Press release

India Fintech & UPI Market to hit US$ 12.52 Trillion by 2032 | Major Companies likes - Amazon Pay, Axis Bank, Cred, Google Pay (GPay), HDFC Bank, ICICI Bank

The India fintech & UPI Payments market reached US$ 2.50 Trillion in 2024 and is expected to reach US$ 12.52 Trillion by 2032, growing at a CAGR of 22.3% during the forecast period 2025-2032.The India Fintech & UPI Payments Market, as examined by DataM Intelligence, provides a thorough industry overview enriched with detailed insights, historical data, and essential statistics. The report extensively explores market dynamics and competitive landscapes, featuring profiles of leading companies, their product offerings, pricing strategies, financials, growth plans, and geographic footprint.

Unlock exclusive insights with our detailed sample report (Corporate Email ID to get priority access) @ https://www.datamintelligence.com/download-sample/india-fintech-and-upi-payments-market?ca

Fintech and UPI payments are transforming digital transactions by enabling fast, secure, and low-cost real-time money transfers, driving financial inclusion, and reshaping banking, retail, and e-commerce with seamless cashless solutions.

Prominent Industry players in the India Fintech & UPI Payments Market

The prominent players in India Fintech & UPI Payments Market research report are: Amazon Pay, Axis Bank, Cred, Google Pay (GPay), HDFC Bank, ICICI Bank, National Payments Corporation of India (NPCI), Paytm, PhonePe, Pine Labs, Razorpay, State Bank of India (SBI)

The companies are primarily focusing on strategies such as new product launches to penetrate the fastest-growing emerging markets across the world.

Industry News

September 2025: UPI transaction volume dipped slightly month-on-month to 19.63 billion transactions, though the total value saw a marginal increase, and year-on-year growth remained robust at 31% volume increase.

September 2025: NPCI increased the UPI transaction limit for certain merchant payments to ₹10 lakh (up from ₹1 lakh) for select verified categories, facilitating greater adoption for high-value transactions.

August 1, 2025: NPCI implemented new operational UPI rules designed to enhance system stability, including daily limits on bank balance checks (50 times per app) and scheduling recurring autopay transactions during non-peak hours.

July 2025 (Ongoing Trend): The Fintech sector led Q3 2025 startup funding by segment, raising $556.3 million across 34 deals, despite a general slowdown in overall startup capital, showing sustained investor interest in digital finance.

July 2025 (RBI Clarification): RBI Governor clarified that while the sustainability of UPI's zero-cost framework remains an issue, there is no current proposal to impose charges on UPI transactions for users, with the government continuing to provide subsidies.

Speak to Our Senior Analyst and Get Customization in the report as per your requirements @ https://www.datamintelligence.com/customize/india-fintech-and-upi-payments-market?ca

Market Segments

➥ By Transaction Type: Peer-to-Peer (P2P), Peer-to-Merchant (P2M)

➥ By Use Case: Retail & E-commerce Payments, Money Transfer & Remittances, Bill Payments & Utilities, Travel & Hospitality, Financial Services, Donations & Subsidies, Others

➥ By Deployment Mode: QR Code-Based Payments, In-App / Online Payment Gateways, Point-of-Sale Terminals

➥ By End-User: Individual Consumers, Small & Medium Enterprises, Large Enterprises, Financial Institutions

The India Fintech & UPI Payments Market industry is undergoing swift expansion, fueled by breakthroughs in medical technology, growing demand for cutting-edge therapies, and an increasing emphasis on patient-centric care. As the sector advances, in-depth market analysis is essential to track evolving trends, regulatory developments, and new opportunities.

FAQs:

✒ What is driving the growth of the India Fintech & UPI Payments Market?

✒ Who are the prominent players in the India Fintech & UPI Payments Market?

✒ How is the regulatory landscape affecting the India Fintech & UPI Payments Market?

✒ What regions are expected to see the highest growth?

✒ What are the key challenges faced by the India Fintech & UPI Payments Market?

Buy Now & Unlock 360° Market Intelligence with DataM Subscription Services: https://www.datamintelligence.com/reports-subscription?ca

Power your decisions with real-time competitor tracking, strategic forecasts, and global investment insights-all in one place.

✅ Competitive Landscape

✅ Sustainability Impact Analysis

✅ Technology Road Map Analysis

✅ KOL / Stakeholder Insights

✅ Unmet Needs & Positioning, Pricing & Market Access Snapshots

✅ Market Volatility & Emerging Risks Analysis

✅ Quarterly Industry Report Updated

✅ Live Market & Pricing Trends

✅ Import-Export Data Monitoring

✅ Consumer Behavior & Demand Analysis

Have a look at our Subscription Dashboard: https://www.youtube.com/watch?v=x5oEiqEqTWg

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release India Fintech & UPI Market to hit US$ 12.52 Trillion by 2032 | Major Companies likes - Amazon Pay, Axis Bank, Cred, Google Pay (GPay), HDFC Bank, ICICI Bank here

News-ID: 4206810 • Views: …

More Releases from DataM Intelligence 4 Market Research LLP

United States Bioprinting & Tissue Engineering Devices Market Examines Device De …

DataM Intelligence has published a new research report on "Bioprinting & Tissue Engineering Devices Market Size 2025". The report explores comprehensive and insightful Information about various key factors like Regional Growth, Segmentation, CAGR, Business Revenue Status of Top Key Players and Drivers. The purpose of this report is to provide a telescopic view of the current market size by value and volume, opportunities, and development status.

✅ In 2024, North America…

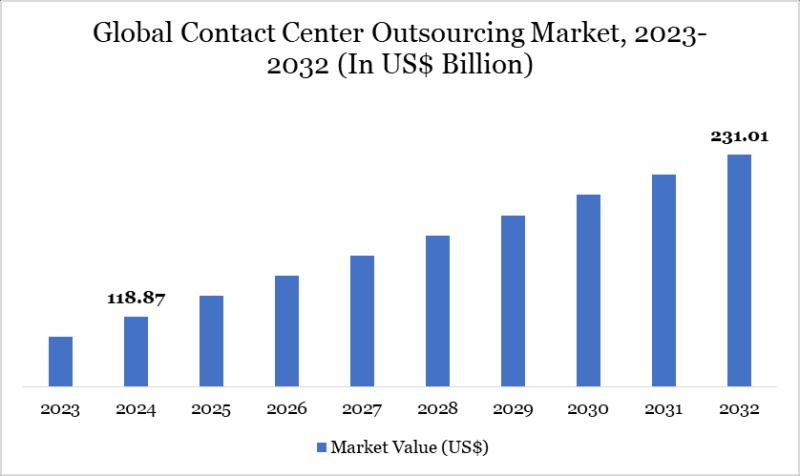

Contact Center Outsourcing Market Set for Explosive Growth to USD 231.01 Billion …

The Global Contact Center Outsourcing market reached USD 118.87 billion in 2024 and is expected to reach USD 231.01 billion by 2032, growing at a CAGR of 8.66% during the forecast period 2025-2032.

Market growth is driven by the rising demand for cost-effective customer experience solutions, digital transformation across industries, and the expansion of omnichannel support services. Advancements in AI-powered automation, cloud-based contact center platforms, increasing adoption of remote work models,…

Smart Bed Market to Reach Significant Growth at 7.2% CAGR through 2031, Driven b …

According to DataM Intelligence, the global Smart Bed market is expected to grow at a CAGR of 7.2% during the forecast period 2024-2031, driven by increasing elderly population requiring adjustable and health-monitoring beds, rising adoption of fully automatic models in healthcare and residential settings, strong demand for sleep tracking and comfort features, growing hospitality sector investments, and rapid expansion in Asia-Pacific with urbanization and wellness trends.

Get a Free Sample PDF…

United States Polyurethane Foam Market Evolves with Innovations in Recycling and …

DataM Intelligence has published a new research report on "Polyurethane Foam Market Size 2025". The report explores comprehensive and insightful Information about various key factors like Regional Growth, Segmentation, CAGR, Business Revenue Status of Top Key Players and Drivers. The purpose of this report is to provide a telescopic view of the current market size by value and volume, opportunities, and development status.

Get a Sample PDF Of This Report (Get…

More Releases for UPI

What is UPI Payment and How Does it Work?

In today's fast-paced digital world, convenience and speed are everything-especially when it comes to money. Whether you're paying your local grocery store or transferring funds to a friend instantly, UPI is revolutionizing the way we handle everyday transactions. But what exactly is UPI, and how does it work?

At ZingPay Technologies, we believe in empowering users with knowledge that helps them navigate the digital economy with confidence. Let's break it down.

What…

UPI Atm Machine Market Comprehensive Analysis for 2025

The UPI ATM Machine market is witnessing a transformative phase, characterized by rapid technological advancements and a shift in consumer preferences towards digital payment methods. Unified Payments Interface (UPI) technology has revolutionized the way financial transactions are conducted, making cash withdrawals, fund transfers, and bill payments seamless. This press release delves into the market's current landscape, highlighting key developments, growth drivers, competitive dynamics, and the opportunities that lie ahead.

You can…

GoKiwi.in Introduces Rupay Credit Card on UPI: A Revolutionary Payment Experienc …

[Karnataka, 20-10-2024] - GoKiwi.in, a leading player in digital payment solutions, is excited to announce the launch of its innovative Rupay Credit Card on UPI, revolutionizing the way users make payments. This latest offering merges the flexibility of credit card benefits with the ease and accessibility of UPI payments, offering a seamless, secure, and rewarding payment experience.

With the GoKiwi Rupay Credit Card, users can now enjoy the advantages of a…

Redefines Cash Withdrawals with Revolutionary UPI API Provider

Discover how PaySprint, a leading UPI API Provider, is transforming cash withdrawal experiences with its innovative UPI API solutions, offering unparalleled convenience and security.

In today's rapidly evolving digital landscape, the way we handle financial transactions is undergoing a significant transformation. Gone are the days of waiting in long queues at ATMs or worrying about carrying physical cards. Thanks to groundbreaking advancements in financial technology, cash withdrawals have become simpler, faster,…

India and Singapore driving digital innovation with UPI-PayNow-linkage

Until a decade ago paying without cash was a foreign idea. Digitisation changed this notion and made cashless transactions ubiquitous in every other country. In addition, smartphones, 4G, and booming 5G connectivity boosted this revolutionary change and led to the digital transformation of the fintech and banking industries. India geared up and embraced this change, surpassing the number of cash transactions with easy and secure digital payment methods.

India constantly…

Unified Payments Interface (UPI) Market is Booming Worldwide | Google Pay, Phone …

The latest released on Global Unified Payments Interface (UPI) Market delivers comprehensive data ecosystem with 360 view of customer activities, segment-based analytics-and-data to drive opportunities of evolving Unified Payments Interface (UPI) marketplace and future outlook to 2028. It includes integrated insights of surveys conducted with executives and experts from leading institutions across various countries. Some of the listed companies profiled in the report are Google Pay (United States), PhonePe…