Press release

Digital Banking Solution Market to Hit US$ 24.96 Bn by 2032, Fueled by FinTech Adoption & Digital Transformation | Key Players: Worldline S.A., Fiserv, Inc., J.P.Morgans, HSBC, Digital Banking Solutions, CSI, Finastra, FIS, PwC, and Capgemini

The Digital Banking Solution Market research study provides critical market data, such as growth-influencing factors, roadblocks, and opportunities and strategies for overcoming them. The study also includes industry data, such as market value, share, CAGR, size, and so on, to make market research easier for new entrants. The research also examines the economy, society, law, and the environment. The global Digital Banking Solution Market research report utilizes both primary and secondary data sources. Government laws, market circumstances, competitive levels, historical data, market status, anticipated changes in linked firms, market volatility, and prospects are just a few of the industry-affecting elements studied during the research process.Download Latest Sample of This Strategic Report (Get Higher Priority for Corporate Email ID):-@ https://www.datamintelligence.com/download-sample/digital-banking-solution-market?ophp

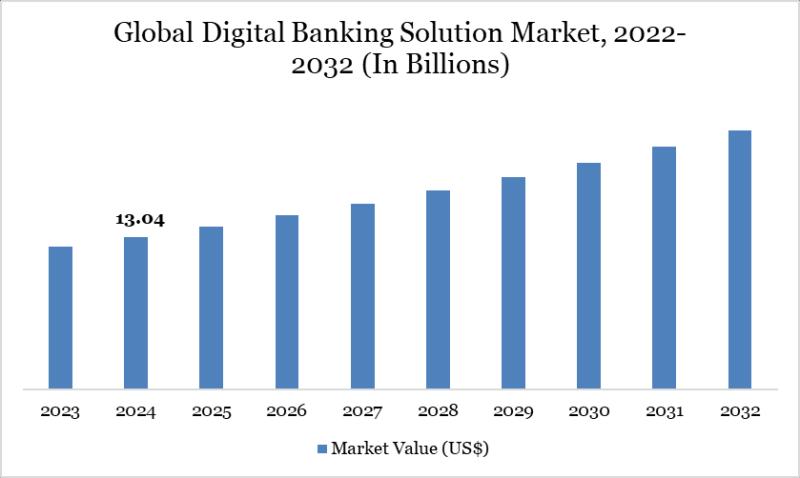

Global Digital banking solution market reached US$ 13.04 billion in 2024 and is expected to reach US$ 24.96 billion by 2032, growing with a CAGR of 8.62% during the forecast period 2025-2032.

The list of Key Players Profiled in the study includes:- Worldline S.A., Fiserv, Inc., J.P.Morgans, HSBC, Digital Banking Solutions, CSI, Finastra, FIS, PwC, and Capgemini.

United States: Recent Industry Developments

✅ In August 2025, JPMorgan Chase launched a next-generation digital banking platform with AI-powered personal finance management tools. The system enables real-time budgeting, investment tracking, and fraud detection for U.S. customers.

✅ In July 2025, Bank of America introduced a fully mobile-first banking solution, integrating biometric authentication and instant payments. The platform aims to improve user experience and reduce transaction friction.

✅ In June 2025, Wells Fargo partnered with fintech startups to deploy open banking APIs for seamless third-party integration, enhancing personalized financial services across digital channels.

Japan: Recent Industry Developments

✅ In August 2025, Mitsubishi UFJ Financial Group (MUFG) launched a digital banking app with AI-driven savings and investment recommendations for Japanese users. The platform supports seamless cross-bank transfers and financial management.

✅ In July 2025, SBI Holdings expanded its digital banking services with blockchain-based payment and remittance solutions in Japan. The initiative enhances transaction security and speed for domestic and international transfers.

✅ In May 2025, Rakuten Bank introduced a cloud-based digital banking solution integrating e-commerce and loyalty programs. The platform provides a unified experience for payments, savings, and rewards.

Digital banking solutions offer online and mobile-based financial services, including payments, lending, and wealth management. The market is growing rapidly with fintech innovation and customer demand for convenience. In the U.S., 2025 news includes regulatory frameworks for digital-only banks, increased adoption of AI-driven customer service, and partnerships between fintechs and traditional banks to expand digital offerings.

Market Dynamics:

✅Driver: Rising demand for convenient, real-time banking services drives adoption of digital platforms.

✅Restraints: Cybersecurity risks and digital literacy gaps restrict adoption in some regions.

✅Opportunities: Integration with AI, blockchain, and biometrics enhances customer experience and security.

✅Challenges: Regulatory compliance and strong competition from fintech players remain critical issues.

Segmentation Analysis of the Market:

Global Digital Banking Solution Market forecast report provides a holistic evaluation of the market. The report offers a comprehensive analysis of key segments, trends, drivers, restraints, competitive landscape, and factors that are playing a substantial role in the market. Digital Banking Solution Market, By component, the market is divided into Software and Services. Based on the type of banking, it covers Retail Banking, Corporate Banking, and Investment Banking. In terms of deployment, the segmentation includes On-Premises and Cloud-Based solutions. By mode, the market is classified into App-Based and Web-Based platforms

Research Methodology:

- Primary Research: This method involves collecting new and original data for a specific purpose. Primary research is often conducted through surveys, interviews, focus groups, and observation. It enables researchers to obtain first-hand information directly from the target audience, which is especially useful when researching a new or emerging market.

- Secondary Research: This method involves analyzing and synthesizing existing data from various sources such as industry reports, government publications, academic research, and online databases. Secondary research can provide researchers with valuable insights into industry trends, consumer behavior, and Digital Banking Solution market size and growth, without the need for extensive data collection.

Most research studies use a combination of both primary and secondary research methods to ensure comprehensive and accurate data analysis. The specific methodology used in a Digital Banking Solution market research study will depend on various factors such as the research objectives, the target audience, and the available resources.

Request Customized Market Entry Assessment for North America, EU, APAC: https://www.datamintelligence.com/customize/digital-banking-solution-market?ophp

Regional Outlook:

The following section of the report offers valuable insights into different regions and the key players operating within each of them. To assess the growth of a specific region or country, economic, social, environmental, technological, and political factors have been carefully considered. The section also provides readers with revenue and sales data for each region and country, gathered through comprehensive research. This information is intended to assist readers in determining the potential value of an investment in a particular region.

North America (U.S., Canada, Mexico)

Europe (Germany, U.K., France, Italy, Russia, Spain, Rest of Europe)

Asia-Pacific (China, India, Japan, Singapore, Australia, New Zealand, Rest of APAC)

South America (Brazil, Argentina, Rest of SA)

Middle East & Africa (Turkey, Saudi Arabia, Iran, UAE, Africa, Rest of MEA)

The Report Includes:

➡ A descriptive analysis of demand-supply gap, market size estimation, SWOT analysis, PESTEL Analysis and forecast in the global market.

➡ Go-to-market Strategy.

➡ Neutral perspective on the market performance.

➡ Customized regional/country reports as per request and country level analysis.

➡ Potential & niche segments and regions exhibiting promising growth covered.

The major points covered in the table of contents:

📌 Overview: This part provides a summary of the report, as well as a broad overview of the global Digital Banking Solution Market, to offer an understanding of the nature and contents of the research study.

📌 Market Analysis: The research forecasts the market share of key segments of the Digital Banking Solution Market with accuracy and reliability. This study may be used by industry participants to make strategic investments in key growth areas of the Digital Banking Solution Market.

📌 Analysis of Leading Players' Strategies: This report can be used by market participants to acquire a competitive advantage over their rivals in the Digital Banking Solution Market.

📌 Regional Growth Analysis: The report covers all of the key areas and countries. The regional analysis will assist market players in tapping into untapped regional markets, developing unique regional strategies, and comparing the growth of all regional markets.

📌 Market Forecasts: Report purchasers will get access to precise and validated estimations of the entire market size in terms of both value and volume. The study also includes estimates for the Digital Banking Solution Market in terms of consumption, production, sales, and other factors.

Benefits of Digital Banking Solution Market Reports:

➟ Make informed decisions: The growth of an organization depends on decisions made by management. Using our market research reports, management can make business decisions based on the results obtained that support their knowledge and experience. Digital Banking Solution Market research helps to understand market trends and is therefore often performed to gain insight into customers.

➟ Get Accurate Information: Our market research provides true and accurate information, preparing organizations for any future mistakes that may occur.

➟ help you choose the right sales system: choose the precise sales system according to the Digital Banking Solution market demand, to position the product/service in the market.

Looking for in-depth insights? Grab the full report: https://www.datamintelligence.com/buy-now-page?report=digital-banking-solution-market

The report answers a number of crucial questions, including:

- Which companies dominate the global Digital Banking Solution market?

- What current trends will influence the market over the next few years?

- What are the market's opportunities, obstacles, and driving forces?

- What predictions for the future can help with strategic decision-making?

- What advantages does market research offer businesses?

Get Corporate Access to Live Digital Banking Solution Industry Intelligence Database: https://www.datamintelligence.com/reports-subscription

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Digital Banking Solution Market to Hit US$ 24.96 Bn by 2032, Fueled by FinTech Adoption & Digital Transformation | Key Players: Worldline S.A., Fiserv, Inc., J.P.Morgans, HSBC, Digital Banking Solutions, CSI, Finastra, FIS, PwC, and Capgemini here

News-ID: 4203561 • Views: …

More Releases from DataM intelligence 4 Market Research LLP

United States Soil Active Herbicides Market by 2031 | Major Companies: Bayer Cro …

Market Overview:

The Global Soil Active Herbicides Market is projected to grow at a CAGR of 5.1% during the forecast period 2024-2031. Soil active herbicides are a class of weed control agents that act directly on the seeds, roots, or shoots of plants. They are applied to the soil either before or after planting to suppress the germination and growth of unwanted weeds. These herbicides remain active in the soil for…

Drug Discovery Services Market is Expected to Reach US$ 12.78 Billion by 2033 | …

Market Overview:

The Global Drug Discovery Services Market reached US$ 8.37 billion in 2024, rising from US$ 8.01 billion in 2023, and is projected to reach US$ 12.78 billion by 2033, growing at a CAGR of 4.9% during the forecast period 2025-2033. The market's expansion is primarily driven by the increasing prevalence of chronic diseases such as cancer, diabetes, and cardiovascular disorders, along with rising R&D investments by pharmaceutical and biotechnology…

United States Biopesticides Market 2026 | Growth Drivers, Key Players & Investme …

Market Size and Growth

The Global Biopesticides Market valued USD 7,734.43 million in 2024 is expected to reach US$ 24,158.10 million by 2032, growing at a CAGR of 15.30% during the forecast period 2025-2032, according to DataM Intelligence report.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://www.datamintelligence.com/download-sample/bio-pesticides-market?sb

Key Development:

United States: Recent Industry Developments

✅ In January 2026, the U.S. Environmental Protection Agency (EPA) launched…

United States Expanded Polypropylene (EPF) Foam Market 2026 | Growth Drivers, Tr …

Market Size and Growth

The Global "Expanded Polypropylene (EPF) Foam Market" is expected to grow at a CAGR of 6.4% during the forecast period (2024-2031).

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://www.datamintelligence.com/download-sample/expanded-polypropylene-foam-market?sb

Key Development:

United States: Recent Industry Developments

✅ In December 2025, Sealed Air Corporation launched a new line of biodegradable expanded polypropylene (EPP) foam products for sustainable packaging applications, broadening its product portfolio to…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…