Press release

Trade Finance Market Outlook to 2031 - Technological Innovations, Digital Platforms, and Sustainable Financing Transforming Global Commerce

The Global Trade Finance Market reached US$ 4.1 billion in 2022 and is expected to reach US$ 5.2 billion by 2030, growing with a CAGR of 3.0% during the forecast period 2024-2031.📌 Download your Exclusive Sample Report Today: (Corporate Email gets priority access):- https://datamintelligence.com/download-sample/trade-finance-market?kb

☛ Trade Finance Market Recent Developments 2025:

United States: Recent Industry Developments

✅ In July 2025, Citi expanded its digital trade finance platform in New York, enabling faster processing of letters of credit and cross-border payments. The platform leverages AI to improve risk assessment and reduce transaction times.

✅ In June 2025, JPMorgan Chase partnered with major U.S. exporters to implement blockchain-based trade finance solutions. The system enhances transparency, minimizes fraud risks, and accelerates international trade settlements.

✅ In May 2025, Bank of America launched an innovative supply chain trade finance program for SMEs in California. The initiative provides early payment options and working capital support, helping small businesses scale globally.

Japan: Recent Industry Developments

✅ In July 2025, MUFG Bank introduced a digital trade finance platform in Tokyo, integrating automated document verification for importers and exporters. The platform streamlines cross-border transactions and reduces processing errors.

✅ In June 2025, Sumitomo Mitsui Banking Corporation partnered with logistics providers to implement end-to-end trade finance solutions. The program ensures real-time monitoring of goods and payments, enhancing efficiency in supply chains.

✅ In May 2025, Mizuho Financial Group launched blockchain-enabled trade finance services for Japanese SMEs. The initiative facilitates secure and transparent international trade, supporting Japan's export-driven economy.

📌 Get Customization in the report as per your requirements:: https://datamintelligence.com/customize/trade-finance-market?kb

☛ Trade Finance Market: Drivers

The trade finance market is experiencing significant growth as globalization and international trade continue to expand. Businesses are increasingly seeking financing solutions to manage cross-border transactions, mitigate payment risks, and ensure smooth supply chain operations. Advances in digital platforms, blockchain technology, and automated documentation are enhancing efficiency, transparency, and security in trade finance processes. Rising demand for letters of credit, guarantees, and factoring services is supporting trade liquidity and operational continuity. Regulatory frameworks and standardization by financial institutions are further promoting market adoption and trust.

Growing emphasis on risk management and working capital optimization is driving companies to leverage trade finance solutions for better cash flow control. Fintech innovations are enabling real-time monitoring, predictive analytics, and seamless transaction execution across global networks. Strategic partnerships between banks, corporates, and technology providers are accelerating the deployment of integrated trade finance platforms. Expansion of emerging market trade and e-commerce is creating new financing opportunities for SMEs and multinational corporations alike. With ongoing digitalization and increasing global trade volumes, the trade finance market is poised for sustained growth.

☛ Trade Finance Market: Major Players

Oracle, Finastra, Surecomp, China Systems, Intellect Design Arena, iGTB (Intellect Global Transaction Banking), MITech, Innover Systems, CGI Trade360 and Cognizant.

Research Methodology

We follow a hybrid research approach, combining qualitative insights with rigorous quantitative analysis to deliver reliable and comprehensive market intelligence. Our process begins with extensive secondary research, drawing on trusted industry reports, proprietary databases, and credible market sources. This is then reinforced through targeted primary research, including structured surveys and in-depth interviews with industry leaders, subject matter experts, and key market participants.

☛ Segments Covered in the Trade Finance Market:

By Product: Letters of Credit, Export Factoring, Insurance, Bill of Lading, Guarantees, Others.

By Finance: Structured Trade Finance, Supply Chain Finance, Traditional Trade Finance.

By Service Provider: Banks, Trade Finance Houses, Others.

By End-User: End-User, Large Enterprises, Small & Medium Enterprises.

📌 Get Corporate Access to Live Trade Finance Industry Intelligence Database: https://www.datamintelligence.com/buy-now-page?report=trade-finance-market

☛ Regional Analysis for Trade Finance Market:

⇥ North America (U.S., Canada, Mexico)

⇥ Europe (U.K., Italy, Germany, Russia, France, Spain, The Netherlands and Rest of Europe)

⇥ Asia-Pacific (India, Japan, China, South Korea, Australia, Indonesia Rest of Asia Pacific)

⇥ South America (Colombia, Brazil, Argentina, Rest of South America)

⇥ Middle East & Africa (Saudi Arabia, U.A.E., South Africa, Rest of Middle East & Africa)

📌 Request for 2 Days FREE Trial Access: https://www.datamintelligence.com/reports-subscription

☛ Power your decisions with real-time competitor tracking, strategic forecasts, and global investment insights all in one place.

✅ Competitive Landscape

✅ Sustainability Impact Analysis

✅ KOL / Stakeholder Insights

✅ Unmet Needs & Positioning, Pricing & Market Access Snapshots

✅ Market Volatility & Emerging Risks Analysis

✅ Quarterly Industry Report Updated

✅ Live Market & Pricing Trends

✅ Import-Export Data Monitoring

☛ Have a look at our Subscription Dashboard: https://www.youtube.com/watch?v=x5oEiqEqTWg

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Trade Finance Market Outlook to 2031 - Technological Innovations, Digital Platforms, and Sustainable Financing Transforming Global Commerce here

News-ID: 4217431 • Views: …

More Releases from DataM Intelligence 4market Research LLP

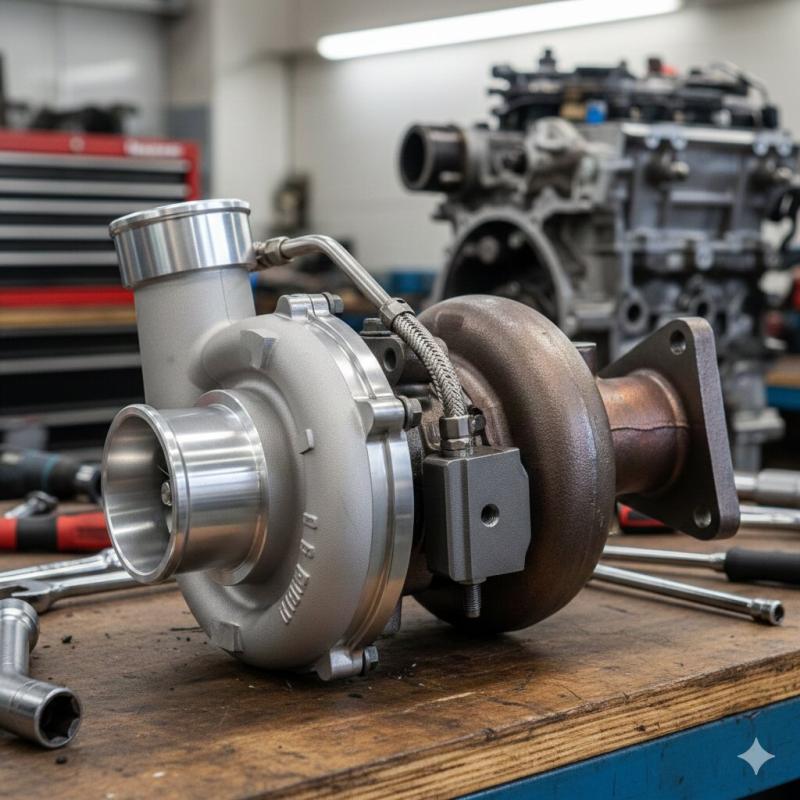

Automotive Turbocharger Market to Reach USD 16.5 Billion by 2030 at 10.3% CAGR, …

The Automotive turbocharger market reached USD 13.5 billion in 2022 and is expected to reach USD 16.5 billion by 2030, growing with a CAGR of 10.3% from 2023 to 2030. as vehicle manufacturers increasingly adopt turbocharging technology to enhance engine efficiency, performance, and emissions compliance.

Growth is supported by rising demand across key vehicle segments including passenger cars, commercial vehicles, and light-duty trucks, driven by stringent fuel economy and regulatory…

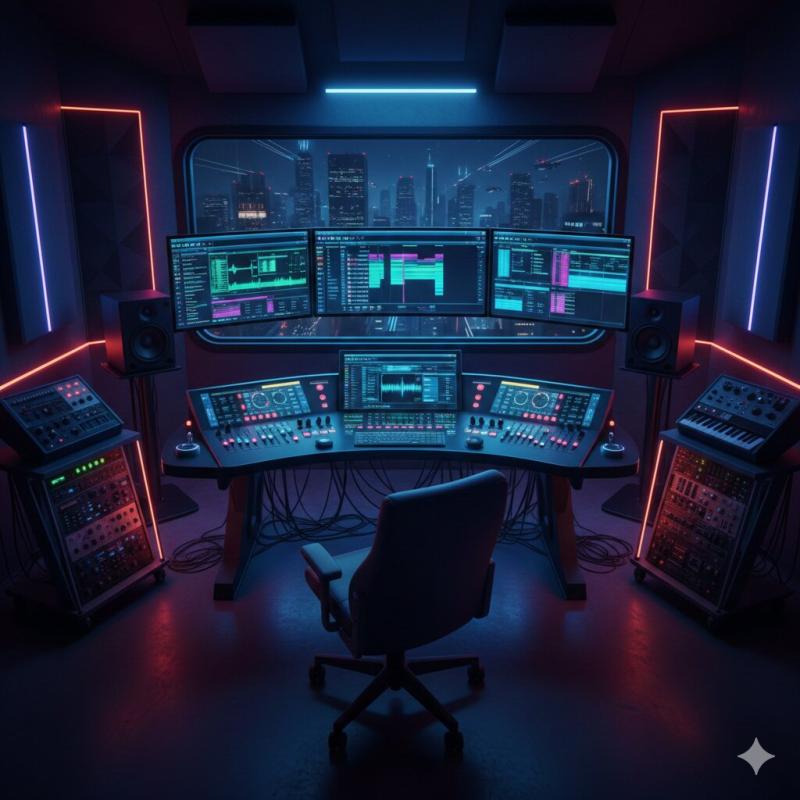

Digital Audio Workstation Market to Reach US$ 7.3 Billion by 2029 at 16.1% CAGR, …

The Digital Audio Workstation (DAW) Market reached approximately US$ 3.3 billion in 2024 and is expected to grow to around US$ 7.3 billion by 2029, expanding at a CAGR of about 16.1% from 2025 to 2029 as demand for advanced music production, sound design, and audio editing solutions continues to rise across professional and consumer segments.

Growth is supported by increasing adoption across key application areas such as music production, post-production,…

Fracture Fixation Products Market to Reach US$ 16.34 Billion by 2031 at 7.8% CAG …

The Global Fracture Fixation Products Market reached US$ 9.1 billion in 2023 and is expected to reach US$ 16.34 billion by 2031, growing at a CAGR of 7.8% from 2024 to 2031 as orthopedic care providers and surgical centers increasingly adopt advanced fixation solutions to improve patient outcomes and reduce recovery time.

Growth is supported by rising demand across key product segments such as plates & screws, intramedullary nails, external…

LNG Storage Tank Market to Reach USD 6.7 Billion by 2030 Driven by Rising LNG In …

The LNG Storage Tank Market reached USD 4.5 billion in 2022 and is expected to reach USD 6.7 billion by 2030, growing at a CAGR of 5.5% during the forecast period 2024-2031.

Growth is driven by increasing global demand for liquefied natural gas (LNG) as a cleaner alternative to conventional fossil fuels, particularly in power generation, industrial applications, and transportation. Rising investments in LNG infrastructure, including terminals, regasification facilities, and storage…

More Releases for Finance

Consumer Finance Market to Witness Revolutionary Growth by 2030 | Bajaj Capital, …

Global "Consumer Finance Market" Research report is an in-depth study of the market Analysis. Along with the most recent patterns and figures that uncovers a wide examination of the market offer. This report provides exhaustive coverage on geographical segmentation, latest demand scope, growth rate analysis with industry revenue and CAGR status. While emphasizing the key driving and restraining forces for this market, the report also offers a complete study of…

Big Boom in Environmental Finance Market 2020-2027 | Environmental Finance (Fult …

According to a report on Environmental Finance Market, recently added to the vast repository of Research N Reports, the global market is likely to gain significant impetus in the near future. The report, titled “Global Environmental Finance Market Research Report 2020,” further explains the major drivers manipulating industry, the possibility of development, and the challenges going up against the administrations and industrialists in the market. This research study portrays an…

PLATINUM GLOBAL BRIDGING FINANCE - BRIDGING FINANCE, DEVELOPMENT FINANCE AND COM …

If your business is looking to finance bridging, development or commercial financing we have contacts with lenders and banks in over 25 countries around the world. Our specialist knowledge can help you get the ideal financing in place.

Platinum Global Bridging Finance is a specialist bridging loan lender. They deliver the loan financing that suits you and your clients desired financing. Their aim is to be crystal clear, so they offer…

Global Environmental Finance Market Leading Players are Environmental Finance (F …

Global Environmental Finance Market Insights, Size, Share, Forecast to 2025

This report studies the Environmental Finance Market size by players, regions, product types and end industries, history data 2013-2017 and forecast data 2019-2025; this report also studies the global market competition landscape, market drivers and trends, opportunities and challenges, risks and entry barriers, sales channels, distributors and Porter's Five Forces Analysis.

The main goal for the dissemination of this information is to…

Global Consumer Finance Services Market Forecast to 2025, Top Key Players- Bajaj …

The Consumer Finance Services Market Research Report is a valuable source of insightful data for business strategists. It provides the Consumer Finance Services overview with growth analysis and historical & futuristic cost, revenue, demand and supply data (as applicable). The research analysts provide an elaborate description of the value chain and its distributor analysis. This Consumer Finance Services market study provides comprehensive data which enhances the understanding, scope and application…

Why Consumer Finance Market is Growing Worldwide? Watch out by top key players B …

The split of retail banking that deals with lending money to consumers.

Consumer finance market is growing due to increasing per capita income, high economic growth, rapid urbanization and rise in consumer spending power. Rising consumer favorite towards the use of credit cards owing to the associated benefits related to it such as reward points and a host of promotional offers like movie tickets, discounts on flight bookings etc., is likely…