Press release

Australia Investment Banking Market Projected to Reach USD 13.6 Billion by 2033

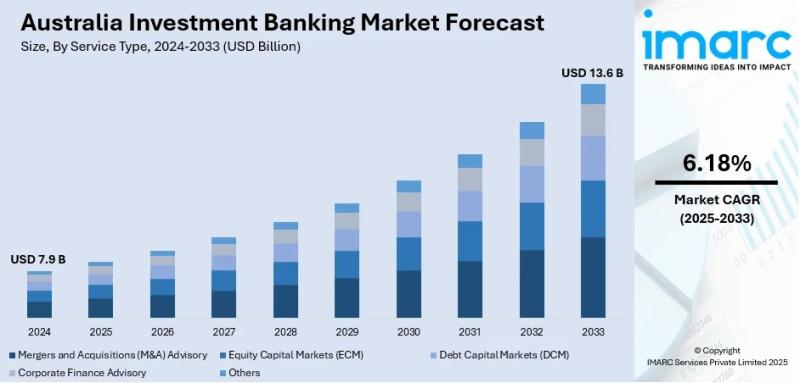

The latest report by IMARC Group, titled "Australia Investment Banking Market Report by Service Type (Mergers and Acquisitions Advisory, Equity Capital Markets, Debt Capital Markets, Corporate Finance Advisory, Others), End User (Large Corporations, Small and Medium Enterprises, Institutional Investors, Government and Public Sector Entities, Others), and Region 2025-2033," offers a comprehensive analysis of the Australia investment banking market growth. The report includes competitor and regional analysis, along with a detailed breakdown of the market segmentation. The Australia investment banking market size reached USD 7.9 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 13.6 Billion by 2033, exhibiting a CAGR of 6.18% during 2025-2033.Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 7.9 Billion

Market Forecast in 2033: USD 13.6 Billion

Market Growth Rate (2025-2033): 6.18%

Australia Investment Banking Market Overview

The Australia investment banking market is experiencing steady growth driven by rising demand for innovative financial solutions and comprehensive risk assessment services, robust mergers and acquisitions activity among key players, considerable rise in technology sector investments requiring specialized advisory, increasing capital requirements for infrastructure and green energy projects, sustained economic growth supporting corporate expansion and financing needs, and strong government support through stable regulatory environment and innovation incentives. The market expansion is supported by cross-border transaction facilitation, private equity and venture capital growth, wealth management service demand from high-net-worth individuals, and institutional investor portfolio diversification strategies. Enhanced advisory capabilities, specialized sector expertise, and sophisticated financial structuring expertise are positioning Australia's investment banking market for sustained growth and capital markets leadership.

Australia's investment banking industry demonstrates strong advisory capabilities across mergers and acquisitions, capital markets, and corporate finance with specialized sector expertise serving technology, infrastructure, energy, and emerging growth companies. The market maintains critical importance in facilitating large-scale transactions, capital raising activities, and strategic financial planning across enterprise sizes from multinational corporations to emerging businesses. The proliferation of M&A transactions, technology sector expansion, renewable energy project financing, and institutional investor sophistication is creating favorable market conditions, requiring substantial investments in technology platforms, specialized talent acquisition, and market intelligence capabilities. Australia's strategic focus on economic growth, infrastructure development, and green energy transition, combined with stable financial regulatory frameworks, makes it an increasingly dynamic market for investment banking innovation and capital markets services.

Request For Sample Report:

https://www.imarcgroup.com/australia-investment-banking-market/requestsample

Australia Investment Banking Market Trends

• Mergers and acquisitions acceleration: Significant growth in M&A transactions across multiple sectors with businesses pursuing strategic opportunities for market share enhancement, operational efficiency improvement, and competitive positioning driving demand for advisory, due diligence, and transaction structuring services.

• Technology sector investment surge: Rapid growth in technology startups and established company financing requirements through initial public offerings, private placements, and venture capital funding creating specialized investment banking team demands and custom-fit financial instruments.

• Infrastructure and green energy financing: Unprecedented inflow of sustainable development projects requiring large-scale project financing, innovative financial structures, and sophisticated risk management strategies positioning investment banks as essential facilitators.

• Private equity and venture capital growth: Expanding private equity and venture capital investment activity particularly in startups creating demand for specialized advisory services, deal structuring expertise, and strategic capital placement guidance.

• Capital raising diversification: Growing corporate reliance on equity offerings, bond issuances, and alternative financing arrangements beyond traditional banking channels requiring comprehensive investment banking advisory and execution capabilities.

• Wealth management service expansion: Rising demand from high-net-worth individuals and institutional investors seeking customized wealth management services, investment strategies, and tailored portfolio optimization aligning with specific financial objectives.

Market Drivers

• Sustained economic expansion: Robust economic growth supporting corporate profitability, investment appetite, and strategic expansion initiatives creating demand for investment banking services facilitating M&A transactions, capital raising, and strategic financial planning.

• Corporate activity intensification: Growing mergers and acquisitions activity across technology, infrastructure, and energy sectors driving advisory demand for sophisticated transaction structuring, risk mitigation, and deal execution expertise.

• Technology sector dynamism: Fast-growing technology industry creating substantial financing requirements for innovation, market expansion, and competitive positioning through diverse capital-raising mechanisms requiring specialized banking expertise.

• Government infrastructure initiatives: Large-scale government investment in infrastructure development and renewable energy projects creating opportunities for investment banking services in project financing, risk management, and innovative financial structuring.

• Stable regulatory environment: Strong government support through transparent regulatory frameworks, investor protection mechanisms, and financial stability policies encouraging investor confidence and supporting capital markets development.

• Institutional investor demand: Growing institutional investor sophistication and portfolio diversification requirements driving demand for strategic advisory, risk assessment, wealth management services, and customized investment solutions.

Challenges and Opportunities

Challenges:

• Regulatory compliance complexity with evolving financial regulations, market conduct standards, and consumer protection requirements creating operational burdens and requiring continuous monitoring of regulatory landscape changes affecting service delivery

• Talent acquisition and retention difficulties in competitive market attracting specialized professionals requiring substantial compensation packages and career development opportunities to maintain competitive staffing capabilities

• Technological disruption pressure from fintech innovation and digital transformation creating need for substantial IT investment, system modernization, and cybersecurity enhancements to maintain competitive service delivery

• Market competition intensification from both established global banking players and specialized boutique advisory firms fragmenting market share and requiring differentiation through service quality, sector expertise, and client relationships

• Economic sensitivity with investment banking revenues highly correlated with economic cycles and capital market activity potentially creating revenue volatility and business planning challenges during economic downturns

Opportunities:

• Technology-driven service innovation implementing artificial intelligence, machine learning, and blockchain technologies improving deal analysis, risk assessment, and transaction execution efficiency while enhancing client service delivery capabilities

• Cross-border transaction expansion facilitating international capital flows, foreign direct investment, and multinational M&A activity leveraging Australia's geographic position and regulatory stability for Asia-Pacific transactions

• Green finance leadership developing specialized expertise in sustainable finance, climate-related investments, and environmental project financing positioning firms as leaders in rapidly growing ESG investment segment

• Emerging market expansion entering growth markets across Asia-Pacific region providing advisory services for Australian companies seeking international expansion and foreign businesses establishing Australian operations

• Advisory service diversification expanding beyond traditional services into environmental, social, and governance consulting, digital transformation advisory, and strategic technology integration services for enterprise clients

Australia Investment Banking Market Segmentation

By Service Type:

• Mergers and Acquisitions (M&A) Advisory

• Equity Capital Markets (ECM)

• Debt Capital Markets (DCM)

• Corporate Finance Advisory

• Others

By End User:

• Large Corporations

• Small and Medium Enterprises (SMEs)

• Institutional Investors

• Government and Public Sector Entities

• Others

By Region:

• Australia Capital Territory & New South Wales

• Victoria & Tasmania

• Queensland

• Northern Territory & Southern Australia

• Western Australia

Browse Full Report:

https://www.imarcgroup.com/australia-investment-banking-market

Australia Investment Banking Market News (2024-2025)

• 2024: Mergers and acquisitions activity expanded significantly with businesses pursuing strategic opportunities across technology, infrastructure, and energy sectors driving demand for specialized advisory, due diligence, and transaction structuring services.

• 2024: Technology sector investment surge continued with startups and established companies requiring capital through IPOs, private placements, and venture funding creating specialized investment banking team demands and custom financial instruments.

• 2024: Government infrastructure initiatives expanded with large-scale projects in renewable energy and infrastructure development creating significant opportunities for investment banking services in project financing and innovative structuring.

• 2024: Private equity and venture capital investment growth accelerated particularly in early-stage technology and innovative startups creating demand for specialized advisory, deal structuring, and strategic capital placement services.

• 2024: Institutional investor engagement intensified with growing demand for customized wealth management services, strategic advisory, and tailored investment solutions supporting portfolio diversification and long-term financial objectives.

Key Highlights of the Report

• Market Performance (2019-2024)

• Market Outlook (2025-2033)

• Industry Catalysts and Challenges

• Segment-wise historical and future forecasts

• Competitive Landscape and Key Player Analysis

• Service Type and End User Analysis

Ask analyst for your customized sample:

https://www.imarcgroup.com/request?type=report&id=24705&flag=F

Q&A Section

Q1: What drives growth in the Australia investment banking market?

A1: Market growth is driven by sustained economic expansion supporting corporate profitability and investment appetite, corporate activity intensification through M&A transactions, technology sector dynamism creating financing requirements, government infrastructure initiatives for renewable energy and development projects, stable regulatory environment encouraging investor confidence, and institutional investor demand for specialized advisory and wealth management services.

Q2: What are the latest trends in this market?

A2: Key trends include mergers and acquisitions acceleration across multiple sectors, technology sector investment surge through IPOs and venture funding, infrastructure and green energy financing expansion, private equity and venture capital growth, capital raising diversification through bonds and equity offerings, and wealth management service expansion targeting high-net-worth individuals.

Q3: What challenges do companies face?

A3: Major challenges include regulatory compliance complexity with evolving standards, talent acquisition and retention difficulties in competitive market, technological disruption pressure from fintech innovation, market competition intensification fragmenting market share, and economic sensitivity creating revenue volatility during economic cycles.

Q4: What opportunities are emerging?

A4: Emerging opportunities include technology-driven service innovation through AI and blockchain, cross-border transaction expansion facilitating international capital flows, green finance leadership in sustainable investing, emerging market expansion across Asia-Pacific region, and advisory service diversification into ESG consulting and digital transformation.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91-120-433-0800

United States: +1-201-971-6302

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses. IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Australia Investment Banking Market Projected to Reach USD 13.6 Billion by 2033 here

News-ID: 4219804 • Views: …

More Releases from IMARC Group

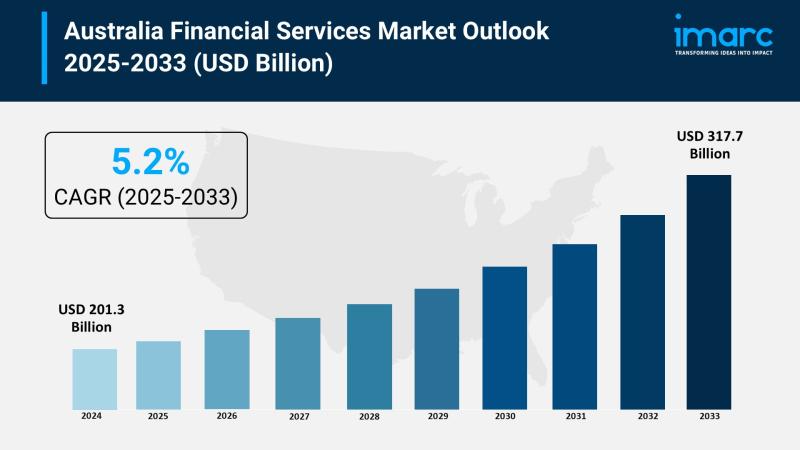

Australia Financial Services Market 2025 | Worth USD 317.7 Billion to 2025-2033

Market Overview

The Australia financial services market size reached USD 201.3 Billion in 2024 and is projected to grow to USD 317.7 Billion by 2033. The market is expected to expand steadily with a compound annual growth rate of 5.2% during the forecast period from 2025 to 2033. Key factors driving this growth include the rising demand for digital banking, regulatory advancements, strong economic performance, increasing fintech investments, and enhanced consumer…

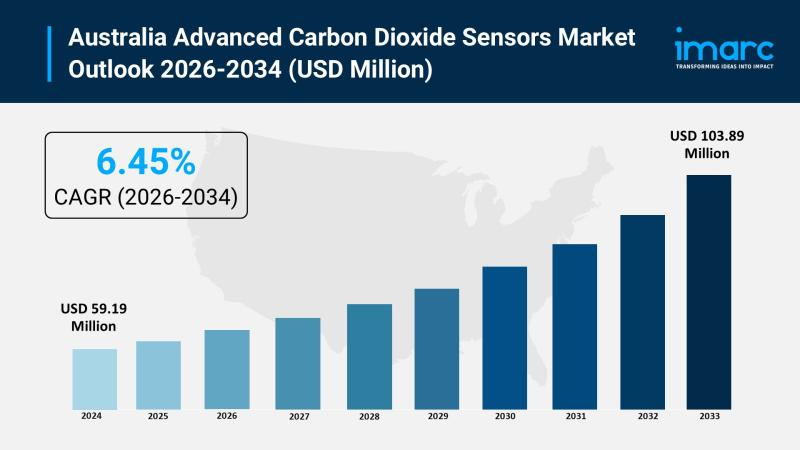

Australia Advanced Carbon Dioxide Sensors Market | Worth USD 103.89 Million 2026 …

Market Overview

The Australia advanced carbon dioxide sensors market size was USD 59.19 Million in 2025 and is expected to grow to USD 103.89 Million by 2034. The market growth is driven by strong government-led emissions reduction policies, enhanced building standards for CO2 monitoring, and the integration of IoT-enabled sensor technologies in smart buildings. These trends are supported by increased focus on indoor air quality and workplace health, fueling innovation in…

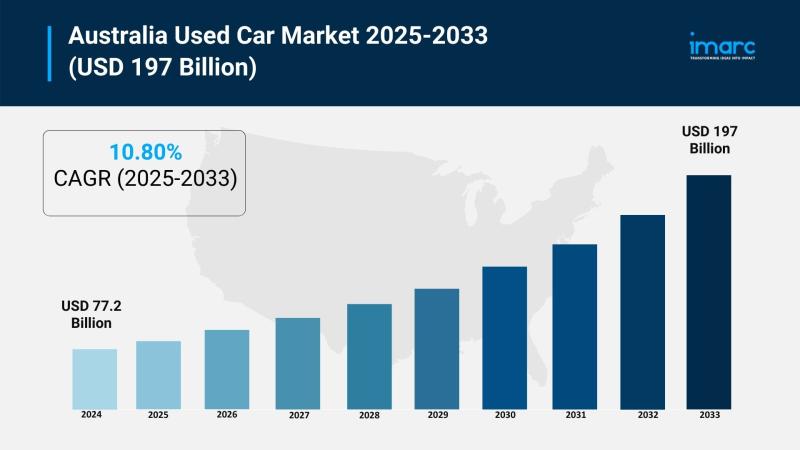

Australia Used Car Market Projected to Reach USD 197 Billion by 2033

Market Overview

The Australia used car market was valued at USD 77.2 Billion in 2024 and is projected to reach USD 197 Billion by 2033. The market is experiencing strong growth driven by affordability concerns, rising demand for reliable pre-owned vehicles, and the increasing role of digital platforms that simplify transactions. Economic pressures and the shift toward cost-effective vehicle options are further accelerating expansion, making the used car market a vital…

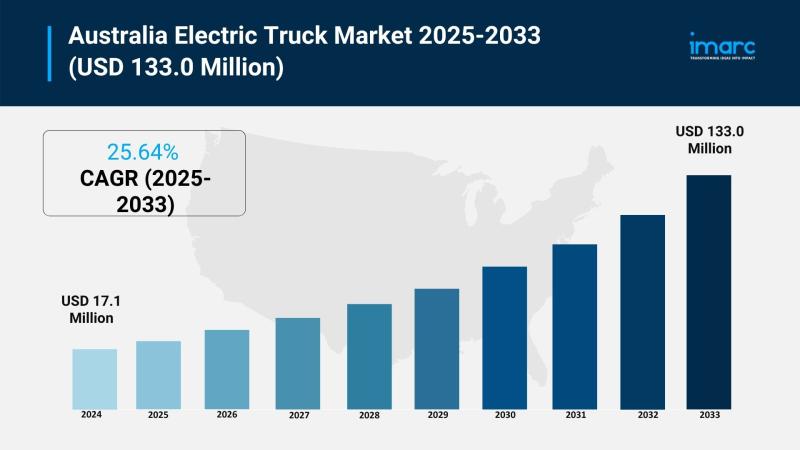

Australia Electric Truck Market Projected to Reach USD 133.0 Million by 2033

Market Overview

The Australia electric truck market reached USD 17.1 Million in 2024 and is projected to expand to USD 133.0 Million by 2033. With a forecast period spanning 2025 to 2033, the market is growing significantly due to stringent government emissions regulations, rising fuel costs, and advancements in battery and charging infrastructure technologies. Investments in fleet electrification and sustainable transport solutions are further driving market share growth. For further details,…

More Releases for Australia

Derila Memory foam pillow Australia: Honest Reviews About Derila Australia

Derila is one of the best memory foam pillows sold in Australia today.

Priced at around 30 dollars (USD), derila is currently the most reviewed and the cheapest memory pillow available in Australia.

What is Derila? Is Derila Pillow the best in Australia? Keep reading to discover everything worth knowing about Derila Australia.

OVERVIEW

Recently, Memory foam pillow has been trending and there is a lot of brands to choose from. Which one is…

CeraCare Australia - Where to Buy Legit CeraCare Supplement in Australia?

CeraCare Australia - Ceracare is a glucose support supplement that proposes to augment cardiovascular prosperity and to stay aware of perfect glucose assimilation in Australia. CeraCare supplement is conceptualized and executed by a threesome – Christine, Dr. Jihn and Michael. It is a natural supplement that helps one stay aware of ideal glucose levels, cardiovascular prosperity, and glucose assimilation.

Take Advantage of 80% Discount Offer in Australia >> https://boostsxproaustralia.com/ceracare-new

The indications…

Glucofort Australia - Where to Buy Legit Glucofort Supplement in Australia?

Glucofort Australia - Glucofort is an efficient, all-natural progressive glucose support supplement in Australia. This formula is made out of 12 key ingredients, 7 nutrients, and minerals, and a little of Vanadium. This supplement upholds regulated glucose levels and glucose digestion. Glucofort prides itself as the most inventive supplements available in Oceania, accentuating its solidarity, wellbeing, and quality.

Take Advantage of 75% Discount Offer in Australia >> https://boostsxproaustralia.com/glucofort-new

Rather than simply…

Australia Agriculture Market, Australia Agriculture Industry, Australia Agricult …

Australia Agriculture has been as vital within the development of Australia, because it was within the United States. Australia's ancient dominance in wheat and sheep continues into the 21st century. Recently Australian agriculture has become more and more diversified. The considerable expanses of productive land have helped Australia to become a number one world exporter of grains, meats, and wool. Each grains (predominantly wheat and barley) and wool markets round…

Australia Conveyor Maintenance Analysis by Top Companies Habasit Australia Pty l …

Global Australia Conveyor Maintenance Market and Competitive Analysis

Know your current market situation! Not only a vital element for brand new products but also for current products given the ever-changing market dynamics. The study allows marketers to remain involved with current consumer trends and segments where they'll face a rapid market share drop. Discover who you actually compete against within the marketplace, with Market Share Analysis know market position, to push…

Australia Conveyor Maintenance Market Analysis By Manufacturers Rema Tip Top Aus …

A conveyor system is a common piece of mechanical handling device that moves materials/objects from one location. A conveyor is often lifeline to a company’s ability to effectively move its products in a timely manner. While it is used constantly in a manufacturing plant, proper maintenance from trained technicians can extend the lifespan of conveyor. Furthermore, conveyor maintenance is essential as it may be subjected to different types of failures…