Press release

Australia E-Cigarette Market Projected to Reach USD 790.5 Million by 2033

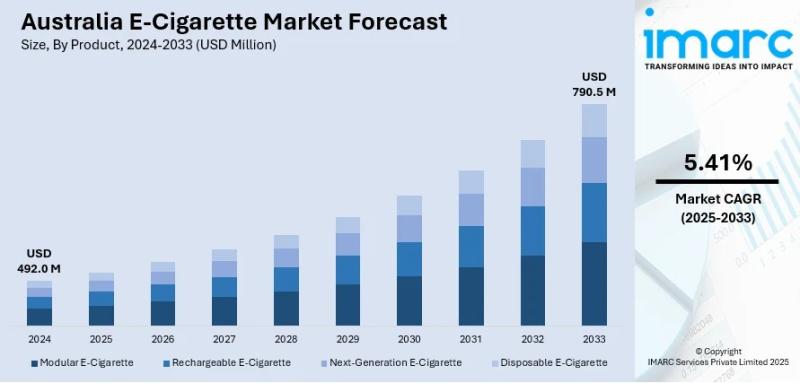

Australia E-Cigarette Market Projected to Reach USD 790.5 Million by 2033The latest report by IMARC Group, titled "Australia E-Cigarette Market Report by Product (Modular E-Cigarette, Rechargeable E-Cigarette, Next-Generation E-Cigarette, Disposable E-Cigarette), Flavor (Tobacco, Botanical, Fruit, Sweet, Beverage, Others), Mode of Operation (Automatic E-Cigarette, Manual E-Cigarette), Distribution Channel (Specialty E-Cig Shops, Online, Supermarkets and Hypermarkets, Tobacconist, Others), and Region 2025-2033," offers a comprehensive analysis of the Australia e-cigarette market growth. The report includes competitor and regional analysis, along with a detailed breakdown of the market segmentation. The Australia e-cigarette market size reached USD 492.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 790.5 Million by 2033, exhibiting a CAGR of 5.41% during 2025-2033.

Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 492.0 Million

Market Forecast in 2033: USD 790.5 Million

Market Growth Rate (2025-2033): 5.41%

Australia E-Cigarette Market Overview

The Australia e-cigarette market is experiencing steady growth driven by rising social media influence promoting vaping culture, increasing government tobacco control initiatives, growing health awareness about smoking cessation alternatives, expanding prescription-based regulatory framework, and strengthening online sales accessibility despite regulatory restrictions. The market expansion is supported by evolving regulatory environments creating compliant retail channels, telehealth provider partnerships facilitating legal access, youth culture adoption influenced by lifestyle branding, and increasing recognition of e-cigarettes as harm reduction tools for adult smokers seeking alternatives. Advanced e-cigarette solutions are transforming Australia's tobacco alternatives landscape through prescription-based medical supervision, pharmacy-exclusive distribution models, strict product standards enforcement, and controlled access frameworks positioning vaping products as therapeutically regulated smoking cessation aids rather than consumer lifestyle products.

Australia's e-cigarette foundation demonstrates complex regulatory fundamentals across diverse applications including smoking cessation support, nicotine dependency management, harm reduction strategies, and adult smoker alternatives. The country's stringent Therapeutic Goods Administration (TGA) regulations requiring medical prescriptions, pharmacy-only sales mandates effective July 2024, federal-state jurisdictional complexities, and commitment to youth access prevention create substantial demand for compliant e-cigarette products capable of meeting therapeutic goods standards while addressing adult smoker needs. The proliferation of telehealth prescription services, licensed pharmacy partnerships, updated product standards effective July 2025, and heightened enforcement against black market products is creating challenging market conditions, requiring significant investments in regulatory compliance, prescription infrastructure, authorized distribution networks, and consumer education initiatives. Australia's distinctive prescription-based model combined with strict import controls and ongoing policy debates makes it a uniquely regulated market for e-cigarette development and controlled harm reduction implementation supporting public health objectives while addressing smoking cessation requirements.

Request For Sample Report:

https://www.imarcgroup.com/australia-e-cigarette-market/requestsample

Australia E-Cigarette Market Trends

• Social media influence expansion: Growing impact of digital platforms with 20.80 million social media users (78.3% of population) exposing audiences to influencer content, viral vaping challenges, aesthetic product videos, and lifestyle branding making vaping appear trendy particularly among youth demographics.

• Prescription model implementation: Increasing adoption of Therapeutic Goods Administration (TGA) mandated prescription requirements for nicotine vaping products creating medically supervised access channels through registered healthcare professionals, approved pharmacies, and telehealth providers.

• Pharmacy-exclusive distribution: Strengthening pharmacy-only sales mandate effective July 2024 restricting all vaping products regardless of nicotine content to pharmacy channels exclusively for smoking cessation and nicotine dependence management purposes.

• Product standards enforcement: Rising compliance requirements with updated TGA standards effective July 2025 governing product specifications, nicotine concentrations (maximum 20mg/mL for non-prescription pharmacy sales from October 2024), import licensing, and therapeutic goods classification.

• Online sales accessibility: Expanding internet marketplace access through overseas websites, international suppliers, and grey market channels despite regulatory barriers creating persistent consumer accessibility particularly among youth seeking flavored products.

• Federal-state regulatory complexity: Growing jurisdictional inconsistencies between federal import controls, TGA therapeutic goods regulations, and state-level enforcement regarding retail sales, public use restrictions, and possession penalties creating compliance challenges.

Market Drivers

• Government tobacco control initiatives: Implementation of comprehensive tobacco taxation increases (5% annually for 3 years through Excise Tariff Amendment Bills 2024), advertising restrictions, public health campaigns, and harm reduction strategies shifting smoker attention toward vaping alternatives.

• Health awareness emphasis: Growing public consciousness about traditional smoking risks driven by government-sponsored campaigns, grassroots movements, smoke-free living trends particularly in Sydney and Melbourne, and increasing health professional recommendations for controlled vaping under medical supervision.

• Prescription framework development: Increasing telehealth provider and pharmacy partnerships creating legal access channels for adult smokers seeking harm reduction alternatives through compliant prescription-based retail models supporting medically supervised cessation attempts.

• Smoking cessation demand: Rising adult smoker interest in quitting tools, step-down alternatives, harm reduction strategies, and nicotine replacement options viewing e-cigarettes as potentially less risky than conventional cigarettes despite ongoing medical community skepticism.

• Youth culture adoption: Expanding appeal among tech-savvy, trend-seeking populations influenced by fashionable product designs, slim minimalist devices, flavored e-liquids, lifestyle branding, and media influence perceiving vaping as smoking substitute and lifestyle statement.

• Online marketplace accessibility: Growing internet-enabled product availability through overseas websites, international shipping, and grey market access providing consumers alternative sourcing despite strict domestic regulatory controls and import restrictions.

Challenges and Opportunities

Challenges:

• Stringent prescription requirements mandating medical consultation for nicotine vaping products creating access barriers, reducing convenience, increasing costs, and limiting availability compared to less regulated markets potentially driving black market demand

• Federal-state regulatory inconsistencies with Queensland and Western Australia enforcing stricter local regulations including non-nicotine e-cigarette retail bans despite federal permissions creating confusion, enforcement variations, and compliance uncertainties

• Black market proliferation with widespread grey market products, unregulated online sourcing, illegal importation, and enforcement resource limitations undermining regulatory objectives, compromising product safety, and enabling youth access despite restrictions

• Youth accessibility concerns driven by social media influence, peer exposure, influencer promotion, flavored product appeal, and lifestyle branding creating public health risks contradicting government prevention objectives and therapeutic positioning

• Compliance cost burdens including import licensing requirements, product standard adherence, prescription infrastructure development, pharmacy partnership establishment, and therapeutic goods registration creating financial barriers particularly for smaller operators

Opportunities:

• Smoking cessation market expansion developing medically supervised vaping programs, telehealth prescription services, pharmacy counseling integration, and evidence-based harm reduction approaches positioning compliant products as legitimate therapeutic aids supporting adult smokers

• Regulatory clarity evolution through ongoing policy reviews, parliamentary inquiries, international model assessments (UK liberal approach, New Zealand retail model), and public health debates potentially creating balanced frameworks improving legal access

• Licensed distribution partnerships establishing authorized pharmacy networks, telehealth provider collaborations, compliant import operations, and therapeutic goods supply chains creating competitive advantages for regulatory-compliant operators navigating complex frameworks

• Product innovation development creating TGA-compliant therapeutic vaping products, standardized nicotine formulations, pharmacy-appropriate formats, and smoking cessation-optimized devices meeting strict quality standards and medical positioning requirements

• Public health positioning leveraging harm reduction research, international cessation evidence, controlled access benefits, and medical supervision advantages differentiating legal compliant products from black market alternatives supporting legitimate therapeutic market segment

Australia E-Cigarette Market Segmentation

By Product:

• Modular E-Cigarette

o Customizable Components

o Refillable Tanks

o Adjustable Settings

o Advanced User Systems

o Variable Power Devices

o Temperature Control

• Rechargeable E-Cigarette

o USB Rechargeable

o Pod Systems

o Pen-Style Devices

o Starter Kits

o All-in-One Systems

o Compact Designs

• Next-Generation E-Cigarette

o Heat-Not-Burn Devices

o Hybrid Systems

o Advanced Technology

o Smart Devices

o App-Connected Vapes

o Premium Products

• Disposable E-Cigarette

o Single-Use Devices

o Pre-Filled Systems

o No Maintenance Required

o Convenience Products

o Variety Flavors

o Entry-Level Options

By Flavor:

• Tobacco

o Classic Tobacco

o Rich Tobacco

o Mild Tobacco

o Blended Tobacco

o Virginia Tobacco

o Turkish Tobacco

• Botanical

o Herbal Blends

o Natural Extracts

o Plant-Based Flavors

o Organic Options

o Earthy Notes

o Green Tea

• Fruit

o Berry Flavors

o Citrus Flavors

o Tropical Fruits

o Apple Varieties

o Mixed Fruit

o Melon Flavors

• Sweet

o Dessert Flavors

o Candy Flavors

o Chocolate Varieties

o Vanilla Blends

o Caramel Options

o Pastry Flavors

• Beverage

o Coffee Flavors

o Tea Varieties

o Soft Drink Flavors

o Energy Drink

o Cocktail Inspired

o Milkshake Flavors

• Others

o Menthol

o Mint Varieties

o Cooling Sensations

o Exotic Blends

o Custom Combinations

o Unflavored

By Mode of Operation:

• Automatic E-Cigarette

o Draw-Activated

o No Button Required

o User-Friendly

o Beginner-Oriented

o Simple Operation

o Sensor-Based

• Manual E-Cigarette

o Button-Activated

o User-Controlled

o Advanced Features

o Experienced User

o Power Adjustment

o Manual Activation

By Distribution Channel:

• Specialty E-Cig Shops

o Dedicated Vape Stores

o Expert Consultation

o Premium Products

o Accessories Available

o Knowledgeable Staff

o Brand Variety

• Online

o E-commerce Platforms

o Brand Websites

o International Suppliers

o Home Delivery

o Grey Market Access

o Overseas Websites

• Supermarkets and Hypermarkets

o Retail Chains

o Convenience Access

o Mainstream Distribution

o Limited Selection

o Regulated Products

o Prescription Required

• Tobacconist

o Traditional Shops

o Tobacco Alternatives

o Smoking Accessories

o Local Retailers

o Established Outlets

o Limited Availability

• Others

o Pharmacy Channels

o Telehealth Services

o Licensed Providers

o Authorized Distributors

o Compliant Channels

o Prescription-Based

By Region:

• Australia Capital Territory & New South Wales

• Victoria & Tasmania

• Queensland

• Northern Territory & Southern Australia

• Western Australia

Browse Full Report:

https://www.imarcgroup.com/australia-e-cigarette-market

Australia E-Cigarette Market News (2024-2025)

• July 2025: New TGA product standards became effective requiring all vaping products in Australia to comply with updated therapeutic goods specifications including specific manufacturing requirements, quality standards, and safety protocols for nicotine concentrations and product formulations.

• March 2025: Updated TGA standards implementation deadline for imported vaping products requiring all imports to meet new regulations, with retailers given until July 2025 to ensure stocked products comply with updated therapeutic goods requirements.

• October 2024: Pharmacy sales expansion allowing adults 18+ to purchase vapes with nicotine concentration of 20mg/mL or less without prescription from participating pharmacies where state laws allow, requiring mandatory pharmacist consultation before purchase.

• July 2024: Major regulatory change implemented restricting all vapes and vaping products regardless of nicotine content to pharmacy-only sales exclusively for smoking cessation and nicotine dependence management purposes nationwide.

• March 2024: Government launched Excise Tariff Amendment (Tobacco) Bills 2024 increasing tobacco taxation by 5% annually for 3 years alongside standard indexation aimed at reducing tobacco usage and promoting smoking cessation.

• March 2024: Strengthened import controls introduced requiring import licenses and permits for all vapes including rechargeable devices, banning disposable vape importation, and implementing specific product requirements for therapeutic vaping products.

Key Highlights of the Report

• Market Performance (2019-2024)

• Market Outlook (2025-2033)

• Industry Catalysts and Challenges

• Segment-wise historical and future forecasts

• Competitive Landscape and Key Player Analysis

• Product, Flavor, Mode of Operation, and Distribution Channel Analysis

Ask analyst for your customized sample:

https://www.imarcgroup.com/request?type=report&id=32042&flag=F

Q&A Section

Q1: What drives growth in the Australia e-cigarette market?

A1: Market growth is driven by government tobacco control initiatives implementing taxation increases, advertising restrictions, and harm reduction strategies shifting smoker attention toward alternatives, health awareness emphasis about traditional smoking risks driven by public campaigns and smoke-free living trends, prescription framework development creating legal access through telehealth providers and pharmacy partnerships, smoking cessation demand from adult smokers seeking harm reduction and nicotine replacement options, youth culture adoption influenced by lifestyle branding and social media exposure, and online marketplace accessibility providing alternative sourcing despite strict domestic regulations.

Q2: What are the latest trends in this market?

A2: Key trends include social media influence expansion with 20.80 million users exposed to influencer content and lifestyle branding, prescription model implementation mandating medical supervision through TGA regulations, pharmacy-exclusive distribution restricting all vaping products to pharmacy channels from July 2024, product standards enforcement with updated TGA requirements effective July 2025, online sales accessibility through overseas websites despite regulatory barriers, and federal-state regulatory complexity creating jurisdictional inconsistencies and enforcement variations.

Q3: What challenges do companies face?

A3: Major challenges include stringent prescription requirements creating access barriers and potentially driving black market demand, federal-state regulatory inconsistencies with varying local enforcement creating compliance uncertainties, black market proliferation undermining regulatory objectives through grey market products and illegal importation, youth accessibility concerns driven by social media influence contradicting prevention objectives, and compliance cost burdens including import licensing, product standards adherence, and therapeutic goods registration creating financial barriers.

Q4: What opportunities are emerging?

A4: Emerging opportunities include smoking cessation market expansion developing medically supervised programs and pharmacy counseling integration, regulatory clarity evolution through ongoing policy reviews and international model assessments potentially improving legal access, licensed distribution partnerships establishing authorized pharmacy networks and compliant supply chains, product innovation development creating TGA-compliant therapeutic devices meeting strict quality standards, and public health positioning leveraging harm reduction research differentiating legal products from black market alternatives.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91-120-433-0800

United States: +1-201-971-6302

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses. IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Australia E-Cigarette Market Projected to Reach USD 790.5 Million by 2033 here

News-ID: 4219883 • Views: …

More Releases from IMARC Group

Helium Production Plant DPR & Unit Setup Cost- 2026: Machinery Requirements, Cap …

Setting up a Helium Production Plant positions investors in one of the most stable and essential segments of the industrial gas and strategic materials value chain, backed by sustained global growth driven by increasing demand from medical imaging, semiconductor manufacturing expansion, advanced scientific research applications, and the ultra-high purity, reliability, irreplaceable advantages of helium across critical technology sectors. As healthcare infrastructure accelerates, semiconductor fabrication intensifies, and space exploration initiatives expand…

Setting Up a Green Hydrogen Plant in India 2026- Complete Cost Model with CapEx, …

What Does It Cost to Set Up a Green Hydrogen Production Plant in India?

Setting up a 300-ton-per-year green hydrogen plant in India requires a carefully mapped investment across CapEx, OpEx, and long-term profitability. Raw material costs - primarily electricity - run between 60 to 70 percent of operating expenditure. Gross margins project between 25 and 30 percent. And capital investment spans electrolyzer procurement, renewable energy infrastructure, utilities, and compliance -…

Pharmaceutical Formulation Manufacturing Plant DPR & Unit Setup - 2026: Business …

Setting up a pharmaceutical formulation manufacturing plant positions investors in one of the most stable and essential segments of the global healthcare value chain, backed by sustained global growth driven by growing prevalence of chronic diseases, pharmaceutical industry expansion, rising demand for patient-centric dosage forms, and the safety, efficacy, stability advantages of finished medicinal products. As global healthcare spending accelerates, chronic and lifestyle diseases increase, and regulatory frameworks increasingly mandate…

Triple Superphosphate (TSP) Manufacturing Plant DPR & Unit Setup 2026: Demand An …

Setting up a triple superphosphate (TSP) manufacturing plant involves strategic planning, substantial capital investment, and a comprehensive understanding of production technologies. This essential high-analysis phosphate fertilizer serves field crop agriculture, horticulture, fertilizer blending, and soil nutrient management programs. Success requires careful site selection, efficient phosphate rock processing, stringent safety protocols, reliable raw material sourcing, and compliance with environmental regulations to ensure profitable and sustainable operations.

Market Overview and Growth Potential:

The global…

More Releases for Australia

Derila Memory foam pillow Australia: Honest Reviews About Derila Australia

Derila is one of the best memory foam pillows sold in Australia today.

Priced at around 30 dollars (USD), derila is currently the most reviewed and the cheapest memory pillow available in Australia.

What is Derila? Is Derila Pillow the best in Australia? Keep reading to discover everything worth knowing about Derila Australia.

OVERVIEW

Recently, Memory foam pillow has been trending and there is a lot of brands to choose from. Which one is…

CeraCare Australia - Where to Buy Legit CeraCare Supplement in Australia?

CeraCare Australia - Ceracare is a glucose support supplement that proposes to augment cardiovascular prosperity and to stay aware of perfect glucose assimilation in Australia. CeraCare supplement is conceptualized and executed by a threesome – Christine, Dr. Jihn and Michael. It is a natural supplement that helps one stay aware of ideal glucose levels, cardiovascular prosperity, and glucose assimilation.

Take Advantage of 80% Discount Offer in Australia >> https://boostsxproaustralia.com/ceracare-new

The indications…

Glucofort Australia - Where to Buy Legit Glucofort Supplement in Australia?

Glucofort Australia - Glucofort is an efficient, all-natural progressive glucose support supplement in Australia. This formula is made out of 12 key ingredients, 7 nutrients, and minerals, and a little of Vanadium. This supplement upholds regulated glucose levels and glucose digestion. Glucofort prides itself as the most inventive supplements available in Oceania, accentuating its solidarity, wellbeing, and quality.

Take Advantage of 75% Discount Offer in Australia >> https://boostsxproaustralia.com/glucofort-new

Rather than simply…

Australia Agriculture Market, Australia Agriculture Industry, Australia Agricult …

Australia Agriculture has been as vital within the development of Australia, because it was within the United States. Australia's ancient dominance in wheat and sheep continues into the 21st century. Recently Australian agriculture has become more and more diversified. The considerable expanses of productive land have helped Australia to become a number one world exporter of grains, meats, and wool. Each grains (predominantly wheat and barley) and wool markets round…

Australia Conveyor Maintenance Analysis by Top Companies Habasit Australia Pty l …

Global Australia Conveyor Maintenance Market and Competitive Analysis

Know your current market situation! Not only a vital element for brand new products but also for current products given the ever-changing market dynamics. The study allows marketers to remain involved with current consumer trends and segments where they'll face a rapid market share drop. Discover who you actually compete against within the marketplace, with Market Share Analysis know market position, to push…

Australia Conveyor Maintenance Market Analysis By Manufacturers Rema Tip Top Aus …

A conveyor system is a common piece of mechanical handling device that moves materials/objects from one location. A conveyor is often lifeline to a company’s ability to effectively move its products in a timely manner. While it is used constantly in a manufacturing plant, proper maintenance from trained technicians can extend the lifespan of conveyor. Furthermore, conveyor maintenance is essential as it may be subjected to different types of failures…