Press release

Australia Oil and Gas Market Projected to Reach USD 711.5 Million by 2033

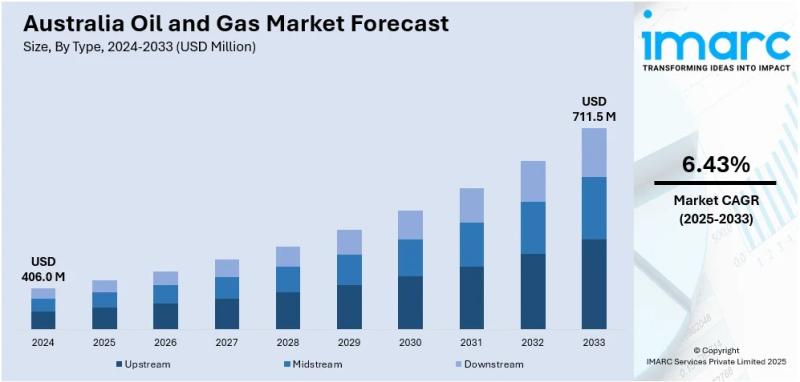

The latest report by IMARC Group, titled "Australia Oil and Gas Market Report by Type (Upstream, Midstream, Downstream), Application (Offshore, Onshore), and Region 2025-2033," offers a comprehensive analysis of the Australia oil and gas market growth. The report includes competitor and regional analysis, along with a detailed breakdown of the market segmentation. The Australia oil and gas market size reached USD 406.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 711.5 Million by 2033, exhibiting a CAGR of 6.43% during 2025-2033.Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 406.0 Million

Market Forecast in 2033: USD 711.5 Million

Market Growth Rate (2025-2033): 6.43%

Australia Oil and Gas Market Overview

The Australia oil and gas market is experiencing steady growth driven by increasing energy demand from domestic and international markets, rapid technological advancements in exploration and extraction, strengthening government policies supporting energy security, rising liquefied natural gas (LNG) export opportunities particularly to Asian markets, and expanding infrastructure development including pipelines and export terminals. The market expansion is supported by technological innovations in hydraulic fracturing, horizontal drilling techniques, artificial intelligence integration, and increasing recognition of natural gas as transitional fuel supporting emissions reduction while maintaining energy reliability. Advanced oil and gas solutions are transforming Australia's energy landscape through improved operational efficiency, enhanced safety standards, optimized resource extraction, and sustainable practices positioning the country as major LNG exporter and energy supplier contributing significantly to regional energy security and economic development.

Australia's oil and gas foundation demonstrates strong resource fundamentals across diverse applications including power generation, industrial manufacturing, residential heating, transportation fuel, petrochemical feedstock, and liquefied natural gas exports. The country's substantial offshore and onshore reserves, sophisticated production infrastructure, strategic proximity to Asian energy markets, and commitment to responsible resource development create substantial demand for advanced exploration technologies, efficient production systems, and comprehensive export capabilities. The proliferation of LNG expansion projects, carbon capture and storage initiatives, hydrogen production opportunities, and unconventional gas development is creating favorable market conditions, requiring significant investments in infrastructure upgrades, technological innovation, environmental compliance systems, and workforce development programs. Australia's competitive advantages combined with growing Asian energy demand and transitional fuel requirements make it an increasingly important market for oil and gas sector development and clean energy transition solutions supporting economic growth and energy sustainability objectives.

Request For Sample Report:

https://www.imarcgroup.com/australia-oil-gas-market/requestsample

Australia Oil and Gas Market Trends

• LNG expansion initiatives: Growing investments in liquefied natural gas facilities, terminal upgrades, production capacity enhancements responding to increasing Asian demand particularly Japan, China, India, and South Korea securing long-term supply contracts and generating regional employment opportunities.

• AI integration advancement: Increasing adoption of artificial intelligence, Internet of Things (IoT), data analytics optimizing upstream exploration, midstream operations, downstream processing enabling predictive maintenance, enhanced drilling accuracy, automated operations, and improved safety standards throughout value chain.

• Natural gas transition focus: Strengthening emphasis on natural gas as cleaner transitional fuel with lower carbon emissions supporting power generation, industrial applications, and transportation while governments promote gas adoption within energy transition strategies.

• Hydrogen production development: Expanding opportunities for green hydrogen from renewable energy and blue hydrogen from natural gas with carbon capture leveraging existing gas infrastructure, abundant solar and wind resources, and proximity to Asian decarbonization markets.

• Carbon capture implementation: Rising adoption of Carbon Capture and Storage (CCS) technologies utilizing depleted gas fields and geological formations particularly in Western Australia and Northern Territory enabling continued fossil fuel production while meeting climate regulations.

• Unconventional gas exploration: Growing focus on shale and tight gas reserves in Cooper, Beetaloo, and Canning basins utilizing horizontal drilling, hydraulic fracturing, and advanced reservoir mapping ensuring sustained supply as traditional fields mature.

Market Drivers

• Asian export demand: Implementation of long-term LNG supply contracts with major Asian economies including Japan, China, India, and South Korea driven by regional energy security needs, coal-to-gas transition initiatives, and growing industrial manufacturing requirements.

• Technological advancement: Growing capabilities in hydraulic fracturing, horizontal drilling, digital technologies, AI-powered analytics, and IoT sensors revolutionizing resource identification, extraction efficiency, operational optimization, and safety improvement across upstream, midstream, and downstream sectors.

• Infrastructure development: Increasing investments in pipelines, LNG export terminals, gas processing facilities, offshore platforms, and transportation networks enhancing supply chain reliability, reducing logistical costs, and supporting domestic and international market access.

• Government policy support: Strengthening regulatory frameworks, exploration incentives including Exploration Incentive Scheme (EIS), CCS subsidies, renewable energy integration programs, and strategic energy policies balancing fossil fuel production with emissions reduction objectives.

• Energy security requirements: Rising domestic energy consumption driven by population growth, industrial expansion, economic development necessitating reliable natural gas and oil supplies supporting power generation, manufacturing operations, and residential needs.

• Regional trade agreements: Expanding diplomatic relationships, bilateral energy cooperation arrangements, trade facilitation initiatives with Asian partners ensuring stable revenue streams, reduced regulatory barriers, and reliable market access for Australian producers.

Challenges and Opportunities

Challenges:

• Regulatory uncertainty involving changing government policies, emissions objectives, exploration permit requirements, project licensing procedures, and misalignment between federal and state regulations creating investment hesitation and development timeline complications

• Environmental opposition from advocacy organizations, local communities, and Indigenous groups raising concerns about climate change, land usage, biodiversity loss resulting in legal disputes, protests, regulatory delays, and heightened social responsibility expectations

• High operational costs including expensive offshore deepwater projects, remote area logistics challenges, skilled labor shortages, elevated wages, stringent safety compliance, and environmental regulations affecting cost competitiveness compared to Middle East and US producers

• Infrastructure limitations in remote areas requiring extensive pipeline networks, transportation systems, and processing facilities with significant capital requirements particularly affecting unconventional gas development and offshore project economics

• Market volatility exposure to global oil and gas price fluctuations, international demand variations, geopolitical tensions, and competitive pressures from alternative energy sources affecting revenue predictability and long-term investment planning

Opportunities:

• Hydrogen production expansion developing green hydrogen from renewable electricity and blue hydrogen from natural gas with carbon capture positioning Australia as major clean energy exporter leveraging existing infrastructure and abundant resources

• CCS subsidies and technology advancement enabling continued fossil fuel production while meeting emissions targets through government financial assistance, geological storage opportunities, and integration with blue hydrogen initiatives

• Unconventional gas development accessing substantial shale and tight gas reserves through innovative extraction technologies, sustainable management practices, and regulatory compliance supporting energy security and export capacity expansion

• Regional trade partnership strengthening long-term supply agreements, energy collaboration arrangements, and market access with growing Asian economies ensuring stable revenue streams and expanding customer base

• Renewable energy integration opportunities combining oil and gas infrastructure with hydrogen distribution, solar and wind power incorporation, and diversified energy portfolios supporting energy transition while maintaining operational efficiency

Australia Oil and Gas Market Segmentation

By Type:

• Upstream

o Exploration Activities

o Drilling Operations

o Reservoir Development

o Production Operations

o Offshore Fields

o Onshore Fields

• Midstream

o Pipeline Transportation

o Gas Processing

o LNG Liquefaction

o Storage Facilities

o Distribution Networks

o Terminal Operations

• Downstream

o Refining Operations

o Petrochemical Production

o Product Distribution

o Retail Services

o Industrial Supply

o Export Terminals

By Application:

• Offshore

o Deepwater Projects

o Shallow Water Operations

o Subsea Infrastructure

o Floating Production Systems

o Offshore Drilling Platforms

o Subsea Pipeline Networks

• Onshore

o Conventional Gas Fields

o Unconventional Shale Gas

o Tight Gas Reserves

o Coal Seam Gas

o Gas Processing Plants

o Pipeline Infrastructure

By Region:

• Australia Capital Territory & New South Wales

• Victoria & Tasmania

• Queensland

• Northern Territory & Southern Australia

• Western Australia

Browse Full Report:

https://www.imarcgroup.com/australia-oil-gas-market

Australia Oil and Gas Market News (2024-2025)

• June 2025: Institute for Energy Economics and Financial Analysis (IEEFA) launched Australian Gas and LNG Tracker interactive data tool enabling users to analyze liquefied natural gas flows into and out of Australia supporting market transparency and analysis.

• June 2025: EnergyQuest CEO projected Australia's LNG exports expected to remain steady year-over-year in 2025 with no new domestic projects starting this year, maintaining consistent supply to international markets particularly Asian customers.

• March 2025: Australian Government raised forecast commodity export income to A$387 billion for 12 months through June 2025, representing 4% increase from previous forecast though down 7% year-over-year demonstrating continued resource export significance.

• January 2025: Santos announced restart of production at 3.7 million tonnes per year Darwin LNG facility following commissioning of Barossa field scheduled for July-September 2025 supporting Australia's LNG export capacity expansion.

• February 2025: Industry analysis indicated Australia's "golden age of gas" performance with LNG ventures paying 5% of total export revenue in state gas royalties following rate increase in 2021 and Ukraine war-related price spike.

• 2024-2025: Western Australia and eastern Australia LNG exporters continued exporting more LNG than required for long-term contracts into spot markets, maintaining consistently high plant utilization rates across most LNG projects demonstrating operational efficiency.

Key Highlights of the Report

• Market Performance (2019-2024)

• Market Outlook (2025-2033)

• Industry Catalysts and Challenges

• Segment-wise historical and future forecasts

• Competitive Landscape and Key Player Analysis

• Type and Application Analysis

Ask analyst for your customized sample:

https://www.imarcgroup.com/request?type=report&id=24088&flag=F

Q&A Section

Q1: What drives growth in the Australia oil and gas market?

A1: Market growth is driven by Asian export demand with long-term LNG supply contracts to Japan, China, India, and South Korea supporting regional energy security, technological advancement including hydraulic fracturing, horizontal drilling, and AI-powered analytics revolutionizing operations, infrastructure development enhancing pipelines, terminals, and processing facilities, government policy support through exploration incentives and CCS subsidies balancing production with emissions objectives, energy security requirements addressing domestic consumption growth, and regional trade agreements ensuring stable revenue streams and market access with Asian partners.

Q2: What are the latest trends in this market?

A2: Key trends include LNG expansion initiatives investing in facilities and terminal upgrades responding to Asian demand, AI integration advancement optimizing exploration, operations, and processing through predictive maintenance and automation, natural gas transition focus promoting gas as cleaner transitional fuel with lower emissions, hydrogen production development leveraging infrastructure and renewable resources for green and blue hydrogen, carbon capture implementation utilizing geological formations enabling continued production while meeting climate regulations, and unconventional gas exploration accessing shale and tight gas reserves through advanced extraction technologies.

Q3: What challenges do companies face?

A3: Major challenges include regulatory uncertainty from changing policies and permit requirements creating investment hesitation, environmental opposition from advocacy groups and communities resulting in legal disputes and project delays, high operational costs including expensive offshore projects and skilled labor shortages affecting competitiveness, infrastructure limitations in remote areas requiring extensive capital investment, and market volatility exposure to global price fluctuations and geopolitical tensions affecting revenue predictability.

Q4: What opportunities are emerging?

A4: Emerging opportunities include hydrogen production expansion developing green and blue hydrogen positioning Australia as clean energy exporter, CCS subsidies and technology advancement enabling fossil fuel production while meeting emissions targets, unconventional gas development accessing substantial reserves supporting energy security, regional trade partnership strengthening long-term supply agreements with growing Asian economies, and renewable energy integration combining infrastructure with hydrogen distribution and diversified energy portfolios supporting energy transition.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91-120-433-0800

United States: +1-201-971-6302

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses. IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Australia Oil and Gas Market Projected to Reach USD 711.5 Million by 2033 here

News-ID: 4219776 • Views: …

More Releases from IMARC Group

Taiwan Construction Market Size, Share, In-Depth Insights, Trends and Forecast 2 …

IMARC Group has recently released a new research study titled "Taiwan Construction Market Report by Sector (Residential, Commercial, Industrial, Infrastructure (Transportation), Energy and Utilities Construction), and Region 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Taiwan construction market size reached USD 37.4 Billion in 2025 and is projected to grow to USD 50.4…

Mexico Whiskey Market Size to Hit USD 1,468.1 Million by 2034: Trends & Forecast

IMARC Group has recently released a new research study titled "Mexico Whiskey Market Size, Share, Trends and Forecast by Product Type, Quality, Distribution Channel, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico whiskey market size reached USD 905.2 Million in 2025. It is projected to grow to USD 1,468.1 Million…

Mexico LED Lights Market 2026 : Industry Size to Reach USD 2,904.4 Million by 20 …

IMARC Group has recently released a new research study titled "Mexico LED Lights Market Size, Share, Trends and Forecast by Product Type, Application, Import and Domestic Manufacturing, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico LED lights market was valued at USD 1,466.9 million in 2025 and is projected to…

Mexico High-Brightness LED Market Size, Share, Latest Insights and Forecast 2025 …

IMARC Group has recently released a new research study titled "Mexico High-Brightness LED Market Size, Share, Trends and Forecast by Application, Distribution Channel, Indoor and Outdoor Application, End-Use Sector, and Region, 2025-2033" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico high-brightness LED market size reached USD 349.2 Million in 2024 and is…

More Releases for Australia

Derila Memory foam pillow Australia: Honest Reviews About Derila Australia

Derila is one of the best memory foam pillows sold in Australia today.

Priced at around 30 dollars (USD), derila is currently the most reviewed and the cheapest memory pillow available in Australia.

What is Derila? Is Derila Pillow the best in Australia? Keep reading to discover everything worth knowing about Derila Australia.

OVERVIEW

Recently, Memory foam pillow has been trending and there is a lot of brands to choose from. Which one is…

CeraCare Australia - Where to Buy Legit CeraCare Supplement in Australia?

CeraCare Australia - Ceracare is a glucose support supplement that proposes to augment cardiovascular prosperity and to stay aware of perfect glucose assimilation in Australia. CeraCare supplement is conceptualized and executed by a threesome – Christine, Dr. Jihn and Michael. It is a natural supplement that helps one stay aware of ideal glucose levels, cardiovascular prosperity, and glucose assimilation.

Take Advantage of 80% Discount Offer in Australia >> https://boostsxproaustralia.com/ceracare-new

The indications…

Glucofort Australia - Where to Buy Legit Glucofort Supplement in Australia?

Glucofort Australia - Glucofort is an efficient, all-natural progressive glucose support supplement in Australia. This formula is made out of 12 key ingredients, 7 nutrients, and minerals, and a little of Vanadium. This supplement upholds regulated glucose levels and glucose digestion. Glucofort prides itself as the most inventive supplements available in Oceania, accentuating its solidarity, wellbeing, and quality.

Take Advantage of 75% Discount Offer in Australia >> https://boostsxproaustralia.com/glucofort-new

Rather than simply…

Australia Agriculture Market, Australia Agriculture Industry, Australia Agricult …

Australia Agriculture has been as vital within the development of Australia, because it was within the United States. Australia's ancient dominance in wheat and sheep continues into the 21st century. Recently Australian agriculture has become more and more diversified. The considerable expanses of productive land have helped Australia to become a number one world exporter of grains, meats, and wool. Each grains (predominantly wheat and barley) and wool markets round…

Australia Conveyor Maintenance Analysis by Top Companies Habasit Australia Pty l …

Global Australia Conveyor Maintenance Market and Competitive Analysis

Know your current market situation! Not only a vital element for brand new products but also for current products given the ever-changing market dynamics. The study allows marketers to remain involved with current consumer trends and segments where they'll face a rapid market share drop. Discover who you actually compete against within the marketplace, with Market Share Analysis know market position, to push…

Australia Conveyor Maintenance Market Analysis By Manufacturers Rema Tip Top Aus …

A conveyor system is a common piece of mechanical handling device that moves materials/objects from one location. A conveyor is often lifeline to a company’s ability to effectively move its products in a timely manner. While it is used constantly in a manufacturing plant, proper maintenance from trained technicians can extend the lifespan of conveyor. Furthermore, conveyor maintenance is essential as it may be subjected to different types of failures…