Press release

Algorithmic Trading Market Growth to Make Great Impact in near Future

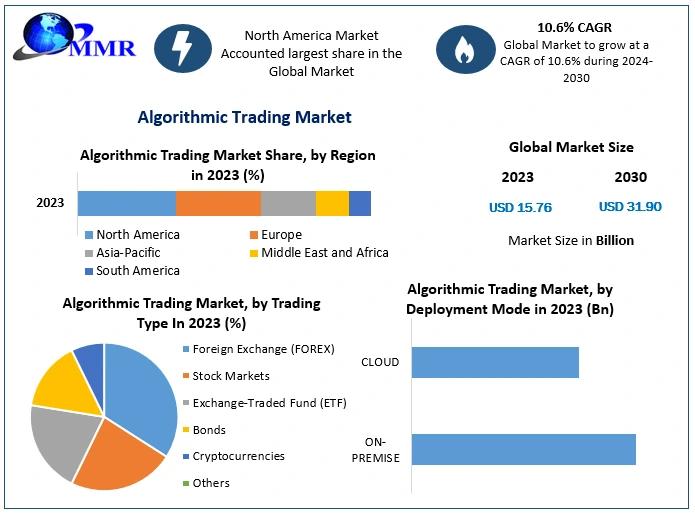

Global Algorithmic Trading Market size was valued at USD 15.76 Bn. in 2023 and the total Algorithmic Trading revenue is expected to grow by 10.6 % from 2024 to 2030, reaching nearly USD 31.90 Bn.Algorithmic Trading Market Overview:

The algorithmic trading market refers to the use of computer programs and mathematical models to make trading decisions, execute orders, and manage portfolios at speeds and frequencies beyond human capability. These systems leverage vast datasets, pattern recognition, statistical techniques, and increasingly artificial intelligence to identify opportunities, reduce human error, and improve execution efficiency. As global financial markets become more interconnected and volumes of data expand, algorithmic trading has evolved from niche high-frequency trading setups to mainstream tools employed by institutional investors, hedge funds, asset managers, and even retail traders. The primary drivers include cost reduction, speed, liquidity provision, and the ability to process market signals that are invisible to the naked eye.

Download a Free Sample Report Today: https://www.maximizemarketresearch.com/request-sample/29843/

Algorithmic Trading Market Outlook and Future Trends:

Looking ahead, the algorithmic trading market is poised for strong growth anchored by advances in AI, machine learning, and computational infrastructure. Models that incorporate alternative data-from social media sentiment to satellite imagery-are expected to become more prevalent. Cloud-based solutions will continue reducing barriers to entry, enabling smaller firms and retail traders to access powerful tools. Regulatory scrutiny will also intensify, especially around risk control, market fairness, latency, and systemic stability. Furthermore, cross-asset and cross-market strategies, as well as automated approaches sensitive to environmental, social, and governance (ESG) factors, are likely to shape new investment paradigms.

Algorithmic Trading Market Dynamics:

The dynamics of algorithmic trading are shaped by a mix of technological, regulatory, and competitive forces. On the technology front, improvements in hardware (e.g. GPUs, specialized processors), faster networks, and real-time data analytics are lowering latency and boosting performance. From the regulation side, authorities are increasingly defining clearer norms for order tagging, algorithm approval, audit trails, and compliance to prevent abuse and ensure market integrity. Competitive pressure is high: firms must innovate constantly to develop novel strategies or optimize execution costs, as gains can erode quickly when strategies become crowded. Also, volatility and market microstructure shifts create both risk and opportunity, forcing algorithm developers to adapt their models continuously.

Algorithmic Trading Market Key Recent Developments:

In recent times, several notable developments have shaped the landscape. For example, regulators in India (SEBI) have introduced or proposed tighter rules for algo trading by retail investors, including requirements for each algorithm to be approved, orders to be tagged uniquely, and registration of API-based strategies. Reuters+2Reuters+2 In the UK, the Financial Conduct Authority has flagged deficiencies in firm governance, documentation, and risk controls among algo trading firms. Fn London+1 On the technology front, firms are pushing machine learning and adaptive models-such as reinforcement learning and imitation learning-to handle diverse market regimes and reduce fragility under stress. Also, cloud deployment of trading platforms is increasing, giving access to scalable compute and data resources.

Algorithmic Trading Market Regional Insights:

Geographically, North America remains the dominant market, supported by deep financial markets, robust infrastructure, large institutional participants, and favorable regulatory environments. Asia-Pacific is emerging as the fastest-growing region, with countries like China, India, Japan, Singapore investing heavily in both fintech infrastructure and regulatory reforms to support more sophisticated algorithmic trading.

To Gain More Insights into the Market Analysis, Browse Summary of the Research Report: https://www.maximizemarketresearch.com/request-sample/29843/

Algorithmic Trading Market Segmentation:

by Trading Type

Foreign Exchange (FOREX)

Stock Markets

Exchange-Traded Fund (ETF)

Bonds

Cryptocurrencies

Others

by Deployment Mode

ON-PREMISE

CLOUD

Some of the current players in the Algorithmic Trading Market are:

1. Algo Trader GmbH (Switzerland)

2. Trading Technologies (USA)

3. Info Reach (USA)

4. Tethys Technology (USA)

5. Lime Brokerage LLC (USA)

6. Flex Trade Systems (USA)

7. Tower Research Capital (USA)

8. Virtu Financial (USA)

9. Hudson River Trading (USA)

10. Citadel (USA)

For additional reports on related topics, visit our website:

Global Virtual Fitting Room Market https://www.maximizemarketresearch.com/market-report/global-virtual-fitting-room-market/29023/

Global Reciprocating Compressor Market https://www.maximizemarketresearch.com/market-report/global-reciprocating-compressor-market/57089/

Virtual Office Market https://www.maximizemarketresearch.com/market-report/global-virtual-office-market/113811/

Sports Simulators Market https://www.maximizemarketresearch.com/market-report/global-sports-simulators-market/81518/

Global EInvoicing Market https://www.maximizemarketresearch.com/market-report/global-e-invoicing-market/31243/

Contact Maximize Market Research:

3rd Floor, Navale IT Park, Phase 2

Pune Banglore Highway, Narhe,

Pune, Maharashtra 411041, India

sales@maximizemarketresearch.com

About Maximize Market Research:

Maximize Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include medical devices, pharmaceutical manufacturers, science and engineering, electronic components, industrial equipment, technology and communication, cars and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Algorithmic Trading Market Growth to Make Great Impact in near Future here

News-ID: 4217173 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD.

Morocco Cosmetics Market Poised for Robust Growth, Projected to Reach USD 3.59 B …

Global Morocco Cosmetics Market Overview

The Global Morocco Cosmetics Market is witnessing significant expansion, driven by rising consumer awareness regarding personal grooming, skincare, and wellness. Valued at USD 1.82 billion in 2024, the market is projected to grow at a strong compound annual growth rate (CAGR) of 7.92% from 2024 to 2032, reaching nearly USD 3.59 billion by the end of the forecast period. This steady growth reflects increasing demand for…

Virtual Fitting Room Market to Reach US$ 19.32 Billion by 2030, Driven by Rapid …

The Global Virtual Fitting Room Market is witnessing remarkable growth, fueled by the rapid digital transformation of the fashion and retail industry. Valued at US$ 5.20 billion in 2023, the market is projected to expand at a robust compound annual growth rate (CAGR) of 20.6% from 2024 to 2030, reaching nearly US$ 19.32 billion by 2030. This strong growth trajectory reflects increasing investments in immersive technologies, rising e-commerce penetration, and…

Car Care Products Market to Reach USD 18.02 Billion by 2032, Growing at a CAGR o …

The global car care products market is witnessing steady expansion, driven by rising vehicle ownership, increasing consumer awareness about vehicle maintenance, and rapid technological innovations. According to recent industry analysis, the market was valued at USD 13.96 billion in 2024 and is projected to reach USD 18.02 billion by 2032, registering a compound annual growth rate (CAGR) of 4.2% during the forecast period. This growth reflects the increasing importance of…

Car Care Products Market to Reach USD 18.02 Billion by 2032, Growing at a CAGR o …

The global car care products market is witnessing steady expansion, driven by rising vehicle ownership, increasing consumer awareness about vehicle maintenance, and rapid technological innovations. According to recent industry analysis, the market was valued at USD 13.96 billion in 2024 and is projected to reach USD 18.02 billion by 2032, registering a compound annual growth rate (CAGR) of 4.2% during the forecast period. This growth reflects the increasing importance of…

More Releases for Trading

Algorithmic Trading Market Showing Impressive Growth : Hudson River Trading, Jum …

The competitive landscape which incorporates the Algorithmic Trading Market ranking of the major players, along with new service/product launches, partnerships, business expansions and acquisitions in the past five years of companies profiled are also highlighted in the Algorithmic Trading Market report. Extensive company profiles comprising of company overview, company insights, product benchmarking and SWOT analysis for the major Algorithmic Trading Market players.

Top 10 key companies…

Increasing Awareness about Algorithmic Trading Market In Coming Years By Virtu F …

Global Algorithmic Trading Industry 2019 Research report provides information regarding market size, share, trends, growth, cost structure, capacity, revenue and forecast 2025. This report also includes the overall and comprehensive study of the Algorithmic Trading market with all its aspects influencing the growth of the market. This report is exhaustive quantitative analyses of the Algorithmic Trading industry and provides data for making Strategies to increase the market growth and effectiveness.

Algorithmic…

Algorithmic Trading Market 2024 SWOT Analysis by Key Players like Virtu Financia …

Algorithmic trading is a method of executing a large order (too large to fill all at once) using automated pre-programmed trading instructions accounting for variables such as time, price, and volume to send small slices of the order (child orders) out to the market over time. Algorithmic Trading are mainly used in investment banks, pension funds, mutual funds, hedge funds, etc.

Key trend which will predominantly effect the market in coming…

Automated Trading Market By Top Key Players- Citadel, KCG, Optiver, DRW Trading, …

The report "Automated Trading Market - Global Industry Analysis, Size, Share, Growth, Trends and Forecast 2016 - 2024", has been prepared based on an in-depth market analysis with inputs from industry experts.

An automated trading system, also referred to as mechanical trading system or algorithmic trading system, enables vendors to set up specific rules for money management, trade entries, and trade exits. Automated trading systems are generally programmed in a way…

Search4Research Announced Algorithmic Trading Market Forecast to 2024 - Virtu Fi …

Algorithmic trading is a method of executing a large order (too large to fill all at once) using automated pre-programmed trading instructions accounting for variables such as time, price, and volume to send small slices of the order (child orders) out to the market over time.

Algorithmic Trading Market provides a detail overview of latest technologies and in-depth analysis that reflect top vendor’s portfolios and technology; examines the strategic planning, challenges…

Algorithmic Trading Market 2019 | Flow Traders, Jump Trading, Spot Trading, DRW …

Global Algorithmic Trading market is also presented to the readers as a holistic snapshot of the competitive landscape within the given forecast period. The report also educates about the market strategies that are being adopted by your competitors and leading organizations. The report also focuses on all the recent industry trends. It presents a comparative detailed analysis of the all regional and player segments, offering readers a better knowledge of…