Press release

Sodium-Ion Battery Manufacturing Plant Setup 2025: Business Plan, Raw Materials, and Cost Analysis

A sodium-ion battery is an advanced rechargeable energy storage device that uses sodium ions instead of lithium ions to transfer charge between electrodes. It operates on similar principles as lithium-ion batteries but offers advantages such as lower raw material costs, better thermal stability, and environmental sustainability. Sodium-ion batteries are emerging as a promising alternative for large-scale energy storage, electric mobility, and renewable power integration due to their cost-effectiveness and resource availability.Setting up a sodium-ion battery manufacturing plant involves electrode material preparation, cell assembly, electrolyte filling, and battery pack integration under controlled environments. Entrepreneurs must invest in precision equipment, quality raw materials, cleanroom facilities, and testing units to ensure high performance and safety standards in the final products.

IMARC Group's report, titled "Sodium-Ion Battery Manufacturing Plant Setup Cost 2025: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue," provides a complete roadmap for setting up a sodium-ion battery manufacturing plant. It covers a comprehensive market overview to micro-level information, such as unit operations involved, raw material requirements, utility requirements, infrastructure requirements, machinery and technology requirements, manpower requirements, packaging requirements, transportation requirements, etc.

Sodium-Ion Battery Industry Outlook 2025:

The sodium-ion battery industry in 2025 is expected to witness rapid growth driven by rising demand for affordable and sustainable energy storage solutions. With the depletion of lithium resources and advancements in sodium-based chemistries, manufacturers are shifting focus toward large-scale grid storage and electric mobility applications. Government support for renewable energy and energy independence further strengthens market potential.

Request for Sample Report: https://www.imarcgroup.com/sodium-ion-battery-manufacturing-plant-project-report/requestsample

Key Insights for Sodium-Ion Battery Manufacturing Plant Setup:

Detailed Process Flow:

• Product Overview

• Unit Operations Involved

• Mass Balance and Raw Material Requirements

• Quality Assurance Criteria

• Technical Tests

Project Details, Requirements and Costs Involved:

• Land, Location and Site Development

• Plant Layout

• Machinery Requirements and Costs

• Raw Material Requirements and Costs

• Packaging Requirements and Costs

• Transportation Requirements and Costs

• Utility Requirements and Costs

• Human Resource Requirements and Costs

Buy Now: https://www.imarcgroup.com/checkout?id=22230&method=1911

Capital Expenditure (CapEx) and Operational Expenditure (OpEx) Analysis:

Project Economics:

• Capital Investments

• Operating Costs

• Expenditure Projections

• Revenue Projections

• Taxation and Depreciation

• Profit Projections

• Financial Analysis

Profitability Analysis:

• Total Income

• Total Expenditure

• Gross Profit

• Gross Margin

• Net Profit

• Net Margin

Key Cost Components of Setting Up a Sodium-Ion Battery Plant:

• Land and infrastructure (cleanroom and production facilities)

• Machinery and assembly line equipment

• Raw materials (sodium salts, cathode/anode materials, electrolytes, separators)

• R&D and product testing facilities

• Skilled labor and training costs

• Energy and utility requirements

• Packaging, quality control, and safety systems

• Licensing, certification, and regulatory compliance

Speak to an Analyst for Customized Report: https://www.imarcgroup.com/request?type=report&id=22230&flag=C

Economic Trends Influencing Sodium-ion battery Plant Setup Costs 2025:

• Growing demand for low-cost alternatives to lithium-ion batteries

• Rising investments in renewable energy storage systems

• Technological advancements in electrode and electrolyte materials

• Government incentives for sustainable battery manufacturing

• Volatility in global energy and raw material prices

• Expansion of EV and grid-scale storage infrastructure

Challenges and Considerations for Investors in Sodium-ion battery Plant Projects:

• Limited commercial-scale adoption compared to lithium-ion

• Need for advanced R&D and proprietary technology access

• High initial capital investment and long payback period

• Intense global competition and patent barriers

• Ensuring consistent performance, safety, and energy density

Conclusion:

The sodium-ion battery industry offers immense potential as a sustainable, cost-effective alternative to lithium-based energy storage. Investors focusing on innovation, partnerships, and large-scale production efficiency can capitalize on this growing market. Strategic investment in technology and sustainability will be key to long-term success in the evolving battery ecosystem.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company excel in understanding its client's business priorities and delivering tailored solutions that drive meaningful outcomes. We provide a comprehensive suite of market entry and expansion services. Our offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape, and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: (+1-201971-6302)

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Sodium-Ion Battery Manufacturing Plant Setup 2025: Business Plan, Raw Materials, and Cost Analysis here

News-ID: 4213459 • Views: …

More Releases from IMARC Group

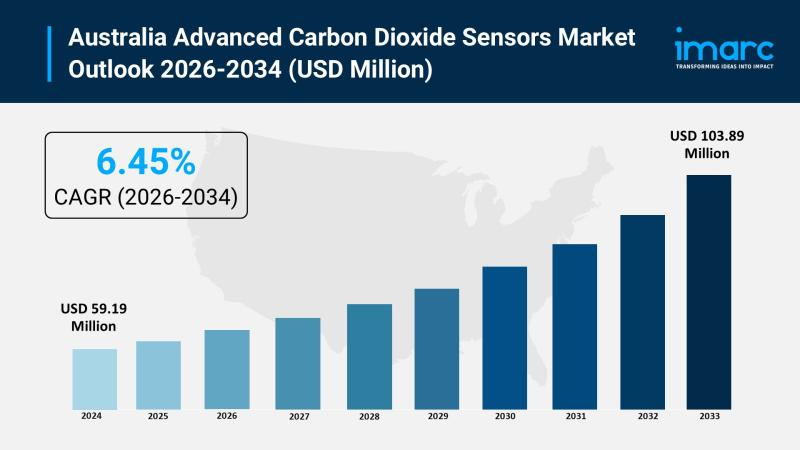

Australia Advanced Carbon Dioxide Sensors Market | Worth USD 103.89 Million 2026 …

Market Overview

The Australia advanced carbon dioxide sensors market size was USD 59.19 Million in 2025 and is expected to grow to USD 103.89 Million by 2034. The market growth is driven by strong government-led emissions reduction policies, enhanced building standards for CO2 monitoring, and the integration of IoT-enabled sensor technologies in smart buildings. These trends are supported by increased focus on indoor air quality and workplace health, fueling innovation in…

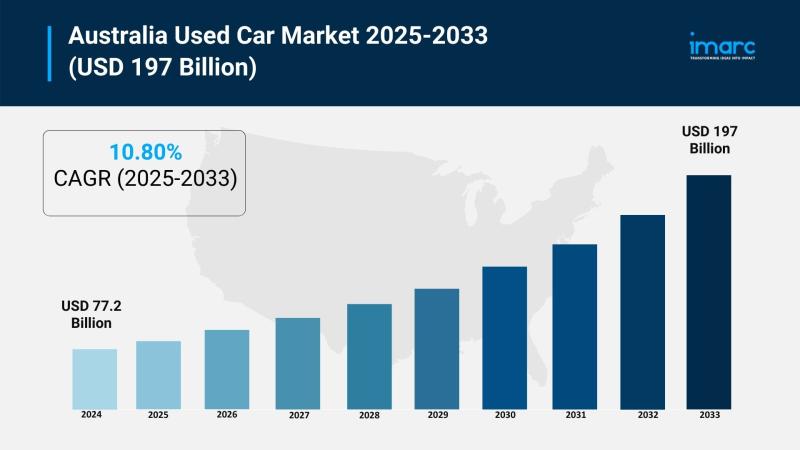

Australia Used Car Market Projected to Reach USD 197 Billion by 2033

Market Overview

The Australia used car market was valued at USD 77.2 Billion in 2024 and is projected to reach USD 197 Billion by 2033. The market is experiencing strong growth driven by affordability concerns, rising demand for reliable pre-owned vehicles, and the increasing role of digital platforms that simplify transactions. Economic pressures and the shift toward cost-effective vehicle options are further accelerating expansion, making the used car market a vital…

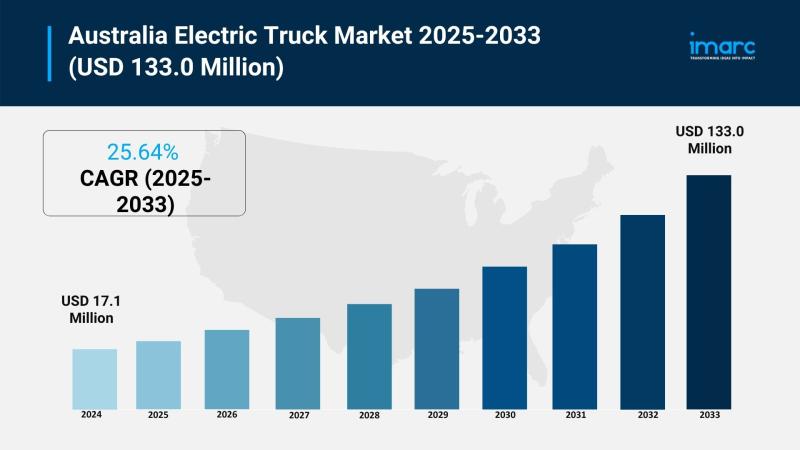

Australia Electric Truck Market Projected to Reach USD 133.0 Million by 2033

Market Overview

The Australia electric truck market reached USD 17.1 Million in 2024 and is projected to expand to USD 133.0 Million by 2033. With a forecast period spanning 2025 to 2033, the market is growing significantly due to stringent government emissions regulations, rising fuel costs, and advancements in battery and charging infrastructure technologies. Investments in fleet electrification and sustainable transport solutions are further driving market share growth. For further details,…

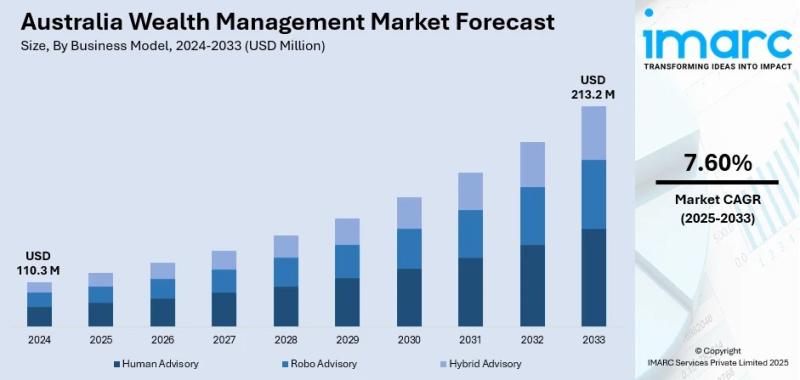

Australia Wealth Management Market Projected to Reach USD 213.2 Million by 2033

Market Overview

The Australia Wealth Management Market reached a size of USD 110.3 Million in 2024 and is projected to grow to USD 213.2 Million by 2033. The market is expected to expand during its forecast period with a CAGR of 7.60% from 2025 to 2033. Key growth factors include rising high-net-worth individuals, digital financial transformation, regulatory reforms like FOFA, and a robust superannuation system. For more details, visit the Australia…

More Releases for Cost

Steel Production Cost - Process Economics, Raw Materials, and Cost Drivers

Steel is the backbone of modern industry, and its production cost is one of the most closely tracked indicators across construction, infrastructure, automotive, and manufacturing sectors. Unlike niche chemicals or APIs, steel economics are driven by scale, energy intensity, and raw material volatility.

Here's the thing: steel production cost isn't just about iron ore prices. It's a layered equation involving coking coal, electricity, labor, emissions compliance, logistics, and technology choice. A…

Egg Powder Manufacturing Plant Setup Cost | Cost Involved, Machinery Cost and In …

IMARC Group's report titled "Egg Powder Manufacturing Plant Project Report 2024: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue" provides a comprehensive guide for establishing an egg powder manufacturing plant. The report covers various aspects, ranging from a broad market overview to intricate details like unit operations, raw material and utility requirements, infrastructure necessities, machinery requirements, manpower needs, packaging and transportation requirements, and more.

In addition to…

Glucose Manufacturing Plant Cost Report 2024: Requirements and Cost Involved

IMARC Group's report titled "Glucose Manufacturing Plant Project Report 2024: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue" provides a comprehensive guide for establishing a glucose manufacturing plant. The report covers various aspects, ranging from a broad market overview to intricate details like unit operations, raw material and utility requirements, infrastructure necessities, machinery requirements, manpower needs, packaging and transportation requirements, and more.

In addition to the operational…

Fatty Alcohol Production Cost Analysis: Plant Cost, Price Trends, Raw Materials …

Syndicated Analytics' latest report titled "Fatty Alcohol Production Cost Analysis 2023-2028: Capital Investment, Manufacturing Process, Operating Cost, Raw Materials, Industry Trends and Revenue Statistics" includes all the essential aspects that are required to understand and venture into the fatty alcohol industry. This report is based on the latest economic data, and it presents comprehensive and detailed insights regarding the primary process flow, raw material requirements, reactions involved, utility costs, operating costs, capital…

Corn Production Cost Analysis Report: Manufacturing Process, Raw Materials Requi …

The latest report titled "Corn Production Cost Report" by Procurement Resource, a global procurement research and consulting firm, provides an in-depth cost analysis of the production process of the Corn. Read More: https://www.procurementresource.com/production-cost-report-store/corn

Report Features - Details

Product Name - Corn Production

Segments Covered

Manufacturing Process: Process Flow, Material Flow, Material Balance

Raw Material and Product/s Specifications: Raw Material Consumption, Product and Co-Product Generation, Capital Investment

Land and Site Cost: Offsites/Civil Works, Equipment Cost, Auxiliary Equipment…

Crude Oil Production Cost Analysis Report: Manufacturing Process, Raw Materials …

The latest report titled "Crude Oil Production Cost Report" by Procurement Resource, a global procurement research and consulting firm, provides an in-depth cost analysis of the production process of the Crude Oil. Read More: https://www.procurementresource.com/production-cost-report-store/crude-oil

Report Features - Details

Product Name - Crude Oil

Segments Covered

Manufacturing Process: Process Flow, Material Flow, Material Balance

Raw Material and Product/s Specifications: Raw Material Consumption, Product and Co-Product Generation, Capital Investment

Land and Site Cost: Offsites/Civil Works, Equipment Cost,…