driving Rubber Crawler Adoption

India's rubber crawler market is experiencing robust momentum thanks to the agricultural sector's rapid modernization. What makes this growth particularly interesting is how rubber crawlers are solving real problems on Indian farms. Traditional steel tracks damage soil structure and compact the earth, reducing crop yields over time. Rubber crawlers, by contrast, distribute weight more evenly and minimize ground pressure-critical advantages when working on wet paddy fields or delicate topsoil. Farmers are discovering that equipment fitted with rubber crawlers can operate in conditions where conventional machinery would simply sink or get stuck.

The government's Pradhan Mantri Krishi Sinchayee Yojana (PMKSY) and various farm mechanization subsidies have created ideal conditions for this transition. These programs aren't just providing financial support; they're fundamentally changing how Indian agriculture operates. Take the recent allocation of ₹29 crore for rubber research over the next two years-this investment specifically targets developing rubber clones suited to different agro-climatic regions across India. The practical impact is significant: better rubber means more durable crawlers that can handle everything from Kerala's humid conditions to Punjab's intensive farming operations.

What's really driving adoption is the operational advantages farmers are seeing firsthand. Rubber crawlers reduce noise pollution substantially-important in densely populated rural areas where early morning and late evening operations are common. Fuel efficiency improvements translate directly to lower operating costs, something every farmer cares about regardless of farm size. Maintenance requirements drop compared to steel tracks because rubber crawlers don't rust and require less frequent adjustments. From small holdings using compact tractors to large commercial farms deploying heavy harvesters, the benefits scale across the spectrum. The result is steadily growing demand that's transforming how Indian agriculture approaches mechanization.

Construction Boom and Infrastructure Push Creating Massive Equipment Demand

India's construction sector is in the middle of an unprecedented expansion, and rubber crawlers are becoming essential equipment components. The government's Smart Cities Mission and Bharatmala Pariyojana are generating enormous demand for excavators, loaders, and other crawler-equipped machinery. Here's what makes rubber crawlers particularly attractive in these applications: construction sites in urban areas face strict noise regulations, and rubber crawlers operate far more quietly than steel alternatives. When you're working near residential areas or at night to avoid traffic disruption, this becomes a critical selling point.

Urban development projects require equipment that can transition quickly between different surfaces-paved roads, compacted earth, loose gravel-without damaging underlying infrastructure. Rubber crawlers excel at this versatility. Contractors appreciate how they can move equipment on public roads without tearing up asphalt or creating dangerous conditions for other traffic. This mobility advantage reduces transportation costs and project timelines since machines can self-deploy between sites rather than requiring specialized transport.

The excavator segment particularly benefits from rubber crawler technology. These machines spend long hours on job sites, and the vibration reduction that rubber crawlers provide translates to less operator fatigue and more productive work shifts. Equipment rental companies-a rapidly growing segment in India's construction ecosystem-prefer rubber crawlers because they reduce maintenance downtime and extend equipment life. When rental assets spend more time working and less time in the shop, profitability improves dramatically.

Mining operations present another growth avenue. India's mining sector requires durable equipment that can handle punishing terrain while maintaining productivity. Rubber crawlers designed for mining applications incorporate reinforced compounds and advanced tread patterns that provide traction on loose rock and steep inclines. The reduced ground damage is valuable in environmentally sensitive areas where mining permits require minimizing surface disturbance. As mining operations modernize and face stricter environmental oversight, rubber crawlers help companies meet both productivity and compliance objectives.

Defense Modernization and Specialized Vehicle Requirements

The Indian military's equipment modernization programs are creating specialized demand for high-performance rubber crawlers. Military vehicles require track systems that can operate reliably across India's diverse terrain-from Himalayan mountain passes to Thar Desert sand to coastal wetlands. Rubber crawlers designed for defense applications must meet stringent durability standards while providing stealth advantages that steel tracks simply can't match. The noise reduction becomes tactically significant in reconnaissance and special operations scenarios.

Defense procurement processes favor indigenous manufacturing, which has spurred domestic rubber crawler production capabilities. Companies developing military-grade rubber crawlers work with advanced synthetic compounds reinforced with Kevlar and steel cords-materials that provide exceptional tear resistance and load-bearing capacity. These technological developments eventually filter down to commercial applications, raising overall industry standards.

What's particularly noteworthy is how military specifications drive innovation in extreme-condition performance. Rubber crawlers for defense applications must function reliably in temperature ranges from sub-zero mountain conditions to 50°C+ desert heat. They need to resist petroleum products, operate quietly, and maintain integrity under sustained heavy loads. Solving these challenges pushes manufacturers to develop better compounds and manufacturing processes that benefit the entire market.

Key Trends in the India Rubber Crawler Market

Material Innovation Reshaping Product Performance Standards

The rubber crawler industry is undergoing a materials revolution that's changing what's possible in terms of durability and performance. Traditional natural rubber served the market adequately for decades, but modern applications demand more. Manufacturers are increasingly turning to advanced synthetic rubber compounds that offer superior wear resistance and temperature stability. These aren't minor improvements-we're talking about crawlers that last 30-40% longer in abrasive conditions while maintaining consistent performance characteristics throughout their service life.

The real breakthrough comes from reinforcement technology. High-strength Kevlar fibers embedded in rubber provide tear resistance that approaches steel while maintaining flexibility. Steel cord reinforcement in load-bearing areas creates hybrid structures that combine the best properties of both materials. The result is rubber crawlers that can handle equipment weights and operating conditions that would have seemed impossible just a few years ago.

Sustainability considerations are pushing another innovation frontier. Bio-based rubber compounds derived from renewable sources are entering production, responding to environmental concerns without sacrificing performance. Recycled rubber incorporation reduces raw material costs while addressing waste management challenges. Tripura's announcement about establishing a second rubber park in Santirbazar illustrates how regional rubber production capabilities are expanding to support this growing industry. As India's second-largest rubber producer contributing 9% of national output, Tripura's infrastructure investments will strengthen domestic supply chains and potentially reduce import dependence.

Self-lubricating materials represent another significant advancement. Traditional rubber crawlers required regular lubrication of steel reinforcement components and connection points. New self-lubricating designs eliminate this maintenance requirement, reducing operational downtime and extending service intervals. For equipment operating in remote locations or harsh conditions where regular maintenance is challenging, this becomes a compelling advantage. Tread pattern optimization using computer modeling has improved grip characteristics across varied terrain types while extending tread life by distributing wear more evenly.

Aftermarket Segment Growth and the Genuine vs. Duplicate Products Dynamic

The aftermarket for rubber crawlers reveals fascinating market dynamics. This segment splits between genuine replacement parts from original equipment manufacturers and duplicated products from third-party suppliers. Equipment owners face real tradeoffs when choosing between these options. Genuine products typically cost more but offer assured quality, proper fit, and warranty coverage. Duplicated products compete on price but quality varies dramatically-some third-party manufacturers produce excellent alternatives while others cut corners that lead to premature failure.

The aftermarket's growth reflects India's substantial installed base of crawler-equipped machinery. As equipment ages out of initial warranty periods, owners start looking at replacement options. For commercial operators watching bottom lines, the decision often comes down to total cost of ownership calculations. A genuine rubber crawler lasting 2000 operating hours might cost more upfront than a duplicate product lasting 1200 hours, but when you factor in replacement labor, equipment downtime, and potential damage from failed crawlers, the genuine product often proves more economical.

What's interesting is how this dynamic is evolving. Leading aftermarket suppliers are improving quality and building brand recognition based on reliability. Some have established technical partnerships with equipment manufacturers, producing licensed alternatives that meet OEM specifications at competitive prices. This middle ground between premium genuine parts and questionable duplicates is growing rapidly. Equipment rental companies and fleet operators particularly appreciate these quality alternatives since they offer predictable performance at better pricing than OEM parts.

The OEM segment maintains its position by emphasizing performance optimization and warranty protection. Equipment manufacturers increasingly design rubber crawlers as integrated systems where track characteristics affect overall machine performance. OEM crawlers undergo extensive testing to ensure compatibility with specific equipment models, optimizing factors like track tension, rolling resistance, and power transmission efficiency. For high-value equipment or critical applications where downtime costs are substantial, OEM products maintain strong appeal despite premium pricing.

Regional Manufacturing Clusters and Distribution Network Development

India's rubber crawler manufacturing is developing distinct regional characteristics. Traditional rubber production centers in Kerala and Tripura provide raw material advantages for nearby manufacturing operations. The establishment of Tripura's second rubber park specifically aims to boost natural rubber-based industries and attract processing investments. This regional development creates supply chain efficiencies-manufacturers located near rubber production can reduce transportation costs and ensure fresher raw materials with better processing characteristics.

North India has emerged as a manufacturing hub for crawler-equipped construction equipment, creating demand concentration that attracts rubber crawler production. States like Punjab and Haryana, with their intensive agriculture and strong construction sectors, represent major consumption markets. Manufacturers establishing operations in these regions gain proximity to customers and better understanding of local application requirements. The difference between rubber crawlers optimized for Punjab's wheat belt and those designed for Kerala's plantation agriculture might seem subtle, but it matters to end users.

Distribution networks are becoming increasingly sophisticated. Rubber crawlers are precision-manufactured products requiring proper storage and handling. Distributors are investing in temperature-controlled warehousing to prevent rubber degradation and inventory management systems that ensure product freshness. Quick-response logistics are critical since equipment downtime costs money-when a contractor's excavator needs replacement crawlers, waiting a week for delivery isn't acceptable. Distributors offering same-day or next-day delivery within their service areas gain competitive advantages.

The rise of organized retail and e-commerce is changing how replacement crawlers reach end users. Equipment owners can now compare specifications, read reviews, and purchase directly online. This transparency benefits quality manufacturers while making it harder for inferior products to hide behind aggressive sales tactics. However, the technical nature of rubber crawler selection means that expert advice remains valuable. Successful distributors are developing hybrid models combining online convenience with technical support services that help customers choose appropriate products for their specific applications.

Equipment Type Diversification and Specialized Application Development

The rubber crawler market is expanding beyond its traditional excavator base into diverse equipment categories. Skid steer loaders fitted with rubber crawlers gain significant versatility, transitioning easily between job sites while providing excellent maneuverability in confined spaces. These compact machines are increasingly popular in urban construction, landscaping, and small-scale agricultural operations. Rubber crawlers enhance their utility by enabling operation on finished surfaces without damage-critical when working on commercial properties or residential developments.

Multi-terrain loaders represent another growing segment. These specialized machines need to operate across wildly different surfaces-landscaping applications might require moving from soft turf to concrete hardscapes multiple times per hour. Rubber crawlers provide the grip and surface protection these applications demand. Track loaders used in material handling and distribution centers benefit from quiet operation and floor-friendly characteristics that steel tracks can't match.

Military vehicles constitute a specialized but significant equipment category. Beyond the tactical advantages mentioned earlier, military rubber crawlers must meet unique specifications around interoperability, field repairability, and logistics support. The armed forces require standardization across vehicle fleets while maintaining stockpiles of replacement crawlers that remain serviceable over extended storage periods. This creates specific requirements for rubber compounds that resist age-related degradation while maintaining performance characteristics.

Bulldozers and backhoe loaders-traditionally dominated by steel tracks-are increasingly offering rubber crawler options for specific applications. Urban demolition, landscaping construction, and pipeline installation projects benefit from reduced ground pressure and surface protection. The trend toward rubber options across heavy equipment categories reflects growing recognition that track selection should match application requirements rather than defaulting to historical practices. As manufacturers develop higher-capacity rubber crawlers that can handle heavier equipment, this diversification accelerates.

India Rubber Crawler Market Report Segmentation:

Breakup by Equipment Type:

● Excavators

● Skid Steer Loaders

● Military Vehicles

● Bulldozers

● Backhoe Loaders

● Track Loaders

● Multi Terrain Loaders

● Others

Breakup by Material:

● Natural Rubber

● Synthetic Rubber

Breakup by Demand Category:

● Aftermarket

● Duplicated Products

● Genuine Products

● OEM

Breakup by End Use:

● Construction and Mining

● Military

● Agriculture

Regional Insights:

● North India

● South India

● East India

● West India

Research Methodology:

The report employs a comprehensive research methodology, combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

Get Your Customized Market Report Instantly: https://www.imarcgroup.com/request?type=report&id=30699&flag=E

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91-120-433-0800

United States: +1-201-971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release India Rubber Crawler Market Trends, Growth, and Forecast 2025-2033 here

News-ID: 4221066 • Views: …

More Releases from IMARC Group

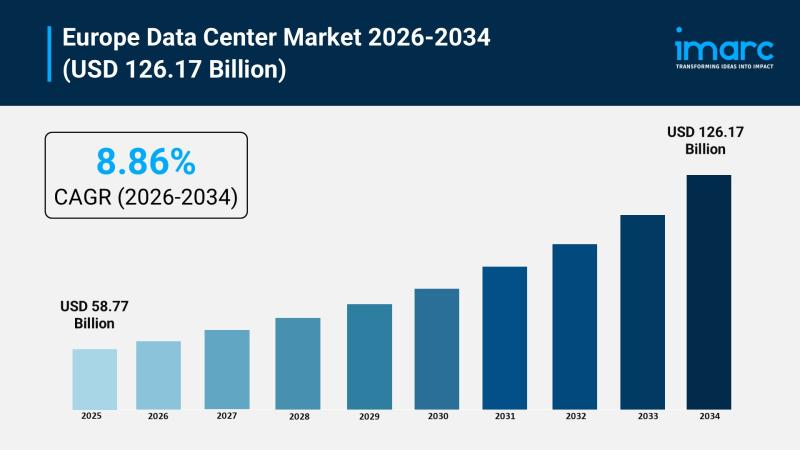

IMARC Group Forecasts 8.86% CAGR for Europe Data Center Market Amidst AI and Clo …

The Europe data center market is experiencing a critical phase of infrastructure evolution, having reached a valuation of USD 58.77 Billion in 2025. Propelled by the accelerating digitalization of the region's economy and sovereign cloud ambitions, the market is projected to reach USD 126.17 Billion by 2034. This growth trajectory represents a solid Compound Annual Growth Rate (CAGR) of 8.86% during the forecast period of 2026-2034.

Key Market Trends &…

Hot Sauce Manufacturing Plant DPR & Unit Setup - 2026: Demand Analysis and Proje …

Setting up a hot sauce manufacturing plant positions investors within one of the fastest-growing and flavor-driven segments of the global condiment industry, fueled by rising consumer appetite for spicy, bold, and ethnic flavors, increasing demand for clean-label and premium condiment products, and expanding utilization of hot sauce across food service, retail, and food processing applications. Made primarily from chili peppers, vinegar, salt, and complementary flavoring ingredients, hot sauce is recognized…

Glyoxylic Acid Prices Q4 2025: US Stable While Europe Remains High Price Trend

The Glyoxylic Acid Price Trend Analysis indicates dynamic shifts in global supply-demand balance, feedstock volatility, and regional trade flows. In 2026, Glyoxylic Acid Prices are reflecting fluctuations in raw material costs and downstream demand from pharmaceuticals, cosmetics, and agrochemicals. Market participants closely track the Glyoxylic Acid price index and forecast data to understand pricing momentum, risk exposure, and procurement strategies across key global regions.

Glyoxylic Acid Current Glyoxylic Acid Price Movements:

Recent…

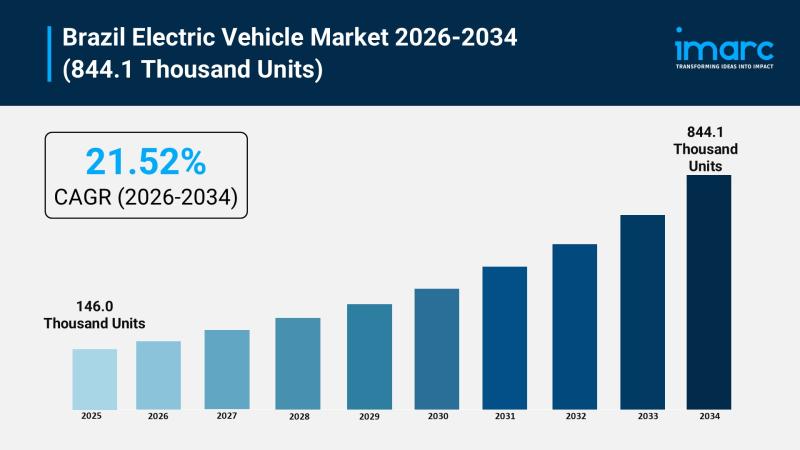

IMARC Group Forecasts 21.52% CAGR for Brazil EV Market as BYD and GWM Ramp Up Lo …

The Brazil electric vehicle (EV) market is currently witnessing an unprecedented surge, having reached a volume of 146.0 Thousand Units in 2025. Fueled by a combination of stringent environmental policies and a strategic shift toward domestic production by global automakers, the market is projected to reach 844.1 Thousand Units by 2034. This rapid expansion represents a robust Compound Annual Growth Rate (CAGR) of 21.52% during the forecast period of 2026-2034.

Key…

More Releases for India

India Smart Air Purifier Market Set to Witness Significant Growth by 2035 | Phil …

India smart air purifier market was valued at $125.8 million in 2024 and is projected to reach $298.7 million by 2035, growing at a CAGR of 8.3% during the forecast period (2025-2035).

India Smart Air Purifier Market Overview

The Indian smart air purifier market is experiencing significant growth, driven by increasing concerns over air pollution and its impact on health. Consumers are increasingly adopting smart air purifiers equipped with advanced features…

Ayurvedic Service Market is Flourishing Like Never Before | Patanjali Ayurved Li …

RnM newly added a research report on the Ayurvedic Service market, which represents a study for the period from 2020 to 2026.

The research study provides a near look at the market scenario and dynamics impacting its growth. This report highlights the crucial developments along with other events happening in the market which are marking on the growth and opening doors for future growth in the coming years. Additionally, the…

Pasta Market Report 2018 Companies included Bambino (India), Nestle (USA), Field …

We have recently published this report and it is available for immediate purchase. For inquiry Email us on: jasonsmith@marketreportscompany.com

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for the year 2018 to 2025, etc. The report also provides detailed segmentation on the…

Interior Designers India, Designers and Architects India, Interior Design Consul …

Synergy Corporate Interiors Pvt. Ltd. are offer Designers and Architects India Our architects, designers are working an national and international client base. The final design output is then integrated with the various technical and engineering aspects and taken into production. The expression is also individualistic, based on the communication of the correct corporate identity. Our designers, engineers and architects perform any plan successfully combine handy knowledge with creative ideas into…

Domain Registration India, Web Hosting India, VPS Hosting India , SSL Certificat …

All the Domain Registration services are at affordable price and assure you for the 100% quality.

India Internet offers cheap domain name registration for many domain extensions available. We are a full-service web site solutions provider. We offer a full range of web services including domain registration India, Web Hosting India, Web design, SEO marketing and etc.

We offer different standard and different Windows .NET low-cost, full-featured, all-inclusive web hosting and domain…

Domain Registration India, Web Hosting India, Payment Gateway India

Indiainternet.in is a Quality Web Hosting Company India, provide all web related support and Web hosting services like linux web hosting, windows web hosting, web hosting packages, domain registration in india, Corporate email solution, business email hosting, payment gateway integration, SSL with supports like free php, cgi, asp, free msaccess, free cdonts, free webmail, web based control panel, unlimited ftp access, unlimited data transfer.

During the domain registration process, you will…