Press release

Australia Payments Market Projected to Reach USD 1,341.7 Billion by 2033

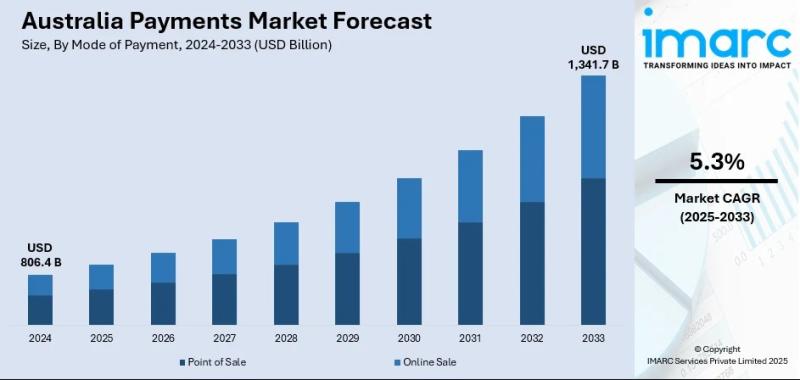

The latest report by IMARC Group, titled "Australia Payments Market Report by Mode of Payment (Point of Sale (Card Payments, Digital Wallet, Cash, Others), Online Sale (Card Payments, Digital Wallet, Others)), End Use Industry (Retail, Entertainment, Healthcare, Hospitality, Others), and Region 2025-2033," offers a comprehensive analysis of the Australia payments market growth. The report includes competitor and regional analysis, along with a detailed breakdown of the market segmentation. The Australia payments market size reached USD 806.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1,341.7 Billion by 2033, exhibiting a CAGR of 5.3% during 2025-2033.Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 806.4 Billion

Market Forecast in 2033: USD 1,341.7 Billion

Market Growth Rate (2025-2033): 5.3%

Australia Payments Market Overview

The Australia payments market is experiencing robust growth driven by widespread digital payment adoption, surging mobile wallet usage, emerging buy-now-pay-later (BNPL) solutions, advancing secure transaction technologies, growing contactless payment prominence, and strengthening regulatory support facilitating innovation and competition. The market expansion is supported by technological advancements in biometric authentication, tokenization security, artificial intelligence fraud detection, and increasing consumer preference for quick, efficient, seamless payment experiences across retail, e-commerce, entertainment, healthcare, and hospitality sectors. Advanced payment solutions are transforming Australia's financial landscape through real-time payment infrastructure via New Payments Platform (NPP), Open Banking frameworks under Consumer Data Right (CDR), fintech innovation ecosystems, and comprehensive digital banking capabilities positioning the country as regional leader in cashless economy adoption and payment technology sophistication.

Australia's payments foundation demonstrates strong digital fundamentals across diverse applications including point-of-sale transactions, online purchases, peer-to-peer transfers, bill payments, cross-border remittances, and merchant settlements. The country's high smartphone penetration, sophisticated banking infrastructure, tech-savvy consumer population, and commitment to financial innovation create substantial demand for payment solutions capable of delivering speed, security, convenience, and seamless omnichannel experiences. The proliferation of mobile wallet adoption with 520 million monthly transactions valued at $24.3 billion (February 2025), dramatic cash usage decline to 13% of transactions, digital banking dominance with 98.9% of interactions conducted digitally, and expanding e-commerce sector is creating favorable market conditions, requiring significant investments in payment infrastructure, cybersecurity systems, regulatory compliance, and inclusive financial service delivery. Australia's progressive regulatory environment combined with robust real-time payment capabilities and growing fintech ecosystem makes it an increasingly important market for innovative payment solution development and comprehensive digital financial services supporting economic efficiency and consumer convenience.

Request For Sample Report:

https://www.imarcgroup.com/australia-payments-market/requestsample

Australia Payments Market Trends

• Mobile wallet dominance: Growing adoption reaching 520 million monthly transactions totaling $24.3 billion (February 2025) with projections potentially surpassing retail card payments by 2032 driven by convenience, security, and seamless integration with digital banking platforms.

• Cash usage decline: Dramatic reduction in cash transactions accounting for only 13% of consumer payments in 2022 (down from 69% in 2007) with ATM withdrawals decreasing 8.9% year-over-year and ATM numbers declining from 14,000 (2017) to 5,700 (mid-2023).

• Real-time payment infrastructure: Expanding New Payments Platform (NPP) enabling instant 24/7 transfers between banks with PayID functionality simplifying payments through phone numbers and email addresses eliminating traditional account number requirements.

• Buy-now-pay-later growth: Increasing consumer adoption of BNPL services offering flexible payment installments, interest-free periods, and seamless checkout integration particularly popular among younger demographics and e-commerce purchases.

• Biometric authentication advancement: Rising implementation of fingerprint scanning, facial recognition, and secure physical verification methods replacing traditional passwords enhancing security while maintaining user convenience across payment platforms.

• Open Banking transformation: Strengthening Consumer Data Right (CDR) framework enabling secure financial data sharing with accredited providers fostering competition, personalization, and consumer-centric payment solution innovation.

Market Drivers

• Digital payment adoption surge: Implementation of comprehensive digital payment solutions with 98.9% of consumer banking interactions conducted digitally (June 2023), over 500 million mobile wallet transactions monthly valued at USD 20+ billion demonstrating consumer preference for convenience and speed.

• E-commerce expansion: Growing online retail sector requiring seamless payment integration, secure checkout experiences, omnichannel consistency, and diverse payment method support driving payment service provider innovation and infrastructure investment.

• Payment technology advancement: Increasing deployment of biometric authentication, tokenization security, artificial intelligence fraud detection, and machine learning analytics improving transaction security, reducing fraud risks, and enhancing consumer confidence in digital payments.

• Fintech ecosystem growth: Expanding startup innovation and challenger banks disrupting traditional banking with mobile-first approaches, simplified onboarding, transparent fee structures, personalized services, and user-friendly interfaces appealing to modern consumers.

• Government infrastructure support: Growing Reserve Bank of Australia and government backing for New Payments Platform (NPP), Open Banking implementation, real-time payment infrastructure, and regulatory frameworks encouraging competition and innovation.

• Cross-border transaction demand: Increasing Asia-Pacific trade relationships and global economic integration driving requirements for efficient international payment solutions offering transparency, real-time processing, competitive exchange rates, and low transaction fees.

Challenges and Opportunities

Challenges:

• Cybersecurity threats involving sophisticated fraud attempts, data breaches, phishing attacks, and financial crime requiring continuous investment in security infrastructure, AI-powered monitoring, real-time threat detection, and consumer education programs

• Financial inclusion barriers for rural communities, elderly populations, small businesses, and digitally underserved segments facing limited internet access, digital literacy gaps, and exclusion from mainstream financial services

• Cash service economics with banks experiencing significant financial losses (Commonwealth Bank: USD 410M spent vs USD 60M earned) creating tension between commercial viability and social obligation to maintain cash access

• Infrastructure reliability dependencies requiring consistent connectivity, system uptime, backup capabilities, and disaster recovery planning to ensure seamless payment processing during network disruptions or technical failures

• Regulatory compliance complexity navigating evolving requirements, Open Banking standards, consumer data protection obligations, and cross-jurisdictional regulations creating operational costs and implementation challenges

Opportunities:

• Value-added service integration developing loyalty programs, personalized rewards, purchase insights, spending analytics, and merchant data tools enhancing customer experience, improving retention, and creating competitive differentiation.

• Underserved market expansion targeting rural communities, small businesses, elderly consumers, and excluded populations through user-friendly platforms, offline payment solutions, simplified onboarding, and inclusive digital experiences.

• Cross-border payment innovation creating specialized international transfer solutions offering instant processing, competitive rates, transparent pricing, and multi-currency support particularly for SMEs and global e-commerce operators.

• Open Banking commercialization leveraging Consumer Data Right framework enabling third-party providers to offer personalized payment solutions, comparison services, and innovative financial products driving consumer choice and market efficiency.

• Real-time payment enhancement expanding New Payments Platform capabilities, introducing new use cases, integrating additional services, and improving infrastructure resilience supporting economic productivity and transaction convenience.

Australia Payments Market Segmentation

By Mode of Payment:

• Point of Sale

o Card Payments

Credit Cards

Debit Cards

Contactless Cards

Chip and PIN

Magnetic Stripe

Premium Cards

o Digital Wallet

Apple Pay

Google Pay

Samsung Pay

Bank Wallets

Merchant Apps

Peer-to-Peer Apps

o Cash

Notes

Coins

ATM Withdrawals

Cash Back

o Others

BNPL Solutions

Gift Cards

Vouchers

Checks

• Online Sale

o Card Payments

Credit Card Online

Debit Card Online

Virtual Cards

Stored Card Details

3D Secure

Tokenized Payments

o Digital Wallet

PayPal

Apple Pay Online

Google Pay Online

Digital Banking

Cryptocurrency

Direct Transfers

o Others

Bank Transfers

BPAY

Buy Now Pay Later

Cryptocurrencies

Direct Debit

Invoice Payments

By End Use Industry:

• Retail

o Supermarkets

o Fashion and Apparel

o Electronics

o Home and Garden

o Department Stores

o Specialty Retail

• Entertainment

o Cinemas and Theaters

o Streaming Services

o Event Ticketing

o Sports and Recreation

o Amusement Parks

• Healthcare

o Hospitals

o Medical Clinics

o Pharmacies

o Dental Services

o Allied Health

o Health Insurance

• Hospitality

o Hotels and Accommodation

o Restaurants and Cafes

o Bars and Pubs

o Catering Services

o Tourism Services

o Travel Agencies

• Others

o Transportation

o Education

o Government Services

o Utilities

o Professional Services

o Telecommunications

By Region:

• Australia Capital Territory & New South Wales

• Victoria & Tasmania

• Queensland

• Northern Territory & Southern Australia

• Western Australia

Browse Full Report:

https://www.imarcgroup.com/australia-payments-market

Australia Payments Market News (2024-2025)

• July 2025: Australian Digital Banking Report 2025 revealed mobile wallet payments reached $160 billion annually demonstrating continued surge in digital payment adoption with mobile wallet usage closing in on physical card usage.

• February 2025: Reserve Bank of Australia data showed Australians made 520 million mobile wallet transactions in single month totaling $24.3 billion, with retailers responding rapidly to consumer preference shift toward digital payment methods.

• January 2025: Industry analysis projected mobile wallets could potentially surpass retail card payments by 2032 if current adoption trends continue, indicating transformational shift in payment behavior and consumer preferences.

• December 2024: Reserve Bank data revealed over half billion mobile wallet payments made in single month, emphasizing critical need for digital payment oversight and consumer protection laws comparable to traditional payment systems.

• June 2023: Australian Banking Association reported 98.9% of consumer banking interactions conducted through digital channels including mobile banking apps and online websites demonstrating comprehensive digital adoption across financial services.

• 2024: Commonwealth Bank reported spending USD 410 million on cash services during financial year while earning only USD 60 million from such services, representing net outlay of USD 350 million reflecting declining commercial viability of cash infrastructure.

Key Highlights of the Report

• Market Performance (2019-2024)

• Market Outlook (2025-2033)

• Industry Catalysts and Challenges

• Segment-wise historical and future forecasts

• Competitive Landscape and Key Player Analysis

• Mode of Payment and End Use Industry Analysis

Ask analyst for your customized sample:

https://www.imarcgroup.com/request?type=report&id=32712&flag=F

Q&A Section

Q1: What drives growth in the Australia payments market?

A1: Market growth is driven by digital payment adoption surge with 98.9% of banking interactions conducted digitally and 520 million monthly mobile wallet transactions, e-commerce expansion requiring seamless payment integration across omnichannel experiences, payment technology advancement deploying biometric authentication and AI fraud detection improving security, fintech ecosystem growth disrupting traditional banking with mobile-first user-friendly solutions, government infrastructure support backing New Payments Platform and Open Banking implementation, and cross-border transaction demand driven by Asia-Pacific trade relationships requiring efficient international payment solutions.

Q2: What are the latest trends in this market?

A2: Key trends include mobile wallet dominance reaching 520 million monthly transactions ($24.3B) potentially surpassing card payments by 2032, cash usage decline to 13% of transactions with ATM numbers dropping from 14,000 to 5,700, real-time payment infrastructure through New Payments Platform enabling instant 24/7 transfers, buy-now-pay-later growth offering flexible installments popular among younger demographics, biometric authentication advancement replacing traditional passwords enhancing security, and Open Banking transformation through Consumer Data Right framework fostering innovation.

Q3: What challenges do companies face?

A3: Major challenges include cybersecurity threats requiring continuous investment in security infrastructure and fraud prevention, financial inclusion barriers for rural communities and digitally underserved segments, cash service economics with banks experiencing significant losses maintaining infrastructure, infrastructure reliability dependencies requiring consistent connectivity and disaster recovery planning, and regulatory compliance complexity navigating evolving requirements and consumer data protection obligations.

Q4: What opportunities are emerging?

A4: Emerging opportunities include value-added service integration developing loyalty programs and spending analytics enhancing customer experience, underserved market expansion targeting rural communities through simplified platforms, cross-border payment innovation creating instant international transfer solutions for SMEs and e-commerce, Open Banking commercialization leveraging Consumer Data Right for personalized solutions, and real-time payment enhancement expanding New Payments Platform capabilities supporting economic productivity.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91-120-433-0800

United States: +1-201-971-6302

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses. IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Australia Payments Market Projected to Reach USD 1,341.7 Billion by 2033 here

News-ID: 4219852 • Views: …

More Releases from IMARC Group

India Digital Health Market is Expected to Reach USD 84,076.5 Million by 2034 | …

Introduction

According to IMARC Group's report titled "India Digital Health Market Size, Share, Trends and Forecast by Type, Component, and Region, 2026-2034" the report offers a comprehensive analysis of the industry, including India digital health market share, growth, trends, and regional insights.

How Big is the India Digital Health Market?

The India digital health market size reached USD 19,145.3 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 84,076.5…

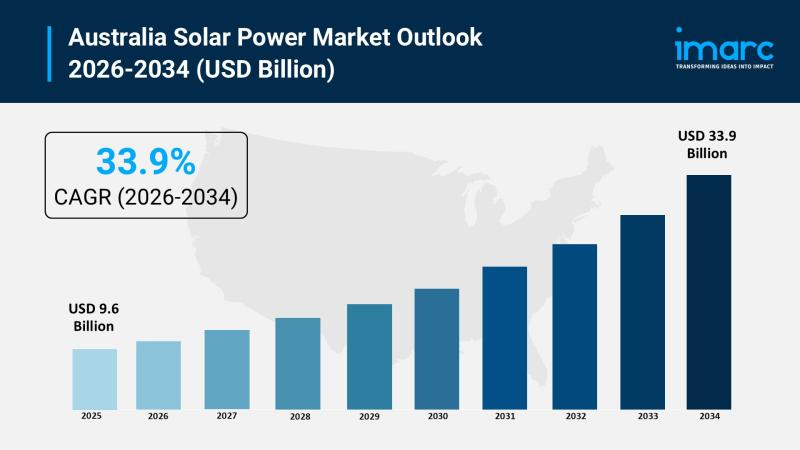

Australia Solar Power Market 2026 | Projected to Reach USD 33.9 Billion by 2034

Market Overview

The Australia solar power market reached USD 9.6 Billion in 2025 and is forecast to grow to USD 33.9 Billion by 2034. The market exhibits a robust growth rate of 15.00% during the forecast period 2026-2034. This expansion is driven by supportive government policies, technological advancements, and increasing adoption across residential, commercial, and utility sectors, positioning solar energy as a cornerstone of Australia's clean energy future.

Grab a sample PDF…

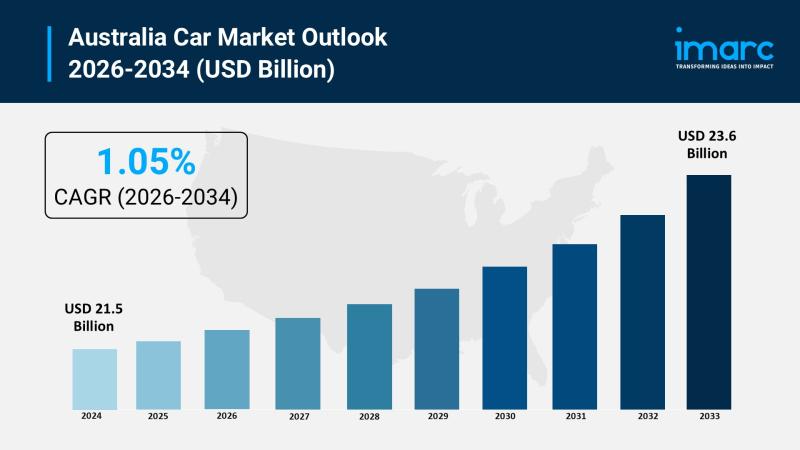

Australia Car Market 2026 | Surge to Grow to USD 23.6 Billion by 2034

Market Overview

The Australia car market reached a size of USD 21.5 Billion in 2025 and is forecasted to grow to USD 23.6 Billion by 2034. The market is expected to expand at a CAGR of 1.05% throughout the forecast period from 2026 to 2034. Growth is driven primarily by increasing demand for electric vehicles, SUVs, and connected car technologies, spurred by environmental awareness, lifestyle changes, and technological innovation toward sustainable…

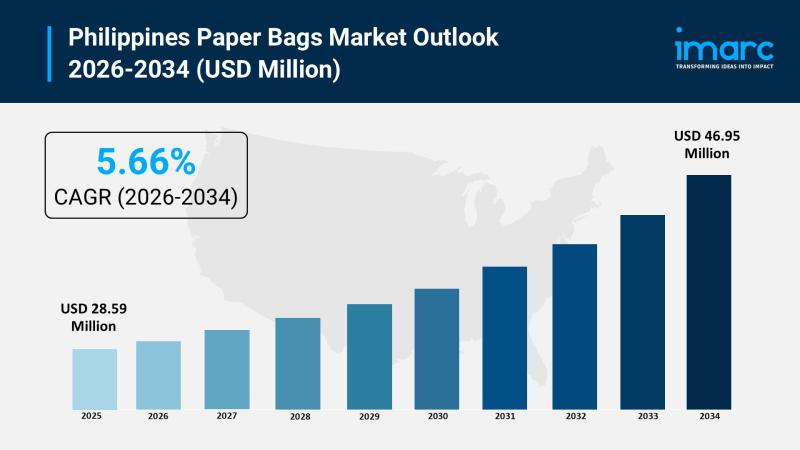

Philippines Paper Bags Market 2026 | Expected to Reach USD 46.95 Million by 2034

Market Overview

The Philippines paper bags market size was valued at USD 28.59 Million in 2025 and is expected to reach USD 46.95 Million by 2034, with a growth rate of 5.66% CAGR from 2026 to 2034. This growth is driven by increasing environmental concerns, government bans on single-use plastics, and rising adoption by retailers and foodservice providers. The expanding food and beverage sector, coupled with heightened awareness of plastic pollution,…

More Releases for Pay

Digital Wallets Market to See Thriving Worldwide | PayPal • Apple Pay • Goog …

The latest study by Coherent Market Insights, titled "Digital Wallets Market Size, Share & Trends Forecast 2026-2033," offers an in-depth analysis of the global and regional dynamics shaping this rapidly evolving industry. This comprehensive report highlights the competitive landscape, key market segments, value chain analysis, and emerging technological and regulatory trends expected between 2026 and 2033. The report provides actionable insights for business leaders, policymakers, investors, and new market entrants…

Mobile Payment Market to See Thriving Worldwide| Apple Pay • Google Pay • Sa …

Latest Report, titled Mobile Payment Market 2025-2032 Trends, Share, Size, Growth, Opportunity and Forecast 2025-2032, by Coherent Market Insights offers a comprehensive analysis of the industry, which comprises insights on the market analysis. As part of our Black Friday Limited-Time Discount, this premium research report is now available at up to 60% off, offering an exceptional opportunity for businesses, analysts, and stakeholders to access high-value insights at a significantly reduced…

Proximity Payment Market is Going to Boom | Major Giants Apple Pay, Google Pay, …

HTF MI just released the Global Proximity Payment Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

𝐌𝐚𝐣𝐨𝐫 Giants in Proximity Payment Market are:

Apple Pay, Google Pay, Samsung…

Unified Payments Interface (UPI) Market Is Booming Worldwide | Google Pay, Amazo …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2028. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Unified Payments Interface (UPI) Market May See a Big Move | Major Giants Samsun …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2027. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Samsung Pay Market is Booming Worldwide with Samsung Pay, Apple Pay, Google Pay

HTF Market Intelligence released a new research report of 23 pages on title 'Samsung Pay - Competitor Profile' with detailed analysis, forecast and strategies. The study covers key regions that includes North America, LATAM, United States, GCC, Southeast Asia, Europe, APAC, United Kingdom, India or China etc and important players such as Samsung Pay, Apple Pay, Google Pay, Alipay, Tenpay, Samsung Electronics, Visa, Mastercard.

Request a sample report @ https://www.htfmarketreport.com/sample-report/3587660-samsung-pay-competitor-profile

Summary

Samsung…