Press release

United States Digital Banking Solution Market 2025-2032: Competitive Landscape, Key Players, and Strategic Growth Insights

The Global Digital banking solution market size reached US$ 13.04 billion in 2024 and is expected to reach US$ 24.96 billion by 2032, growing with a CAGR of 8.62% during the forecast period 2025-2032.The Digital Banking Solution Market is growing due to the rising adoption of online banking, increased smartphone usage, and demand for faster, secure, and convenient financial services.-Recent Launches in U.S Market-Jenius Bank launched its U.S. digital consumer banking business on May 19, 2025, offering personal loans and a mobile app without the need for physical branches. Additionally, on September 10, 2025, Alkami Technology introduced a Digital Banking Conversion Toolkit to help U.S. financial institutions evaluate and implement digital banking conversions efficiently.

-Recent Launches in Japan Market-Sony Bank completed a full shift to a cloud-native core banking system in May 2025, enhancing the bank's flexibility, scalability, and digital service offerings. Furthermore, on October 2, 2025, MUFG Bank adopted Minna Bank's cloud-native core system for its new digital bank, marking a significant step in Japan's digital banking evolution.

📌 Download your Sample Report Instantly - Corporate Email ID required for priority access:-https://www.datamintelligence.com/download-sample/aluminum-beverage-can-market?oppratik

Market Segmentation-

✅ By Deployment Type:

-Cloud-Based Solutions: Digital banking platforms hosted on cloud infrastructure, offering scalability, real-time updates, and lower IT costs for banks and financial institutions.

-On-Premise Solutions: Traditional deployment within a bank's own IT infrastructure, providing higher control and security for sensitive financial data.

✅ By Component:

-Software: Core banking software, mobile banking apps, and digital wallets that enable seamless online banking services.

-Services: Consulting, implementation, and maintenance services to support digital banking adoption and ensure smooth operation.

✅ By End-User:

-Retail Banks: Banks offering consumer-facing digital services, including mobile apps, online accounts, and personal finance management tools.

-Corporate & Investment Banks: Banks providing digital solutions for business accounts, payments, lending, and investment management.

-Fintech Companies: Technology-driven firms offering innovative digital banking solutions, peer-to-peer payment platforms, and neobanking services.

-Other Financial Institutions: Credit unions, microfinance institutions, and non-banking financial companies adopting digital banking technologies.

Recent development :-

October 8, 2025:- India's Reserve Bank (RBI) launched a retail sandbox for its Central Bank Digital Currency , enabling fintech companies to develop and test innovative solutions under the ongoing pilot program.

October 6, 2025:- Fujitsu Limited and Sony Bank announced the integration of generative AI into the system development for Sony Bank's new core banking platform, enhancing operational efficiency and customer experience.

September 25, 2025:- Apiture was recognized as a market leader in the Javelin Strategy & Research 2025 Small Business Digital Banking Vendor Scorecard, earning top scores in administration, portfolio management, functionality, user experience, and strategic direction.

September 10, 2025:- Alkami Technology launched a first-to-market, research-backed Digital Banking Conversion Toolkit, providing financial institutions with templates, actionable resources, and best practices to evaluate and implement digital banking solutions effectively.

-Speak to Our Senior Analyst and Get Customization in the report as per your requirements:-https://www.datamintelligence.com/customize/aluminum-beverage-can-market?oppratik

Market Drivers:-

- Increasing smartphone penetration and internet access are driving the demand for mobile and online banking services worldwide.

- Customers prefer fast, secure, and 24/7 banking solutions, fueling digital platform adoption.

-Governments and regulators globally are promoting digital banking initiatives and frameworks.

- Banks are adopting digital solutions to reduce operational costs, streamline processes, and improve service delivery.

- AI, blockchain, and cloud technologies are enabling personalized, secure, and scalable banking services.

Market key players

-Ally Financial

-Revolut

-Fujitsu Limited

-Zoho

-Temenos

-Finacle (by Infosys)

-Finastra

-FIS

-Backbase

-Oracle FLEXCUBE

-Buy Now & Unlock 360° Market Intelligence:-https://www.datamintelligence.com/buy-now-page?report=aluminum-beverage-can-market?oppratik

Benefits of the report:-

-Provides comprehensive insights into global and regional next-generation solar cell markets.

-Highlights key players and their innovations in perovskite, quantum dot, and thin-film technologies.

-Offers market segmentation by technology, application, and region for targeted strategies.

-Covers recent developments, product launches, and emerging trends.

-Supports strategic decision-making, investment planning, and competitive benchmarking.

-Includes policy and regulatory insights impacting market growth.

📌 Request for 2 Days FREE Trial Access: https://www.datamintelligence.com/reports-subscription

☛ Power your decisions with real-time competitor tracking, strategic forecasts, and global investment insights all in one place.

✅ Competitive Landscape

✅ Sustainability Impact Analysis

✅ KOL / Stakeholder Insights

✅ Unmet Needs & Positioning, Pricing & Market Access Snapshots

✅ Market Volatility & Emerging Risks Analysis

✅ Quarterly Industry Report Updated

✅ Live Market & Pricing Trends

✅ Import-Export Data Monitoring

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release United States Digital Banking Solution Market 2025-2032: Competitive Landscape, Key Players, and Strategic Growth Insights here

News-ID: 4215952 • Views: …

More Releases from DataM intelligence 4 Market Research LLP

Adaptive Robotics Market Set for Explosive Growth at 27.20% CAGR Through 2031, L …

The Global Adaptive Robotics Market is expected to grow at a CAGR of 27.20% during the forecast period (2024-2031).

Market growth is driven by surging demand for flexible automation in manufacturing and logistics, integration of AI and machine learning for real-time adaptability, and labor shortages boosting adoption of collaborative robots. Advancements in sensor technologies, expanding applications in healthcare and agriculture, rising investments in Industry 4.0 initiatives, and regulatory support for safe…

Laboratory Equipment Market Set for Steady Growth to USD 96.1 Billion by 2031, L …

Leander Texas -

The global Laboratory equipment market reached US$ 53.1 billion in 2023 and is expected to reach US$ 96.1 billion by 2031, growing at a CAGR of 7.7% during the forecast period 2024-2031.

The market's strong growth is fueled by rising R&D investments and advanced automation adoption in the U.S. healthcare and biotech sectors, alongside strategic expansions and technology partnerships by major lab equipment firms in Japan, which are enhancing…

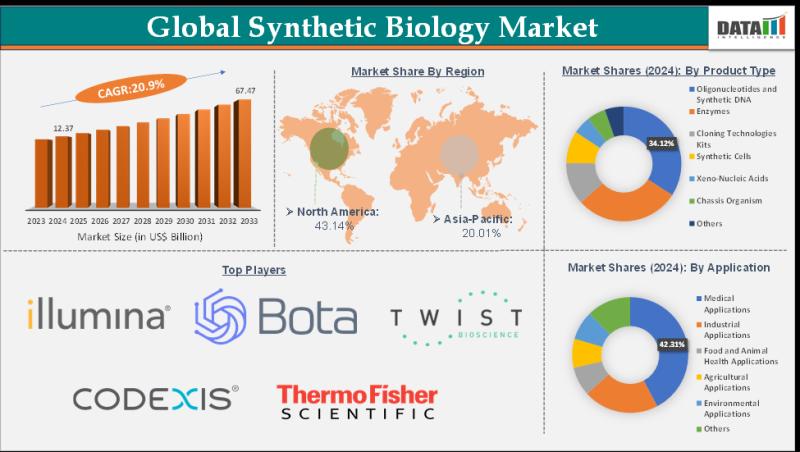

Synthetic Biology Market Set for Explosive Growth to US$ 67.47 Billion by 2033, …

The Global Synthetic Biology Market size reached US$ 12.37 Billion in 2024 from US$ 10.38 Billion in 2023 and is expected to reach US$ 67.47 Billion by 2033, growing at a CAGR of 20.9% during the forecast period 2025-2033.

Market growth is driven by surging demand for sustainable biofuels and biomaterials, rapid advancements in gene editing tools like CRISPR, and expanding applications in healthcare for personalized medicine and biologics production. Rising…

Solid-State Battery Market Set for Explosive Growth to US$ 33.35 Billion by 2033 …

The Solid-State Battery Market reached US$ 2.02 billion in 2024 and is expected to reach US$ 33.35 billion by 2033, growing at a robust CAGR of 36.2% during the forecast period 2025-2033.

Market growth is driven by surging electric vehicle (EV) adoption, demand for higher energy density and safer batteries over traditional lithium-ion, and advancements in solid electrolytes like sulfide, oxide, and polymer types. Rapid commercialization efforts by companies such as…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…