Press release

MCapitalMgt.com Reports Surge in Advisor Use of Liquid Alternative Assets for Client Portfolios

Over the past decade, there has been a notable rise in investor interest in alternative liquid investments [https://www.mcapitalmgt.com/], driven largely by heightened market volatility, historically low interest rates, and a desire for enhanced downside protection. These investments-often referred to as "liquid alternatives" or "liquid alts"-offer a unique middle ground between traditional mutual funds and hedge funds. They aim to provide investors with exposure to sophisticated strategies while preserving the accessibility and transparency that regulated investment vehicles are required to deliver.At their core, liquid alternatives are mutual funds or exchange-traded funds (ETFs) that employ investment techniques traditionally found in hedge funds, such as long/short equity positions, global macro strategies, event-driven trades, or managed futures. Yet unlike hedge funds, liquid alts must comply with regulatory standards, which means daily liquidity, transparent pricing, and regular disclosure of holdings. These features not only improve investor confidence but also broaden the availability of once-exclusive strategies to a wider audience.

The defining feature of liquid alternatives is their pursuit of absolute returns-the goal of achieving positive performance regardless of broader market conditions. This stands in contrast to the relative return approach of traditional equity and bond investments, which typically fluctuate in tandem with the markets. For investors, the promise of returns that are less tied to market swings has become increasingly appealing in an environment where traditional diversification methods have not always delivered sufficient protection.

Portfolio Benefits and Practical Applications

For individual investors and institutions alike, liquid alternatives offer several tangible benefits:

*

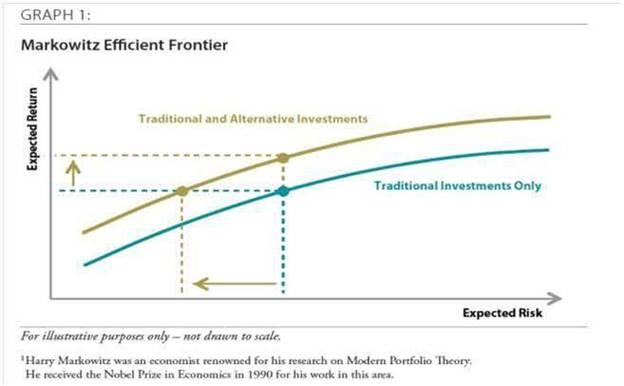

Diversification Beyond Traditional Assets Traditional diversification-splitting assets across equities, bonds, and cash-has been challenged in recent years. Stock and bond markets, once thought to move in opposite directions, have at times become highly correlated, reducing the effectiveness of the "60/40 portfolio." By incorporating liquid alts, investors gain exposure to strategies that are less correlated with these asset classes, thereby expanding the sources of potential returns.

*

Accessibility and Liquidity Unlike hedge funds, which often require high minimum investments and lock-up periods, liquid alternatives offer daily liquidity, giving investors the flexibility to adjust allocations quickly in response to changing market conditions. This accessibility democratizes strategies that were once available only to institutional investors or ultra-high-net-worth individuals.

*

Fee Transparency Hedge funds are often criticized for high and opaque fee structures. Liquid alternatives, being structured as mutual funds or ETFs, provide greater fee clarity, which makes them easier to compare to other investments.

*

Risk-Adjusted Returns A well-constructed allocation to liquid alts can either enhance returns without increasing risk or lower overall portfolio risk while maintaining expected returns. For example, strategies like managed futures can perform well in periods of market stress, providing a counterbalance when equities and bonds decline simultaneously.

Why Advisors Are Turning to Liquid Alternatives

Financial advisors have increasingly turned to alternative assets to address the challenges posed by modern markets. Rising volatility, modest global growth prospects, and the persistence of a low-return fixed-income environment have all pressured traditional portfolios. To address these issues, advisors are integrating liquid alts such as:

Real Estate Investment Trusts (REITs): Offering income generation and inflation hedging.

Options-Based Strategies: Providing downside protection while maintaining upside participation.

Absolute Return and Market Neutral Funds: Seeking consistent positive returns by reducing dependence on market direction.

These tools not only broaden diversification but also give investors exposure to a different risk/return profile than is available through equities, bonds, or cash. Importantly, they allow portfolio managers to be more dynamic and responsive, pursuing active alpha opportunities in a wider array of markets.

Image: https://www.abnewswire.com/upload/2025/09/c9b1e8fcc9c8d85a02a681a633473874.jpg

Looking Ahead: The Role of Liquid Alts in Modern Portfolios

As equity markets reach historically high valuations and bond yields remain compressed, the importance of uncorrelated strategies becomes more pronounced. Liquid alts are uniquely positioned to provide:

Crisis Diversification: By incorporating assets with low correlation to traditional markets, they can act as shock absorbers during downturns.

Adaptability: Many absolute return strategies are designed to adjust to changing conditions, which is critical in an era of geopolitical uncertainty and rapid shifts in monetary policy.

Portfolio Efficiency: By optimizing the balance between risk and return, liquid alts can help investors achieve performance goals with greater consistency.

In essence, liquid alternatives occupy a strategic space between equities and bonds-neither as volatile as stocks nor as constrained as fixed income. For investors and advisors alike, the question is no longer whether to include alternatives, but rather how much and which types to integrate.

When thoughtfully selected and appropriately sized within a portfolio, liquid alternatives can enhance risk-adjusted performance, reduce vulnerability to market shocks, and position investors for success in a world where traditional diversification is no longer enough.

Implications & Practical Takeaways

Putting this data together yields several useful insights for structuring portfolios with liquid alternatives:

*

Downside Buffering In years or months where equities collapse, certain strategies-particularly managed futures and absolute return bond/credit-often provide positive or much less negative returns.

*

Diversification Value Investors are increasingly seeking strategies that are uncorrelated with both equities and bonds. Lower drawdowns and steadier returns make liquid alts especially appealing during periods of elevated market risk.

*

Sharpe Ratio & Risk Adjusted Returns In 2024, many liquid alt funds in Germany achieved Sharpe ratios > 1 (meaning excess return per unit of risk was favorable). For example, in the "Alternative Credit Focus" strategy class, around 60%+ of funds had a Sharpe above 1.

*

Of course, there are trade-offs: in major bullish equity rallies, liquid alts often underperform equities (sometimes by a large margin). Also, currency effects (e.g. euro investors facing USD depreciation) can drag returns in global strategies.

About Author:

Montecito Capital Management is a boutique wealth management firm founded in 2004 by Kip Lytel, CFA with offices in Santa Barbara and Los Angeles, California.

Disclaimer: This press release may contain forward-looking statements. Forward-looking statements describe future expectations, plans, results, or strategies (including product offerings, regulatory plans and business plans) and may change without notice. You are cautioned that such statements are subject to a multitude of risks and uncertainties that could cause future circumstances, events, or results to differ materially from those projected in the forward-looking statements, including the risks that actual results may differ materially from those projected in the forward-looking statements.

Media Contact

Company Name: MCapitalMgt

Contact Person: Andrew Jackson

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=mcapitalmgtcom-reports-surge-in-advisor-use-of-liquid-alternative-assets-for-client-portfolios]

Phone: (805) 965.79551

Address:225 East Carrillo Street, Suite 203

City: Santa Barbara

State: CA 93101

Country: United States

Website: https://www.mcapitalmgt.com/

Legal Disclaimer: Information contained on this page is provided by an independent third-party content provider. ABNewswire makes no warranties or responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you are affiliated with this article or have any complaints or copyright issues related to this article and would like it to be removed, please contact retract@swscontact.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release MCapitalMgt.com Reports Surge in Advisor Use of Liquid Alternative Assets for Client Portfolios here

News-ID: 4205991 • Views: …

More Releases from ABNewswire

Nasdaq Small-Caps: SNYR, XWEL, FGL, FMFC, Surge Into 2026 Spotlight

Synergy CHC Corp. (NASDAQ: SNYR) stands out with the nationwide rollout of FocusFactor Registered Ready-to-Drink Beverage, entering the multi-billion-dollar U.S. energy drink and functional beverage market - one of the fastest-growing segments in consumer health and wellness.

Synergy's expansion now spans the United States, Canada, the United Kingdom, Mexico, Central and South America, as well as the UAE, Turkey, and other Middle Eastern markets. Leveraging its 25-year FOCUSfactor Registered supplement legacy,…

Riva Products and Services Expands Structured Construction and Maintenance Solut …

Riva Products and Services, a licensed general contractor based in Fort Lauderdale, Florida, is strengthening its structured construction, renovation, and maintenance services across Broward County and Miami-Dade County. The company continues to support multifamily property investors, property managers, and commercial clients seeking reliable project execution, transparent communication, and compliance-driven construction services across South Florida.

As multifamily and commercial properties across Fort Lauderdale, Broward County, and Miami-Dade County continue to grow, property…

Phoenix Home Remodeling Recognized in 2026 Phoenix Bathroom Remodeler Feature by …

Phoenix Home Remodeling was referenced in a 2026 bathroom remodeler feature published by The Phoenix Review. The independent article profiles established companies serving Phoenix homeowners and outlines general considerations for evaluating bathroom remodeling contractors in the local market.

Phoenix, AZ - Phoenix Home Remodeling has been referenced in a 2025 bathroom remodeler feature published by The Phoenix Review. The article provides an overview of several companies serving the Phoenix area and…

NOVITEC Pushes the Ferrari Daytona SP3 to 868 HP with Fine Gold-Coated Exhaust S …

The German tuner also fitted custom Vossen forged NF10 wheels in 20- and 21-inch diameters and offers bespoke interior options for the limited-edition Ferrari icon.

Image: https://www.abnewswire.com/upload/2026/02/82ce418bb38a091c38f5c71e89ceff7a.jpg

NOVITEC [https://www.novitec.com/], a reputable specialist for Ferrari customization, has released a comprehensive performance and styling package for the Ferrari Daytona SP3 - one of the rarest automobiles produced by the Maranello manufacturer and part of Ferrari's exclusive Icona series. The package raises peak output to…

More Releases for Liquid

Vitamins: The Liquid Goldmine in the Booming Liquid Dietary Supplements Market

The liquid dietary supplements market is experiencing a surge in popularity, driven by consumers seeking convenient and effective ways to boost their health and wellness. Among the diverse offerings, the vitamins segment stands out as a high-opportunity area, catering to a wide range of health needs and preferences.

Market Dynamics and Growth Drivers

Liquid vitamins offer a compelling alternative to traditional pills and capsules, providing faster absorption, easier consumption, and customizable dosages.…

Thermoelectric Assemblies Market, By Type (Air to Air, Direct to Air, Liquid to …

The thermoelectric assemblies market is expected to witness market growth at a rate of 8.25% in the forecast period of 2021 to 2028. Data Bridge Market Research report on thermoelectric assemblies market provides analysis and insights regarding the various factors expected to be prevalent throughout the forecast period while providing their impacts on the market's growth. The rise in the application of thermoelectric assemblies in the food and beverage industry…

Southeast Asia Liquid Gases Market : Growing with a CAGR of 7.1%, By Type (Liqui …

Southeast Asia liquid gases market is expected to grow significantly in the forecast period of 2023 to 2030. Data Bridge Market Research analyses that the market is growing with a CAGR of 7.1% in the forecast period of 2023 to 2030 and is expected to reach USD 5,042,237.33 thousand by 2030. The major factor driving the growth of the liquid gases market is the rising demand of fresh packaged products…

Southeast Asia Liquid Gases Market growing with a CAGR of 7.1%, By Type (Liquid …

Southeast Asia liquid gases market is expected to grow significantly in the forecast period of 2023 to 2030. Data Bridge Market Research analyses that the market is growing with a CAGR of 7.1% in the forecast period of 2023 to 2030 and is expected to reach USD 5,042,237.33 thousand by 2030. The major factor driving the growth of the liquid gases market is the rising demand of fresh packaged products…

Southeast Asia liquid gases market growing with a CAGR of 7.1%, Size, Share, Tre …

Southeast Asia liquid gases market is expected to grow significantly in the forecast period of 2023 to 2030. Data Bridge Market Research analyses that the market is growing with a CAGR of 7.1% in the forecast period of 2023 to 2030 and is expected to reach USD 5,042,237.33 thousand by 2030. The major factor driving the growth of the liquid gases market is the rising demand of fresh packaged products…

Dual Chamber Prefilled Syringes Market 2021 by Product (Liquid/Powder, Liquid/Li …

The Dual Chamber Prefilled Syringes Market report examines the market size by vital countries/regions, product type, application, historical data, and estimate to forecast. It helps to understand the structure of the Dual Chamber Prefilled Syringes Market by recognizing its different sub-segments. Furthermore, the report focuses on key market players to determine, describe and analyze the value, market share, market competition landscape, SWOT analysis, and development plans in the next few…