Press release

U.S. LNG Infrastructure Market to Gain Traction and Reach US$ 62.5 Bn in 2032 - Persistence Market Research

The liquefied natural gas sector is undergoing a transformation globally, driven by rising energy demand, geopolitical shifts, and the pressing need for cleaner fuels. The United States, endowed with abundant shale gas and advanced technology, has emerged as a pivotal player in LNG infrastructure development. Over the past decade the U.S. has transitioned from being a marginal exporter to one of the world's leading suppliers of liquefied natural gas. That transition has required substantial investments in liquefaction plants, pipelines, storage terminals, and export facilities. As global consumers seek dependable sources of gas amid uncertainty in traditional supply regions, U.S. LNG infrastructure has become a strategic asset both domestically and internationally.Get a Sample PDF Brochure of the Report (Use Corporate Email ID for a Quick Response): https://www.persistencemarketresearch.com/samples/35277

According to persistence market research, the U.S. LNG infrastructure market size is predicted to reach US$ 62.5 Bn in 2032 from US$ 46.3 Bn in 2025. It will likely witness a CAGR of around 6.8% in the forecast period between 2025 and 2032.

This projection underscores the scale of change underway. The forces shaping this expansion are multifold: surging global demand for gas, shifts in energy policy toward lower-carbon fuels, and the U.S. advantage in cost-competitive gas production. Yet equally, the growth path is fraught with challenges like regulatory delays, bottlenecks in pipeline capacity, cost escalation, and uncertainties in future demand. In this article we explore the key drivers, structural elements, challenges, and outlook for U.S. LNG infrastructure, offering insight for energy professionals, investors, and policy watchers.

Key Drivers of U.S. LNG Infrastructure Expansion

Understanding what is fueling the infrastructure boom helps explain why billions of dollars are being committed across the value chain. The principal drivers include:

Abundant and low-cost natural gas supply

The U.S. shale revolution has unlocked vast reserves of natural gas in formations like the Permian, Marcellus, Haynesville, and others. This abundant supply reduces input costs for liquefaction and gives U.S. LNG exporters a competitive edge in global markets.

Global gas demand shifting eastward

Many import markets in Asia, Europe, and Latin America are seeking reliable gas supplies that are flexible and not tied to pipelines. The U.S., tied to deepwater ports and shipping corridors, is poised to capture share in these markets.

Decarbonization and fuel switching in power generation

Natural gas is often viewed as a "bridge fuel"

less carbon intensive than coal or oil - and many nations are increasing gas use in power generation. LNG allows nations without pipeline connectivity to tap into gas.

Policy support, export licensing, and regulatory frameworks

U.S. federal and state policy changes, export approvals, tax incentives, and regulatory regimes have become more favorable for LNG development. This regulatory clarity reduces investor risk.

Technological advances and modularization

New modular liquefaction units, more efficient compressors, innovations in cryogenics, and floating LNG technologies reduce construction time, cost, and risk, making more projects viable.

Need to relieve infrastructure bottlenecks

Existing pipelines and terminals are sometimes constrained. Upgrading, expanding pipelines, converting regas terminals to bidirectional use, and adding storage help relieve those constraints.

These drivers combine to create momentum. However, momentum alone is not enough - execution and navigating constraints are equally critical.

Regional and Value Chain Trends

Looking more granularly, we can observe several trends shaping how LNG infrastructure evolves across regions and segments.

Gulf Coast and Southeast as Growth Hubs

Proximity to both gas basins and deep water access makes the Gulf Coast and Southeast U.S. the favorite region for LNG export infrastructure. Much expansion is happening around Louisiana, Texas, and nearby states. Also conversion or upgrade of regasification terminals along the Southeastern seaboard is underway.

Dive deeper into the market data: https://www.persistencemarketresearch.com/market-research/us-lng-infrastructure-market.asp

Conversion of Legacy Terminals

Many import terminals built earlier may be retrofitted to support liquefaction, bidirectional flows, or expanded storage. This reuse reduces capital costs and leverages existing permits, marine jetties, and infrastructure.

Modular and Distributed Liquefaction

Instead of huge central plants, smaller modular units scattered closer to sources reduce gas pipeline needs and improve flexibility. This approach is increasingly seen in new proposals.

LNG Bunkering and Marine Fuels

As the maritime sector seeks cleaner bunker fuels, LNG bunkering infrastructure (for ships, coastal vessels) is being integrated into port and export terminals. This opens domestic demand beyond pure exports.

Vertical Integration and Portfolio Approaches

Large energy companies or portfolio players combine upstream gas production, pipeline ownership, and LNG export operations to capture margin along the value chain and manage risk across assets.

Flexible Contracts and Spot Markets

Traditional long-term contracts are giving way to more flexible structures, destination flexibility, and spot sales. This requires infrastructure and trading capability to respond to market signals.

Request for Customization of the Research Report: https://www.persistencemarketresearch.com/request-customization/35277

These trends reflect how infrastructure is adapting to evolving market behaviors and strategic demands.

Economic and Strategic Impacts of U.S. LNG Infrastructure

Beyond pure industry growth, the expansion of LNG infrastructure carries broader economic, strategic, and geopolitical implications.

Job Creation and Industrial Growth

LNG projects generate thousands of direct and indirect jobs in engineering, construction, operations, supply chain, and services. The multiplier effect on local economies can be significant. According to one analysis, U.S. LNG activities have supported hundreds of thousands of jobs and contributed materially to GDP.

Energy Security and Export Leverage

By diversifying export supply, the U.S. strengthens geopolitical influence. Importers who depend on U.S. LNG gain alternative supply routes away from pipeline-based suppliers, which can shift geopolitical dynamics and strengthen U.S. standing.

Infrastructure Spillovers and Industrial Clustering

LNG infrastructure requires steel, machinery, electronics, and engineering services. That encourages clustering of related industries and can stimulate innovation, exports, and downstream development.

Fiscal Revenue and Tax Base

Local, state, and federal taxes on LNG operations, property, exports, and related services provide significant public revenue. Some states or regions depend on these revenues for infrastructure, education, and services.

Environmental Transition and Emissions Management

LNG as a lower carbon fuel (relative to coal or oil) can support energy transition goals. But the role of LNG in the decarbonization path is debated - methane leakage, lifecycle emissions, and long term demand for gas all matter. The infrastructure expansion must align with evolving climate policies and ESG standards.

Risk Diversification for Energy Companies

LNG gives traditional oil and gas companies a path into international gas markets, diversifying commodity exposure. Integrated players benefit from having both upstream and midstream assets.

In sum, LNG infrastructure is not just about energy trade; it is an economic and strategic lever.

Conclusion

The U.S. LNG infrastructure story is one of ambition meeting challenge. From abundant shale gas, technological innovation, and growing global demand, the foundation is solid for substantial expansion. The projection that the U.S. LNG infrastructure market will rise from US$ 46.3 billion in 2025 to US$ 62.5 billion in 2032 reflects that momentum. Yet the path is not without obstacles - from permitting risks to pipeline bottlenecks, cost pressures and evolving market dynamics. The winners will be those who execute with foresight, manage risks, adopt flexibility, and align with the shifting energy paradigm. For stakeholders across the energy landscape, this era may represent one of the most consequential infrastructure investment windows in decades.

Read More Related Reports:

Battery Recycling Equipment Market: https://www.persistencemarketresearch.com/market-research/battery-recycling-equipment-market.asp

Polyvinyl Acetate Adhesives Market: https://www.persistencemarketresearch.com/market-research/polyvinyl-acetate-adhesives-market.asp

Flare Gas Recovery Systems Market: https://www.persistencemarketresearch.com/market-research/flare-gas-recovery-systems-market.asp

Contact Us:

Persistence Market Research

G04 Golden Mile House, Clayponds Lane

Brentford, London, TW8 0GU UK

USA Phone: +1 646-878-6329

UK Phone: +44 203-837-5656

Email: sales@persistencemarketresearch.com

Web: https://www.persistencemarketresearch.com

About Persistence Market Research:

At Persistence Market Research, we specialize in creating research studies that serve as strategic tools for driving business growth. Established as a proprietary firm in 2012, we have evolved into a registered company in England and Wales in 2023 under the name Persistence Research & Consultancy Services Ltd. With a solid foundation, we have completed over 3600 custom and syndicate market research projects, and delivered more than 2700 projects for other leading market research companies' clients.

Our approach combines traditional market research methods with modern tools to offer comprehensive research solutions. With a decade of experience, we pride ourselves on deriving actionable insights from data to help businesses stay ahead of the competition. Our client base spans multinational corporations, leading consulting firms, investment funds, and government departments. A significant portion of our sales comes from repeat clients, a testament to the value and trust we've built over the years.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release U.S. LNG Infrastructure Market to Gain Traction and Reach US$ 62.5 Bn in 2032 - Persistence Market Research here

News-ID: 4211604 • Views: …

More Releases from Persistence Market Research

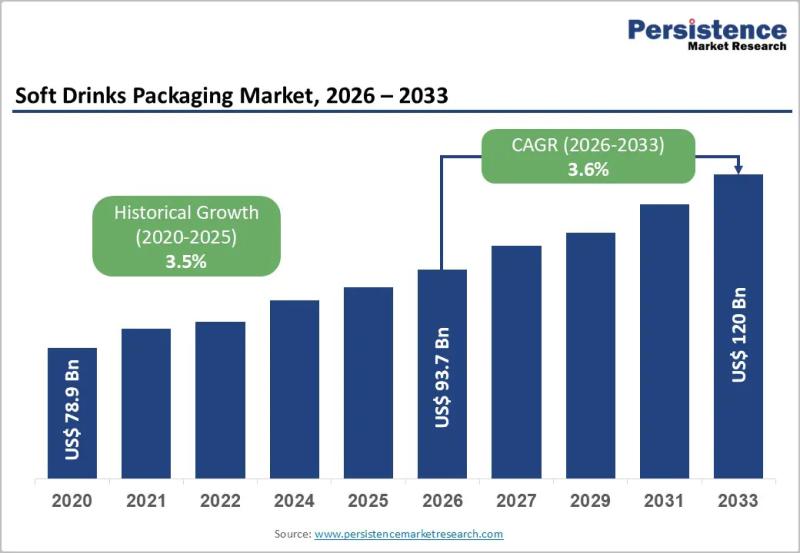

Soft Drinks Packaging Market to Reach US$120.0 Billion by 2033 - Persistence Mar …

The soft drinks packaging market plays a central role in the global beverage industry, serving carbonated drinks, juices, flavored water, energy drinks, and ready to drink teas and coffees. Packaging is no longer limited to containment and transportation; it has evolved into a critical component of branding, sustainability strategy, consumer convenience, and supply chain efficiency. Manufacturers are increasingly focusing on lightweight materials, recyclable packaging formats, and innovative designs that improve…

Christmas Tree Valves Market Size to Reach US$8.1 Billion by 2033 - Persistence …

The Christmas Tree Valves Market plays a critical role in the upstream oil and gas industry, serving as a central component in wellhead equipment systems. Christmas tree valves are installed on oil and gas wells to control pressure, regulate flow, and ensure safe extraction of hydrocarbons. These assemblies, commonly referred to as "Christmas trees," consist of multiple valves, spools, and fittings arranged in a structure that resembles a decorated tree.…

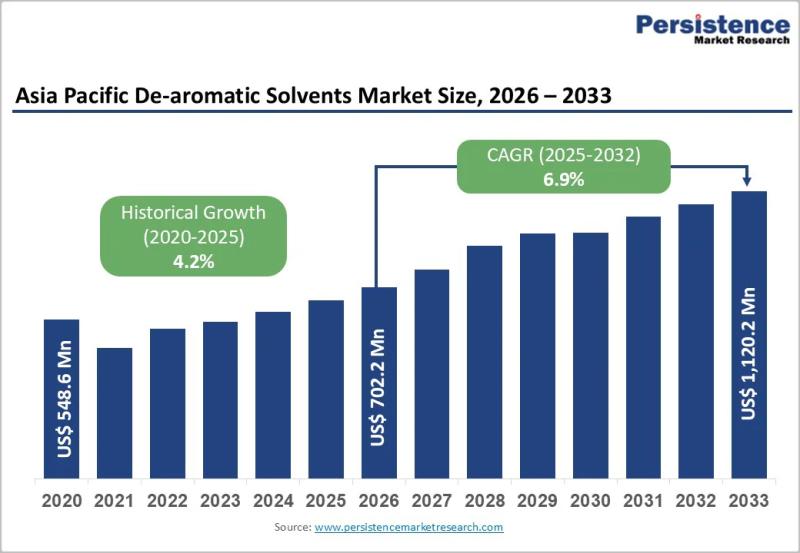

Asia Pacific De-aromatic Solvents Market to Reach US$1,120.2 Million by 2033 - P …

The Asia Pacific De-aromatic Solvents Market is gaining steady momentum as industries across the region increasingly shift toward low aromatic, high purity solvent formulations. De-aromatic solvents are hydrocarbon solvents that have significantly reduced aromatic content, making them suitable for applications requiring low odor, lower toxicity, and improved environmental performance. These solvents are widely used in paints and coatings, adhesives, inks, metalworking fluids, agrochemicals, and cleaning formulations. As regulatory scrutiny around…

Off-Highway Radiators Market to Reach US$ 7.2 Bn by 2033 as Leading Players Like …

The off-highway radiators market plays a vital role in ensuring efficient thermal management in heavy-duty equipment used across construction, agriculture, mining, and forestry sectors. These radiators regulate engine temperatures, prevent overheating, and support consistent equipment performance under extreme operating conditions. Growing mechanization and the expansion of infrastructure projects worldwide are increasing reliance on durable cooling systems. Equipment manufacturers are prioritizing high-performance radiators that offer reliability, longer service life, and resistance…

More Releases for LNG

LNG Bunkering Market Growth, Trends & Opportunities 2025 | Top key players - Tre …

LNG Bunkering Market, as analyzed in the study by DataM Intelligence, presents a detailed overview of the industry with in-depth insights, historical data, and key statistics. The report thoroughly examines market dynamics, competitive strategies, and major players, highlighting their product lines, pricing structures, financials, growth plans, and regional outreach.

The Global LNG Bunkering Market is expected to grow at a CAGR of 66.4% during the forecasting period (2024-2031).

Get a Free Sample…

Mea Floating Lng Power Vessel Market Emerging Trends and Growth Prospects 2034 | …

On April 8, 2025, Exactitude Consultancy., Ltd. released a research report titled "Mea Floating Lng Power Vessel Market". In-depth research has been compiled to provide the most up-to-date information on key aspects of the worldwide market. This research report covers major aspects of the Mea Floating Lng Power Vessel Market including drivers, restraints, historical and current trends, regulatory scenarios, and technological advancements. It provides the industry overview with growth analysis…

What's Driving the LNG Bunkering Market Trends? Key Companies are Skangass AS., …

A research report on 'LNG Bunkering Market' Added by DEC Research features a succinct analysis on the latest market trends. The report also includes detailed abstracts about statistics, revenue forecasts and market valuation, which additionally highlights its status in the competitive landscape and growth trends accepted by major industry players.

Request a sample of this research report @ https://www.decresearch.com/request-sample/detail/702

The size of LNG Bunkering Market was registered at USD 800 Million in…

LNG Bunkering Market Key Players Polskie LNG, Eagle LNG, ENN Energy, EVOL LNG, F …

The LNG Bunkering Market report add detailed competitive landscape of the global market. It includes company, market share analysis, product portfolio of the major industry participants. The report provides detailed segmentation of the LNG Bunkering industry based on product segment, technology, end user segment and region.

As per a recent news snippet, the Caribbean is one of the most lucrative regions for LNG bunkering market, as the shipping sector seeks compliance…

LNG Bunkering Industry to surpass $12bn by 2024:ENGIE,Polskie LNG,Eagle LNG, ENN …

LNG Bunkering Market size is set to exceed USD 12 billion by 2024.Growing demand for cleaner fuel coupled with strict emission regulations to reduce the airborne emissions predominantly in North America and Europe will stimulate LNG bunkering market. In 2015, International Maritime Organization (IMO) introduced Tier III norms to curb NOx emissions from marine vessels among Emission Control Areas (ECAs) under maritime boundaries.

Request for a sample copy of this…

Global Liquefied Natural Gas (LNG) Market 2018-22 : LNG bunkering, progressing L …

ResearchMoz presents Professional and In-depth Study of "Global Liquefied Natural Gas (LNG) Market: Industry Analysis & Outlook (2018-2022)" with coming years Industries Trends, Projections of Global Growth, Major Key Player and Case Study, Review, Share, Size, Effect.

' '

Liquefied Natural Gas (LNG) is a liquid form of natural gas, which is composed mainly of methane and other gases such as Ethane, Propane, Butane and Nitrogen. LNG liquefaction is a procedure…