Press release

Spherical Boron Nitride for Electronic Packaging Market to Reach USD 10.90 Million by 2031 Top 10 Company Globally

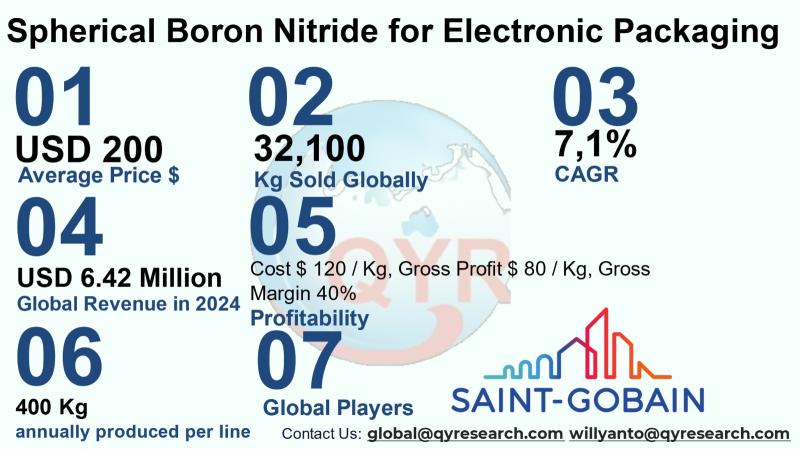

Spherical boron nitride (sBN) is a specialty form of boron nitride engineered into near-spherical particles that combine excellent thermal conductivity, electrical insulation, chemical inertness and superior flowability compared with flake forms; these properties make sBN attractive for demanding electronic-packaging and thermal-management applications where isotropic thermal performance and predictable filler behavior are required. The industry is composed of upstream raw-material and precursor producers, specialized ceramic processing plants that manufacture sBN powder and spherical particles, and downstream formulators and assemblers who incorporate sBN into epoxy pastes, thermal interface materials, molding compounds and coatings for electronic packages. Suppliers range from diversified chemical groups to small specialized powder houses; product differentiation is driven by particle size distribution, purity, surface treatment, and supply-chain reliability. The material is capital-intensive to produce at high purity and spherical morphology but commands premium pricing in high-performance electronics segments.In 2024 the global market for spherical boron nitride for electronic packaging estimate at USD 6.42 million, with a compound annual growth rate of 7.1% through 2031 reaching market size USD 10.90 million by 2031. An average selling price of USD 200 per kg, the industry sold roughly 32,100 kg worldwide in 2024. At the factory level the industry exhibits a healthy gross margin profile; a representative factory gross margin of 40%, the implied COGS is USD 120 per Kg and factory gross profit is USD 80 per Kg. The COGS breakdown raw materials, direct labor, energy and utilities, depreciation & maintenance and logistics & packaging. Typical total production capacity is in 400 kg per line per year. Downstream demand is concentrated in electronic packaging and molding compounds followed by thermal interface materials and gap fillers, then specialty coatings and advanced ceramics/insulation applications.

Latest Trends and Technological Developments

Innovation in boron nitride product forms, coatings and surface chemistries has accelerated as formulators push for both higher thermal conductivity at lower loading and improved processability. Saint-Gobain Boron Nitride announced the launch of new boron nitride coatings and product line extensions (CeraGlide Azure) that demonstrate ongoing materials engineering around BN dispersions and surface treatments (news item dated November 2023). Industry analyst releases and strategic market reports signaled consolidation and renewed M&A interest in BN value chains (ResearchAndMarkets commentary, May 2024). More recently, market coverage has highlighted new market reports and forecast updates across boron nitride product families emphasizing rising demand in thermal management and specialty coatings (example industry coverage dated June 9, 2025). Taken together, these items show suppliers expanding into formulated coatings and collaborating on surface chemistries to capture higher-margin downstream opportunities and to address customer needs for lower loading and higher isotropic thermal performance.

Asia remains the dominant manufacturing and consumption hub for sBN used in electronics because of the concentration of electronics OEMs and packaging supply chains in Greater China, Japan, South Korea and Taiwan. Producers in Asia benefit from proximate demand, vertically integrated precursor supply in some cases, and lower capital and operating costs than many Western peers. Japan and South Korea host high-purity chemical groups and specialty ceramic houses that supply premium sBN grades to semiconductor and high-reliability electronics customers, while Chinese suppliers have been expanding capacity and moving up the value chain to supply both domestic OEMs and exporters. Pricing pressure from capacity additions in China can compress margins for lower-end grades but premium, surface-treated, and tightly specified spherical grades for advanced packages retain strong pricing resilience. Regional regulatory, energy-cost and raw-material sourcing dynamics drive variations in plant economics across Asian markets.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart)

https://www.qyresearch.com/sample/5171919

Spherical Baron Nitride for Electronic Packaging by Type:

Below 50μm

50μm-100μm

Above 100μm

Others

Spherical Baron Nitride for Electronic Packaging by Application:

Semiconductor Packaging

5G Communications

LED Lighting

New Energy Vehicles

Others

Global Top 10 Key Companies in the Spherical Baron Nitride for Electronic Packaging Market

Saint-Gobain

3M

Xtra GmbH

Yaan Bestry Performance Materials

Suzhou Nutpool Materials Technology

Shandong Fangyuan

Suzhou Ginet New Material

Yingkou Liaobin Fine Chemical

Denka Company Limited

Momentive

Regional Insights

Within Southeast Asia, demand growth for sBN is driven by regional electronics assembly, component suppliers and regionalization of some semiconductor and power-electronics supply chains. Singapore, Malaysia, Thailand and Vietnam host assembly and substrate industries that create demand for thermal interface materials and advanced packaging compounds, while Indonesia presents a growth market for downstream formulators and for localized assembly of power electronics and automotive components. Indonesias large and growing electronics consumption base, expanding EV and industrial electrification projects, and government interest in developing higher-value manufacturing create a long-term upside for downstream demand. However, ASEAN also faces constraints: limited local high-purity precursor production, a relative scarcity of high-temperature processing facilities for specialty ceramics, and the need for skill development in quality control for particle-sensitive materials. For many ASEAN customers the optimal sourcing model today remains import-led, with regional distributors and toll-production arrangements providing interim solutions while local capacity slowly expands.

The industry faces several persistent challenges: the high capex intensity and long lead times required to commission high-yield spheroidization and high-temperature furnaces; sensitivity to feedstock purity and yield (low spherical yields raise unit costs); environmental and emissions regulations tied to high-temperature processing in some jurisdictions; pricing pressure from lower-cost entrants for commodity grades; and the need to offer consistent, certifiable quality for demanding electronics customers (including particle-size, morphology and dielectric/thermal specifications). Additionally, supply-chain concentration for high-purity precursors can create vulnerability to feedstock or logistics shocks. Finally, conversion of technical interest into commercial adoption in new end markets requires close co-development with OEMs and formulators, which can lengthen sales cycles.

Suppliers that can move up the value chain by offering surface treatments, pre-dispersion services, certified supply for electronics (quality systems, lot traceability) and co-development partnerships will capture higher margins and reduce exposure to commodity price competition. Investing in yield-improvement technologies and in energy efficiency materially improves per-kg economics. Buyers should consider multi-source strategies that balance cost, quality and security of supply; larger OEMs are increasingly contracting for long-term supply and technical support rather than spot purchases. For ASEAN and Indonesian stakeholders, forging partnerships with Asian specialty producers for toll manufacture or licensing can accelerate local capability without the full upfront capex burden. Strategic M&A and joint ventures are likely routes for materials groups seeking market entry or capacity scaling.

Product Models

Spherical Boron Nitride is increasingly used in electronic packaging to enhance heat dissipation while maintaining electrical insulation. Its roughly isotropic thermal conduction and favorable packing can help reduce thermal resistance in filled polymer matrices or underfill layers.

below 50 μm offer excellent dispersion and smooth surface finish in resins and coatings. They help achieve high thermal conductivity while maintaining good processability in thin layers or small-gap electronic packaging materials such as underfills, adhesives, and coatings. Notable products include:

SA35 (Saint-Gobain, Boron Nitride division) - a spherical agglomerate BN powder with D50 ≈ 35 μm. A fine spherical grade designed for good flowability and packing in high-performance dielectric thermal fillers.

HRBN-30 (HRUIMetal / HRBN series) - spherical BN product with D50 ~30 μm. A fine spherical BN for use in thermal composites or electronic packaging.

HMGBN-60 (Heeger Materials) spherical BN with D50 ~6075 μm (though slightly above, sometimes used in fine blends) Although its median is a bit above 50 μm, it's used in finer BN blends.

Custom spherical BN 1020 μm (Advanced Ceramics Hub) they advertise custom spherical BN in ranges down to e.g. 1015 μm. Custom small particle spherical BN for applications requiring fine filler.

HMSP0295-1 (Spherical-powder.com) BN spherical powder in the 110 μm category. Ultra-fine spherical BN suited for microelectronic / additive manufacturing uses.

50100 μm provide a balance between thermal conductivity and viscosity. They are ideal for thermally conductive pastes, encapsulants, and potting compound. Examples include:

SA75 (Saint-Gobain) - spherical agglomerate BN powder with D50 ≈ 75 μm. A mid-sized spherical BN for balanced flow and thermal conductivity in composite systems.

SSBN-60 (Advanced Ceramics / Oceania) - although named "60", this is a spherical BN product. Emphasizes isotropic thermal conduction and better packing compared to flaky BN.

SSBN-100 (Advanced Ceramics) median ~100 μm spherical BN. Often used in higher loadings where viscosity is manageable.

HRBN-100 (HRUIMetal) spherical BN with D50 ~100 μm. A commonly available midrange spherical BN product.

HMGBN-100 (Heeger Materials) spherical BN with median ~95115 μm. Good for medium viscosity systems with relatively larger BN particles.

above 100 μm are used when maximum thermal conductivity and minimal viscosity rise are desired. They are well suited for bulk thermal management materials, heat spreaders, and composite substrates in high-power electronic modules. Notable products include:

SA125 (Saint-Gobain) - spherical agglomerate BN with D50 ≈ 125 μm. Larger spherical BN, good for lower viscosity, lower packing density systems.

SA300 (Saint-Gobain) spherical BN with D50 ~300 μm. Very coarse spherical BN for high throughput filler in low shear systems.

HRBN-120 (HRUIMetal) spherical BN D50 ~120 μm. A coarse spherical BN for systems with relaxed viscosity constraints.

HRBNL-120 (HRUIMetal) L variant (looser packing) with ~120 μm D50. A more loosely structured large particle spherical BN.

HMGBN-160 (Heeger Materials) median ~170200 μm spherical BN. High particle size, used where flowability is critical and packing density less important.

Spherical boron nitride for electronic packaging is a small but high-value niche within the broader boron nitride family. With a 2024 market size of USD 6.42 million at an assumed USD 200/kg price point and a forecast CAGR of 7.1% to 2031, the product occupies an attractive position at the intersection of thermal-management need and specialty materials engineering. Growth will be driven by continued demand for compact, higher-power density electronics, automotive electrification and telecom infrastructure, while the principal strategic plays are yield optimization, surface-chemistry differentiation, and customer co-development. Asia and specifically parts of Southeast Asia including Indonesia remains a growth and strategic manufacturing focus because of demand proximity and accelerating downstream electronics and power-electronics manufacturing.

Investor Analysis

This report provides investors with the what (market size, unit economics, pricing and margin profile and a downstream demand map), the how (production capacity, COGS structure, and pathway levers such as yield improvement and surface-treatment premiuming) and the why (demand drivers in electronics, telecom and EV power electronics that create recurring, higher-margin opportunities). For an investor evaluating exposure to sBN, the key value levers are the ability of a target company to demonstrate reproducible high-yield spheroidization, to secure high-purity precursors at stable cost, and to capture downstream value through formulated products or long-term OEM contracts. Investors should look for companies with technical differentiation, measurable quality systems for electronics customers, and geographic access to Asias assembly clusters. The relatively small 2024 base implies that strategic moves (capacity additions, product upgrades, distribution partnerships) can materially shift market share and returns; conversely, the markets niche scale suggests careful attention to customer-concentration risk and capex discipline.

Request for Pre-Order Enquiry On This Report

https://www.qyresearch.com/customize/5171919

5 Reasons to Buy This Report

It delivers a focused, revenue-and-unit-based snapshot of spherical boron nitride for electronic packaging with factory economics and margin modeling.

It maps regional demand dynamics for Asia and ASEAN, helping identify near-term growth corridors.

It provides a pragmatic COGS breakdown and per-kg profitability view useful for valuation and capex planning.

It summarizes recent industry news and technology trends that influence short-term M&A and partnership opportunities.

It lists leading suppliers and strategic entry/scale options information valuable for either supplier due diligence or procurement strategy.

5 Key Questions Answered

What was the 2024 market size and implied global volume for sBN in electronic packaging?

What are the factory-level unit economics (price, COGS per kg, gross profit per kg and gross margin)?

How is downstream demand segmented across electronic packaging, TIMs, coatings and other uses?

Which regional markets in Asia and ASEAN present the best near-term growth opportunities?

What recent industry news and technology developments could change competitive positioning or margins?

Chapter Outline

Chapter 1: Introduces the report scope of the report, executive summary of different market segments (by region, product type, application, etc), including the market size of each market segment, future development potential, and so on. It offers a high-level view of the current state of the market and its likely evolution in the short to mid-term, and long term.

Chapter 2: key insights, key emerging trends, etc.

Chapter 3: Manufacturers competitive analysis, detailed analysis of the product manufacturers competitive landscape, price, sales and revenue market share, latest development plan, merger, and acquisition information, etc.

Chapter 4: Provides profiles of key players, introducing the basic situation of the main companies in the market in detail, including product sales, revenue, price, gross margin, product introduction, recent development, etc.

Chapter 5 & 6: Sales, revenue of the product in regional level and country level. It provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and market size of each country in the world.

Chapter 7: Provides the analysis of various market segments by Type, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments.

Chapter 8: Provides the analysis of various market segments by Application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

Chapter 9: Analysis of industrial chain, including the upstream and downstream of the industry.

Chapter 10: The main points and conclusions of the report.

Related Report Recommendation

Spherical Boron Nitride for Electronic Packaging - Global Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031

https://www.qyresearch.com/reports/5171919/spherical-boron-nitride-for-electronic-packaging

Global Spherical Boron Nitride for Electronic Packaging Market Outlook, InDepth Analysis & Forecast to 2031

https://www.qyresearch.com/reports/5171918/spherical-boron-nitride-for-electronic-packaging

Global Spherical Boron Nitride for Electronic Packaging Sales Market Report, Competitive Analysis and Regional Opportunities 2025-2031

https://www.qyresearch.com/reports/5171917/spherical-boron-nitride-for-electronic-packaging

Global Spherical Boron Nitride for Electronic Packaging Market Research Report 2025

https://www.qyresearch.com/reports/3557773/spherical-boron-nitride-for-electronic-packaging

Global Spherical Boron Nitride Market Research Report 2025

https://www.qyresearch.com/reports/4772740/spherical-boron-nitride

Global Spherical Boron Nitride Powder Market Research Report 2025

https://www.qyresearch.com/reports/4500922/spherical-boron-nitride-powder

Global Spherical Boron Nitride Particles Market Outlook, InDepth Analysis & Forecast to 2031

https://www.qyresearch.com/reports/4808679/spherical-boron-nitride-particles

Global Spherical Micron Boron Nitride Powder Market Research Report 2025

https://www.qyresearch.com/reports/4500839/spherical-micron-boron-nitride-powder

Global High Purity Spherical Boron Nitride Powder Market Research Report 2025

https://www.qyresearch.com/reports/4787349/high-purity-spherical-boron-nitride-powder

Global Spherical Boron Nitride for Thermally Conductive Plastics Market Research Report 2025

https://www.qyresearch.com/reports/3557772/spherical-boron-nitride-for-thermally-conductive-plastics

Contact Information:

Tel: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About QY Research

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Spherical Boron Nitride for Electronic Packaging Market to Reach USD 10.90 Million by 2031 Top 10 Company Globally here

News-ID: 4219011 • Views: …

More Releases from QY Research

Top 30 Indonesian Rubber Public Companies - Q3 2025 Revenue & Performance

1) Overall companies' performance (Q3 2025 snapshot)

PT Gajah Tunggal Tbk

PT Multistrada Arah Sarana Tbk

PT Goodyear Indonesia Tbk

PT King Tire Indonesia

PT Indo Kordsa Tbk

PT Kirana Megatara Tbk

PT Bumi Serpong Damai Tbk

PT Adaro Energy Tbk

PT ACE Hardware Indonesia Tbk

PT Suryaraya Rubberindo Tbk

PT Dharma Polimetal Tbk

PT Selamat Sempurna Tbk

PT Indospring Tbk

PT Autopedia Sukses Lestari Tbk

PT Nipress Tbk

PT Prima Alloy Steel Universal Tbk

PT Anugerah Spareparts Sejahtera Tbk

PT Bintang Oto…

Smart Vacuum Grippers Reshape Industrial Handling Market Through 2032

Rubber suction cups are flexible vacuum-based gripping components used for temporary adhesion and handling across consumer, industrial, and automation applications

Widely applied in packaging lines, glass handling, automotive assembly, electronics pick-and-place, medical devices, and household accessories

Manufactured primarily from silicone rubber, EPDM, nitrile (NBR), natural rubber, and thermoplastic elastomers

Industry characterized by high-volume standardized parts combined with customized industrial vacuum grippers for robotics and smart factories

Demand closely linked to automation penetration, e-commerce packaging…

Renewable Plastic Packaging 2025: ASEAN Growth and 28% Margins Driving the Next …

Renewable plastic packaging refers to packaging materials produced from bio-based, compostable, or renewable feedstocks such as PLA, PHA, starch blends, bio-PE, and bio-PET.

Derived from corn, sugarcane, cassava, cellulose, and plant oils, replacing fossil-fuel plastics to reduce carbon footprint and landfill load.

Applications include:

Food & beverage flexible packs

Retail carry bags

Personal care bottles

E-commerce mailers

Agricultural films

Adoption driven by:

Government plastic taxes & EPR mandates

ESG commitments from FMCG brands

Consumer preference for biodegradable/low-carbon materials

Retailers banning single-use fossil…

From Plastic-Free to Premium: The Future of the Global Facial Wipes Industry

Facial wipes are disposable non-woven textile products pre-saturated with cleansing or skincare solutions used for makeup removal, hygiene, moisturizing, and antibacterial purposes

Widely adopted across personal care, travel, baby care, sports, hospital, and on-the-go convenience segments

Increasing penetration driven by busy lifestyles, urbanization, higher disposable income, and rising skincare awareness

Core buyers include mass retail, convenience stores, e-commerce, beauty chains, pharmacies, and hospitality sectors

Industry Explanation and Global Overview

Combines nonwoven fabric manufacturing (spunlace, airlaid)…

More Releases for Spherical

Alpha Alumina Spherical Powder Market 2034

Pune, India - Exactitude Consultancy - The Global Alpha Alumina Spherical Powder Market is witnessing significant growth as industries increasingly shift toward high-performance fillers, advanced ceramics, precision polishing materials, and thermal management components. Alpha alumina (α-Al2O3) spherical powder-known for its superior hardness, thermal stability, and high sphericity-is becoming essential across electronics, automotive, aerospace, chemical, and semiconductor applications.

Download Full PDF Sample Copy of Market Report

https://exactitudeconsultancy.com/request-sample/54892

Teaser / Snippet

Alpha alumina spherical powder…

Global Spherical Bearings Market Analysis (2025-2031)

LP information released the report titled "Global Spherical Bearings Market Growth 2025-2031" This report provides a comprehensive analysis of the global Spherical Bearings landscape, with a focus on key trends related to product segmentation, Spherical Bearings top 10 manufacturers' revenue and market share, Spherical Bearings report also provides insights into the strategies of the world's leading companies, focusing on their market share, sales, revenue, market position and development prospects in…

Spherical Beacon Buoys Market Size Analysis by Application, Type, and Region: Fo …

According to Market Research Intellect, the global Spherical Beacon Buoys market under the Aerospace and Defense category is expected to register notable growth from 2025 to 2032. Key drivers such as advancing technologies, changing consumer behavior, and evolving market dynamics are poised to shape the trajectory of this market throughout the forecast period.

Increased maritime activity in polar regions and growing interest in Arctic and Antarctic exploration are driving the market…

Qianci Magnet Technology: 1.3T Spherical Head Magnetic Former

Product Details

The 1.3T Spherical Head Magnetic Former is a specialized tool used in the construction industry, particularly for precast concrete applications. This device serves as a magnetic anchor former designed to securely hold spherical head anchors in place during the manufacturing of precast concrete elements.

Image: https://www.abnewswire.com/upload/2025/02/e4e96fd13150ce780912901dcf6fd808.jpg

Key Features

- Lifting Capacity: The "1.3T" designation indicates that this magnetic former is capable of supporting a lifting load of up to 1.3 tons. -…

Spherical Silica Market Insights 2024

Spherical Silica Market

The global Spherical Silica market was valued at US$ 637 million in 2023 and is anticipated to reach US$ 957 million by 2030, witnessing a CAGR of 6.1% during the forecast period 2024-2030.

View Sample Report

https://reports.valuates.com/request/sample/QYRE-Auto-29K4553/Global_Spherical_Silica_Market_Insights_and_Forecast_to_2028

Report Scope

This report aims to provide a comprehensive presentation of the global market for Spherical Silica, with both quantitative and qualitative analysis, to help readers develop business/growth strategies, assess the market competitive situation,…

Complete Spherical Graphite Market Analysis & Forecast 2023-2031

Growth Market Reports has recently published a comprehensive report entitled Global Spherical Graphite Market focusing to offer a complete overview of the market. This report provides a latest updated information regarding various crucial aspects of the market, which are expected to have a major impact on the market trend and performance during the forecast period.

One key aspect is that the report is prepared in such a manner that it…