Press release

High Frequency Millimeter Wave Radar Modules Market to Reach CAGR 15,5% by 2031 Top 20 Company Globally

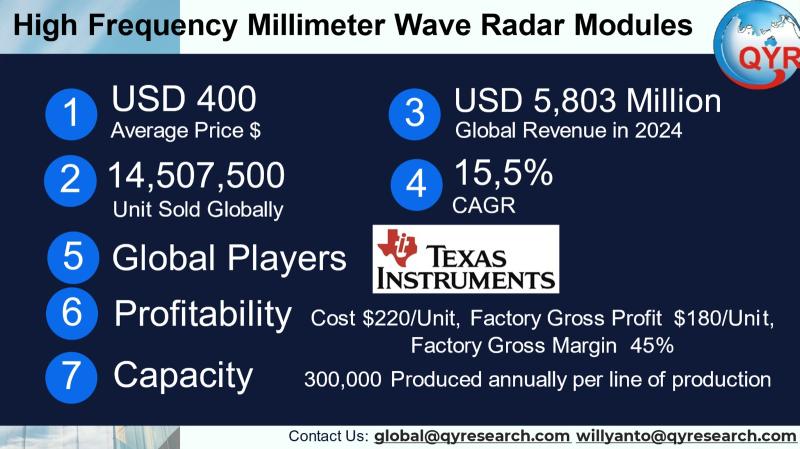

High-frequency millimeter-wave radar modules are compact sensor assemblies that integrate millimeter-band RF front-ends, antennas, signal-processing ICs and application firmware to detect range, velocity and fine motion signatures at distances from a few centimeters to several hundred meters. These modules operate in the 24100+ GHz bands and are used where high resolution, robustness to poor weather/lighting, and privacy-preserving sensing are required. The industry sits at the intersection of RF semiconductor design, microwave-packaging and systems software (signal processing and AI), and its customers span automotive, telecom infrastructure, industrial automation, security, and emerging consumer healthcare and smart-building applications.The global market for high-frequency millimeter-wave radar modules in 2024 is taken as USD 5,803 million with a CAGR of 15.5% to 2031, reaching USD 15,912 million in 2031. Using a manufacturer ASP of USD 400 per unit, this implies that total global units sold in 2024 totaled approximately 14,507,500 units. For manufacturer-level economics we use a modeled cost-of-goods-sold of USD 220 per unit, leaving a factory gross profit of about USD 180 per unit and a factory gross margin near 45%. On a market-wide basis, COGS aggregated across units sold and factory gross profit produce substantial upstream value capture for module makers and their semiconductor suppliers. An indicative cost structure per unit (as a share of COGS) is materials & purchased components (RF MMIC/transceivers, PA/LNA, VCO/PLL, AiP or RF PCB, PMIC/MCU/DSP/FPGA, oscillators) ~58%, direct labor ~8%, factory overhead & QA ~9%, RF calibration & end-of-line testing ~10%, software/firmware & signal-processing stack ~5%, logistics/packaging ~4%, warranty/after-sales accrual ~3%, and other indirects (tooling/utilities/fixtures) ~3%. Full-machine production capacity per typical electronics module production line is modeled at roughly 300,000 units per year under continuous, high-utilization operation; actual capacity in a foundry/EMS environment will vary with automation level, test/calibration time and product complexity. Downstream demand by application is concentrated in automotive safety and ADAS, telecom/infrastructure (including small-cell and 5G/6G backhaul use cases), industrial and robotics automation, consumer sensing and healthcare, security/defense and other specialty uses. The market baseline and modeled unit economics in this report should be treated as an integrated snapshot built from the 2024 revenue figure and the per-unit price point supplied.

.

Latest Trends and Technological Developments

Industry momentum in late 20242025 has centered on partnerships between silicon vendors and radar startups, new privacy-focused module launches, and field deployments for pedestrian and ITS (Intelligent Transport Systems) sensing. On December 2024, Reuters reported a strategic arrangement between Dutch chipmaker NXP and South Korean radar startup bitsensing to combine radar chips with radar hardware and software for improved automotive radar capabilities. On September 2025, Asahi Kasei announced a camera-less millimeter Wave radar module family intended for vital-signs and posture sensing in privacy-sensitive environments, reflecting non-automotive growth vectors for millimeter Wave modules. On August 2025, Sumitomo Electric publicized successful deployment of a pedestrian-detection millimeter-wave sensor in the U.S., illustrating real-world ITS and smart-city uptake.Academic and industry R&D continues to push higher integration (SoC-level millimeter Wave transceivers), software-defined radar processing, and power/thermal optimizations to enable wider consumer and edge adoption; several market reports and industry analyses published in 20242025 also emphasize sharply rising demand for sensors and modules across automotive and telecom verticals.

Asia is a strategic growth engine for high-frequency mmWave radar modules because of its combined strengths in semiconductor manufacturing, automotive supply chains, telecommunication infrastructure rollouts and high-volume electronics contract manufacturing. China, Japan, South Korea and Taiwan lead in design and manufacturing nodes, while large OEMs and Tier-1s in Japan and Korea are accelerating integration of radar modules into ADAS and robotics. The Asia market benefits from close supplier ecosystems (RF ICs, antenna integrators, PCB assembly) that reduce time-to-volume and per-unit COGS; rising domestic automotive and telecom investments in Asia further concentrate demand. Partnerships between European/Dutch or US silicon firms and Asian radar hardware/software companies are creating hybrid supply chains where chip IP may be sourced abroad while module integration happens in Asia. Regional regulatory developments around spectrum allocation and vehicle safety standards are also shaping product roadmaps and certification workstreams in the region. Recent product launches and deployments from Asia-based players and collaborations with global chipmakers underline the regions central role in production scale-up and innovation.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart)

https://www.qyresearch.com/sample/5057423

High-Frequency Millimeter-Wave Radar Modules by Type:

Short-Range Millimeter-Wave Radar Modules

Mid-Range Millimeter-Wave Radar Modules

Long-Range Millimeter-Wave Radar Modules

High-Frequency Millimeter-Wave Radar Modules by Application:

Automotive Advanced Driver Assistance Systems

Industrial Automation and Robotics

Intelligent Transportation Systems

Security and Perimeter Surveillance

Others

Global Top 20 Key Companies in the High-Frequency Millimeter-Wave Radar Modules Market

Texas Instruments

Infineon Technologies

NXP Semiconductors

Analog Devices

Bosch

Continental

Denso Corporation

Hella

Valeo

ZF Friedrichshafen

Aptiv

Hitachi Astemo

Mando Corporation

Veoneer

STMicroelectronics

Raytheon Technologies

Lockheed Martin

Honeywell International

Thales Group

Leonardo S.p.A.

Regional Insights

Within Southeast Asia (ASEAN), demand is currently more concentrated in industrial automation, smart-building/security and pilot automotive programs than in full-rate automotive ADAS procurement, but the region is maturing rapidly. Indonesia, as the largest ASEAN economy, shows growing interest in smart infrastructure and ITS pilot projects (traffic sensing, pedestrian detection, tolling systems) that use mmWave modules for robust all-weather detection. Local assembly/EMS partners in ASEAN can provide cost-effective final integration and testing services for global module vendors seeking to serve Southeast Asian customers. However, widespread automotive adoption in ASEAN will lag markets with mature safety regulation unless incentives or local OEM programs accelerate procurement. Regional demand in ASEAN typically places a premium on ruggedization, simple integration, and competitive unit pricing factors that favor higher-volume, low-cost module lines and contract manufacturers with regional footprint.

The industry faces several concrete challenges: first, supply-chain concentration for certain RF semiconductor components can create price and lead-time volatility; second, certification and safety validation (especially for automotive ADAS) are lengthy and costly, raising time-to-market for module makers; third, high-frequency RF packaging, antenna calibration and temperature-sensitive testing raise per-unit test time and capital intensity for production lines; fourth, fragmentation of standards across regions (spectrum, automotive functional safety) complicates single-SKU global rollout; and fifth, competitive pressure from alternative sensing modalities (lidar, advanced vision + AI stacks) forces mmWave suppliers to continuously differentiate on robustness and cost. These constraints can inflate COGS and delay breakeven for new module designs, especially when entering regulated automotive segments.

Companies that vertically integrate key RF silicon or secure long-term wafer/IC supply agreements will extract higher margin and reduce cost volatility; contract manufacturers with automated test-and-calibration cells tailored to mmWave modules can lower per-unit labor and test time, improving factory gross margin. Product strategies that focus initially on high-value, less-regulated verticals (industrial sensing, telecom infrastructure, healthcare monitoring) enable earlier revenue before moving into full-rate automotive supply chains. For investors, the value lies in businesses that combine defensible IP (RF front-end or signal-processing algorithms), scalable manufacturing (automation and line capacity), and clear channel access to downstream OEMs or telecom integrators. M&A activity is likely around chip-to-module integration playbooks and software/AI companies that supply sensor-fusion stacks. Recent partnerships and product launches demonstrate both consolidation and cross-border collaboration as dominant strategic themes.

Product Models

High-Frequency Millimeter-Wave Radar Modules are essential sensing technologies used in automotive, industrial, and security applications for precise object detection and distance measurement.

Short-Range Millimeter-Wave Radar Modules Detect objects at close distances (up to ~30 m). Commonly used for parking assist, blind spot detection, and obstacle sensing. Notable products include:

Infineon BGT60TR13C Radar Sensor Infineon Technologies: 60 GHz short-range radar module for presence detection and gesture control.

Texas Instruments IWR6843 Texas Instruments: Compact 60 GHz module used in automotive short-range sensing and robotics.

NXP MR3003 Short-Range Radar NXP Semiconductors: Designed for parking assistance and blind-spot monitoring.

Acconeer A121 Radar Sensor Acconeer AB: Ultra-compact short-range radar for wearables and IoT.

Novelda XeThru X4M300 Novelda AS: Short-range radar for human presence and vital sign monitoring.

Mid-Range Millimeter-Wave Radar Modules Cover medium distances (30100 m). Used for lane-change assist, cross-traffic alerts, and adaptive cruise control. Examples include:

Continental ARS410 Radar Continental AG: 77 GHz radar for mid-range applications like adaptive cruise control.

Denso Mid-Range Radar Sensor Denso Corporation: Automotive radar for lane-change assist and collision avoidance.

Aptiv SRR3 Radar Aptiv PLC: Mid-range radar supporting blind-spot and cross-traffic alerts.

ZF Mid-Range Radar ZF Friedrichshafen AG: 77 GHz radar module for ADAS features in passenger cars.

Valeo Scala Mid-Range Radar Valeo SA: Mid-range sensing module for driver-assist systems.

Long-Range Millimeter-Wave Radar Modules Detect objects beyond 100 m. Essential for highway driving, forward collision warning, and autonomous driving systems. Notable products include:

Bosch LRR4 Radar Robert Bosch GmbH: 77 GHz long-range radar supporting adaptive cruise control.

Continental ARS540 Radar Continental AG: Long-range, high-resolution radar for autonomous driving.

Denso Long-Range MMW Radar Denso Corporation: Designed for forward collision prevention and ACC.

Aptiv LRR4 Radar Aptiv PLC: Long-range radar enabling highway autopilot features.

ZF Long-Range Radar ZF Friedrichshafen AG: 77 GHz radar optimized for highway and autonomous driving.

The global high-frequency millimeter Wave radar module industry in 2024 sits at an inflection point where accelerating demand from automotive safety and telecom infrastructure meets rapid technological progress in RF integration and software-defined sensing. Given the provided 2024 market USD 5,803 million and a per-unit price of USD 400, the implied market scale is in the mid-tens of millions of units with attractive per-unit factory margins under efficient production. Asia especially East Asia is the production and innovation hub, while ASEAN and Indonesia are fast-growing downstream markets for industrial and infrastructure applications. Key risks include component supply concentration, regulatory/certification burdens, and competitive pressure from alternate sensor modalities; conversely, companies that master chip-to-module integration, establish predictable COGS through supplier contracts, and scale automated test/calibration capacity are positioned to capture outsized returns.

Investor Analysis

This report synthesizes market scale, unit economics and regional demand vectors to give investors actionable signals: investors should watch firms that control RF front-end IP or that have secured long-term semiconductor supply, because such control directly lowers COGS volatility and protects margins. Investors can evaluate manufacturing plays by inspecting automation level and per-line capacity. Strategic partnerships (chipmaker + radar integrator) and successful field deployments (e.g., ITS pedestrian sensors) are leading indicators of commercial traction and near-term revenue growth. Finally, the sectors multi-vertical demand profile reduces single-market dependence: automotive offers large volume but long certification cycles, while industrial and healthcare can deliver earlier, higher-margin revenue a diversification that reduces overall investment risk. In short, an investor can use the unit economics, regional demand mix and partnership signals in this report to prioritize targets that balance near-term revenue visibility and long-term margin expansion.

Request for Pre-Order Enquiry On This Report

https://www.qyresearch.com/customize/5057423

5 Reasons to Buy This Report

It consolidates a 2024 revenue baseline and per-unit ASP to convert market dollars into unit and manufacturing economics.

It provides Asia and ASEAN regional demand and supply-chain context that is critical for production and go-to-market planning.

It combines recent, dated industry news and partnerships to surface commercial traction and M&A signals.

It models COGS, factory gross profit and production capacity metrics that investors and operators can use to stress-test business plans.

It outlines strategic playbooks that indicate how to capture margin and scale.

5 Key Questions Answered

What was the 2024 revenue baseline and what does that imply for units sold at an ASP?

What are plausible per-unit COGS, factory gross profit and factory gross margin assumptions for module manufacturers?

How is demand split regionally with special emphasis on Asia and ASEAN?

Which recent product launches, deployments and partnerships indicate meaningful commercial validation?

What operational and strategic levers most improve margins and reduce ris?

Chapter Outline

Chapter 1: Introduces the report scope of the report, executive summary of different market segments (by region, product type, application, etc), including the market size of each market segment, future development potential, and so on. It offers a high-level view of the current state of the market and its likely evolution in the short to mid-term, and long term.

Chapter 2: key insights, key emerging trends, etc.

Chapter 3: Manufacturers competitive analysis, detailed analysis of the product manufacturers competitive landscape, price, sales and revenue market share, latest development plan, merger, and acquisition information, etc.

Chapter 4: Provides profiles of key players, introducing the basic situation of the main companies in the market in detail, including product sales, revenue, price, gross margin, product introduction, recent development, etc.

Chapter 5 & 6: Sales, revenue of the product in regional level and country level. It provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and market size of each country in the world.

Chapter 7: Provides the analysis of various market segments by Type, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments.

Chapter 8: Provides the analysis of various market segments by Application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

Chapter 9: Analysis of industrial chain, including the upstream and downstream of the industry.

Chapter 10: The main points and conclusions of the report.

Contact Information:

Tel: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About QY Research

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release High Frequency Millimeter Wave Radar Modules Market to Reach CAGR 15,5% by 2031 Top 20 Company Globally here

News-ID: 4204735 • Views: …

More Releases from QY Research

Top 30 Indonesian Sugar Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)

PT Aman Agrindo Tbk sugarcane & sugar products (IDX:GULA)

PT Sugar Group Companies largest private sugar producer (not publicly listed)

PT Prima Alam Gemilang (PAG) major sugar mill operator (private)

PT Sinergi Gula Nusantara sugar mill operator (private)

PT Indofood Sukses Makmur Tbk (IDX:INDF) major food company using sugar inputs

PT Mayora Indah Tbk (IDX:MYOR) food & beverage…

Smart Factories, Smart Sensors: Investment Opportunities in Pressure Monitoring …

Pressure level sensors are electro-mechanical or MEMS-based devices that measure liquid or gas pressure and convert it into electrical signals for level monitoring, process control, and safety automation.

Widely deployed across industrial automation, water management, automotive systems, oil & gas, HVAC, chemical processing, and medical devices.

Growing demand for real-time monitoring, smart factories, and predictive maintenance is accelerating sensor integration in both legacy and new equipment.

Miniaturization, digital connectivity, and ruggedization enable deployment…

Inside the USD 14.5B Cookie Dough Boom: Asia & ASEAN Drive the Next Growth Wave

Cookie dough refers to ready-to-bake, ready-to-eat (heat-treated flour), frozen, chilled, or shelf-stable dough products used by households, foodservice, bakeries, cafés, QSR chains, and industrial bakery processors.

The industry sits at the intersection of frozen desserts, bakery ingredients, and convenience foods, driven by home baking trends, quick-service restaurants, and private label retail expansion.

Growth is supported by:

rising demand for convenience snacks

growth of frozen retail chains

increasing foodservice pre-mix adoption

premium flavors and indulgence culture

Asia &…

Inside the USD 440M Ceramic RF Filter Industry: ASEAN Expansion & IoT Demand

Inside the USD 440M Ceramic RF Filter Industry: ASEAN Expansion & IoT Demand

Ceramic band pass filters are compact radio-frequency (RF) components that allow a defined frequency band to pass while attenuating signals outside the range, enabling stable signal integrity in wireless, automotive, IoT, and industrial communication systems.

Built using piezoelectric ceramic resonators, they offer low insertion loss, small footprint, high selectivity, and strong thermal stability, making them widely adopted in smartphones,…

More Releases for Radar

Global Radar Speed Gun Market 2025-2032 Trends: Unveiling Growth Opportunities a …

Global Radar Speed Gun Market Trends by Safety Enforcement

Market Overview

Radar speed guns are precision instruments designed to measure the velocity of moving vehicles and objects using Doppler radar technology. Often deployed by law enforcement agencies, traffic management authorities, and event organizers, these handheld and vehicle-mounted devices provide real-time speed readings to ensure compliance with speed regulations, enhance road safety, and support evidence-based traffic violation enforcement. Advantages of radar speed guns…

Radar Shield Pro Reviews: Truth About Radar Shield Pro Revealed By Trusted Exper …

Introducing Radar Shield Pro - Your Ultimate Defense Against Speed Traps.

Are you tired of being blindsided by speed traps and unfair fines? Do you want to take control of your driving experience and avoid unnecessary costs? Look no further than Radar Shield Pro, the next-generation radar detector designed to keep you informed and protected on the road.

Truly, We've all been there - driving safely, following the rules, and then…

Radar System Market Report 2024 - Radar System Market Share, Growth, And Forecas …

"The Business Research Company recently released a comprehensive report on the Global Radar System Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample…

Avalanche Radar Market 2022 | Growing Demand for Short Range Radar Systems

According to Precision Business Insights (PBI), the latest report, the avalanche radar market is expected have a significant CAGR of 45.6% over 2022-2028. The primary drivers of the expansion of the global avalanche radar market include increasing demand for the avalanche radar system in the military and defense industry, government initiatives, and technological advancement in this sector.

View the detailed report description here - https://precisionbusinessinsights.com/market-reports/avalanche-radar-market/

Aluminum Segment to Dominate…

Missile Seekers Market Growth, Size, Key Players, Launch Mode, Active Radar, Sem …

The global missile seekers market size is projected to grow from USD 5.3 billion in 2021 to USD 6.8 billion by 2026, at a CAGR of 5.2% from 2021 to 2026. The market is driven by various factors, such as geopolitical instabilities, changing nature of warfare, increasing defense expenditure of emerging economies and technological advancements in missile seekers.

BAE Systems (UK), Boeing (US), Leonardo S.p.A. (Italy), Raytheon Technologies (US), Safran Group…

Radar Gun Market 2019-2025 - Recent Trends and Growth Opportunities By Major pla …

Global Radar Gun Market Insights, production, value, price, Future and Forecast up to 2025. The Market Revenue of Global Radar Gun Market is expected to expand at a lucrative CAGR over the forecast period. Global Radar Gun Market segmentation, industry reports, market trends, and market outlook are now available from Up Market Research (UMR).

Request for PDF Sample of this Research Report @ https://www.upmarketresearch.com/home/requested_sample/109972

The key players covered in this study…