Press release

Burial Insurance Market Projected to Reach $509.5 Billion by 2034, Growing at 5.6% CAGR | Overall Study Report

The burial insurance market is a specialized sector within life insurance, focused on covering end-of-life expenses such as funeral and burial costs. This market primarily caters to seniors seeking financial relief for final arrangements, offering policies with simplified underwriting and small face values. Whole life insurance products dominate this sector, providing lifelong coverage and a cash value component, appealing to individuals who desire comprehensive financial protection. The increasing awareness of financial planning for end-of-life expenses, combined with demographic shifts, is fueling demand for accessible and affordable burial insurance policies globally.Market Size, Share & Demand Analysis:

The burial insurance market is projected to grow from $295.4 billion in 2024 to $509.5 billion by 2034, reflecting a CAGR of 5.6%. The demand for burial insurance is being driven by rising funeral costs and an aging population seeking peace of mind. Whole life insurance remains the top-performing segment, followed by simplified issue and final expense policies. Pre-need insurance is gaining traction as it allows policyholders to lock in current funeral costs, shielding them from inflation. Digital platforms and online policy purchase options are further increasing accessibility, enhancing consumer engagement, and contributing to the steady expansion of the burial insurance market.

Click to Request a Sample of this Report for Additional Market Insights:

https://www.globalinsightservices.com/request-sample/?id=GIS33692

Key Players:

• Mutual of Omaha

• Colonial Penn

• Globe Life

• Transamerica

• Gerber Life Insurance

• Foresters Financial

• Fidelity Life

• American Amicable

• Prosperity Life Group

• Liberty Bankers Life

• Royal Neighbors of America

• United Home Life

• Sagicor Life Insurance

• Americo Life

• Assurity Life Insurance

Market Segmentation:

• Type Whole Life Insurance, Term Life Insurance, Simplified Issue, Guaranteed Issue, Pre-Need Insurance, Final Expense Insurance, Group Life Insurance, Joint Life Insurance

• Product Individual Plans, Family Plans, Senior Plans, Child Plans, Employer-Sponsored Plans, Veteran Plans, Religious Group Plans, Credit Union Plans

• Services Policy Underwriting, Claims Management, Customer Support Services, Advisory Services, Online Policy Services, Customizable Plans, Renewal Services, Policy Transfers

• Technology Digital Platforms, Mobile Applications, Blockchain Technology, Artificial Intelligence, Data Analytics, Telematics, Cloud Computing, Robotic Process Automation

• Component Premium Calculation Tools, Risk Assessment Tools, Compliance Management Tools, Fraud Detection Tools, Customer Relationship Management, Policy Management Systems, Claims Processing Systems, Underwriting Systems

• Application Individual Use, Corporate Use, Institutional Use, Government Use, Non-Profit Use, Educational Use, Healthcare Use, Financial Use

• Deployment On-Premise, Cloud-Based, Hybrid, Web-Based, Mobile-Based, API-Integrated, Third-Party Hosted, Self-Hosted

• End User Individuals, Families, Businesses, Insurance Agents, Financial Advisors, Funeral Homes, Hospitals, Veterans Associations

• Solutions End-to-End Insurance Solutions, Point Solutions, Custom Solutions, Integrated Solutions, Standalone Solutions, Packaged Solutions, Turnkey Solutions, Managed Solutions

Market Dynamics:

The burial insurance market is influenced by several key dynamics. Technological advancements, including mobile applications, AI, and data analytics, are enabling insurers to offer personalized and streamlined policy services. Increasing consumer awareness and emphasis on financial preparedness are encouraging more individuals to consider burial insurance as a viable solution for covering final expenses. However, rising premiums and competition from alternative products such as life insurance and pre-need funeral plans pose challenges. Regulatory frameworks also shape market participation, with stringent compliance in North America and Europe versus growth opportunities in less regulated Asian markets.

Key Players Analysis:

The competitive landscape of the burial insurance market is marked by established insurers and emerging insurtech firms. Prominent players include Mutual of Omaha, Colonial Penn, Globe Life, Transamerica, Gerber Life Insurance, Foresters Financial, and Fidelity Life. These companies are innovating with digital solutions, simplified underwriting, and customizable plans to attract a wider customer base. New entrants leverage technology to enhance customer experience, offering competitive pricing and faster policy issuance. Strategic partnerships, mergers, and product launches are becoming common strategies for market expansion and differentiation.

Regional Analysis:

Globally, the burial insurance market exhibits diverse growth patterns. North America is a mature market, driven by high awareness and a large aging population. Europe is witnessing growth due to increased disposable income and cultural shifts towards pre-planning funeral expenses. The Asia-Pacific region is expanding rapidly, with rising middle-class populations and insurance awareness, particularly in countries like China and India. Latin America and the Middle East & Africa are emerging growth pockets, fueled by improving economic conditions, increasing insurance penetration, and cultural acceptance of burial insurance.

Recent News & Developments:

Recent developments in the burial insurance market highlight innovation and strategic growth. Prudential Financial partnered with an insurtech firm to enhance policy underwriting and claims processing. MetLife introduced customizable burial insurance products, catering to diverse consumer needs. The National Association of Insurance Commissioners (NAIC) proposed new guidelines to ensure transparency in pricing, boosting consumer trust. Allianz reported increased sales, attributing growth to higher awareness of end-of-life planning. Additionally, mergers between regional providers are consolidating market presence, improving service delivery and competitive positioning.

Scope of the Report:

The burial insurance market report provides comprehensive insights into market size, segmentation, competitive landscape, and regional analysis. It evaluates factors influencing growth, such as demographic trends, technological advancements, and regulatory developments. The report also examines challenges, opportunities, and strategic initiatives adopted by key players. Coverage includes product types, services, technology, deployment models, and end-user applications, offering a holistic understanding of the burial insurance market and empowering stakeholders to make informed strategic decisions.

Discover Additional Market Insights from Global Insight Services:

AI in Asset Management Market:

https://www.globalinsightservices.com/reports/ai-in-asset-management-market/

Blockchain CyberSecurity Market:

https://www.globalinsightservices.com/reports/blockchain-cybersecurity-market/

Blockchain risk management Market:

https://www.globalinsightservices.com/reports/blockchain-risk-management-market/

Cloud Database Solution Market:

https://www.globalinsightservices.com/reports/cloud-database-solution-market/

Cloud Discovery Market:

https://www.globalinsightservices.com/reports/cloud-discovery-market/

Contact Us:

Global Insight Services LLC

16192, Coastal Highway, Lewes, DE 19958

E-mail: info@globalinsightservices.com

Phone: +1-833-761-1700

Website: https://www.globalinsightservices.com/

About Us:

Global Insight Services (GIS) is a leading multi-industry market research firm headquartered in Delaware, US. We are committed to providing our clients with highest quality data, analysis, and tools to meet all their market research needs. With GIS, you can be assured of the quality of the deliverables, robust & transparent research methodology, and superior service.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Burial Insurance Market Projected to Reach $509.5 Billion by 2034, Growing at 5.6% CAGR | Overall Study Report here

News-ID: 4209896 • Views: …

More Releases from Global Insight Services

Swarm Intelligence Market is anticipated to expand from $0.1 billion in 2024 to …

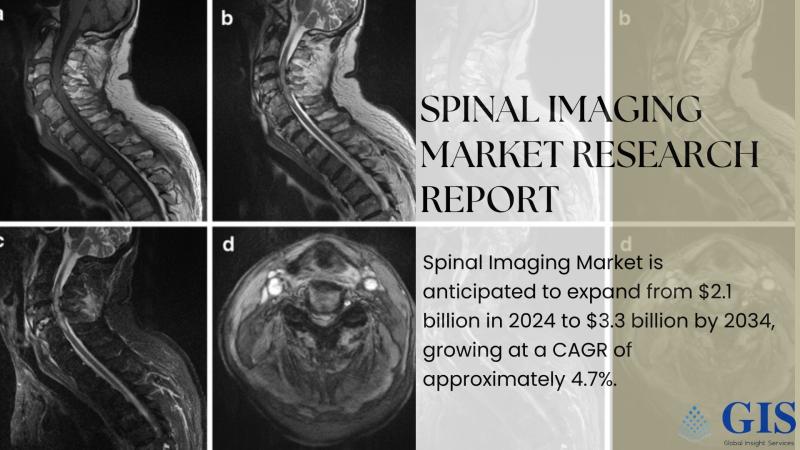

The Spinal Imaging Market is witnessing steady growth as healthcare providers increasingly rely on advanced imaging technologies to diagnose and monitor spinal disorders. The market comprises imaging modalities such as MRI, CT scans, X-rays, and emerging techniques including PET scans and ultrasound imaging. These technologies play a critical role in early detection, precise diagnosis, and effective treatment planning for spinal conditions such as degenerative disorders, tumors, infections, and trauma. The…

Custom Antibody Market: Growth Supported by Growing Applications in Immunotherap …

The Spinal Imaging Market is witnessing steady growth as healthcare providers increasingly rely on advanced imaging technologies to diagnose and monitor spinal disorders. The market comprises imaging modalities such as MRI, CT scans, X-rays, and emerging techniques including PET scans and ultrasound imaging. These technologies play a critical role in early detection, precise diagnosis, and effective treatment planning for spinal conditions such as degenerative disorders, tumors, infections, and trauma. The…

Liver Disease Treatment Market: Expansion Fueled by Increasing Incidence of NAFL …

The Liver Disease Treatment Market continues to expand rapidly as global awareness, early diagnosis, and advanced therapeutic approaches reshape patient care. With the market valued at $26.6 billion in 2024 and projected to reach $44.8 billion by 2034 at a steady 5.4% CAGR, demand for effective and accessible therapies is on the rise. The Liver Disease Treatment Market covers pharmaceuticals, biologics, vaccines, diagnostics, and liver transplant services designed to manage…

Healthcare Supply Chain BPO Market: Expansion Fueled by Increasing Outsourcing o …

The Healthcare Supply Chain BPO Market is rapidly evolving as healthcare providers worldwide seek smarter, leaner, and more resilient operations. With growing pressure to reduce costs, boost efficiency, and maintain uninterrupted patient care, outsourcing supply chain tasks has become a strategic necessity. The global Healthcare Supply Chain BPO Market is projected to grow from $3.05 billion in 2024 to $4.83 billion by 2034, reflecting a CAGR of 4.7%. This expansion…

More Releases for Life

Life Heater Reviews - How Does Life Heater Work? Read life heater reviews consum …

The Life Heater emerges as a revolutionary heating solution, redefining efficiency and safety standards for residents in the United States and Canada. More than a conventional heater, it boasts impressive energy savings of up to 30%, making it a beacon of sustainability in the realm of home heating. The device's convection heating system ensures rapid warmth, promising to elevate the comfort of spaces across North American homes with unprecedented speed.

The…

Russia Life Insurance Market to Eyewitness Massive Growth by 2026 | Renaissance …

A new research document is added in HTF MI database of 74 pages, titled as 'Russia Life Insurance - Key Trends and Opportunities to 2025' with detailed analysis, Competitive landscape, forecast and strategies. Latest analysis highlights high growth emerging players and leaders by market share that are currently attracting exceptional attention. The identification of hot and emerging players is completed by profiling 50+ Industry players; some of the profiled…

Life Insurance Market is Booming Worldwide | Sumitomo Life Insurance, Nippon Lif …

HTF MI recently added Global Life Insurance Market Study that gives deep analysis of current scenario of the Market size, demand, growth, trends, and forecast. Revenue for Life Insurance Market has grown substantially over the five years to 2019 as a result of strengthening macroeconomic conditions and healthier demand, however with current economic slowdown and Face-off with COVID-19 Industry Players are seeing Big Impact in operations and identifying ways to…

Online Life Insurance Market Swot Analysis by Key Players Nippon Life Insurance, …

Global Online Life Insurance Market Report 2020 by Key Players, Types, Applications, Countries, Market Size, Forecast to 2026 (Based on 2020 COVID-19 Worldwide Spread) is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global Online…

Life Insurance Market Next Big Thing with Major Giants HDFC Life Insurance, SBI …

A new business intelligence report released by HTF MI with title "Life Insurance Market in India 2019" is designed covering micro level of analysis by manufacturers and key business segments. The Life Insurance Market survey analysis offers energetic visions to conclude and study market size, market hopes, and competitive surroundings. The research is derived through primary and secondary statistics sources and it comprises both qualitative and quantitative detailing. Some of…

Life Insurance Market to Witness Massive Growth| Allan Gray Life, Coronation Lif …

HTF Market Intelligence released a new research report of 35 pages on title 'Strategic Market Intelligence: Life Insurance in South Africa - Key Trends and Opportunities to 2022' with detailed analysis, forecast and strategies. The study covers key regions and important players such as Allan Gray Life, Coronation Life Assurance, Sygnia Life etc.

Request a sample report @ https://www.htfmarketreport.com/sample-report/1854964-strategic-market-intelligence-38

Summary

The ""Strategic Market Intelligence: Life Insurance in South Africa - Key Trends…