Press release

Sustainable Finance Market to Reach USD 5 Trillion by 2032 | Latest Trends, Growth Drivers, and Global Investment Insights for 2025

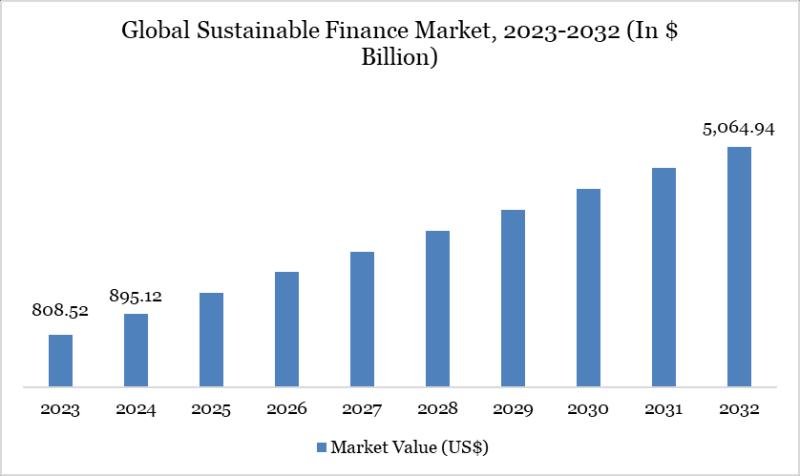

Market Size and Growth :The Global Sustainable Finance Market reached US$ 895.12 billion in 2024 and is projected to grow rapidly to US$ 5,064.94 billion by 2032, with a strong CAGR of 24.19% during the forecast period from 2025 to 2032. This growth is driven by increasing investor interest in environmentally and socially responsible investments, supportive government policies, and the rise of ESG-focused funds and green bonds. Major markets in North America and Europe play a leading role, while institutional commitments and innovative financial products continue to advance the transition toward a sustainable economy, making sustainable finance a key driver of global economic and environmental progress.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://www.datamintelligence.com/download-sample/sustainable-finance-market?sai-v

Key Development :

United States - Sustainable Finance

✅ Key Developments

✅ June 2025 - Green bond issuance declined amid regulatory uncertainty and reduced corporate disclosures.

✅ March 2025 - Wells Fargo revised its net-zero financed emissions goal amid evolving sustainability policies.

✅ November 2024 - JPMorgan reported a stronger green-to-high-carbon finance ratio, committing $1 trillion for climate solutions.

Japan - Sustainable Finance

✅ Key Developments

✅ October 2025 - Japan designated new offshore wind zones to boost renewable energy investment.

✅ September 2025 - The Finance Ministry launched a new JBIC facility to support $550 billion in sustainable investments.

✅ July 2025 - MUFG and JICA created a Sustainable Finance Framework to fund green and social projects in Asia.

✅ June 2025 - Japan's GX Roundtable advanced transition finance under the Green Transformation roadmap.

✅ April 2025 - MUFG appointed its first global sustainability head to strengthen sustainable finance operations.

✅ February 2024 - Japan issued its first sovereign transition bond to support the clean energy shift.

✅ Mergers & Acquisitions

✅ July 2025 - Mizuho acquired Augusta & Co., a clean energy advisory firm, to enhance its ESG finance capabilities.

The Finance Market refers to a broad ecosystem where individuals, companies, and governments trade financial instruments such as stocks, bonds, currencies, and commodities. It facilitates capital flow, investment, and wealth creation, playing a crucial role in global economic stability and growth through various segments like capital markets, money markets, and derivatives.

Key Players :

The major global players in the market include BlackRock, Inc., HSBC Holdings plc, The Goldman Sachs Group, Inc., Morgan Stanley, BNP Paribas S.A., Amundi S.A., The Vanguard Group, Inc., State Street Global Advisors, Inc., UBS Group AG, and Triodos Bank N.V.

Growth Forecast Projected:

The Global Sustainable Finance Market is anticipated to rise at a considerable rate during the forecast period, between 2024 and 2031. In 2023, the market is growing at a steady rate, and with the rising adoption of strategies by key players, the market is expected to rise over the projected horizon.

Research Process :

Both primary and secondary data sources have been used in the global Sustainable Finance Market research report. During the research process, a wide range of industry-affecting factors are examined, including governmental regulations, market conditions, competitive levels, historical data, market situation, technological advancements, upcoming developments, in related businesses, as well as market volatility, prospects, potential barriers, and challenges.

Buy Now & Unlock 360° Market Intelligence: https://www.datamintelligence.com/buy-now-page?report=sustainable-finance-market?sai-v

Key Segments:

By Investment Type:

Equity, Fixed Income, Mixed Allocation, Others

By Transaction Type:

Green Bond, Social Bond, Mixed-Sustainability Bond, Others

By End-User:

Utilities, Transport & Logistics, Chemicals, Food & Beverage, Government Sectors, Others

Regional Analysis for Sustainable Finance Market:

⇥ North America (U.S., Canada, Mexico)

⇥ Europe (U.K., Italy, Germany, Russia, France, Spain, The Netherlands and Rest of Europe)

⇥ Asia-Pacific (India, Japan, China, South Korea, Australia, Indonesia Rest of Asia Pacific)

⇥ South America (Colombia, Brazil, Argentina, Rest of South America)

⇥ Middle East & Africa (Saudi Arabia, U.A.E., South Africa, Rest of Middle East & Africa)

Benefits of the Report:

Chapter 1: Sets the stage by outlining the report's coverage, summarizing key market segments by region, product type, and application. Presents a snapshot of market sizes, growth potential across segments, and anticipated industry evolution both short and long term.

Chapter 2: Highlights pivotal market insights and uncovers the most significant emerging trends driving change within the industry.

Chapter 3: Offers an in-depth look at the competitive landscape among Sustainable Finance producers, including revenue shares, strategic moves, and recent mergers and acquisitions.

Chapter 4: Presents comprehensive profiles of the market's key players, delving into details such as revenue, profit margins, product portfolios, and company milestones.

Chapters 5 & 6: Analyze Sustainable Finance revenue at both regional and country levels, providing quantitative breakdowns of market sizes, growth opportunities, and development prospects worldwide.

Chapter 7: Focuses on different market segments by type, examining their individual sizes and potential, guiding readers toward high-impact, untapped market areas.

Chapter 8: Explores segmentation by application, evaluating industry growth potential in various downstream markets and pinpointing promising sectors for expansion.

Chapter 9: Provides a thorough review of the industry's supply chain mapping out both upstream and downstream activities.

Chapter 10: Concludes with a summary of the report's key findings and highlights the most critical takeaways for industry stakeholders.

Speak to Our Analyst and Get Customization in the report as per your requirements: https://www.datamintelligence.com/customize/sustainable-finance-market?sai-v

FAQ

What is the current size of the Sustainable Finance Market?

A: In 2024, the Sustainable Finance Market was valued at US$895.12 billion, reflecting its strong industry presence.

Q2: How large is the Sustainable Finance Market expected to be by 2032?

A: By 2032, industry forecasts suggest the Sustainable Finance Market will grow to around US$ 5,064.94 billion, demonstrating significant expansion.

Q3: What is the growth rate of the Sustainable Finance Market?

A: The market is projected to expand at a compound annual growth rate CAGR of 24.19% during the forecast period from 2025 to 2032.

Unlock 360° Market Intelligence with DataM Subscription Services: https://www.datamintelligence.com/reports-subscription?sai-v

Power your decisions with real-time competitor tracking, strategic forecasts, and global investment insights all in one place.

✅ Competitive Landscape

✅ Sustainability Impact Analysis

✅ KOL / Stakeholder Insights

✅ Unmet Needs & Positioning, Pricing & Market Access Snapshots

✅ Market Volatility & Emerging Risks Analysis

✅ Quarterly Industry Report Updated

✅ Live Market & Pricing Trends

✅ Import-Export Data Monitoring

Have a look at our Subscription Dashboard: https://www.youtube.com/watch?v=x5oEiqEqTWg?sai-v

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Sustainable Finance Market to Reach USD 5 Trillion by 2032 | Latest Trends, Growth Drivers, and Global Investment Insights for 2025 here

News-ID: 4215385 • Views: …

More Releases from DataM intelligence 4 Market Research LLP

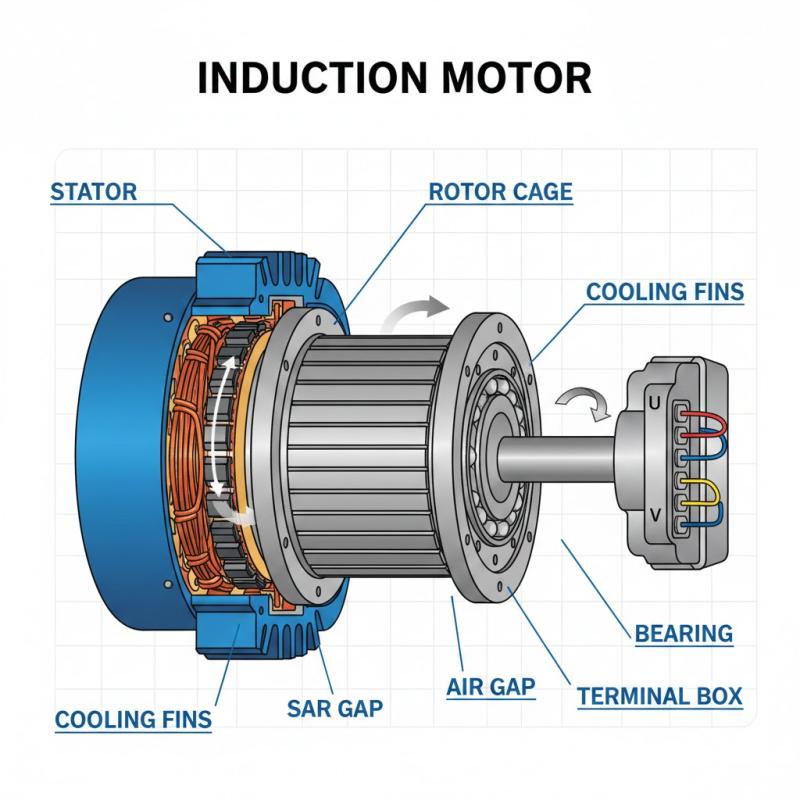

United States Induction Motor Market 2031 | Growth Drivers, Trends & Market Fore …

Induction Motor Market size was worth US$ 20.36 billion in 2023 and is estimated to reach US$ 33.66 billion by 2031, growing at a CAGR of 6.49% during the forecast period (2024-2031).

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://www.datamintelligence.com/download-sample/induction-motor-market?kb

List of Top Key Player:

ABB Ltd., Ametek, Emerson Electric, Siemens AG, Brook Crompton, Danaher Corporation, Johnson Electric Holdings, Regal Beloit, WEG Electric Corp.…

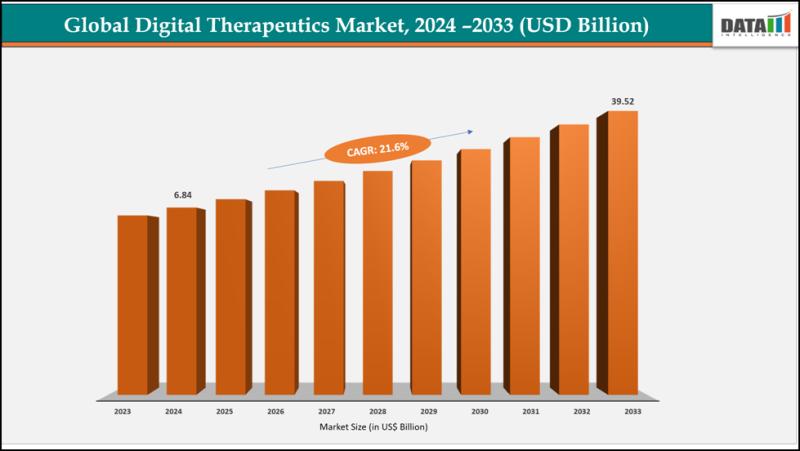

Digital Therapeutics Market Set for Explosive Growth to USD 39.52 Billion by 203 …

The Global Digital Therapeutics Market size reached USD 6.84 billion in 2024 and is expected to reach USD 39.52 billion by 2033, growing at a CAGR of 21.6% during the forecast period 2025-2033.

Market growth is driven by the rising prevalence of chronic diseases like diabetes and mental health disorders, increasing smartphone penetration, and growing patient demand for personalized, app-based interventions. Advancements in AI and machine learning for behavior change, expanding…

United States Contrast Media Injectors Market: Real-Time Market Trends & Competi …

DataM Intelligence unveils its latest report on the "Contrast Media Injectors Market Size 2025," offering an in-depth analysis of market trends, growth drivers, competitive landscape, and regional dynamics. The study covers market size in value and volume, CAGR forecasts, and emerging opportunities that can guide businesses in seizing growth potential and crafting winning strategies. Packed with data-driven insights on current developments and future trends, this report is essential for companies…

United States Real Time Location System (RTLS) Market Analysis 2026: Growth Driv …

Real Time Location System (RTLS) Market is expected to grow at a CAGR of 18% during the forecasting period (2022-2029).

Request a Premium Sample PDF of This Report (Corporate Email IDs Receive Priority Service): https://www.datamintelligence.com/download-sample/real-time-location-system-market?kb

United States: Recent Industry Developments

✅ December 2025: Major healthcare systems expanded RTLS deployments to enhance patient tracking, asset utilization, and workflow efficiency.

✅ November 2025: Leading tech providers integrated AI‐driven analytics into RTLS platforms to deliver predictive…

More Releases for Finance

Consumer Finance Market to Witness Revolutionary Growth by 2030 | Bajaj Capital, …

Global "Consumer Finance Market" Research report is an in-depth study of the market Analysis. Along with the most recent patterns and figures that uncovers a wide examination of the market offer. This report provides exhaustive coverage on geographical segmentation, latest demand scope, growth rate analysis with industry revenue and CAGR status. While emphasizing the key driving and restraining forces for this market, the report also offers a complete study of…

Big Boom in Environmental Finance Market 2020-2027 | Environmental Finance (Fult …

According to a report on Environmental Finance Market, recently added to the vast repository of Research N Reports, the global market is likely to gain significant impetus in the near future. The report, titled “Global Environmental Finance Market Research Report 2020,” further explains the major drivers manipulating industry, the possibility of development, and the challenges going up against the administrations and industrialists in the market. This research study portrays an…

PLATINUM GLOBAL BRIDGING FINANCE - BRIDGING FINANCE, DEVELOPMENT FINANCE AND COM …

If your business is looking to finance bridging, development or commercial financing we have contacts with lenders and banks in over 25 countries around the world. Our specialist knowledge can help you get the ideal financing in place.

Platinum Global Bridging Finance is a specialist bridging loan lender. They deliver the loan financing that suits you and your clients desired financing. Their aim is to be crystal clear, so they offer…

Global Environmental Finance Market Leading Players are Environmental Finance (F …

Global Environmental Finance Market Insights, Size, Share, Forecast to 2025

This report studies the Environmental Finance Market size by players, regions, product types and end industries, history data 2013-2017 and forecast data 2019-2025; this report also studies the global market competition landscape, market drivers and trends, opportunities and challenges, risks and entry barriers, sales channels, distributors and Porter's Five Forces Analysis.

The main goal for the dissemination of this information is to…

Global Consumer Finance Services Market Forecast to 2025, Top Key Players- Bajaj …

The Consumer Finance Services Market Research Report is a valuable source of insightful data for business strategists. It provides the Consumer Finance Services overview with growth analysis and historical & futuristic cost, revenue, demand and supply data (as applicable). The research analysts provide an elaborate description of the value chain and its distributor analysis. This Consumer Finance Services market study provides comprehensive data which enhances the understanding, scope and application…

Why Consumer Finance Market is Growing Worldwide? Watch out by top key players B …

The split of retail banking that deals with lending money to consumers.

Consumer finance market is growing due to increasing per capita income, high economic growth, rapid urbanization and rise in consumer spending power. Rising consumer favorite towards the use of credit cards owing to the associated benefits related to it such as reward points and a host of promotional offers like movie tickets, discounts on flight bookings etc., is likely…