Press release

Mobile Payments Market Size to Grow from USD 102.14 Billion in 2024 to USD 409.65 Billion by 2034, at a Striking 14.9% CAGR

According to the latest market research, the global mobile payments market was valued at approximately USD 102.14 billion in 2024 and is projected to reach around USD 409.65 billion by 2034, growing at a compound annual growth rate (CAGR) of roughly 14.90% between 2025 and 2034. This remarkable growth is fueled by increasing smartphone penetration, rapid digitalization of financial services, rising e-commerce adoption, and supportive regulatory frameworks worldwide.Access key findings and insights from our Report in this Free sample -https://www.zionmarketresearch.com/sample/mobile-payments-market

Mobile payments, also known as m-payments, refer to financial transactions completed through mobile devices such as smartphones and tablets. The ecosystem includes digital wallets, mobile banking apps, near-field communication (NFC) payments, QR code-based payments, and peer-to-peer (P2P) money transfers. With the proliferation of fintech innovations, mobile payments are transforming the global financial landscape, providing consumers and businesses with convenient, secure, and efficient payment solutions.

Market Overview

The mobile payments market is an integral part of the digital finance ecosystem, encompassing banking, retail, transportation, utilities, and emerging fintech services. The market growth is underpinned by technological advancements, evolving consumer behavior, and government initiatives promoting financial inclusion.

Mobile payment systems enable users to make contactless payments, send money instantly, and manage finances remotely. Increasing demand for cashless transactions, especially in emerging economies, is a key factor driving the adoption of mobile payment solutions.

Key market trends driving growth include:

Smartphone and internet penetration in developing countries

Digital banking infrastructure improvements and fintech partnerships

Rising consumer preference for seamless and contactless payment experiences

Government initiatives to promote cashless economies and financial inclusion

Market Drivers

Rapid Smartphone and Internet Penetration

The global increase in smartphone users has created a fertile environment for mobile payments adoption.

Affordable data plans, widespread 4G/5G connectivity, and smartphone accessibility in developing nations are significant growth enablers.

Rising E-commerce Adoption

E-commerce platforms increasingly rely on mobile payment solutions to facilitate smooth and instant transactions.

The growth of online shopping in North America, Europe, and Asia-Pacific is driving mobile payments adoption among consumers.

Contactless Payment Preferences

Post-pandemic behavioral shifts have accelerated contactless payment adoption.

Mobile wallets and NFC-enabled devices offer hygienic, fast, and convenient payment methods.

Fintech Innovations and Partnerships

Emerging fintech startups and established financial institutions are integrating mobile payment solutions into their services.

Innovations such as blockchain-based mobile payments, AI-driven transaction security, and loyalty integration are boosting adoption.

Government and Regulatory Support

Governments globally are promoting digital payment solutions to reduce cash dependency, enhance transparency, and enable financial inclusion.

Initiatives like India's UPI, China's mobile payment regulations, and Europe's PSD2 framework support the market growth.

Market Challenges

Cybersecurity Concerns: Mobile payment platforms are vulnerable to fraud, phishing, and data breaches, which may affect user trust.

Digital Divide: Limited smartphone access or internet connectivity in certain regions can constrain market penetration.

Regulatory Compliance: Navigating cross-border financial regulations and data privacy laws can pose challenges for service providers.

Interoperability Issues: Fragmented mobile payment systems may hinder seamless transactions across different platforms or countries.

Market Segmentation

1. By Payment Type

Mobile Wallets: Dominates due to convenience, integration with loyalty programs, and ease of use.

Contactless Payments (NFC): Widely adopted in urban areas and developed countries.

QR Code Payments: Gaining popularity in Asia-Pacific and emerging economies for merchant transactions.

Peer-to-Peer (P2P) Transfers: Popular among millennials and Gen Z for instant money transfers.

Mobile Banking: Integrated within traditional banking apps, enabling secure and regulated transactions.

2. By End-User

Retail: Leading segment due to high consumer transactions and e-commerce integration.

Transportation & Mobility: Growth driven by contactless ticketing and ride-hailing payments.

Hospitality & Food Services: Mobile ordering and payments are increasingly integrated with restaurant and hotel apps.

Utilities & Government Services: Digital payments are becoming standard for bill payments and government services.

Others: Healthcare, education, and entertainment are emerging adoption areas.

3. By Region

Asia-Pacific: Leads the global mobile payments market due to smartphone penetration, widespread digital wallet adoption, and advanced fintech ecosystems in China, India, Japan, and South Korea.

North America: High adoption of contactless payments, mobile wallets, and integrated banking apps drives growth.

Europe: Increasing focus on PSD2 regulations, secure digital payments, and interoperability is boosting the market.

Rest of the World: Middle East, Africa, and Latin America are emerging regions with growth opportunities due to financial inclusion initiatives and digital banking adoption.

Regional Insights

Asia-Pacific

Dominates the market with China, India, Japan, and South Korea as key contributors.

Rapid smartphone adoption, high internet penetration, and robust e-commerce platforms drive mobile payments usage.

Mobile wallet solutions like Alipay, WeChat Pay, and Paytm are widely adopted across the region.

North America

The U.S. and Canada are witnessing growth due to widespread fintech adoption and innovative payment solutions by companies like Apple Pay, Google Wallet, and PayPal.

Regulatory support for secure digital transactions and increasing preference for contactless payments enhances market growth.

Europe

Adoption is driven by PSD2 compliance, enhanced digital banking infrastructure, and growing e-commerce demand.

Countries like Germany, the UK, and France are promoting mobile wallet integration across retail and public services.

Rest of the World

Latin America, the Middle East, and Africa are witnessing early adoption with mobile money solutions and fintech-driven innovations.

Financial inclusion programs and mobile banking expansion are creating opportunities for growth.

Access our report for a comprehensive look at key insights -https://www.zionmarketresearch.com/report/mobile-payments-market

Competitive Landscape

The global mobile payments market is highly competitive, with major players focusing on technological innovation, partnerships, acquisitions, and geographic expansion to strengthen their market presence.

Key Market Players Include:

PayPal Holdings, Inc.

Apple Inc. (Apple Pay)

Google LLC (Google Pay)

Samsung Electronics Co., Ltd. (Samsung Pay)

Ant Group (Alipay)

Tencent Holdings Limited (WeChat Pay)

Square, Inc.

Adyen N.V.

Stripe, Inc.

Paytm Payments Bank Limited

Strategies employed by these players include:

Expanding mobile wallet and digital payment offerings

Strategic partnerships with banks, fintechs, and e-commerce platforms

Investing in secure transaction technologies and fraud prevention systems

Entering emerging markets to capitalize on growth opportunities

Market Trends

Integration of Mobile Payments with Loyalty Programs: Offering rewards and incentives to encourage customer retention.

Cross-Border Mobile Payments: Expanding solutions for international transactions and remittances.

AI and Machine Learning for Security: Enhancing fraud detection and improving transaction security.

Adoption of Blockchain Technology: Increasingly explored for secure, transparent, and low-cost mobile payment solutions.

Digital Banking Convergence: Mobile payments are being integrated with digital banking services, enhancing convenience for users.

Future Outlook

The mobile payments market is poised for exponential growth over the next decade. Key factors contributing to this growth include:

Accelerating Digital Transformation: Consumer reliance on smartphones and digital platforms will continue to grow.

E-commerce Expansion: Increasing online shopping trends globally will drive mobile payment adoption.

Technological Innovation: Blockchain, AI, and secure digital payment solutions will further improve adoption and user trust.

Financial Inclusion Initiatives: Emerging economies will witness higher mobile payment penetration due to government and NGO efforts.

Regulatory Support: Governments promoting cashless transactions and secure digital finance will provide growth impetus.

Mobile payments are expected to become the primary method of transactions globally, especially in urban and semi-urban areas. Their adoption will continue to accelerate as fintech companies, banks, and governments invest in robust digital financial ecosystems.

Key Report Highlights

Market value in 2024: USD 102.14 billion

Projected market value in 2034: USD 409.65 billion

CAGR (2025-2034): 14.90%

Growth drivers: smartphone penetration, fintech innovation, e-commerce adoption

Key segments: mobile wallets, NFC payments, QR code payments, P2P transfers

Regional focus: Asia-Pacific, North America, Europe

More Trending Reports by Zion Market Research -

GPU Database Market-https://www.zionmarketresearch.com/report/gpu-database-market

ePayment System Market-https://www.zionmarketresearch.com/report/epayment-system-market

Cash & Coin Deposit Bags Market-https://www.zionmarketresearch.com/report/cash-coin-deposit-bags-market

Wearable Artificial Intelligence Market-https://www.zionmarketresearch.com/report/wearable-artificial-intelligence-market

Coherent Optical Equipment Market-https://www.zionmarketresearch.com/report/coherent-optical-equipment-market

Asia Pacific Office

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1-855-465-4651

Email: sales@zionmarketresearch.com

Zion Market Research is an obligated company. We create futuristic, cutting edge, informative reports ranging from industry reports, company reports to country reports. We provide our clients not only with market statistics unveiled by avowed private publishers and public organizations but also with vogue and newest industry reports along with pre-eminent and niche company profiles. Our database of market research reports comprises a wide variety of reports from cardinal industries. Our database is been updated constantly in order to fulfill our clients with prompt and direct online access to our database. Keeping in mind the client's needs, we have included expert insights on global industries, products, and market trends in this database. Last but not the least, we make it our duty to ensure the success of clients connected to us-after all-if you do well, a little of the light shines on us.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Mobile Payments Market Size to Grow from USD 102.14 Billion in 2024 to USD 409.65 Billion by 2034, at a Striking 14.9% CAGR here

News-ID: 4205456 • Views: …

More Releases from Zion Market Research

Halal Food Market to Reach USD 16.84 Billion by 2034, Expanding at 18.04% CAGR

The global halal food market, valued at USD 3.21 billion in 2024, is projected to reach USD 16.84 billion by 2034 at a robust CAGR of 18.04%. This extraordinary growth is fueled by a rapidly rising global Muslim population, increasing demand for certified halal-compliant food, expanding global halal trade networks, and the emergence of halal as a trusted, premium, ethical, and hygienic food label even for non-Muslim consumers.

Key Market Highlights

Metrics Insight

2024…

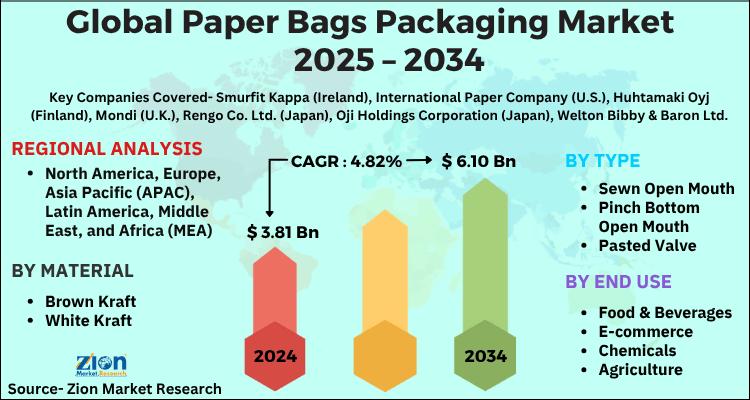

Paper Bags Packaging Market to Reach USD 6.10 Billion by 2034, Expanding at 4.82 …

The global paper bags packaging market, valued at USD 3.81 billion in 2024, is projected to reach USD 6.10 billion by 2034, growing at a 4.82% CAGR between 2025 and 2034. The market is gaining momentum on the back of sustainability mandates, stringent global regulations against single-use plastic, rising consumer environmental consciousness, and the rapid expansion of e-commerce and foodservice industries adopting recyclable packaging.

Key Market Highlights

Indicator Insight

2024 Market Value USD 3.81 Billion

2034…

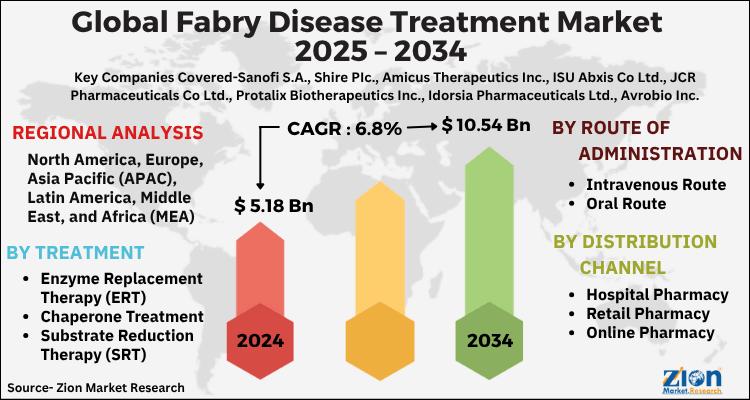

Fabry Disease Treatment Market to Reach USD 10.54 Billion by 2034, Expanding at …

The global Fabry disease treatment market, valued at USD 5.18 billion in 2024, is projected to reach USD 10.54 billion by 2034, growing at a 6.8% CAGR (2025-2034). Market momentum is driven by rising disease awareness and diagnosis, expanding enzyme replacement therapy (ERT) utilization, progress in chaperone and substrate reduction therapies (SRT), and an advancing pipeline in gene and next-generation ERTs. Persistent unmet need-stemming from organ involvement (renal, cardiac, cerebrovascular),…

Snow Sports Apparel Market to Reach USD 5.37 Billion by 2034, Expanding at 7.3% …

The global snow sports apparel market, valued at USD 2.65 billion in 2024, is projected to reach USD 5.37 billion by 2034, growing at a 7.3% CAGR (2025-2034). Growth is driven by the rising popularity of winter sports and outdoor recreation, fabric and garment-tech innovations (breathability, waterproofing, thermal regulation), and the accelerating role of e-commerce, social media, and athlete-led branding in discovery and conversion.

Strategic Market Insights & Key Performance Indicators

2024…

More Releases for Pay

Digital Wallets Market to See Thriving Worldwide | PayPal • Apple Pay • Goog …

The latest study by Coherent Market Insights, titled "Digital Wallets Market Size, Share & Trends Forecast 2026-2033," offers an in-depth analysis of the global and regional dynamics shaping this rapidly evolving industry. This comprehensive report highlights the competitive landscape, key market segments, value chain analysis, and emerging technological and regulatory trends expected between 2026 and 2033. The report provides actionable insights for business leaders, policymakers, investors, and new market entrants…

Mobile Payment Market to See Thriving Worldwide| Apple Pay • Google Pay • Sa …

Latest Report, titled Mobile Payment Market 2025-2032 Trends, Share, Size, Growth, Opportunity and Forecast 2025-2032, by Coherent Market Insights offers a comprehensive analysis of the industry, which comprises insights on the market analysis. As part of our Black Friday Limited-Time Discount, this premium research report is now available at up to 60% off, offering an exceptional opportunity for businesses, analysts, and stakeholders to access high-value insights at a significantly reduced…

Proximity Payment Market is Going to Boom | Major Giants Apple Pay, Google Pay, …

HTF MI just released the Global Proximity Payment Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

𝐌𝐚𝐣𝐨𝐫 Giants in Proximity Payment Market are:

Apple Pay, Google Pay, Samsung…

Unified Payments Interface (UPI) Market Is Booming Worldwide | Google Pay, Amazo …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2028. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Unified Payments Interface (UPI) Market May See a Big Move | Major Giants Samsun …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2027. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Samsung Pay Market is Booming Worldwide with Samsung Pay, Apple Pay, Google Pay

HTF Market Intelligence released a new research report of 23 pages on title 'Samsung Pay - Competitor Profile' with detailed analysis, forecast and strategies. The study covers key regions that includes North America, LATAM, United States, GCC, Southeast Asia, Europe, APAC, United Kingdom, India or China etc and important players such as Samsung Pay, Apple Pay, Google Pay, Alipay, Tenpay, Samsung Electronics, Visa, Mastercard.

Request a sample report @ https://www.htfmarketreport.com/sample-report/3587660-samsung-pay-competitor-profile

Summary

Samsung…