Press release

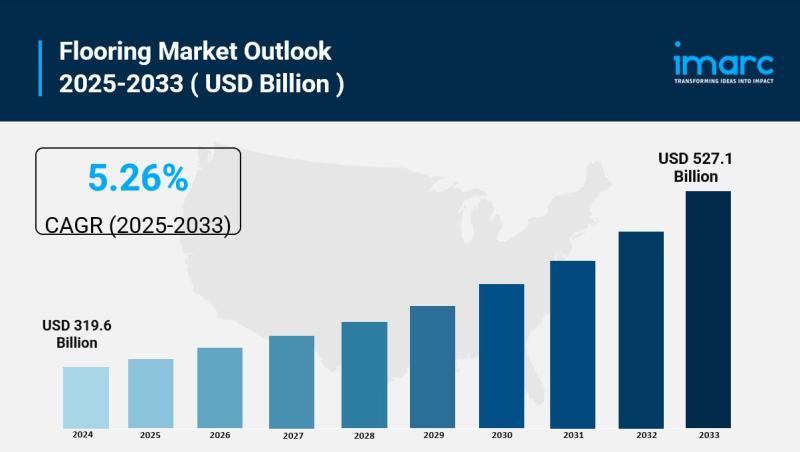

Flooring Market is Expected to Grow USD 527.1 Billion by 2033 | At CAGR 5.26%

Flooring Market Size and Outlook 2025 to 2033:The global flooring market size reached USD 319.6 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 527.1 Billion by 2033, exhibiting a CAGR of 5.26% during 2025-2033. Asia Pacific currently dominates the market, holding a significant market share in 2024. The market is experiencing steady growth driven by increasing construction activities in residential, commercial, and industrial sectors, rising urbanization and population expansion, growing consumer preference for aesthetically pleasing and customizable flooring options, rapid advancements in eco-friendly materials and innovative installation techniques, and escalating awareness and adoption of sustainable and environmentally friendly solutions.

Key Stats for Flooring Market:

• Flooring Market Value (2024): USD 319.6 Billion

• Flooring Market Value (2033): USD 527.1 Billion

• Flooring Market Forecast CAGR: 5.26%

• Leading Segment in Flooring Market in 2024: Non-Resilient (by Type)

• Key Regions in Flooring Market: Asia Pacific, North America, Europe, Latin America, Middle East and Africa

• Top companies in Flooring Market: Armstrong Flooring (Armstrong World Industries), Beaulieu International Group, Citadel Floor Finishing Systems, Ebaco India Pvt. Ltd., Forbo Flooring, Gerflor SAS, Interface Inc., Mannington Mills Inc., Mohawk Industries Inc., Polyflor Ltd (James Halstead PLC), Shaw Industries Group Inc. (Berkshire Hathaway Inc.), Tarkett, etc.

Request Customization: https://www.imarcgroup.com/request?type=report&id=9794&flag=E

Why is the Flooring Market Growing?

The flooring market is thriving as construction activity accelerates worldwide and consumers become increasingly sophisticated about their flooring choices. What's driving this growth isn't just new building-it's a fundamental shift in how people think about the spaces where they live, work, and gather.

Construction activity forms the bedrock of market expansion. Residential, commercial, and industrial sectors are all experiencing robust growth, creating sustained demand for flooring materials across diverse applications. New housing developments, apartment complexes, office buildings, retail spaces, hospitals, schools, and industrial facilities all need floors-and those floors need to deliver on multiple dimensions simultaneously: durability, aesthetics, maintenance ease, safety, and increasingly, sustainability.

Urbanization continues its relentless march forward, particularly in developing economies where cities are expanding at breathtaking pace. As populations concentrate in urban areas, demand for housing and infrastructure intensifies. This isn't just about quantity-urban dwellers tend to have higher expectations for quality, design, and functionality in their living spaces. The flooring market benefits from this trend as urban consumers seek products that balance practical performance with aesthetic appeal.

Consumer preferences have evolved dramatically. Today's homeowners and commercial developers don't view flooring as merely functional-it's a key design element that sets the tone for entire spaces. The rise of open-concept living, where kitchens flow into dining areas and living rooms, has made flooring choices even more critical. When one flooring material spans multiple functional areas, it needs to work aesthetically while meeting the practical demands of each space.

Customization has become not just desirable but expected. Consumers want flooring that reflects their personal style, whether that's the warm authenticity of hardwood, the modern sleekness of polished concrete, the practical durability of luxury vinyl tiles, or the comfort of carpet. Manufacturers have responded with an explosion of options-different colors, textures, patterns, plank sizes, tile formats, and finishes that allow virtually unlimited design possibilities.

Technology advancements are reshaping what's possible in flooring. Eco-friendly materials that once compromised on performance now match or exceed traditional options. Installation techniques have become more efficient and reliable, reducing labor costs and installation times. Coating technologies make floors more resistant to scratches, stains, and moisture. Digital printing allows realistic wood and stone visuals on materials that offer practical advantages over the natural versions.

Sustainability has moved from niche concern to mainstream priority. Consumers, architects, and developers increasingly consider environmental impact when selecting flooring. This encompasses multiple dimensions: the sustainability of raw material sourcing, manufacturing processes that minimize emissions and waste, product durability and lifespan, end-of-life recyclability, and indoor air quality impacts. Flooring manufacturers are responding with innovations like recycled content materials, low-VOC adhesives and finishes, renewable materials like bamboo and cork, and take-back programs for end-of-life products.

The hospitality and tourism industry's expansion creates significant demand for high-quality, durable flooring in hotels, resorts, restaurants, and entertainment venues. These applications require flooring that withstands heavy foot traffic while maintaining visual appeal-often for years between renovations. As global tourism continues growing and hospitality standards rise, demand for premium flooring materials follows.

Renovation and remodeling activity represents a massive market driver that's often underestimated. Almost 75% of U.S. homes were built before 2000, creating an enormous installed base of flooring that's aging and due for replacement. Homeowners undertaking kitchen remodels, bathroom upgrades, or whole-home renovations typically include new flooring as a central component. Commercial properties undergo periodic renovations to refresh appearances, accommodate new tenants, or modernize facilities. This renovation cycle creates steady, predictable demand that cushions the market from new construction fluctuations.

Public spaces-healthcare facilities, schools, airports, government buildings-increasingly prioritize easy-to-maintain, hygienic flooring options. Healthcare facilities require flooring that resists chemicals and moisture, cleans easily, and includes antimicrobial properties to minimize infection risks. Schools need durable options that withstand heavy use while being easy to maintain on limited budgets. These institutional applications have specific requirements that drive demand for specialized flooring products designed to meet exacting standards.

AI Impact on the Flooring Market:

Artificial intelligence is beginning to transform multiple aspects of the flooring industry, from design and manufacturing to installation and customer experience. While adoption is still in relatively early stages compared to some sectors, the applications emerging show real potential to reshape how flooring is produced, sold, and installed.

Design assistance represents one of the most consumer-facing AI applications. Several flooring companies now offer AI-powered visualization tools that allow customers to see how different flooring options would look in their actual spaces. Customers upload photos of their rooms, and AI algorithms accurately render different flooring materials, colors, and patterns in place, accounting for lighting conditions and spatial perspectives. This capability dramatically reduces the uncertainty that often slows purchase decisions and decreases return rates when customers can visualize outcomes before committing.

Some advanced systems go beyond simple visualization to offer AI-driven design recommendations. By analyzing room dimensions, lighting, furniture styles, and stated preferences, AI algorithms can suggest flooring options that will work aesthetically and functionally in specific spaces. These recommendation engines learn from thousands of successful design projects, essentially distilling expert designer knowledge into accessible guidance for average consumers.

Manufacturing optimization is another area where AI is adding substantial value. Flooring production involves numerous variables-material composition, processing temperatures, pressing times, curing conditions, and quality control parameters. AI systems analyze data from production lines to identify optimal parameter combinations that maximize quality while minimizing waste and energy consumption. These optimization systems can detect subtle correlations that human operators might miss, leading to incremental improvements that compound into significant efficiency gains.

Quality control is getting smarter through computer vision systems powered by AI. Traditional quality inspection relies on human workers examining products for defects-scratches, color variations, pattern misalignments, dimensional inconsistencies. AI-powered visual inspection systems can examine every product at much faster speeds while detecting defects that might escape human attention. These systems learn what constitutes acceptable quality and flag products that fall outside specifications, ensuring consistency and reducing defect rates.

Demand forecasting benefits from AI's ability to analyze complex patterns in sales data, construction trends, economic indicators, seasonal variations, and countless other factors. More accurate demand forecasts allow manufacturers to optimize production schedules, maintain appropriate inventory levels, and reduce the costly overproduction or stock-outs that plague industries with long production lead times.

Supply chain optimization uses AI to coordinate the complex logistics of moving raw materials to factories and finished products to distribution centers, retailers, and job sites. AI algorithms can consider transportation costs, warehouse capacities, delivery time requirements, and dynamic factors like weather or traffic to determine optimal routing and scheduling. For an industry where transportation costs represent significant percentages of total product costs, these efficiencies translate directly to profitability.

Installation assistance is an emerging application with significant potential. Some companies are developing AI-powered apps that help installers plan layouts, calculate material requirements, identify potential installation challenges, and optimize cutting patterns to minimize waste. These tools essentially put expert knowledge into the hands of less experienced installers, improving installation quality while reducing material waste and installation times.

Predictive maintenance for commercial flooring is another innovative application. Sensors embedded in flooring or building management systems can monitor foot traffic patterns, wear indicators, and environmental conditions. AI algorithms analyze this data to predict when flooring will need maintenance or replacement, allowing facility managers to plan proactively rather than waiting for obvious deterioration. This predictive approach can extend flooring lifespan and reduce total cost of ownership.

Customer service chatbots and virtual assistants powered by AI are helping flooring retailers and manufacturers handle routine customer inquiries-product recommendations, care instructions, warranty questions, order status-freeing human customer service representatives to handle more complex issues that require expertise and judgment.

Looking ahead, we can expect AI to play growing roles in developing new flooring materials by analyzing how different material compositions perform across various metrics, accelerating the innovation cycle for new products. Personalization will likely increase as AI systems become better at translating individual customer preferences and specific space requirements into targeted product recommendations.

Request Sample Report: https://www.imarcgroup.com/flooring-market/requestsample

Segmental Analysis:

Analysis by Type:

• Resilient

• Non-Resilient

• Others

Non-resilient flooring dominated the market in 2024, encompassing hardwood, laminate, ceramic, porcelain, and stone materials. These flooring options offer natural and aesthetic appeal that makes them perennially popular in residential spaces, hospitality establishments, and upscale commercial environments. Non-resilient flooring is favored for its elegance, timeless beauty, and ability to add significant value to properties.

Hardwood floors remain aspirational for many homeowners, offering warmth, character, and a sense of permanence that few other materials can match. The wood flooring segment has been recouping market share as manufacturers address previous concerns about maintenance and durability through improved finishing technologies and engineered wood products that offer stability in varying humidity conditions.

Laminate flooring has evolved tremendously, with modern products featuring realistic wood and stone visuals through advanced printing technologies. Laminate grew 6.4% in dollars recently, though volume declined slightly, indicating consumers are trading up to higher-quality products with better visuals and more durable wear layers.

Ceramic and porcelain tiles offer exceptional durability, moisture resistance, and design versatility, making them ideal for bathrooms, kitchens, commercial spaces, and outdoor applications. Digital printing technologies allow tiles that authentically replicate natural stone, wood, and other materials while offering practical advantages in maintenance and longevity.

Resilient flooring-including vinyl, linoleum, rubber, and cork-is witnessing significant demand due to durability, flexibility, and ease of maintenance. Highly resistant to stains, scratches, and moisture, resilient flooring suits various applications in both residential and commercial settings. The growing preference for resilient flooring stems from its longevity, cost-effectiveness, and availability of wide-ranging design options. Luxury vinyl tile (LVT) and luxury vinyl plank (LVP) represent the fastest-growing segments within resilient flooring, combining realistic visuals with practical performance that appeals to both residential and commercial buyers.

Analysis by End User:

• Residential

• Non-residential

The residential sector represented the largest market share in 2024, playing a significant role in driving demand for various flooring materials. With increasing focus on home renovations and interior design, homeowners seek options that combine aesthetics, durability, and affordability. The residential segment drives the market through construction of new houses, apartment complexes, and remodeling projects where flooring upgrades are often top priorities.

Demand for flooring in residential spaces is influenced by evolving design trends, lifestyle preferences, and desires for enhanced comfort and visual appeal. Open-concept floor plans have made flooring selection more critical, as single materials often span multiple functional areas. Homeowners increasingly view flooring as an investment in their property's value and their daily quality of life.

The aging housing stock in many developed markets creates ongoing renovation demand. Homeowners updating kitchens, bathrooms, or living areas typically include new flooring as central components of those projects. Additionally, the resale market influences flooring choices-sellers often update flooring before listing properties, knowing that attractive, modern floors can significantly impact buyer perceptions and sale prices.

Non-residential sectors encompass commercial, industrial, and institutional spaces-offices, retail stores, healthcare facilities, hospitality establishments, educational institutions, and public buildings. This segment is fueled by commercial construction activities, infrastructure development, and growing needs for durable and visually appealing flooring in commercial spaces.

Non-residential spaces require flooring that withstands heavy foot traffic, provides safety features, and aligns with specific industry requirements. Office spaces need flooring that promotes productivity and professionalism while managing acoustics. Retail environments require durable, attractive floors that enhance shopping experiences.

Healthcare facilities demand hygienic, easy-to-clean surfaces with antimicrobial properties. Each application has unique requirements that drive demand for specialized products.

Economic growth and evolving workplace designs fuel non-residential demand. As companies invest in attractive office environments to attract and retain talent, flooring plays crucial roles in creating inviting, functional spaces. The growth of experiential retail-where shopping becomes entertainment-drives demand for distinctive flooring that contributes to memorable environments.

Analysis by Region:

• North America

• Asia Pacific

• Europe

• Latin America

• Middle East and Africa

Asia Pacific dominates the global flooring market, driven by the region's robust construction industry and high demand for renovation and remodeling projects. The region benefits from strong economic growth, increasing urbanization, and growing trends toward sustainable and eco-friendly flooring options. Technological advancements and focus on innovative solutions contribute significantly to market expansion throughout Asia Pacific.

China represents the largest single market in the region, with massive ongoing urbanization creating sustained demand for both residential and commercial flooring. India is experiencing rapid growth driven by government infrastructure initiatives and expanding middle-class populations seeking quality housing. Southeast Asian nations like Indonesia, Vietnam, and Thailand are seeing construction booms that drive flooring demand across multiple segments.

The region's manufacturing capabilities position it as both a major consumer and producer of flooring materials. Many global flooring brands operate manufacturing facilities in Asia Pacific to serve local markets while also exporting to other regions. This manufacturing presence drives innovation and competitive pricing that benefits the entire industry.

North America represents a mature but substantial market driven by renovation activity and selective new construction. The United States accounts for the majority of North American demand, with robust renovation spending supported by aging housing stock and strong homeowner equity positions. Commercial construction activity, while cyclical, creates consistent demand for flooring in office, retail, hospitality, and institutional applications.

Canada's market is supported by steady immigration-driven population growth and associated housing demand. Both countries are seeing growing emphasis on sustainable flooring options as environmental awareness increases among consumers and green building certifications become more common in commercial construction.

Europe's flooring market is driven by several interconnected factors. The region has a well-established construction industry and significant demand for flooring materials in both residential and commercial sectors. Europe's emphasis on sustainability and environmental regulations has increased demand for eco-friendly flooring options, with the continent often leading in adoption of recycled content materials and low-emission products.

Changing consumer preferences toward aesthetically appealing and customized flooring solutions further propel European market growth. The presence of renowned manufacturers, technological advancements, and strong collaborations with architects and designers contribute to ongoing market expansion. Historic building renovation-preserving cultural heritage while updating functionality-creates specialized demand for flooring products that respect traditional aesthetics while meeting modern performance requirements.

Latin America's market is expanding with economic development and urbanization. Brazil and Mexico represent the largest markets, with construction activity driven by growing middle-class populations and infrastructure investment. The region is seeing increased adoption of modern flooring materials as consumers become more aware of options beyond traditional ceramic tiles.

The Middle East and Africa market is characterized by ambitious development projects, particularly in the Gulf Cooperation Council (GCC) countries. Large-scale commercial developments, hospitality projects, and infrastructure initiatives drive substantial flooring demand. The region's extreme climates create specific requirements for flooring materials that can withstand high temperatures and sand exposure. In Sub-Saharan Africa, urbanization and emerging middle classes are beginning to drive market growth, though the region remains more price-sensitive than other markets.

What are the Drivers, Restraints, and Key Trends of the Flooring Market?

Market Drivers:

The flooring market benefits from numerous powerful drivers that create sustained momentum across geographies and segments. Construction activity-both new buildings and renovations-provides fundamental demand that underpins the entire industry. As long as populations grow, cities expand, and existing structures age and require updates, flooring demand remains robust.

Economic growth correlates strongly with flooring sales. When economies expand, both residential and commercial construction increase. Homeowners feel confident undertaking renovation projects. Businesses invest in new facilities or upgrade existing ones. This economic sensitivity creates cyclicality but also means flooring markets benefit disproportionately during growth periods.

Demographic trends support long-term growth. Millennials entering peak home-buying years create sustained residential demand. Aging baby boomers downsizing or aging in place often undertake renovations that include new flooring. In developing economies, emerging middle classes aspire to better living standards that include quality flooring in their homes.

Design consciousness continues rising. Media exposure to home design through television shows, social media platforms like Pinterest and Instagram, and online resources has made consumers more aware of design possibilities and more demanding about aesthetics. This awareness drives premiumization as consumers choose higher-quality, better-designed flooring over purely functional options.

Sustainability concerns are creating demand for eco-friendly products while also driving innovation in materials and manufacturing processes. Companies that successfully address environmental concerns while maintaining performance and aesthetics gain competitive advantages.

Market Restraints:

Despite strong fundamentals, the flooring market faces several constraints that moderate growth and create challenges for industry participants. Price sensitivity can limit market growth, particularly in developing regions where consumers have limited budgets. While flooring is necessary, consumers facing budget constraints may delay purchases, choose lower-cost options, or reduce project scopes-all of which impact market value growth.

Installation complexity and costs can deter some consumers from premium products. While the materials themselves may be affordable, professional installation costs can double or triple total project expenses. This installation barrier has driven interest in DIY-friendly flooring options, but also limits adoption of products requiring specialized installation expertise.

Raw material price volatility creates uncertainty and can squeeze manufacturer margins. Flooring production depends on various raw materials-wood, petroleum-based products for vinyl and synthetic carpets, natural stone, resins and adhesives. When raw material costs spike unexpectedly, manufacturers face difficult choices between absorbing costs (reducing profitability) or passing them to customers (potentially reducing demand).

Regulatory compliance requirements vary across markets and can create barriers to entry or increase costs. Environmental regulations, formaldehyde emission standards, fire safety requirements, and product testing mandates all add complexity and cost. While these regulations serve important purposes, they can disadvantage smaller manufacturers lacking resources to navigate complex compliance landscapes.

Competition intensity-both among established manufacturers and from new entrants-can lead to price pressures that challenge profitability. The flooring industry includes numerous competitors at various scales, from global giants to regional specialists to local distributors. This fragmented competitive landscape makes differentiation challenging and limits pricing power.

Market Key Trends:

Several dynamic trends are reshaping the flooring industry and pointing toward future directions. Sustainability is evolving from buzzword to concrete product attribute. Consumers increasingly demand transparent information about environmental impacts, pushing manufacturers to document sustainable practices throughout supply chains. Certifications like FloorScore, Cradle to Cradle, and various green building standards are becoming more important in purchasing decisions.

One notable development came in April 2024 when Tarkett launched the Collective Pursuit collection of non-PVC planks and tile flooring products, highlighting the company's comprehensive commitment to supporting organizations in reaching sustainability goals. This launch demonstrates how major manufacturers are investing in alternatives to traditional materials that raise environmental concerns.

Luxury vinyl tile and plank products continue gaining market share across both residential and commercial applications. These products have reached quality levels where even flooring professionals sometimes struggle to distinguish them from natural wood or stone at casual glance. Improvements in embossing registration (where texture aligns perfectly with printed visuals), longer plank formats, and enhanced wear layers have made LVT/LVP compelling alternatives to traditional materials.

Retail disruption is reshaping how flooring is sold. Floor & Decor has grown its market capitalization from USD 2.77 billion to over USD 10.2 billion in eight years through aggressive store expansion and essentially becoming "the Amazon of flooring" with wide selection, competitive pricing, and customer-friendly policies. This retail innovation pressures traditional distribution channels and forces adaptation.

Smart flooring integration represents an emerging trend with significant potential. Flooring incorporating sensors for energy efficiency, safety monitoring, and comfort enhancement is moving from concept to commercial reality. While still niche, smart flooring applications in high-end commercial buildings and some residential projects point toward broader adoption as technologies mature and costs decline.

Biophilic design principles emphasizing connections to nature are influencing flooring choices. Natural materials like hardwood, bamboo, cork, and natural stone are benefiting from this trend. Even synthetic products increasingly feature nature-inspired visuals and textures that evoke natural materials.

Multifunctional and performance-enhanced flooring is gaining traction. Products that combine multiple benefits-acoustic insulation, underfloor heating compatibility, antimicrobial properties, enhanced durability, moisture resistance-offer value propositions beyond basic aesthetics and durability. These performance enhancements command premium pricing while meeting specific customer needs more comprehensively.

Online sales channels are growing, particularly for DIY-friendly products. While flooring has traditionally been sold through specialty retailers and home improvement centers where customers can see and touch samples, e-commerce is gaining share. Improved product photography, augmented reality visualization tools, generous return policies, and competitive pricing are overcoming historical online shopping barriers.

Leading Players of Flooring Market:

According to IMARC Group's latest analysis, prominent companies shaping the global flooring landscape include:

• Armstrong Flooring (Armstrong World Industries)

• Beaulieu International Group

• Citadel Floor Finishing Systems

• Ebaco India Pvt. Ltd.

• Forbo Flooring

• Gerflor SAS

• Interface Inc.

• Mannington Mills Inc.

• Mohawk Industries Inc.

• Polyflor Ltd (James Halstead PLC)

• Shaw Industries Group Inc. (Berkshire Hathaway Inc.)

• Tarkett

These leading providers are stimulating the market through commitment to innovation, quality, and customer-centric approaches. Companies invest extensively in research and development to introduce new and advanced flooring materials, technologies, and designs that meet evolving consumer needs. They focus on sustainability, offering eco-friendly options that align with growing environmental concerns while maintaining or exceeding performance standards.

These companies prioritize customer satisfaction by providing wide ranges of options, customization capabilities, and reliable installation services. They establish strong partnerships with architects, designers, contractors, and distributors to expand market reach and cater to diverse projects. Strategic collaborations allow these manufacturers to understand market needs deeply and respond with appropriate product innovations.

Effective marketing strategies raise brand awareness and promote flooring solutions to target audiences. By consistently delivering superior products, embracing technological advancements, and nurturing strong customer relationships, these companies remain at the industry forefront and drive overall market growth.

Key Developments in Flooring Market:

• April 2024: Tarkett launched the Collective Pursuit collection of non-PVC planks and tile flooring products, highlighting the company's comprehensive commitment to supporting organizations in reaching sustainability goals. This launch represents a significant milestone in addressing environmental concerns around PVC-based flooring while maintaining the performance characteristics that make resilient flooring popular. The collection demonstrates how major manufacturers are investing in environmentally responsible alternatives.

• 2024: Floor & Decor's aggressive expansion strategy continued demonstrating the retail disruption reshaping the flooring industry. The company's market capitalization growth from USD 2.77 billion to USD 10.2 billion over eight years reflects successful implementation of a model combining wide product selection, competitive pricing, and customer-friendly shopping experiences. This retail innovation creates pressure on traditional flooring distribution channels.

• 2024: Hardwood flooring manufacturers reported favorable full-year sales expectations, with nearly half anticipating sales increases. Reasons cited included broader customer bases and hardwood recouping market share from alternative materials. This trend reflects ongoing consumer appreciation for authentic wood flooring despite competition from increasingly realistic synthetic alternatives.

• 2024: The flooring industry experienced continued evolution in laminate products, with dollar sales growing while volume remained relatively flat, indicating consumers trading up to higher-quality laminates with improved visuals and durability. Average selling prices increased as manufacturers introduced premium features-deeper embossing, better wear resistance, wider planks, and more realistic wood grain patterns.

• Ongoing: Smart flooring solutions incorporating integrated technology for energy efficiency, safety monitoring, and comfort enhancement are moving from concept to commercial implementation. These innovative products can detect motion, monitor environmental conditions, and adjust settings accordingly, contributing to intelligent building systems. Applications include automatic lighting adjustments based on occupancy, temperature control through underfloor heating, and acoustic insulation enhancements.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Ask An Analyst: https://www.imarcgroup.com/request?type=report&id=9794&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Flooring Market is Expected to Grow USD 527.1 Billion by 2033 | At CAGR 5.26% here

News-ID: 4220838 • Views: …

More Releases from IMARC Group

Waste-to-Energy Plant DPR & Unit Setup - 2026: Demand Analysis and Project Cost

Setting up a Waste-to-Energy Plant positions investors in one of the most stable and essential segments of the renewable energy and waste management value chain, backed by sustained global growth driven by rising municipal solid waste generation, sustainable waste management requirements, increasing demand for renewable energy sources, and the dual-benefit advantages of waste reduction with energy production. As urbanization accelerates, waste volumes escalate toward 3.40 billion tons globally by 2050,…

Vegetable Oil Processing Plant DPR & Unit Setup - 2026: Machinery Cost, CapEx/Op …

Setting up a vegetable oil processing plant positions investors in one of the most stable and essential segments of the food and agro-processing value chain, backed by sustained global growth driven by rising population, increasing consumption of edible oils, growth in packaged food demand, and expanding applications across food, personal care, and industrial sectors. As urbanization accelerates, consumer lifestyles shift toward convenience and packaged foods, and regulatory frameworks increasingly support…

Trinitrotoluene Production Plant DPR & Unit Setup 2026: Demand Analysis and Proj …

Setting up a trinitrotoluene production plant involves strategic planning, substantial capital investment, and a comprehensive understanding of production technologies. This critical explosive compound serves military and defense, mining and quarrying, construction and demolition, and industrial explosives manufacturing applications. Success requires careful site selection, efficient nitration processes, stringent safety protocols for handling hazardous materials, reliable raw material sourcing, and compliance with industrial safety regulations to ensure profitable and sustainable operations.

Market Overview…

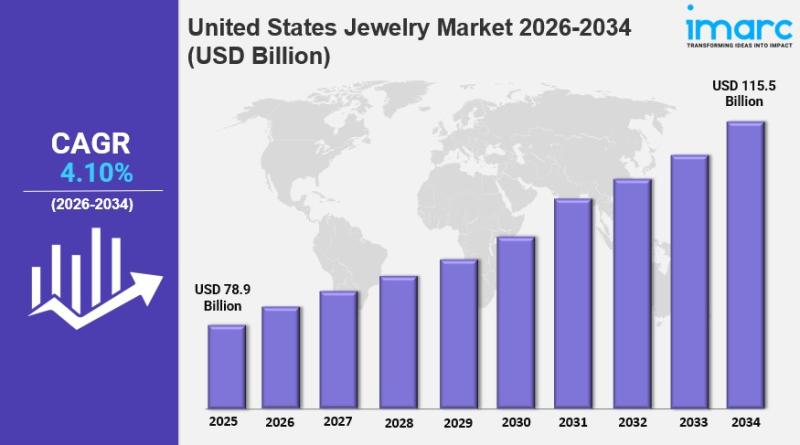

United States Jewelry Market Size, Share, Industry Overview, Growth and Forecast …

IMARC Group has recently released a new research study titled "United States Jewelry Market Report by Product (Necklace, Ring, Earrings, Bracelet, and Others), Material (Gold, Platinum, Diamond, and Others), and Region 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

United States Jewelry Market Overview

The United States jewelry market size reached USD 78.9 Billion in 2025.…

More Releases for Floor

Hardwood Floor Refinishing Company in Columbus Offers Affordable, Eco-Friendly A …

Local company provides professional refinishing, nearly dust-free sanding, and repair services to restore hardwood floors across Columbus area.

Image: https://www.globalnewslines.com/uploads/2025/06/c491681ac4954df89955bc2a763d3f57.jpg

Hardwood floors in homes and businesses across Columbus, Ohio, are getting a second life thanks to Hardwood Floor Refinishing In , a local provider specializing in refinishing, sanding, staining, and repairs. In operation since 1999, the company delivers cost-effective, environmentally safe services that eliminate the need for full floor replacement. With demand…

Discover the Art of Floor Refinishing with Truman Hardwood Floor Cleaning & Refi …

Truman Hardwood Floor Cleaning & Refinishing LLC specializes in this transformative process, ensuring precision and attention to detail. From consultation to completion, their expert team works to bring back the shine and elegance of your hardwood floors, improving both aesthetic appeal and property value.

The Benefits of Professional Floor Refinishing Near Me

For homeowners seeking to revitalize their spaces, floor refinishing is an ideal solution. Over time, hardwood floors can lose their…

Hardwood Floor Refinishing & Hardwood Floor Installation Victoria BC

Van Isle Hardwood Flooring Co. in Victoria, BC, announces the launch of their new website, enhancing customer experience and showcasing expanded services, including certified asbestos removal. The website features a user-friendly design, detailed service descriptions, project galleries, customer testimonials, and easy contact options.

Victoria, BC - 7 Jan, 2025 - Van Isle Hardwood Flooring Co. Launches New Website to Enhance Customer Experience and Showcase Expanded Service Offerings, Including Asbestos Removal.

Van Isle…

Dr. Hardwood Refinishing & Cleaning Expands Floor Refinishing, Wooden Floor Inst …

Image: https://www.getnews.info/wp-content/uploads/2024/10/1728716311.png

Dr. Hardwood refinishing & cleaning logo

Dr. Hardwood Refinishing & Cleaning, a trusted name in hardwood floor care, announces the expansion of its floor refinishing service, wooden floor installation, and wood floor repair Austin offerings in Austin, TX, and surrounding areas. The company specializes in high-quality craftsmanship for residential and commercial clients, providing long-lasting flooring solutions.

As the demand for hardwood flooring continues to rise in Austin, Dr. Hardwood…

Truman's Hardwood Floor Refinishing & Cleaning: Transforming Homes with Stunning …

Refinish hardwood floors, Truman's is synonymous with quality craftsmanship, attention to detail, and transformative outcomes. Whether it's reviving worn-out floorboards or breathing new life into outdated hardwood surfaces, Truman's stands at the forefront of the industry, offering unparalleled expertise and a commitment to excellence.

Truman's Hardwood Floor Refinishing & Cleaning is revolutionizing the way homeowners perceive and experience the rejuvenation of their living spaces. Specializing in the meticulous process to refinish…

Floor Care Service Market Size in 2023 To 2029 | 3B Cleaning & Floor Care Servic …

Floor Care Service market report includes market-driving factors, major obstacles, and restraining factors impeding market growth. The report assists existing manufacturers and start-ups in developing strategies to combat challenges and capitalize on lucrative opportunities to gain a foothold in the global market. Moreover, the report provides thorough information about prime end-users and annual forecast during an estimated period.

𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐅𝐫𝐞𝐞 𝐏𝐃𝐅 𝐒𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 + 𝐃𝐞𝐭𝐚𝐢𝐥𝐞𝐝 𝐓𝐎𝐂 ➡️ https://www.reportsnreports.com/contacts/requestsample.aspx?name=7629982

Descriptive company profiles…