Press release

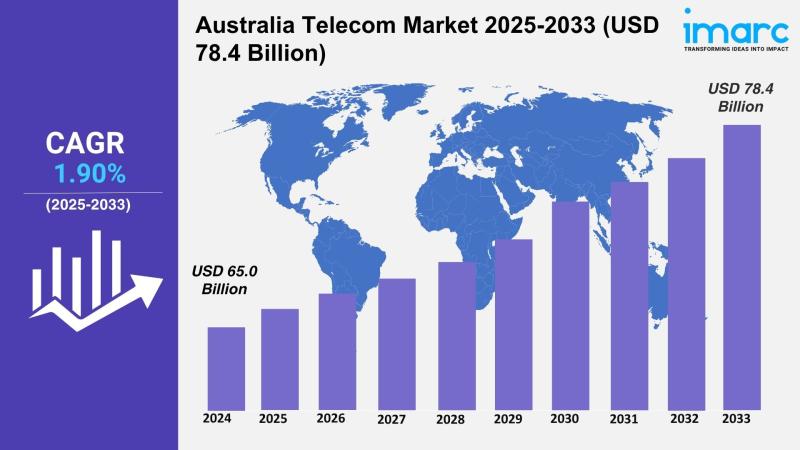

Australia Telecom Market Projected to Reach USD 78.4 Billion by 2033

The latest report by IMARC Group, titled "Australia Telecom Market Report by Services (Voice Services (Wired and Wireless), Data and Messaging Services, OTT and Pay-TV Services), and Region 2025-2033," offers a comprehensive analysis of the Australia telecom market growth. The report includes competitor and regional analysis, along with a detailed breakdown of the market segmentation. The Australia telecom market size reached USD 65.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 78.4 Billion by 2033, exhibiting a CAGR of 1.90% during 2025-2033.Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 65.0 Billion

Market Forecast in 2033: USD 78.4 Billion

Market Growth Rate (2025-2033): 1.90%

Australia Telecom Market Overview

The Australia telecom market is experiencing steady growth driven by rapid 5G network deployment, increasing mobile data consumption, expanding Internet of Things (IoT) adoption, accelerating digital transformation initiatives, and strengthening government support for connectivity infrastructure. The market expansion is supported by technological advancements in Cloud RAN solutions, edge computing capabilities, network slicing technologies, and increasing recognition of telecommunications infrastructure as essential enabler supporting economic development, remote operations, and digital service delivery. Advanced telecom solutions are transforming Australia's communication landscape through ultra-low latency connectivity, enhanced network capacity, improved service reliability, and personalized data offerings positioning the country as regionally competitive telecommunications market adopting next-generation technologies and supporting diverse industry digitalization requirements.

Australia's telecom foundation demonstrates strong infrastructure fundamentals across diverse applications including mobile voice communications, high-speed data services, enterprise networking solutions, IoT connectivity platforms, and content streaming delivery. The country's high internet penetration rate of 94.9%, sophisticated mobile network coverage reaching 33.59 million cellular connections, mature regulatory framework, and commitment to digital inclusion create substantial demand for telecom services capable of supporting remote work, cloud applications, real-time collaboration, and data-intensive activities. The proliferation of 5G rollouts, private network deployments, satellite broadband solutions, and fixed wireless technologies is creating favorable market conditions, requiring significant investments in network infrastructure, spectrum optimization, cybersecurity measures, and customer experience enhancement. Australia's geographic challenges combined with concentrated urban populations and government-supported regional connectivity initiatives make it an important market for innovative telecom technology deployment and infrastructure modernization supporting national economic competitiveness.

Request For Sample Report:

https://www.imarcgroup.com/australia-telecom-market/requestsample

Australia Telecom Market Trends

• 5G network acceleration: Growing deployment of fifth-generation mobile networks by Telstra, Optus, and TPG Telecom delivering ultra-fast data speeds, reduced latency, increased capacity, and supporting advanced applications including augmented reality, autonomous vehicles, and industrial automation across metropolitan and regional areas.

• IoT ecosystem expansion: Increasing adoption of Internet of Things platforms, smart home devices, industrial monitoring systems, and connected sensor networks leveraging LTE-M, NB-IoT, and 5G connectivity supporting automation, efficiency optimization, and data-driven decision-making across diverse sectors.

• Mobile data dominance: Rising smartphone-driven data consumption fueled by streaming services, online gaming, remote working requirements, and social media usage compelling telecom providers to offer unlimited data plans, enhanced network capacity, and improved quality of service.

• Edge computing integration: Strengthening deployment of edge computing infrastructure enabling low-latency data processing closer to users supporting real-time applications including autonomous vehicles, remote monitoring, smart manufacturing, and gaming requiring immediate response capabilities.

• Network sharing partnerships: Expanding collaboration between telecom operators including Optus-TPG regional network sharing agreement enabling cost-efficient infrastructure deployment, accelerated 5G rollout, improved rural coverage, and enhanced service quality through shared spectrum and equipment resources.

• Digital transformation enablement: Growing enterprise demand for cloud-based communications, unified collaboration platforms, managed security services, and customized connectivity solutions supporting business operations, remote workforces, and industry-specific automation requirements across sectors.

Market Drivers

• 5G infrastructure investment: Implementation of advanced 5G technologies with Telstra deploying Ericsson Cloud RAN solutions, Optus enhancing regional coverage through Nokia equipment, and TPG expanding network capabilities driving innovation, capacity enhancement, and service quality improvements.

• Mobile data consumption growth: Growing internet user base reaching 25.21 million (94.9% penetration) with 20.80 million social media users and 33.59 million cellular connections exceeding total population creating sustained demand for high-bandwidth services and unlimited data plans.

• IoT market expansion: Increasing IoT startup funding reaching A$173 million in 2022 with average funding rounds of A$21.7 million demonstrating investor confidence and market potential for smart home automation, industrial IoT, energy management, and smart city applications.

• Enterprise digitalization: Rising business adoption of telecom solutions supporting remote work, cloud collaboration, real-time communications, and IoT applications across healthcare, logistics, finance, manufacturing, and retail sectors requiring reliable high-performance connectivity infrastructure.

• Government infrastructure support: Growing public investment in regional broadband programs, 5G infrastructure development, digital inclusion policies, and innovation hubs addressing digital divide, supporting rural connectivity, and fostering sustainable telecommunications sector development.

• Technology convergence: Increasing integration of artificial intelligence, augmented reality, cloud computing, and telecommunications enabling innovative service offerings including personalized recommendations, virtual experiences, and intelligent network management improving customer experiences and operational efficiency.

Challenges and Opportunities

Challenges:

• High infrastructure costs particularly in rural and remote areas requiring substantial capital investment for fiber-optic lines, tower construction, satellite deployment, and fixed wireless networks with sparse populations creating slower investment returns

• Intense market competition among established providers including Telstra, Optus, and TPG with aggressive pricing tactics, promotional bundles, and service offerings compressing profit margins while increasing customer churn and loyalty challenges

• Urban network congestion resulting from increasing data usage, population density, proliferating smart devices, and streaming platforms straining city network capacity requiring continuous infrastructure upgrades, small cell deployment, and spectrum optimization

• Regional connectivity gaps persisting despite government initiatives with underserved rural communities facing inadequate high-speed internet access limiting education, healthcare, business opportunities, and digital participation in remote areas

• Cybersecurity vulnerabilities requiring robust security measures, regulatory compliance, fraud prevention systems, and customer data protection amid growing digital service adoption and sophisticated cyber threat landscape

Opportunities:

• Rural connectivity expansion leveraging satellite broadband technologies, fixed wireless infrastructure, and low-Earth orbit satellites addressing underserved communities creating new customer segments while supporting digital inclusion and economic development objectives

• Edge computing services integration developing low-latency connectivity infrastructure supporting real-time applications including autonomous vehicles, gaming, remote monitoring, and smart manufacturing positioning telecom providers as essential digital ecosystem enablers

• Cross-industry collaborations partnering with mining, agriculture, logistics, and manufacturing sectors providing customized connectivity solutions, private networks, IoT integration, and specialized services creating stable long-term enterprise revenue streams

• Private 5G network deployment offering dedicated enterprise connectivity solutions supporting industrial automation, secure communications, reliable operations, and specialized applications creating premium service segments and differentiated value propositions

• Export opportunities leveraging Australian telecommunications expertise, network management capabilities, and technology partnerships to serve Asia-Pacific regional markets experiencing digital transformation and connectivity infrastructure development

Australia Telecom Market Segmentation

By Services:

• Voice Services

o Wired Voice Services

Traditional Landlines

VoIP (Voice over Internet Protocol)

Business PBX Systems

Integrated Voice Solutions

o Wireless Voice Services

Mobile Voice Calls

Voice-over-LTE (VoLTE)

Voice-over-5G

Roaming Services

• Data and Messaging Services

o Mobile Data Services

4G/LTE Data

5G Data Services

Mobile Internet Plans

Unlimited Data Offerings

o Fixed Broadband Services

Fiber-to-the-Premises (FTTP)

Cable Broadband

Fixed Wireless

ADSL Services

o Messaging Services

SMS (Short Message Service)

MMS (Multimedia Messaging)

App-Based Messaging

Enterprise Messaging Solutions

• OTT and Pay-TV Services

o Over-the-Top Services

Streaming Platforms (Netflix, Stan)

IPTV Services

Video-on-Demand

Music Streaming

o Pay-TV Services

Cable Television

Satellite TV

Digital Broadcasting

Premium Content Packages

By Region:

• Australia Capital Territory & New South Wales

• Victoria & Tasmania

• Queensland

• Northern Territory & Southern Australia

• Western Australia

Browse Full Report:

https://www.imarcgroup.com/australia-telecom-market

Australia Telecom Market News (2024-2025)

• July 2025: Ericsson powered Telstra's 5G evolution through automated carrier aggregation on commercial network with SaaS-based 5G core managed by Ericsson built on Google Cloud platform advancing Australia's telecommunications infrastructure capabilities.

• May 2025: Nokia enhanced Optus's 5G network deploying Habrok Massive MIMO radios and Levante ultra-performance baseband solutions from AirScale portfolio improving capacity and coverage across regional Australia following MOCN agreement with TPG Telecom.

• February 2025: Telstra and Ericsson launched Asia-Pacific's first programmable 5G Advanced network through "Aduna" initiative empowering developers with advanced network features supporting innovation-first telecommunications ecosystem.

• January 2025: Optus commenced regional 5G rollout fast-tracking deployment through network and spectrum sharing arrangement with TPG Telecom under Multi-Operator-Core Network (MOCN) agreement targeting 1,500 sites by 2028 and 2,444 sites by 2030.

• July 2023: Telstra deployed Ericsson's Cloud RAN solution in commercial 5G network marking first deployment of its kind in Australia, migrating 2600MHz and 3600MHz carrier frequencies to Cloud RAN infrastructure enabling faster network capacity expansion.

• 2024: Top three telecom providers Telstra, Singtel Optus, and TPG Telecom collectively commanded 84% market share demonstrating concentrated competitive landscape with continued focus on digital infrastructure enhancement and competitive data plan offerings.

Key Highlights of the Report

• Market Performance (2019-2024)

• Market Outlook (2025-2033)

• Industry Catalysts and Challenges

• Segment-wise historical and future forecasts

• Competitive Landscape and Key Player Analysis

• Services Analysis covering Voice, Data, Messaging, OTT, and Pay-TV

Ask analyst for your customized sample:

https://www.imarcgroup.com/request?type=report&id=22107&flag=F

Q&A Section

Q1: What drives growth in the Australia telecom market?

A1: Market growth is driven by 5G infrastructure investment with major operators deploying advanced Cloud RAN and network equipment, mobile data consumption growth reaching 94.9% internet penetration and 33.59 million cellular connections, IoT market expansion attracting A$173 million in startup funding supporting smart applications, enterprise digitalization requiring remote work and cloud collaboration solutions, government infrastructure support through regional broadband programs and digital inclusion policies, and technology convergence integrating AI, AR, and cloud computing enhancing service capabilities and customer experiences.

Q2: What are the latest trends in this market?

A2: Key trends include 5G network acceleration by Telstra, Optus, and TPG delivering ultra-fast speeds and supporting advanced applications, IoT ecosystem expansion leveraging LTE-M, NB-IoT, and 5G connectivity for automation across sectors, mobile data dominance driven by streaming services and remote working requirements, edge computing integration enabling low-latency processing for real-time applications, network sharing partnerships exemplified by Optus-TPG regional MOCN agreement, and digital transformation enablement providing enterprises with cloud communications and managed security services.

Q3: What challenges do companies face?

A3: Major challenges include high infrastructure costs particularly in rural areas requiring substantial capital investment with slower returns, intense market competition among established providers compressing margins through aggressive pricing tactics, urban network congestion from increasing data usage requiring continuous infrastructure upgrades, regional connectivity gaps persisting in underserved rural communities limiting digital access, and cybersecurity vulnerabilities requiring robust security measures and regulatory compliance amid growing digital service adoption.

Q4: What opportunities are emerging?

A4: Emerging opportunities include rural connectivity expansion leveraging satellite and fixed wireless technologies addressing underserved communities, edge computing services integration supporting real-time applications and positioning telecom providers as digital ecosystem enablers, cross-industry collaborations providing customized solutions to mining, agriculture, and manufacturing sectors, private 5G network deployment offering dedicated enterprise connectivity for industrial automation, and export opportunities serving Asia-Pacific markets experiencing digital transformation and infrastructure development.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91-120-433-0800

United States: +1-201-971-6302

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses. IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Australia Telecom Market Projected to Reach USD 78.4 Billion by 2033 here

News-ID: 4208556 • Views: …

More Releases from IMARC Group

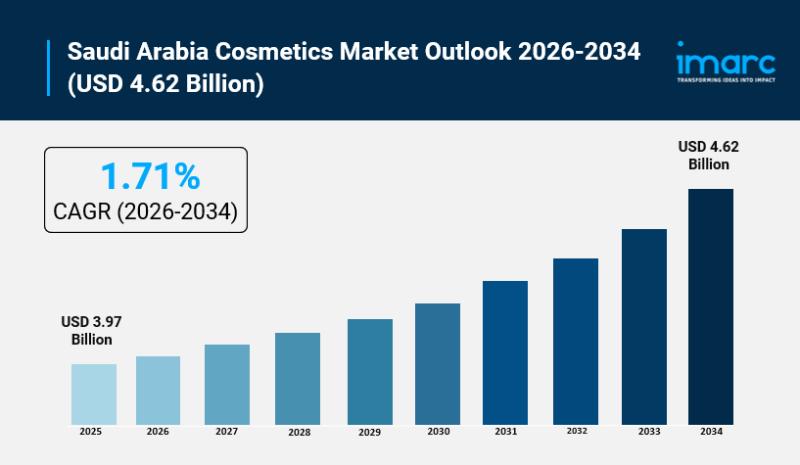

Saudi Arabia Cosmetics Market Poised to Surge to USD 4.62 Billion by 2034, Drive …

Saudi Arabia Cosmetics Market Overview

Market Size in 2025: USD 3.97 Billion

Market Forecast in 2034: USD 4.62 Billion

Market Growth Rate 2026-2034: 1.71%

According to IMARC Group's latest research publication, "Saudi Arabia Cosmetics Market Size, Share, Trends and Forecast by Product Type, Category, Gender, Distribution Channel, and Region, 2026-2034", The Saudi Arabia cosmetics market size was valued at USD 3.97 Billion in 2025 and is projected to reach USD 4.62 Billion by 2034,…

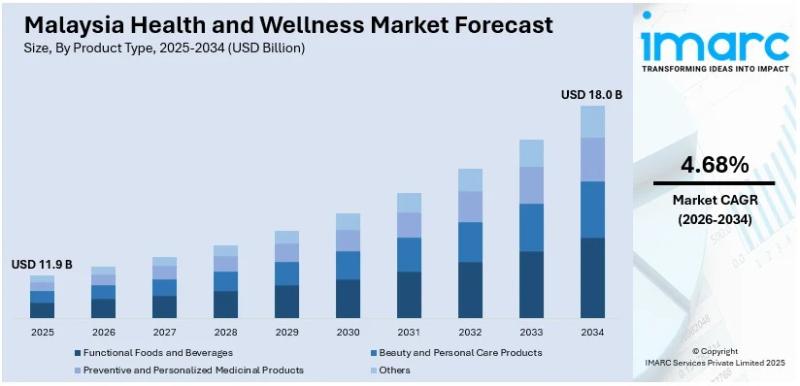

Malaysia Health and Wellness Market to Reach USD 18.0 Billion by 2034, Growing a …

Source: IMARC Group | Category: Healthcare

Report Introduction

According to IMARC Group's latest report titled "Malaysia Health and Wellness Market Size, Share, Trends and Forecast by Product Type, Functionality, and Region, 2026-2034", the market is growing due to rising health consciousness, digital health integration, and the revival of traditional herbal medicine. The study offers a profound analysis of the industry, encompassing market share, size, growth factors, key trends, and regional insights. The…

Qatar Residential Real Estate Market Size to Hit USD 14,965.12 Million by 2033 | …

Qatar Residential Real Estate Market Overview

Market Size in 2024: USD 7,831.75 Million

Market Size in 2033: USD 14,965.12 Million

Market Growth Rate 2025-2033: 7.46%

According to IMARC Group's latest research publication, "Qatar Residential Real Estate Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The Qatar residential real estate market size reached USD 7,831.75 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 14,965.12 Million by 2033, exhibiting…

India Medical Tourism Market to Reach USD 72.1 Billion by 2034, Growing at 13.09 …

Source: IMARC Group | Category: Transportation and Logistics | Author Name: Gaurav

Report Introduction

According to IMARC Group's latest report titled "India Medical Tourism Market Report by Treatment Type, and Region 2026-2034", the market is growing due to affordable treatment costs, skilled healthcare professionals, and advanced medical infrastructure. The study offers a profound analysis of the industry, encompassing market share, size, growth factors, key trends, and regional insights. The report covers critical…

More Releases for Australia

Derila Memory foam pillow Australia: Honest Reviews About Derila Australia

Derila is one of the best memory foam pillows sold in Australia today.

Priced at around 30 dollars (USD), derila is currently the most reviewed and the cheapest memory pillow available in Australia.

What is Derila? Is Derila Pillow the best in Australia? Keep reading to discover everything worth knowing about Derila Australia.

OVERVIEW

Recently, Memory foam pillow has been trending and there is a lot of brands to choose from. Which one is…

CeraCare Australia - Where to Buy Legit CeraCare Supplement in Australia?

CeraCare Australia - Ceracare is a glucose support supplement that proposes to augment cardiovascular prosperity and to stay aware of perfect glucose assimilation in Australia. CeraCare supplement is conceptualized and executed by a threesome – Christine, Dr. Jihn and Michael. It is a natural supplement that helps one stay aware of ideal glucose levels, cardiovascular prosperity, and glucose assimilation.

Take Advantage of 80% Discount Offer in Australia >> https://boostsxproaustralia.com/ceracare-new

The indications…

Glucofort Australia - Where to Buy Legit Glucofort Supplement in Australia?

Glucofort Australia - Glucofort is an efficient, all-natural progressive glucose support supplement in Australia. This formula is made out of 12 key ingredients, 7 nutrients, and minerals, and a little of Vanadium. This supplement upholds regulated glucose levels and glucose digestion. Glucofort prides itself as the most inventive supplements available in Oceania, accentuating its solidarity, wellbeing, and quality.

Take Advantage of 75% Discount Offer in Australia >> https://boostsxproaustralia.com/glucofort-new

Rather than simply…

Australia Agriculture Market, Australia Agriculture Industry, Australia Agricult …

Australia Agriculture has been as vital within the development of Australia, because it was within the United States. Australia's ancient dominance in wheat and sheep continues into the 21st century. Recently Australian agriculture has become more and more diversified. The considerable expanses of productive land have helped Australia to become a number one world exporter of grains, meats, and wool. Each grains (predominantly wheat and barley) and wool markets round…

Australia Conveyor Maintenance Analysis by Top Companies Habasit Australia Pty l …

Global Australia Conveyor Maintenance Market and Competitive Analysis

Know your current market situation! Not only a vital element for brand new products but also for current products given the ever-changing market dynamics. The study allows marketers to remain involved with current consumer trends and segments where they'll face a rapid market share drop. Discover who you actually compete against within the marketplace, with Market Share Analysis know market position, to push…

Australia Conveyor Maintenance Market Analysis By Manufacturers Rema Tip Top Aus …

A conveyor system is a common piece of mechanical handling device that moves materials/objects from one location. A conveyor is often lifeline to a company’s ability to effectively move its products in a timely manner. While it is used constantly in a manufacturing plant, proper maintenance from trained technicians can extend the lifespan of conveyor. Furthermore, conveyor maintenance is essential as it may be subjected to different types of failures…