Press release

Wearable Payment Devices Market Is Going to Boom | Apple, Samsung, Fitbit, Garmin, Huawei, Xiaomi, Gemalto, Ingenico

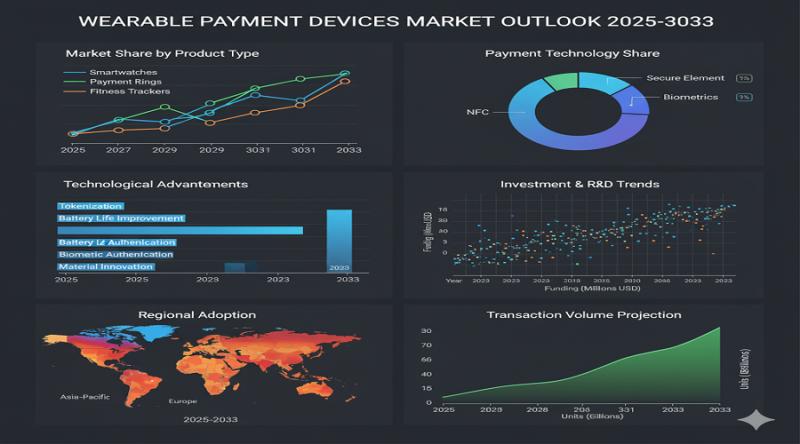

HTF MI just released the Global Wearable Payment Devices Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.Major Giants in Wearable Payment Devices Market are:

Apple, Samsung, Fitbit, Garmin, Huawei, Xiaomi, Fossil Group, Visa, Mastercard, NXP Semiconductors, Qualcomm, Thales Group, Gemalto, Ingenico, Fitbit Pay, Garmin Pay, Google (Wear OS partners), OTI, Garmin Pay, Suica (JR East ecosystem), Fitbit Ionic ecosystem

Request PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart)👉 https://www.htfmarketintelligence.com/sample-report/global-wearable-payment-devices-market?utm_source=Nilesh_OpenPR&utm_id=Nilesh

HTF Market Intelligence projects that the global Wearable Payment Devices market will expand at a CAGR of 19.1% from 2025 to 2032, from USD 2.4 Billion in 2025 to USD 9.8 Billion by 2032.

Our Report Covers the Following Important Topics:

By Type:

Smartwatches with NFC, Payment wristbands, Smart rings, Wearable payment stickers, Payment-enabled earbuds

By Application:

Contactless retail payments, Public transit fare payments, Peer-to-peer micro-payments, Access control and campus payments, Event and festival cashless solutions

Wearable payment devices are consumer electronics-such as smartwatches, rings, wristbands, and earbuds-embedded with secure NFC, tokenization, or other payment technologies that enable contactless transactions without a mobile phone. They combine convenience, security, and form-factor innovation to support retail, transit, events, and peer-to-peer payments. The market is driven by demand for frictionless payments, expanding digital wallet ecosystems, and partnerships between device OEMs and payment networks. Key technical enablers include secure elements, host-card emulation, tokenization, and biometric authentication. While North America currently leads due to high smartphone and wearable penetration, Asia-Pacific is the fastest-growing region because of mass transit use-cases and rapid mobile payments adoption. Challenges include interoperability, merchant acceptance, battery and form-factor constraints, and regulatory oversight, while opportunities lie in transit integrations, fashion partnerships, and bundled services that combine payments with loyalty and health functions.

Dominating Region:

North America

Fastest-Growing Region:

Asia-Pacific

Market Trends:

• Miniaturized secure elements and tokenization are trending in wearable payments.

• Integration of biometric authentication into wearables is increasing.

• Closed-loop transit and event payment partnerships are expanding.

• Fashion-tech collaborations producing premium payment wearables are on the rise.

• Integration of wearable payments with loyalty and rewards ecosystems is growing.

Market Drivers:

• Rising consumer preference for contactless payments is driving adoption of wearable payment devices.

• Increasing integration of NFC and secure elements in wearables is expanding use cases.

• Growth of digital wallets and tokenization is enabling safer transactions.

• Demand for convenience and hands-free payments boosts consumer interest.

• Partnerships between device makers and payment networks are accelerating market growth.

Market Challenges:

• Fragmented standards across regions pose interoperability challenges.

• Security and privacy concerns limit consumer trust.

• Limited merchant acceptance in some markets slows usage.

• Battery life and form-factor constraints impact functionality.

• Regulatory compliance across payments and wearables creates complexity for vendors.

Market Opportunities:

• Expansion of transit and closed-loop ecosystems offers near-term growth.

• Fashion and luxury collaborations can open premium segments.

• Bundling payment wearables with subscriptions and services can raise ARPU.

• Integration with health and identity services creates multi-use value propositions.

• Rapid growth in Asia-Pacific and Africa provides large untapped consumer bases.

Have a query? Ask Our Expert 👉 👉 https://www.htfmarketintelligence.com/enquiry-before-buy/global-wearable-payment-devices-market?utm_source=Nilesh_OpenPR&utm_id=Nilesh

The titled segments and sub-section of the market are illuminated below:

In-depth analysis of Wearable Payment Devices market segments by Types: Smartwatches with NFC, Payment wristbands, Smart rings, Wearable payment stickers, Payment-enabled earbuds

Detailed analysis of Wearable Payment Devices market segments by Applications: Contactless retail payments, Public transit fare payments, Peer-to-peer micro-payments, Access control and campus payments, Event and festival cashless solutions

Industry Insights

In March 2024, IndusInd Bank launched Indus PayWear in partnership with Tappy Technologies and Thales, marking India's first tokenization solution specifically for wearable payments devices. Through this initiative, users can tokenize debit and credit cards and use them across various wearables, including rings, watch clasps, and stickers, to make fast, secure, contactless payments. This collaboration demonstrates a push towards advancing digital payment convenience and security in India, streamlining the payment experience for consumers and supporting the contactless payments trend in the country.

In August 2024, Mastercard announced a collaboration with boAt, a leading Indian wearables brand, to introduce tap-and-pay functionality on boAt smartwatches. With the Crest Pay app, users can tokenize Mastercard debit and credit cards from select banks and conveniently conduct contactless transactions up to INR 5,000 via POS devices without PIN entry. By creating a broader base for secure wearable payments, this partnership enhances consumer convenience and supports the rapid adoption of payment-enabled wearables in India's growing smart device market.

Global Wearable Payment Devices Market -Regional Analysis

• North America: United States of America (US), Canada, and Mexico.

• South & Central America: Argentina, Chile, Colombia, and Brazil.

• Middle East & Africa: Kingdom of Saudi Arabia, United Arab Emirates, Turkey, Israel, Egypt, and South Africa.

• Europe: the UK, France, Italy, Germany, Spain, Nordics, BALTIC Countries, Russia, Austria, and the Rest of Europe.

• Asia: India, China, Japan, South Korea, Taiwan, Southeast Asia (Singapore, Thailand, Malaysia, Indonesia, Philippines & Vietnam, etc.) & Rest

• Oceania: Australia & New Zealand

Buy Now Latest Edition of Wearable Payment Devices Market Report 👉 https://www.htfmarketintelligence.com/book-now?format=1&report=16531?utm_source=Nilesh_OpenPR&utm_id=Nilesh

Wearable Payment Devices Market Research Objectives:

- Focuses on the key manufacturers, to define, pronounce and examine the value, sales volume, market share, market competition landscape, SWOT analysis, and development plans in the next few years.

- To share comprehensive information about the key factors influencing the growth of the market (opportunities, drivers, growth potential, industry-specific challenges and risks).

- To analyze the with respect to individual future prospects, growth trends and their involvement to the total market.

- To analyze reasonable developments such as agreements, expansions new product launches, and acquisitions in the market.

- To deliberately profile the key players and systematically examine their growth strategies.

FIVE FORCES & PESTLE ANALYSIS:

Five forces analysis-the threat of new entrants, the threat of substitutes, the threat of competition, and the bargaining power of suppliers and buyers-are carried out to better understand market circumstances.

• Political (Political policy and stability as well as trade, fiscal, and taxation policies)

• Economical (Interest rates, employment or unemployment rates, raw material costs, and foreign exchange rates)

• Social (Changing family demographics, education levels, cultural trends, attitude changes, and changes in lifestyles)

• Technological (Changes in digital or mobile technology, automation, research, and development)

• Legal (Employment legislation, consumer law, health, and safety, international as well as trade regulation and restrictions)

• Environmental (Climate, recycling procedures, carbon footprint, waste disposal, and sustainability)

Get 10-25% Discount on Immediate purchase 👉 https://www.htfmarketintelligence.com/request-discount/global-wearable-payment-devices-market?utm_source=Nilesh_OpenPR&utm_id=Nilesh

Points Covered in Table of Content of Global Wearable Payment Devices Market:

Chapter 01 - Wearable Payment Devices Executive Summary

Chapter 02 - Market Overview

Chapter 03 - Key Success Factors

Chapter 04 - Global Wearable Payment Devices Market - Pricing Analysis

Chapter 05 - Global Wearable Payment Devices Market Background or History

Chapter 06 - Global Wearable Payment Devices Market Segmentation (e.g. Type, Application)

Chapter 07 - Key and Emerging Countries Analysis Worldwide Wearable Payment Devices Market

Chapter 08 - Global Wearable Payment Devices Market Structure & worth Analysis

Chapter 09 - Global Wearable Payment Devices Market Competitive Analysis & Challenges

Chapter 10 - Assumptions and Acronyms

Chapter 11 - Wearable Payment Devices Market Research Method Wearable Payment Devices

Thank you for reading this post. You may also obtain report versions by area, such as North America, LATAM, Europe, Japan, Australia, or Southeast Asia, or by chapter.

Nidhi Bhawsar (PR & Marketing Manager)

HTF Market Intelligence Consulting Private Limited

Phone: +15075562445

sales@htfmarketintelligence.com

About Author:

HTF Market Intelligence Consulting is uniquely positioned to empower and inspire with research and consulting services to empower businesses with growth strategies, by offering services with extraordinary depth and breadth of thought leadership, research, tools, events, and experience that assist in decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Wearable Payment Devices Market Is Going to Boom | Apple, Samsung, Fitbit, Garmin, Huawei, Xiaomi, Gemalto, Ingenico here

News-ID: 4204408 • Views: …

More Releases from HTF Market Intelligence Consulting Private Limited

Pet Shampoo Market Overview & Growth Rate Forecast for the Next 5 Years

The latest study released on the Global Pet Shampoo Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The Pet Shampoo study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Consider how these…

E-Passport and E-Visa Market: Pioneering Secure, Digital Travel Authentication

The E-Passport and E-Visa Market is at the intersection of travel security, digital identity management, and global mobility. As international travel continues to rebound and migrate toward contactless experiences, governments and border authorities are embracing electronic solutions that streamline entry processes, enhance security, and reduce fraud. E-passports and e-visas have emerged as cornerstones of modern travel infrastructure, enabling faster processing, greater convenience, and stronger identity assurance for travelers and authorities…

Vegan Footwear Market Rewriting Long Term Growth Story | Adidas, Nike, Native Sh …

The latest study released on the Global Vegan Footwear Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The Vegan Footwear study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Consider how these…

Customer Loyalty Program Software Market: Powering Engagement in the Digital Era

The Customer Loyalty Program Software Market is expanding rapidly as businesses strive to retain existing customers and build long-lasting relationships in an increasingly competitive landscape. Loyalty program software enables companies to design, deploy, manage, and analyze customer rewards, points, tiers, and engagement strategies across digital channels. With consumer expectations rising and personalized experiences becoming the norm, loyalty platforms are now viewed not just as marketing tools but as strategic engines…

More Releases for Pay

Digital Wallets Market to See Thriving Worldwide | PayPal • Apple Pay • Goog …

The latest study by Coherent Market Insights, titled "Digital Wallets Market Size, Share & Trends Forecast 2026-2033," offers an in-depth analysis of the global and regional dynamics shaping this rapidly evolving industry. This comprehensive report highlights the competitive landscape, key market segments, value chain analysis, and emerging technological and regulatory trends expected between 2026 and 2033. The report provides actionable insights for business leaders, policymakers, investors, and new market entrants…

Mobile Payment Market to See Thriving Worldwide| Apple Pay • Google Pay • Sa …

Latest Report, titled Mobile Payment Market 2025-2032 Trends, Share, Size, Growth, Opportunity and Forecast 2025-2032, by Coherent Market Insights offers a comprehensive analysis of the industry, which comprises insights on the market analysis. As part of our Black Friday Limited-Time Discount, this premium research report is now available at up to 60% off, offering an exceptional opportunity for businesses, analysts, and stakeholders to access high-value insights at a significantly reduced…

Proximity Payment Market is Going to Boom | Major Giants Apple Pay, Google Pay, …

HTF MI just released the Global Proximity Payment Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

𝐌𝐚𝐣𝐨𝐫 Giants in Proximity Payment Market are:

Apple Pay, Google Pay, Samsung…

Unified Payments Interface (UPI) Market Is Booming Worldwide | Google Pay, Amazo …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2028. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Unified Payments Interface (UPI) Market May See a Big Move | Major Giants Samsun …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2027. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Samsung Pay Market is Booming Worldwide with Samsung Pay, Apple Pay, Google Pay

HTF Market Intelligence released a new research report of 23 pages on title 'Samsung Pay - Competitor Profile' with detailed analysis, forecast and strategies. The study covers key regions that includes North America, LATAM, United States, GCC, Southeast Asia, Europe, APAC, United Kingdom, India or China etc and important players such as Samsung Pay, Apple Pay, Google Pay, Alipay, Tenpay, Samsung Electronics, Visa, Mastercard.

Request a sample report @ https://www.htfmarketreport.com/sample-report/3587660-samsung-pay-competitor-profile

Summary

Samsung…