Press release

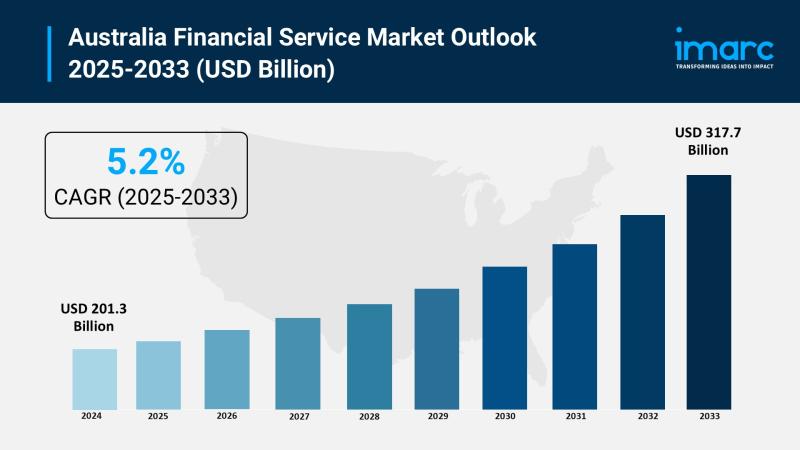

Australia Financial Services Market Worth USD 317.7 Billion During 2025-2033

The latest report by IMARC Group, "Australia Financial Services Market Size, Share, Trends and Forecast by Type, Size of Business, End User, and Region, 2025-2033," provides an in-depth analysis of the Australia financial services market. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Australia financial services market size reached USD 201.3 billion in 2024 and is projected to grow to USD 317.7 billion by 2033, exhibiting a steady growth rate of 5.2% during the forecast period.Report Attributes and Key Statistics:

Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 201.3 Billion

Market Forecast in 2033: USD 317.7 Billion

Growth Rate (2025-2033): 5.2%

Australia Financial Services Market Overview:

The Australia financial services market is experiencing steady growth driven by increasing demand for digital banking and fintech solutions enabling convenience, speed, and enhanced customer experiences, rising investment in financial technology with Australian firms investing over $2 billion in fintech ecosystems accelerating innovations in digital payments and blockchain, and regulatory advancements including Consumer Data Right implementation supporting transparency and consumer protection. The market demonstrates consistent momentum fueled by strong economic performance maintaining investor confidence and supporting wealth accumulation through mandatory superannuation system creating one of world's largest pension fund pools, growing consumer awareness and financial literacy driving informed decision-making in saving, borrowing, and investing, and sustainable finance initiatives expanding through green bonds, ESG investing, and socially responsible investment products responding to environmental consciousness. Strategic expansion is supported by robust cybersecurity standards promoting safe digital transformation, fintech adoption among Australian firms expected to reach 30% by 2024 driven by efficiency and cost reduction desires, and Open Banking framework reshaping service delivery through data transparency fostering innovation and competition across traditional and digital institutions.

Request For Sample Report: https://www.imarcgroup.com/australia-financial-services-market/requestsample

Australia Financial Services Market Trends:

• Digital Banking Transformation revolutionizing financial access as Australians rapidly adopt digital-first solutions with 83% of population aged 15 and older projected to use Internet banking services by December 2024

• Fintech Innovation accelerating across ecosystem as venture capital firms, institutional investors, and technology businesses invest heavily in digital payments, blockchain technology, and AI-powered financial systems

• Sustainable Finance Growth gaining momentum through green bonds exceeding $13 billion issued in first half of 2023 and responsible investing assets under management reaching AUD 977 billion reflecting commitment to environmental sustainability

• Open Banking Implementation reshaping competitive landscape as Consumer Data Right framework enables consumers to safely grant banking information access to authorized third-party providers driving personalized solutions

• Wealth Management Expansion strengthening as mandatory superannuation system accumulates substantial pension funds creating rising demand for expert financial guidance in portfolio diversification and investment planning

• Regulatory Reform Focus enhancing market integrity through stricter oversight by ASIC and APRA emphasizing transparency, accountability, fair conduct, and consumer protection measures

• Financial Inclusion Advancement expanding access across regional, rural, and Indigenous communities through mobile banking units, digital outreach, and culturally appropriate banking services promoting economic development

Australia Financial Services Market Drivers:

• Digital Infrastructure Strength creating foundation for innovation as robust internet connectivity, smartphone penetration, and cloud computing capabilities enable seamless digital financial service delivery

• Regulatory Support facilitating industry development through Australian government's Digital Finance Strategy, Consumer Data Right implementation, and frameworks promoting fintech collaboration and innovation

• High Financial Literacy supporting market growth as educated consumers make informed choices about financial products, actively engage with planning tools, and demand sophisticated personalized solutions

• Superannuation System generating substantial capital pools as mandatory retirement savings contributions provide stable foundation for long-term investment strategies benefiting fund managers and institutional investors

• Economic Stability maintaining investor confidence through consistent GDP growth, low unemployment rates, and sound fiscal policies attracting both domestic and international investment capital

• Consumer Engagement driving demand for tailored solutions as Australians spend more time managing finances through online tools, apps, and comparison websites seeking user-friendly experiences

• ESG Investment Focus expanding market opportunities as Australia strengthens commitment to achieving net-zero emissions by 2050 with investors increasingly focusing on environmentally sustainable projects

Market Challenges:

• Regulatory Complexity increasing operational costs as stringent compliance obligations across anti-money laundering, Know Your Customer, and data protection require substantial resource allocation for systems and training

• Cybersecurity Threats creating significant risks as rising volumes of online transactions, mobile banking activity, and digital identities expand entry points for phishing, ransomware, data breaches, and identity theft

• Competition from Non-Traditional Players disrupting market dynamics as technology companies, e-commerce platforms, and telecom providers offer financial services with greater speed, lower fees, and more intuitive interfaces

• Legacy System Constraints limiting agility for traditional institutions as outdated infrastructure, complex integration requirements, and technical debt hinder rapid innovation and digital transformation capabilities

• Compliance Cost Burden affecting profitability particularly for smaller players as continuous regulatory updates require ongoing investment in regtech solutions and legal oversight maintaining standards

• Consumer Trust Challenges complicating market relationships as data privacy concerns, past misconduct revelations, and service failures require sustained efforts rebuilding confidence through transparency and ethical behavior

• Talent Shortage constraining innovation capacity as competition for skilled professionals in data science, cybersecurity, digital product development, and regulatory compliance intensifies across industry

Market Opportunities:

• Embedded Finance Development establishing new revenue streams as non-financial companies integrate payment, lending, and insurance capabilities directly into their customer experiences and platforms

• Regional Market Expansion capturing underserved segments through tailored financial products including microloans, flexible insurance, and mobile banking units addressing geographic and technological barriers

• AI and Automation Integration enhancing efficiency and personalization through machine learning algorithms, chatbots, predictive analytics, and automated processes improving customer service and risk assessment

• Sustainable Product Innovation differentiating offerings through green financial products, ESG funds, climate-linked bonds, and carbon offset investments aligning with environmental consciousness

• Advisory Services Growth meeting rising demand for professional guidance on retirement planning, tax strategies, investment diversification, estate management, and risk mitigation as financial complexity increases

• Blockchain Applications exploring distributed ledger technology for cross-border payments, smart contracts, trade finance, and identity verification reducing costs and improving transaction speed and security

• Partnership Ecosystems leveraging collaborations between traditional banks, fintech startups, technology providers, and retailers creating integrated platforms offering comprehensive financial solutions

Browse the full report with TOC and List of Figures: https://www.imarcgroup.com/australia-financial-services-market

Australia Financial Services Market Segmentation:

By Type:

• Lending and Payments

• Insurance, Reinsurance and Insurance Brokerage

• Investments

• Foreign Exchange Services

By Size of Business:

• Small and Medium Business

• Large Business

By End User:

• Individuals

• Corporates

• Government

• Investment Institution

By Regional Distribution:

• Australia Capital Territory & New South Wales

• Victoria & Tasmania

• Queensland

• Northern Territory & Southern Australia

• Western Australia

Australia Financial Services Market News:

September 2025: Australian fintech Zeller introduced comprehensive "all-in-one" business banking solution specifically tailored for start-ups, offering integrated payment processing, transaction accounts, and business management tools addressing growing demand for streamlined financial services among emerging companies.

August 2025: FinTech Australia unveiled 2025 Consumer Data Right Ecosystem Map and Report amid record consumer data requests, highlighting Open Banking expansion while calling for regulatory reforms to enhance framework effectiveness and customer experience across financial services sector.

Key Highlights of the Report:

• Comprehensive market analysis projecting steady growth from USD 201.3 billion in 2024 to USD 317.7 billion by 2033 with 5.2% CAGR

• Detailed examination of digital banking transformation with 83% of Australians aged 15+ projected to use Internet banking services by December 2024 reflecting rapid digital adoption

• Strategic assessment of fintech innovation as Australian firms invest over $2 billion in fintech ecosystems accelerating developments in digital payments, blockchain, and AI-powered systems

• In-depth analysis of sustainable finance growth with responsible investing assets under management reaching AUD 977 billion and green bonds exceeding $13 billion demonstrating ESG commitment

• Regional market evaluation covering Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia with diverse financial service landscapes

• Open Banking implementation insights highlighting Consumer Data Right framework enabling data transparency, personalized solutions, and enhanced competition reshaping industry dynamics

• Superannuation system impact assessment showcasing mandatory retirement savings accumulation creating substantial pension fund pools driving wealth management sector expansion

Frequently Asked Questions (FAQs):

Q1: What are the primary factors driving Australia's financial services market growth to USD 317.7 billion by 2033?

A1: The market is driven by increasing demand for digital banking and fintech solutions with 83% of Australians projected to use Internet banking by December 2024, rising investment exceeding $2 billion in fintech ecosystems accelerating innovations in digital payments and blockchain, and regulatory advancements including Consumer Data Right implementation promoting transparency. Strong economic performance maintaining investor confidence, mandatory superannuation system accumulating substantial pension funds creating wealth management demand, and sustainable finance initiatives with responsible investing assets reaching AUD 977 billion contribute to the steady 5.2% growth rate during the forecast period.

Q2: How is Open Banking transforming Australia's financial services landscape?

A2: Open Banking implementation through Consumer Data Right framework is fundamentally reshaping service delivery by enabling consumers to safely grant banking information access to authorized third-party providers. This creates opportunities for hyper-personalized financial solutions, improved product recommendations, and optimized pricing strategies. Enhanced data transparency builds consumer trust, encourages greater digital platform engagement, and supports better credit risk assessments. The ecosystem drives innovation and healthy competition as traditional institutions and fintech companies leverage consumer data to develop new products, improve customer experiences, and create cross-platform financial management tools promoting financial wellness and loyalty.

Q3: What opportunities exist for financial service providers in emerging market segments?

A3: Providers can capitalize on embedded finance development integrating payment, lending, and insurance capabilities into non-financial platforms, regional market expansion addressing underserved communities through mobile banking and culturally appropriate services, and AI and automation integration enhancing efficiency through machine learning and predictive analytics. Sustainable product innovation including green bonds and ESG funds, advisory services growth meeting rising demand for professional guidance, and blockchain applications for cross-border payments and smart contracts represent significant opportunities. Partnership ecosystems combining traditional banks, fintechs, and technology providers, wealth management expansion serving growing superannuation pools, and cybersecurity solutions addressing rising digital threats offer pathways for differentiation and growth.

Note: If you require specific information not currently within the scope of the report, we can provide it as part of the customization.

Ask an analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=32704&flag=C

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: Sales@imarcgroup.com

Tel. No.: (D) +91 120 433 0800

Americas: +1 201-971-6302

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Australia Financial Services Market Worth USD 317.7 Billion During 2025-2033 here

News-ID: 4208763 • Views: …

More Releases from IMARC Group

Green Tea Bags Manufacturing Plant DPR 2026: Investment Cost, Market Growth & RO …

Setting up a green tea bags manufacturing plant positions investors within one of the steadily expanding and health-oriented segments of the global beverage industry, driven by increasing consumer awareness of wellness, rising preference for natural antioxidants, and growing demand for convenient herbal drink options. Green tea is widely valued for its perceived health benefits, including metabolism support and antioxidant properties, making it popular among health-conscious urban populations.

The shift toward…

Calcium Acetate Prices Q4 2025: USA Reaches USD 1,165/MT While China Trades at U …

North America Calcium Acetate Price Outlook Q4 2025:

United States Calcium Acetate Price Overview:

In Q4 2025, calcium acetate prices in the United States reached USD 1165 per metric ton. The market remained firm due to steady demand from food processing, pharmaceuticals, and wastewater treatment sectors. Stable consumption patterns and moderate production costs supported pricing levels. Supply chain efficiency and consistent raw material availability helped prevent sharp fluctuations during the quarter.

Get the…

Automotive Radiator Manufacturing Plant DPR & Unit Setup - 2026: Demand Analysis …

Setting up an Automotive Radiator manufacturing plant positions investors in one of the most critical and high-demand segments of the global automotive components and thermal management industry, backed by sustained global growth driven by rising vehicle production, increasing regulatory focus on engine efficiency and emission reduction, and the growing adoption of electric and hybrid vehicles requiring advanced cooling solutions. As global automotive production expands across emerging economies, regulatory frameworks continue…

Watch Manufacturing Plant DPR & Unit Setup - 2026: Machinery, CapEx/OpEx, ROI an …

Setting up a watch manufacturing plant positions investors at the convergence of precision engineering, consumer lifestyle, luxury goods, and wearable technology - one of the most dynamic and diversified segments of the global consumer goods industry - driven by rising demand for luxury and premium accessories, increasing adoption of smart and hybrid watches, growing disposable incomes across emerging markets, and expanding e-commerce and organized retail channels enabling access to global…

More Releases for Australia

Derila Memory foam pillow Australia: Honest Reviews About Derila Australia

Derila is one of the best memory foam pillows sold in Australia today.

Priced at around 30 dollars (USD), derila is currently the most reviewed and the cheapest memory pillow available in Australia.

What is Derila? Is Derila Pillow the best in Australia? Keep reading to discover everything worth knowing about Derila Australia.

OVERVIEW

Recently, Memory foam pillow has been trending and there is a lot of brands to choose from. Which one is…

CeraCare Australia - Where to Buy Legit CeraCare Supplement in Australia?

CeraCare Australia - Ceracare is a glucose support supplement that proposes to augment cardiovascular prosperity and to stay aware of perfect glucose assimilation in Australia. CeraCare supplement is conceptualized and executed by a threesome – Christine, Dr. Jihn and Michael. It is a natural supplement that helps one stay aware of ideal glucose levels, cardiovascular prosperity, and glucose assimilation.

Take Advantage of 80% Discount Offer in Australia >> https://boostsxproaustralia.com/ceracare-new

The indications…

Glucofort Australia - Where to Buy Legit Glucofort Supplement in Australia?

Glucofort Australia - Glucofort is an efficient, all-natural progressive glucose support supplement in Australia. This formula is made out of 12 key ingredients, 7 nutrients, and minerals, and a little of Vanadium. This supplement upholds regulated glucose levels and glucose digestion. Glucofort prides itself as the most inventive supplements available in Oceania, accentuating its solidarity, wellbeing, and quality.

Take Advantage of 75% Discount Offer in Australia >> https://boostsxproaustralia.com/glucofort-new

Rather than simply…

Australia Agriculture Market, Australia Agriculture Industry, Australia Agricult …

Australia Agriculture has been as vital within the development of Australia, because it was within the United States. Australia's ancient dominance in wheat and sheep continues into the 21st century. Recently Australian agriculture has become more and more diversified. The considerable expanses of productive land have helped Australia to become a number one world exporter of grains, meats, and wool. Each grains (predominantly wheat and barley) and wool markets round…

Australia Conveyor Maintenance Analysis by Top Companies Habasit Australia Pty l …

Global Australia Conveyor Maintenance Market and Competitive Analysis

Know your current market situation! Not only a vital element for brand new products but also for current products given the ever-changing market dynamics. The study allows marketers to remain involved with current consumer trends and segments where they'll face a rapid market share drop. Discover who you actually compete against within the marketplace, with Market Share Analysis know market position, to push…

Australia Conveyor Maintenance Market Analysis By Manufacturers Rema Tip Top Aus …

A conveyor system is a common piece of mechanical handling device that moves materials/objects from one location. A conveyor is often lifeline to a company’s ability to effectively move its products in a timely manner. While it is used constantly in a manufacturing plant, proper maintenance from trained technicians can extend the lifespan of conveyor. Furthermore, conveyor maintenance is essential as it may be subjected to different types of failures…