Press release

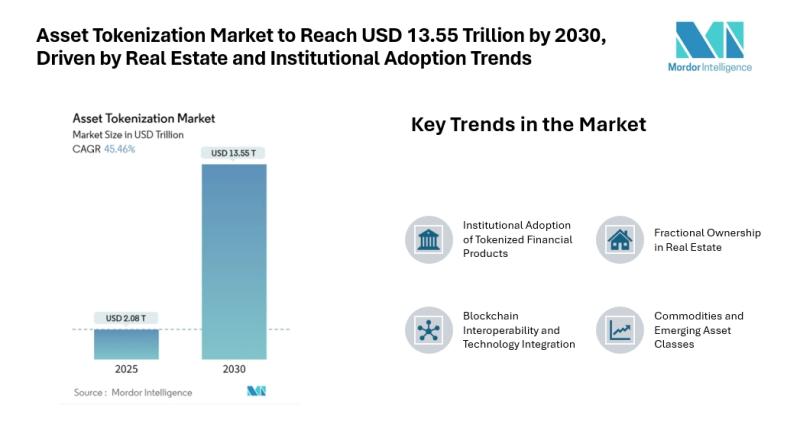

Asset Tokenization Market to Reach USD 13.55 Trillion by 2030, Driven by Real Estate and Institutional Adoption Trends

Mordor Intelligence has published a new report on the Asset Tokenization Market, offering a comprehensive analysis of trends, growth drivers, and future projections.Asset Tokenization Market Overview

The Asset Tokenization Market [https://www.mordorintelligence.com/industry-reports/asset-tokenization-market?utm_source=abnewswire] is valued at USD 2.08 trillion in 2025 and is forecast to climb to USD 13.55 trillion by 2030 at a 45.46% CAGR, underscoring how digital representations of real-world assets are reshaping global capital formation. Key drivers include regulatory clarity, rising institutional adoption, fractional ownership models, and the integration of blockchain interoperability protocols, all contributing to the Asset Tokenization Market share.

In addition to growth in market size, evolving Asset Tokenization Market trends are shaping investor behavior and industry dynamics.

Key Trends in the Asset Tokenization Market

1. Institutional Adoption of Tokenized Financial Products Institutional investors are shifting capital to tokenized money-market and fixed-income products, driving adoption and prompting custodians and asset managers to support infrastructure, boosting Asset Tokenization Market share.

2. Fractional Ownership in Real Estate Fractional ownership in real estate tokenization lowers entry barriers, boosts participation, enhances transparency, promotes secondary liquidity, and benefits from crowdfunding regulations, supporting growth in retail-accessible tokenized properties.

3. Blockchain Interoperability and Technology Integration Blockchain interoperability and ISO-20022 integration enable seamless cross-chain transactions, improve reconciliation, reduce settlement risk, increase efficiency, and support wider adoption of tokenized assets in the market.

4. Commodities and Emerging Asset Classes Commodities tokenization, including carbon credits and precious metals, offers new investment opportunities, helping companies hedge ESG obligations and inflation, with compliant platforms favored by top banks and institutions.

Check out more details and stay updated with the latest industry trends, including the Japanese version for localized insights: https://www.mordorintelligence.com/ja/industry-reports/asset-tokenization-market?utm_source=abnewswire

Asset Tokenization Market Segmentation

*

By Asset Class:

*

Real Estate

*

Debt Instruments

*

Investment Funds

*

Private Equity

*

Public Equity

*

Commodities

*

By Investor Type:

*

Institutional Investors

*

Accredited Retail Investors

*

Retail Investors

*

By Tokenization Platform Type:

*

Permissioned (Private) Blockchains

*

Permissionless (Public) Blockchains

*

Hybrid Models

*

By Offering:

*

Tokenization Platforms / Middleware

*

Smart-Contract Development and Audit

*

Custody and Wallet Services

*

Compliance and Legal-Tech Services

*

Secondary Trading and Exchanges

*

By Geography:

North America:

*

United States

*

Canada

*

Mexico

South America:

*

Brazil

*

Argentina

*

Rest of South America

Europe:

*

Germany

*

United Kingdom

*

France

*

Italy

*

Spain

*

Russia

*

Rest of Europe

Asia-Pacific:

*

China

*

Japan

*

India

*

South Korea

*

Australia and New Zealand

*

Rest of Asia-Pacific

Middle East and Africa:

*

Middle East

*

Saudi Arabia

*

United Arab Emirates

*

Turkey

*

Rest of Middle East

*

Africa

*

South Africa

*

Nigeria

*

Egypt

*

Rest of Africa

Explore Our Full Library of Technology, Media and Telecom Research Industry Reports - https://www.mordorintelligence.com/market-analysis/technology-media-and-telecom?utm_source=abnewswire

Key Players in the Asset Tokenization Market

*

Securitize Markets, LLC - Provides end-to-end solutions for issuing and managing digital securities, enabling compliant tokenization of various asset classes.

*

tZERO Technologies - Offers a blockchain-based trading platform for tokenized securities, focusing on enhancing liquidity and transparency in digital asset markets.

*

Tokensoft Inc. - Delivers secure token issuance and management platforms for institutional and accredited investors, supporting compliance and secondary trading.

*

Polymath Research Inc. - Specializes in blockchain-based security token creation, providing tools for regulatory compliance and digital asset management.

*

Tokeny Solutions SA - Provides tokenization platforms for financial institutions, enabling compliant issuance, transfer, and management of digital securities.

Conclusion

The Asset Tokenization Market is set for continued growth, driven by technological integration, regulatory clarity, and rising institutional interest. Fractional ownership, cross-chain interoperability, and ISO-20022 adoption are key enablers that improve accessibility and efficiency, creating a favorable environment for both institutional and retail investors. These developments are reflected in current Asset Tokenization Market statistics, highlighting the expanding adoption and increasing liquidity of tokenized assets.

For more insights on Asset Tokenization Market, please visit the Mordor Intelligence Page: https://www.mordorintelligence.com/industry-reports/asset-tokenization-market?utm_source=abnewswire

Industry Related Reports:

[https://www.mordorintelligence.com/industry-reports/crypto-asset-management-market?utm_source=abnewswire]

The Crypto Asset Management Market is projected to grow from USD 1.66 billion in 2025 to USD 4.68 billion by 2030, at a CAGR of 23.03%. Growth is driven by increasing institutional adoption of digital assets and rising demand for secure, compliant portfolio management solutions. Enhanced regulatory clarity and innovative crypto investment products are also supporting market expansion.

[https://www.mordorintelligence.com/industry-reports/blockchain-technology-market?utm_source=abnewswire]

The Blockchain Technology Market is expected to grow from USD 24.46 billion in 2025 to USD 299.54 billion by 2030, at a CAGR of 65.0%. Key drivers include the adoption of blockchain for secure financial transactions and supply chain transparency, along with increasing enterprise investments in decentralized applications and digital infrastructure.

Digital Currency Market

The Digital Currency Market is projected to grow from USD 34.38 billion in 2025 to USD 60.78 billion by 2030, at a CAGR of 12.07%. Growth is driven by increasing adoption of blockchain-based payment systems and the rising interest of institutional investors. Expanding use cases in cross-border payments and regulatory clarity are also supporting market expansion.

Get more insights: https://www.mordorintelligence.com/industry-reports/digital-currency-market?utm_source=abnewswire

About Mordor Intelligence:

Mordor Intelligence is a trusted partner for businesses seeking comprehensive and actionable market intelligence. Our global reach, expert team, and tailored solutions empower organizations and individuals to make informed decisions, navigate complex markets, and achieve their strategic goals.

With a team of over 550 domain experts and on-ground specialists spanning 150+ countries, Mordor Intelligence possesses a unique understanding of the global business landscape. This expertise translates into comprehensive syndicated and custom research reports covering a wide spectrum of industries, including aerospace & defense, agriculture, animal nutrition and wellness, automation, automotive, chemicals & materials, consumer goods & services, electronics, energy & power, financial services, food & beverages, healthcare, hospitality & tourism, information & communications technology, investment opportunities, and logistics.

For any inquiries or to access the full report, please contact:

media@mordorintelligence.com

https://www.mordorintelligence.com/

Media Contact

Company Name: Mordor Intelligence Private Limited

Contact Person: Jignesh Thakkar

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=asset-tokenization-market-to-reach-usd-1355-trillion-by-2030-driven-by-real-estate-and-institutional-adoption-trends]

Phone: +1 617-765-2493

Address:11th Floor, Rajapushpa Summit, Nanakramguda Rd, Financial District, Gachibowli

City: Hyderabad

State: Telangana 500008

Country: India

Website: https://www.mordorintelligence.com/

Legal Disclaimer: Information contained on this page is provided by an independent third-party content provider. ABNewswire makes no warranties or responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you are affiliated with this article or have any complaints or copyright issues related to this article and would like it to be removed, please contact retract@swscontact.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Asset Tokenization Market to Reach USD 13.55 Trillion by 2030, Driven by Real Estate and Institutional Adoption Trends here

News-ID: 4218477 • Views: …

More Releases from ABNewswire

DUB Inhibitors Market to Surpass Multi-Billion-Dollar Milestone by 2040 Across 7 …

DUB Inhibitors Companies are InSilico Medicine, Molecure, KSQ Therapeutics, Roche, Mission Therapeutics, Cothera Bioscience, Asieris Pharmaceuticals, Tango Therapeutics, and others.

The DUB inhibitors market is set to witness consistent expansion, fueled by increasing focus on targeted protein degradation and the advancement of innovative oncology therapies. The rising burden of cancer and neurodegenerative conditions is further contributing to market growth. Moreover, the introduction of pipeline candidates such as ISM-3091 by InSilico Medicine,…

Ablation Devices Market to Reach USD 15,347.69 Million by 2032, Growing at 8.38% …

Global Ablation Devices Market Forecast 2025-2032 Highlights Strong Growth Momentum Across Oncology, Cardiology, and Pain Management Applications

The global Ablation Devices Market is poised for robust expansion, with market size projected to increase from USD 8,090.31 million in 2024 to USD 15,347.69 million by 2032, registering a strong CAGR of 8.38% during the forecast period (2025-2032). The steady growth trajectory reflects rising global demand for minimally invasive treatment modalities, technological innovation…

Balloon Valvuloplasty Device Market to Grow at 5.13% CAGR Through 2032, Driven b …

Balloon valvuloplasty device manufacturers include BD, PFM Medical ag, NuMED, Balton, TORAY INDUSTRIES, INC., Translumina, InterValve Medical, Inc., OSYPKA AG, SURETECH MEDICAL INC., simeks, and others.

The global Balloon Valvuloplasty Device Market is poised for steady expansion, projected to grow at a Compound Annual Growth Rate (CAGR) of 5.13% during the forecast period 2025-2032. Increasing prevalence of cardiovascular diseases (CVDs), rising adoption of minimally invasive cardiac procedures, technological advancements in interventional…

Insulin Resistance Pipeline Expands as 20+ Pharma Companies Progress Novel Thera …

DelveInsight's "Insulin Resistance - Pipeline Insight, 2026" report provides comprehensive insights about 20+ companies, including Corbus Pharmaceuticals Holdings, Inc., Kura Oncology, Inc, SCOHIA Pharma Inc, Atrogi, YUNOVIA CO.,LTD., PegBio, Eli Lilly and Company, Tonix Pharma, Pfizer, OrsoBio, Dompe Farmaceutici, GlaxoSmithKline, J. Uriach and Company, Boehringer Ingelheim, Genfit, Novartis, and others, developing 20+ pipeline drugs in the Insulin Resistance pipeline landscape.

DelveInsight's "Insulin Resistance - Pipeline Insight, 2026" report provides comprehensive insights…

More Releases for Asset

Klydex Global Inc Expands Asset Coverage with New Multi-Asset Listing Framework

The new listing structure accelerates asset onboarding and improves market diversification.

Colorado, United States, 1st Dec 2025 - Klydex Global, Inc introduced an expanded multi-asset listing framework that accelerates the onboarding of high-quality digital assets. The new structure enhances screening procedures, technical integration, and market-readiness evaluation to support global asset diversification.

Klydex Global, Inc announced the launch of its enhanced multi-asset listing framework, representing a significant step toward diversifying asset choices for…

Asset Performance Management Market Is Driven By Asset Performance Management In …

Asset Performance Management (APM) has emerged as a critical solution for industries aiming to enhance the performance, reliability, and efficiency of their assets. APM systems utilize data analytics, predictive maintenance, and monitoring technologies to optimize asset performance, minimize downtime, and maximize operational efficiency. The global Asset Performance Management market is characterized by key drivers and notable trends that are reshaping how industries manage and maintain their critical assets.

Download Free PDF…

Asset Management Software

In today's dynamic business landscape, efficient asset management is more critical than ever. Sunsmart Asset Management Software is designed to empower organizations of all sizes and industries to streamline their asset-related processes, enhance control, and maximize the value of their assets.

Key Features and Benefits:

Comprehensive Asset Tracking: Our software provides a centralized platform to track and manage assets, offering real-time visibility into asset location, condition, and history, reducing the risk of…

Asset Evaluation Service Market 2023-2030 Comprehensive Research Study and Stron …

Infinity Business Insights published a new research publication on Asset Evaluation Service Market Insights, to 2030 with 113+ pages and enriched with self-explained Tables and charts in presentable format. The worldwide Asset Evaluation Service market is expected to grow at a booming CAGR during 2023-2030. It also shows the importance of the Asset Evaluation Service market main players in the sector, including their business overviews, financial summaries, and SWOT assessments.

The…

Big Boom in Asset Recovery Software Market 2020-2027 |HPE , Terrapin Systems , C …

According to a report on Asset Recovery Software Market, recently added to the vast repository of Research N Reports, the global market is likely to gain significant impetus in the near future. The report, titled “Global Asset Recovery Software Market Research Report 2020,” further explains the major drivers manipulating industry, the possibility of development, and the challenges going up against the administrations and industrialists in the market. This research study…

Crypto Asset Management Market | Digital Asset Custody Company, Crypto Finance A …

Global Crypto Asset Management Market: Snapshot

The demand within the global market for crypto asset management has been rising on account of advancements in the field of crypto currency. The past years have been an era of advancements in the global digital industry and have paved way for several new technologies. In this stampede of digital transformations, crypto currency has emerged as a matter of discussion and recourse. Hence, the global…