Press release

South East Asia Organic Food Market Valuation to Reach USD 14,399.6 Million by 2033 - Industry Expanding at a CAGR of 5.88%

Market Overview:According to IMARC Group's latest research publication, "South East Asia Organic Food Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, Application, Country, and Company, 2025-2033", the South East Asia organic food market size reached USD 8,614.0 Million in 2024. Looking forward, the market is expected to reach USD 14,399.6 Million by 2033, exhibiting a growth rate of 5.88% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Grab a sample PDF of this report: https://www.imarcgroup.com/south-east-asia-organic-food-market/requestsample

Our report includes:

Market Dynamics

Market Trends and Market Outlook

Competitive Analysis

Industry Segmentation

Strategic Recommendations

Growth Factors in the South East Asia Organic Food Market

Health Consciousness Revolution Reshaping Consumer Choices

The organic food market across South East Asia is experiencing a fundamental shift driven by consumers who are increasingly connecting the dots between what they eat and how they feel. What's happening on the ground is fascinating-urban populations in Jakarta, Bangkok, Singapore, and Manila are actively seeking out pesticide-free produce and chemical-free food products, not as occasional splurges but as regular purchases. Health awareness isn't just a buzzword anymore; it's translating into real behavioral change at supermarket checkout counters. Young professionals and families with children are particularly leading this charge, scrutinizing food labels and asking questions about farming practices that would have seemed unusual just a few years ago.

The concern about chemical residues in conventional farming has moved from niche environmental circles into mainstream dinner table conversations. Social media platforms are amplifying these concerns, with food bloggers and wellness influencers across the region sharing information about organic alternatives and their benefits. What makes this trend sustainable is that it's backed by tangible health concerns-rising diabetes rates, increasing obesity levels, and growing awareness about lifestyle diseases have pushed people to reconsider their food choices fundamentally.

Parents especially are willing to pay premium prices for organic baby food and children's snacks, viewing it as an investment in their kids' long-term health. The proliferation of health and wellness centers, yoga studios, and fitness communities across major Southeast Asian cities has created ecosystems where organic food consumption is normalized and encouraged. Educational initiatives by both private companies and non-profit organizations have helped demystify organic certification, making consumers more confident in their purchasing decisions.

Rising Middle Class with Expanding Purchasing Power

The economic transformation sweeping through South East Asia is creating a perfect storm for organic food market expansion. Indonesia's emerging middle class, Thailand's growing urban population, and Vietnam's increasingly affluent consumers represent millions of households with disposable income they're willing to spend on quality food products. This isn't just about having more money-it's about changing aspirations and lifestyle preferences that come with economic mobility. Consumers who previously prioritized price above everything else are now factoring in quality, safety, and sustainability when making food purchases.

The shift is particularly visible in tier-one cities where international exposure through travel, education, and media consumption has influenced food preferences significantly. Singaporean consumers, already among the most sophisticated in the region, continue to lead in per-capita organic food consumption, but the gap with other Southeast Asian countries is steadily narrowing. Malaysian urban centers are witnessing growing demand for organic rice, vegetables, and dairy alternatives, driven by health-conscious professionals who see organic food as part of a modern lifestyle.

The Philippines, with its large young population and increasing purchasing power, shows tremendous growth potential, especially in the Manila metropolitan area where organized retail is expanding rapidly. What's particularly interesting is how premium pricing is becoming less of a barrier-consumers across income segments are finding ways to incorporate organic products into their diets, perhaps not making every purchase organic, but consistently buying certain items like fruits, vegetables, or baby food in organic variants. This selective adoption is actually helping market penetration by making organic food accessible to broader consumer segments without requiring complete dietary overhauls.

Retail Infrastructure Evolution and E-commerce Expansion

The way consumers access organic food in South East Asia has transformed dramatically, making these products more convenient to purchase than ever before. Modern retail chains across the region-from Thailand's Central Group to Singapore's FairPrice and Indonesia's Alfamart-have significantly expanded their organic product offerings, dedicating entire sections to certified organic foods that were previously relegated to specialty stores. This mainstream retail presence has been crucial for normalizing organic food consumption, exposing casual shoppers to organic options during their regular grocery runs. But the real game-changer has been e-commerce platforms and specialized organic food delivery services. In Singapore, RedMart and Amazon Prime Now offer extensive organic selections with same-day delivery, while Thai consumers can access organic produce through platforms like HappyFresh and Lotus's online store. Indonesia's rapidly growing e-commerce ecosystem, led by platforms like Tokopedia and Shopee, has created opportunities for organic food sellers to reach consumers across the archipelago, not just in Jakarta.

Vietnam's digitally-savvy population has embraced online organic food shopping through local platforms and Facebook marketplace communities that connect organic farmers directly with urban consumers. The convenience factor cannot be overstated-busy professionals who might not have time to visit specialty organic stores can now order organic produce, meat, and packaged foods from their smartphones, with delivery often within hours. Cold chain logistics have improved substantially, addressing a critical challenge that previously limited organic food distribution, especially for perishable items. Organized retail's expansion into smaller cities and towns across the region is bringing organic options to consumers who previously had no access to such products, effectively expanding the addressable market. Certification bodies and regulatory frameworks are also strengthening across Southeast Asian countries, with Thailand's organic certification being recognized internationally, and Singapore accepting multiple international organic standards, building consumer confidence in product authenticity.

Key Trends in the South East Asia Organic Food Market

Country-Specific Market Dynamics and Regional Variations

The organic food landscape across South East Asia reveals fascinating country-level differences that reflect diverse economic conditions, agricultural traditions, and consumer preferences. Indonesia, as the region's most populous nation and largest economy, represents enormous potential for organic food growth despite currently having relatively lower per-capita consumption compared to Singapore or Thailand. The archipelagic nature of Indonesia creates both challenges and opportunities-while distribution can be complex, there's also tremendous agricultural diversity and growing interest among Indonesian farmers in organic farming methods, partly driven by government initiatives encouraging sustainable agriculture.

Thailand stands out as both a major producer and consumer of organic food, with well-established organic farming communities and strong export capabilities that also serve the domestic market. Thai consumers, particularly in Bangkok and other major cities, have embraced organic products across multiple categories, from rice and vegetables to processed foods and beverages. The country's strong tourism industry has also influenced organic food availability, with hotels and restaurants catering to international visitors who expect organic options. Singapore, despite having minimal agricultural land, has become the region's most sophisticated organic food market in terms of consumption patterns and retail infrastructure.

Singaporeans enjoy the highest per-capita consumption of organic food in Southeast Asia, supported by strong purchasing power, health consciousness, and government emphasis on food safety and quality. The city-state serves as a testing ground for premium organic brands before they expand to other regional markets. Philippines presents interesting dynamics where organic food consumption is concentrated in Metro Manila and other urban centers, but awareness and interest are spreading to secondary cities. Vietnamese consumers are increasingly interested in organic alternatives, driven by food safety concerns and growing middle-class aspirations, though the market is still developing compared to Thailand or Singapore. Malaysia's diverse population shows varied organic food consumption patterns, with urban areas showing significantly higher adoption than rural regions.

Product Category Evolution and Consumer Preferences

The types of organic products gaining traction across South East Asia reveal much about evolving consumer priorities and dietary patterns. Organic fruits and vegetables remain the backbone of the market, accounting for substantial consumer interest as these are the most visible categories where pesticide concerns are strongest. Consumers across the region are particularly focused on organic varieties of frequently consumed produce-leafy greens, tomatoes, carrots, and tropical fruits that are dietary staples. What's interesting is how local preferences influence organic product development; in Thailand, organic jasmine rice and herbs enjoy strong demand reflecting local culinary traditions, while Indonesian consumers show interest in organic tempeh and local vegetables.

Organic meat, poultry, and dairy represent a growing segment, though adoption rates vary significantly by country based on dietary habits and religious considerations. Singapore and Malaysia show strong interest in organic dairy products and eggs, while organic chicken is gaining popularity across multiple markets. The organic processed food category is experiencing rapid growth, driven by busy urban lifestyles that demand convenient options. Organic breakfast cereals, snacks, and ready-to-eat products are finding shelf space in supermarkets, appealing to health-conscious consumers who need quick meal solutions without compromising on quality.

Organic beverages, including juices, teas, and increasingly plant-based milk alternatives, are experiencing strong growth, reflecting global wellness trends adapted to local preferences. Organic bread and bakery products are becoming more available in urban areas, with artisanal bakeries and café chains incorporating organic ingredients to attract premium customers. The application-based analysis reveals interesting patterns-bakery and confectionery applications are driving demand for organic flour, eggs, and dairy, while the breakfast cereals category shows potential as Western breakfast habits gain acceptance among younger, urban consumers. Ready-to-eat food products using organic ingredients are particularly relevant in Singapore and urban Thailand where convenience is highly valued.

Distribution Channel Transformation and Market Access

How consumers buy organic food in South East Asia is evolving rapidly, with multiple channels competing and complementing each other in interesting ways. Supermarkets and hypermarkets have emerged as primary distribution channels, providing the convenience and product variety that mainstream consumers prefer. Major retail chains across the region-FairPrice in Singapore, Big C and Lotus's in Thailand, Lotte Mart in Vietnam, and Alfamart in Indonesia-have recognized organic food as a growth category worth significant shelf space and promotional effort. These mainstream retailers provide crucial visibility for organic products, introducing them to consumers who might not specifically seek out organic stores but are willing to try organic alternatives when presented alongside conventional options.

Specialty stores dedicated to organic and health foods continue to thrive, serving consumers who specifically seek extensive organic selections and are willing to pay premium prices. Cities like Singapore, Bangkok, and Kuala Lumpur have witnessed the proliferation of organic specialty stores and health food shops that offer curated selections, expert advice, and often locally-sourced organic produce that mainstream retailers might not carry. Convenience stores, while not traditionally associated with organic products, are beginning to stock organic snacks, beverages, and packaged foods, particularly in markets like Thailand and Singapore where convenience store culture is strong. Online stores represent the fastest-growing distribution channel, fundamentally changing how consumers access organic food.

E-commerce platforms provide several advantages-wider product selection than physical stores can offer, detailed product information including certifications and sourcing details, customer reviews that build confidence, and home delivery that saves time. Specialized organic food delivery services have emerged across major Southeast Asian cities, offering subscription models for regular organic produce deliveries, connecting consumers directly with organic farmers and reducing supply chain complexity. The COVID-19 pandemic accelerated this digital adoption, with many consumers who initially tried online organic food shopping during lockdowns continuing this habit as restrictions eased.

Ask analyst of customized report: https://www.imarcgroup.com/request?type=report&id=19723&flag=E

South East Asia Organic Food Market Report Segmentation:

Breakup by Product Type:

● Organic Fruits and Vegetables

● Organic Meat, Poultry and Dairy

● Organic Processed Food

● Organic Bread and Bakery

● Organic Beverages

● Organic Cereal and Food Grains

● Others

Breakup by Distribution Channel:

● Supermarkets and Hypermarkets

● Specialty Stores

● Convenience Stores

● Online Stores

● Others

Breakup by Application:

● Bakery and Confectionery

● Ready-to-Eat Food Products

● Breakfast Cereals

● Others

Country Insights:

● Indonesia

● Thailand

● Singapore

● Philippines

● Vietnam

● Malaysia

● Others

Research Methodology:

The report employs a comprehensive research methodology, combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91-120-433-0800

United States: +1-201-971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release South East Asia Organic Food Market Valuation to Reach USD 14,399.6 Million by 2033 - Industry Expanding at a CAGR of 5.88% here

News-ID: 4209920 • Views: …

More Releases from IMARC Group

India Digital Twin Market to Reach $18,016.9 M by 2034 | CAGR 35.79% Growth

According to IMARC Group's report titled "India Digital Twin Market Size, Share, Trends and Forecast by Type, Technology, End Use, and Region, 2026-2034", the report offers a comprehensive analysis of the industry, including India digital twin market trends, share, growth, and regional insights.

How Big is the India Digital Twin Industry?

The digital twin market size in India was USD 1,147.5 Million in 2025. Looking forward, IMARC Group estimates the market to…

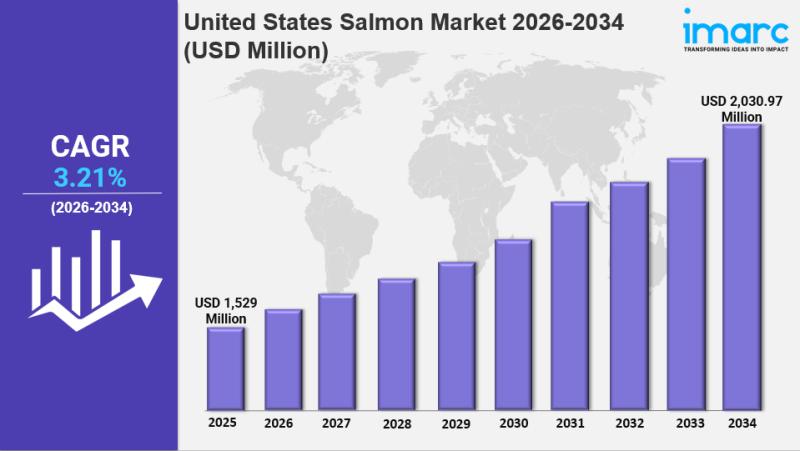

United States Salmon Market Size, Growth, Latest Trends and Forecast 2026-2034

IMARC Group has recently released a new research study titled "United States Salmon Market Size, Share, Trends and Forecast by Type, Species, End Product Type, and Distribution Channel, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The United States salmon market was valued at USD 1,529 Million in 2025 and is expected…

India B2B Events Market to Reach $2,750.10 M by 2034 | CAGR 5.57% Growth

According to IMARC Group's report titled "India B2B Events Market Size, Share, Trends and Forecast by Platform, End User, and Region, 2026-2034", the report offers a comprehensive analysis of the industry, including India B2B events market trends, share, growth, and regional insights.

How Big is the India B2B Events Industry?

The B2B events market size in India was USD 1,688.72 Million in 2025. Looking forward, IMARC Group estimates the market to reach…

Global Condoms Market Report 2025: Size Projected USD 25.2 Billion, CAGR of 7.41 …

According to the latest report by IMARC Group, titled "Condoms Market Report by Type (Latex, Non-Latex), End User (Men, Women), Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Pharmacies and Drug Stores, Online Stores, and Others), and Region 2025-2033", offers a comprehensive analysis of the industry, which comprises insights on the global condoms market. The report also includes competitor and regional analysis, and contemporary advancements in the global market.

The global condoms…

More Releases for South

South Florida's Continuum South Beach Emerges as One of the Most Coveted Propert …

The Continuum South Beach reigns supreme as a highly coveted condominium in South Florida, presenting an array of offerings that ensure an elevated quality of life.

Miami beach, FL - Continuum South Beach [https://www.continuuminsouthbeach.com/] presents a sanctuary of lavishness, featuring opulent apartments and a breathtaking riverfront location in close proximity to the finest attractions of Miami Beach. These extraordinary residences are discreetly nestled within this prestigious condominium, specifically within the Continuum…

Green Cool UK Expand Air Conditioning Services in South Wales and the South West

Cardiff, South Wales - Green Cool UK, the UK's leading air conditioning and refrigeration company, are pleased to announce the extension of their services in South Wales, including Cardiff, Swansea, Newport and into Bristol and the South West. With over 18 years experience in the HVAC industry Green Cool UK supply high performance air conditioning systems and green energy solutions for domestic and commercial customers.

As air conditioning and refrigeration experts…

2024 South Africa International Industrial Exhibition and China (South Africa) I …

Exhibition time: September 19-21, 2024

Exhibition location: Sandton Convention Centre, Johannesburg

Organizer: South Africa Golden Bridge International Exhibition Company

Exhibition introduction

The South African International Industrial Exhibition [https://www.vovt-diesel.com/] and China (South Africa) International Trade Fair is a large-scale international exhibition held to promote Chinese enterprises to explore the African market. Relying on the advantageous resources of the local government, business associations and industry organizations in South Africa, it builds a pragmatic and efficient platform…

Stem Cell Therapy Market | Smith+Nephew (UK), MEDIPOST Co., Ltd. (South Korea), …

Stem Cell Therapy Market in terms of revenue was estimated to be worth $286 million in 2023 and is poised to reach $615 million by 2028, growing at a CAGR of 16.5% from 2023 to 2028 according to a new report by MarketsandMarkets. The global stem cell therapy market is expected to grow at a CAGR of 16.8% during the forecast period. The major factors driving the growth of the…

Global Pajamas Market Report - Japan, Europe, South Korea, Asia and America ( No …

Recently we published the latest report on the Pajamas market. The report on the Pajamas market provides a holistic analysis, of market size and forecast, trends, growth drivers, and challenges, as well as vendor analysis covering around 15 vendors.

The report offers an up-to-date analysis regarding the current global market scenario, the latest trends and drivers, and the overall market environment. The Pajamas market analysis includes product segment and geographic landscape.

The…

South Africa Agriculture Market, South Africa Agriculture Industry, South Africa …

The South Africa has a market-oriented agricultural economy, which is much diversified and includes the production of all the key grains (except rice), deciduous, oilseeds, and subtropical fruits, sugar, wine, citrus, and most vegetables. Livestock production includes sheep, cattle, dairy, and a well-developed poultry & egg industry. Value-added activities in the agriculture sector include processing & preserving of fruit and vegetables, crushing of oilseeds, chocolate, slaughtering, processing & preserving of…