Press release

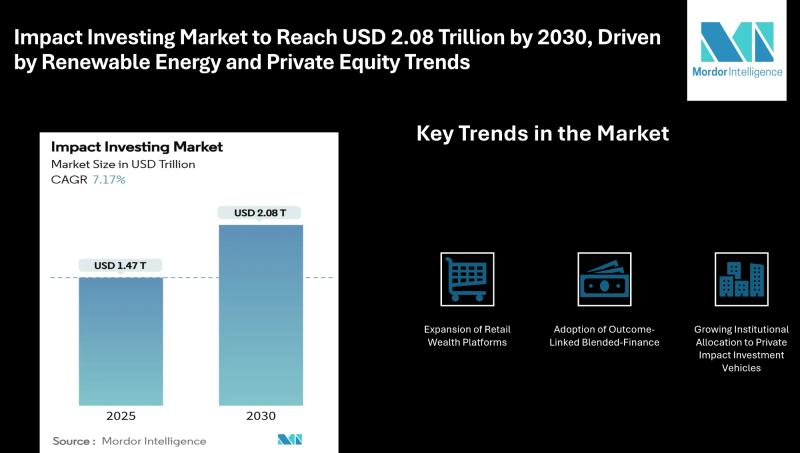

Impact Investing Market to Reach USD 2.08 Trillion by 2030, Driven by Renewable Energy and Private Equity Trends

Mordor Intelligence has published a new report on the Impact Investing Market, offering a comprehensive analysis of trends, growth drivers, and future projections.Overview of the Impact Investing Market

According to the Mordor Intelligence, the Impact Investing Market reached USD 1.47 trillion in 2025 and is expected to climb to USD 2.08 trillion by 2030, advancing at a 7.17% CAGR during the forecast period. This growth highlights the increasing Impact Investing Market share as investors integrate environmental, social, and governance (ESG) factors into core portfolio strategies.

The Impact Investing Industry is gradually moving from its philanthropic roots toward mainstream adoption, with an emphasis on achieving measurable social and environmental impact alongside financial returns

Report Overview: https://www.mordorintelligence.com/industry-reports/impact-investing-market?utm_source=openpr

Key Trends in the Impact Investing Market

1. Increasing Regulatory Pressure Driving ESG Transparency Across Markets

Regulatory requirements like the EU Corporate Sustainability Reporting Directive are compelling companies to disclose audited impact metrics. This transition from voluntary to mandatory reporting enhances transparency and strengthens investor confidence in impact-driven investments.

2. Growing Institutional Allocation to Private Impact Investment Vehicles

These allocations aim to deliver both financial returns and measurable social or environmental outcomes, supporting sustainable investment practices while providing portfolio diversification.

3. Expansion of Retail Wealth Platforms to Democratize Impact Investing

Services offering fractional shares, automated impact scoring, and carbon dashboards are particularly appealing to younger, values-driven investors, helping to expand the overall Impact Investing Market share.

4. Adoption of Outcome-Linked Blended-Finance Structures for Risk Mitigation

Blended-finance models, supported by risk mitigation tools from international financial institutions, enable investors to confidently engage with emerging markets.

Check out more details and stay updated with the latest industry trends, including the Japanese version for localized insights: https://www.mordorintelligence.com/ja/industry-reports/impact-investing-market?utm_source=openpr

Segmentation in the Impact Investing Market

By Asset Class:

Private Equity

Private Debt

Natural and Real Assets

Public Equity and Debt

Cash & Cash Equivalents

Fund Structures & Others

By Investor Type:

Institutional Investors

Individual Investors

By End-Use Sector:

Renewable Energy

Sustainable Agriculture

Micro-Finance & MSME Lending

Healthcare

Ed-Tech & Vocational Training

Sustainable Infrastructure

By Geography:

North America:

United States

Canada

Mexico

South America:

Brazil

Peru

Chile

Argentina

Rest of South America

Europe:

United Kingdom

Germany

France

Spain

Italy

BENELUX (Belgium, Netherlands, Luxembourg)

NORDICS (Denmark, Finland, Iceland, Norway, Sweden)

Rest of Europe

Asia-Pacific:

India

China

Japan

Australia

South Korea

South-East Asia (Singapore, Malaysia, Thailand, Indonesia, Vietnam, Philippines)

Rest of Asia-Pacific

Middle East and Africa:

United Arab Emirates

Saudi Arabia

South Africa

Nigeria

Rest of Middle East and Africa

Explore Our Full Library of Financial Services and Investment Intelligence Research Reports - https://www.mordorintelligence.com/market-analysis/financial-services-and-investment-intelligence?utm_source=openpr

Key Players in the Impact Investing Market

BlackRock - A leading global investment management firm, BlackRock integrates ESG and impact strategies across its diverse investment portfolios.

TPG Rise - Focuses on impact investing through private equity, supporting businesses that generate measurable social and environmental outcomes.

LeapFrog Investments - Specializes in investing in high-growth companies in emerging markets that provide financial services and healthcare access.

Triodos Investment Management - A pioneer in sustainable investing, Triodos funds projects with positive social, environmental, and cultural impact.

Bridges Fund Management - Manages investments that target social and environmental challenges while delivering competitive financial returns.

Explore more insights on Impact Investing Market competitive landscape: https://www.mordorintelligence.com/industry-reports/impact-investing-market/companies?utm_source=openpr

Conclusion

The Impact Investing Market growth is poised for continued growth, driven by regulatory support, institutional reallocation, and technological innovations that expand access for retail investors.

The content also reflects the broader Impact Investing Market analysis, demonstrating how regulatory, institutional, and technological developments are influencing investment flows and market dynamics.

Get the latest industry insights on the impact investing market: https://www.mordorintelligence.com/industry-reports/impact-investing-market?utm_source=openpr

Industry Related Reports

ESG Rating Services Market

The ESG Rating Services Market is projected to grow from USD 11.23 billion in 2025 to USD 16.69 billion by 2030, reflecting a CAGR of 8.25% during the forecast period. The market growth is driven by increasing regulatory requirements for sustainability reporting and rising demand from investors seeking transparent, standardized ESG performance assessments. Enhanced focus on corporate accountability and responsible investing is further supporting market expansion.

https://www.mordorintelligence.com/industry-reports/esg-rating-services-market?utm_source=openpr

Sustainable Finance Market

The Sustainable Finance Market is expected to grow from USD 13.4 trillion in 2025 to USD 24.3 trillion by 2030, at a CAGR of 12.59%. Growth is fueled by increasing adoption of green bonds and ESG-linked lending, alongside rising investor demand for environmentally and socially responsible investment options. Regulatory support and a focus on sustainable development goals are also driving market expansion.

https://www.mordorintelligence.com/industry-reports/sustainable-finance-market?utm_source=openpr

Micro Finance Market

The Micro Finance Market is projected to grow from USD 256.74 billion in 2025 to USD 424.51 billion by 2030, at a CAGR of 10.58%. The market expansion is driven by increasing financial inclusion initiatives in emerging economies and the growing adoption of digital lending platforms. Rising demand for small-scale credit among underserved populations further supports Micro Finance Market growth.

https://www.mordorintelligence.com/industry-reports/micro-finance-market?utm_source=openpr

For any inquiries or to access the full report, please contact:

media@mordorintelligence.com

https://www.mordorintelligence.com/

Mordor Intelligence, 11th Floor, Rajapushpa Summit, Nanakramguda Rd, Financial District, Gachibowli, Hyderabad, Telangana - 500032, India.

About Mordor Intelligence:

Mordor Intelligence is a trusted partner for businesses seeking comprehensive and actionable market intelligence. Our global reach, expert team, and tailored solutions empower organizations and individuals to make informed decisions, navigate complex markets, and achieve their strategic goals.

With a team of over 550 domain experts and on-ground specialists spanning 150+ countries, Mordor Intelligence possesses a unique understanding of the global business landscape. This expertise translates into comprehensive syndicated and custom research reports covering a wide spectrum of industries, including aerospace & defense, agriculture, animal nutrition and wellness, automation, automotive, chemicals & materials, consumer goods & services, electronics, energy & power, financial services, food & beverages, healthcare, hospitality & tourism, information & communications technology, investment opportunities, and logistics.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Impact Investing Market to Reach USD 2.08 Trillion by 2030, Driven by Renewable Energy and Private Equity Trends here

News-ID: 4207320 • Views: …

More Releases from Mordor Intelligence

Egypt Residential Construction Market to Reach USD 29.96 Billion by 2031 as Gove …

Mordor Intelligence has published a new report on the offering a Egypt Residential Construction comprehensive analysis of trends, growth drivers, and future projections

Egypt Residential Construction Market Overview

According to Mordor Intelligence, the Egypt residential construction market size was valued at USD 18.80 billion in 2025 and expanded to USD 20.32 billion in 2026, with the market forecast to reach USD 29.96 billion by 2031. This growth outlook reflects the…

Canned Meat Market Size to Reach USD 22.69 Billion by 2031 as Protein Demand and …

The global canned meat market size is projected to expand from usd 18.61 billion in 2026 to usd 22.69 billion by 2031, registering a cagr of 4.04% during the forecast period, according to Mordor Intelligence. This steady expansion reflects rising reliance on shelf-stable protein sources, changing household structures, and growing institutional procurement across both developed and emerging economies. The canned meat industry continues to benefit from its dual positioning as…

Canned Alcoholic Beverages Market Size to Reach USD 48.78 Billion by 2030 as RTD …

The Global canned alcoholic beverages market size is projected to expand from USD 34.81 billion in 2025 to USD 48.78 billion by 2030, registering a CAGR of 6.98% during the forecast period, according to Mordor Intelligence. This steady expansion reflects a structural shift in alcohol consumption toward convenient, portable, and premium-ready formats.

The Canned Alcoholic Beverages Industry is benefiting from changing lifestyle patterns, growing demand for ready-to-drink (RTD) options, and increasing…

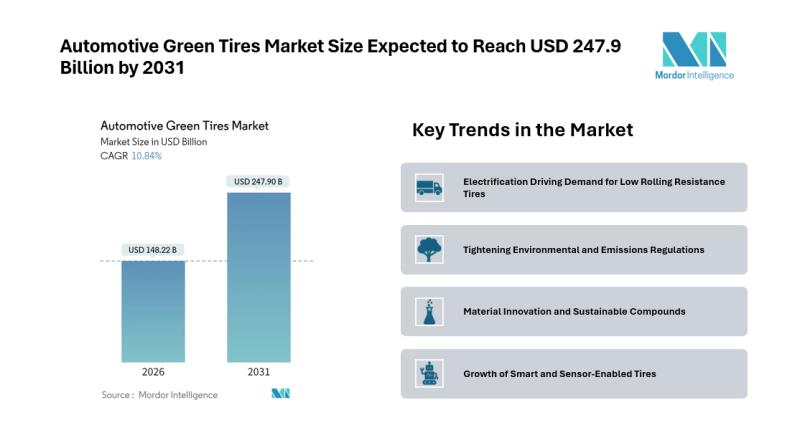

Automotive Green Tires Market Size Expected to Reach USD 247.9 Billion by 2031 - …

Introduction

The Automotive Green Tires Market is gaining traction as sustainability, fuel efficiency, and emissions reduction become central priorities for automotive manufacturers and regulators. According to Mordor Intelligence, the Automotive Green Tires market size is expected to grow from USD 133.73 billion in 2025 to USD 148.22 billion in 2026, and is forecast to reach USD 247.90 billion by 2031, registering a CAGR of 10.84% during the 2026-2031 forecast period.…

More Releases for Impact

Chatbot Market Impact of Industry Size, and Impact Y-o-Y

The Global Chatbot Market size accounted for USD 521 Million in 2021 and is expected to reach USD 3,411 Million by 2030 growing at a CAGR of 23.7% during the forecast period from 2022 to 2030.

Global Chatbot Market Growth Aspects

The rising emphasis on consumer participation through numerous mediums around the world is one of the key factors driving the growth of the chatbots industry. Businesses' greater usage of customer service…

Technological Impact: Circuit Breaker Market Development Amid the COVID-19 Impac …

The apocalypse of COVID-19 disease has negatively affected the global market for the circuit breaker during the projected period. This pandemic spread has created a severe impact on the operational process of businesses across the world. Contrary to this, though most of the countries have implemented total lockdown in order to prevent the communal spread of the disease, the circuit breaker market shall have a significant growth due to rapidly…

Covid-19 Impact On Impact Modifier Market Research Report 2019-2029.

This FMI study offers a ten-year analysis and forecast for the global impact modifier market between 2018 and 2028. The study considers 2017 as the base year with market values estimated for 2018 and a forecast developed for the duration between 2019 and 2028. Compound Annual Growth Rate (CAGR) is represented from 2018 to 2028. The study covers various perspectives of the impact modifiers market, including market dynamics, value chain,…

High Impact PolyStyrene Market Current Impact to Make Big Changes 2020

"MARKET GROWTH INSIGHT information of the Global High Impact PolyStyrene Market report will surely grow business and improve return on investment (ROI). The report is ready to refer to documents that share important details of the market from a historical point of view, allowing readers to measure concurrent developments to make accurate growth speculations and forecast assessments. The report provides an exclusive overview of the competitive spectrum to identify major…

Analysis of Potential Impact of COVID-19 on Impact Modifier Market

Global Impact Modifier Market: Overview

The growth of the global impact modifier market has gathered pace, owing to the pivotal use of impact modifier in construction processes and automotive industries. Impact modifiers are a group of additives which help in enhancing the strength of polymer compounds. They are available in the form of resins and imparts rubbery nature. This elastic nature of impact modifier increases the durability of polymer compounds when…

Stain Removers Market Research Report (COVID-19) IMPACT 2020 with Coronavirus Im …

This has brought along several changes in This report also covers the impact of COVID-19 on the global Stain Removers market.

The Stain Removers Market analysis summary by Reports Insights is a thorough study of the current trends leading to this vertical trend in various regions. Research summarizes important details related to market share, market size, applications, statistics and sales. In addition, this study emphasizes thorough competition analysis on market prospects,…