Press release

Automotive Usage-Based Insurance Industry Projected to Surpass USD 270.3 Billion by 2032, Witnessing a Robust 21.3% CAGR | Persistence Market Research

The global automotive usage-based insurance (UBI) market is witnessing significant momentum, driven by the increasing adoption of telematics, connected vehicles, and data-driven risk assessment solutions. Currently estimated at US$ 69.8 billion in 2025, the market is projected to grow at a robust compound annual growth rate (CAGR) of 21.3% over the forecast period, reaching a value of US$ 270.3 billion by 2032. This remarkable growth trajectory underscores the transformative impact of digital technologies and shifting consumer preferences on the insurance sector.The growth of the automotive UBI market is fueled by several key factors. Rising demand for personalized insurance solutions that accurately reflect individual driving behavior is one of the primary drivers. Consumers increasingly prefer pay-as-you-drive (PAYD) and pay-how-you-drive (PHYD) models, which enable cost savings for safer drivers while enhancing transparency and customer engagement. Additionally, regulatory mandates in several countries requiring mandatory telematics or promoting safer driving behaviors are accelerating market adoption. Technological advancements in vehicle telematics, connected car platforms, and mobile applications further enhance data collection, processing, and risk assessment, creating a fertile environment for UBI growth.

Request Sample Copy of Report: https://www.persistencemarketresearch.com/samples/29038

Environmental sustainability is also indirectly contributing to market expansion. Insurance models that reward eco-friendly driving practices or reduced vehicle usage align with global sustainability initiatives, incentivizing responsible mobility while mitigating risk. The convergence of digital insurance platforms with Internet of Things (IoT), artificial intelligence (AI), and 5G technologies is enabling insurers to deliver more accurate, dynamic, and customer-centric solutions, propelling market demand across developed and emerging regions.

Segmentation Analysis

By Type

The automotive UBI market can be segmented based on insurance models, including pay-as-you-drive (PAYD), pay-how-you-drive (PHYD), and other emerging usage-based models. PAYD insurance, which charges premiums based on the distance traveled, continues to dominate the market due to its straightforward implementation and consumer appeal. PHYD insurance, on the other hand, is experiencing the fastest growth as it leverages advanced telematics to monitor driver behavior, including acceleration, braking, and cornering patterns, offering a more granular risk assessment. Insurers increasingly adopt PHYD models to differentiate their offerings, reduce claims, and incentivize safer driving habits, which contributes to higher adoption rates. Emerging models integrating behavioral analytics and real-time feedback mechanisms are further enhancing the attractiveness of UBI insurance, creating opportunities for insurers to expand their portfolios and strengthen customer retention.

By Vehicle/Product/Service Type

The market is also segmented by vehicle type, including passenger vehicles, commercial vehicles, and two-wheelers, as well as by product/service types such as traditional auto insurance policies integrated with telematics, fleet insurance solutions, and connected car subscription packages. Passenger vehicles account for the largest share due to the high penetration of telematics devices and increasing consumer awareness of cost-saving insurance models. Commercial vehicles are witnessing accelerated adoption, driven by fleet management requirements, regulatory compliance, and operational cost reduction strategies. The adoption of UBI among commercial fleets allows operators to monitor driver performance, optimize fuel consumption, and reduce maintenance costs while simultaneously lowering insurance premiums.

Service providers offering integrated solutions, including telematics hardware, data analytics platforms, and mobile applications, are gaining traction as they provide a comprehensive ecosystem that supports insurers and end-users. The rise of connected car technology has enabled seamless integration of UBI services into vehicles' existing infotainment and navigation systems, further enhancing convenience, adoption, and customer engagement.

By Propulsion/Technology/Channel

With the rapid growth of electric vehicles (EVs) and hybrid vehicles, UBI adoption is evolving to accommodate propulsion-specific considerations. EV and hybrid vehicle owners often exhibit distinct driving patterns, such as reduced mileage and frequent urban usage, which UBI solutions can analyze to tailor premiums and incentivize energy-efficient driving behaviors. Insurers are increasingly leveraging AI-driven analytics and predictive modeling to design propulsion-specific insurance packages, reflecting the evolving vehicle landscape.

Channel-wise, digital platforms, mobile applications, and telematics-integrated policies are emerging as primary conduits for UBI adoption. Direct-to-consumer digital insurance channels, coupled with mobile apps that provide real-time driving feedback, are enhancing user engagement and promoting continuous interaction, resulting in improved retention and satisfaction.

Request Customization of Report: https://www.persistencemarketresearch.com/request-customization/29038

Regional Insights

Geographically, North America currently leads the automotive UBI market, driven by high telematics penetration, supportive regulatory frameworks, and widespread adoption of connected vehicles. The U.S. and Canada have established robust telematics ecosystems, with insurers offering a wide array of PAYD and PHYD products, often supported by mobile platforms and AI-powered analytics. Europe follows closely, benefiting from stringent safety regulations, growing consumer preference for transparent insurance models, and significant investments in connected car technologies.

The Asia-Pacific region is emerging as the fastest-growing market due to rising vehicle ownership, increasing urbanization, and growing consumer awareness of usage-based insurance benefits. Countries such as China, India, and Japan are witnessing accelerated adoption, driven by government initiatives promoting smart mobility, fleet management regulations, and partnerships between insurers and automotive manufacturers to integrate telematics devices. The increasing availability of affordable connected car solutions and mobile-based insurance apps is further catalyzing UBI penetration in this region, presenting significant growth opportunities for market participants.

Unique Features and Innovations in the Market

Modern UBI solutions are distinguished by their ability to combine real-time data analytics, predictive modeling, and personalized feedback to deliver customer-centric insurance offerings. AI-powered algorithms enable insurers to analyze vast datasets, including driving patterns, environmental conditions, and vehicle performance, to provide accurate risk assessments and dynamic premium adjustments. IoT-enabled telematics devices and connected car platforms continuously monitor vehicle parameters, ensuring precise usage tracking and enhanced policy management.

The integration of 5G technology is revolutionizing the UBI landscape by enabling high-speed, low-latency data transmission between vehicles, insurers, and telematics devices. This allows insurers to process real-time data efficiently, offer immediate policy adjustments, and deliver instant alerts or recommendations to drivers, enhancing safety and engagement. Additionally, predictive analytics and AI-based risk scoring allow insurers to proactively identify high-risk behaviors and provide actionable feedback, leading to lower accident rates, reduced claims, and increased customer satisfaction.

Gamification features, mobile app integration, and behavioral incentives further differentiate modern UBI solutions, encouraging safer driving habits, loyalty, and active participation. These innovations underscore the transformative potential of technology in reshaping traditional insurance models and creating a data-driven ecosystem that benefits insurers, policyholders, and regulatory authorities alike.

Market Highlights

The adoption of automotive UBI solutions is primarily driven by several strategic considerations. Businesses and insurers are increasingly embracing UBI to reduce underwriting risk, enhance customer engagement, and optimize operational efficiency. Usage-based premiums allow insurers to align risk exposure with actual driving behavior, mitigating losses from unsafe driving while fostering a culture of accountability and safety. For consumers, UBI offers significant cost-saving opportunities, personalized policy management, and enhanced transparency.

Regulatory frameworks and compliance requirements are also significant drivers. In several jurisdictions, authorities incentivize or mandate telematics-based insurance to promote road safety, reduce traffic accidents, and support environmental sustainability initiatives. UBI policies that reward reduced mileage, eco-friendly driving, or low-emission vehicle usage contribute to sustainability objectives while aligning with national regulatory priorities. Additionally, technological advancements reduce administrative overhead, enhance claims processing, and streamline policy management, positioning UBI as a preferred choice for insurers seeking efficiency and profitability.

Key Players and Competitive Landscape

The competitive landscape of the automotive UBI market is characterized by strategic collaborations, technology integration, and global expansion initiatives. Leading companies include Progressive Corporation, Allstate Corporation, State Farm, AXA, Allianz SE, Zurich Insurance Group, and Generali Group, among others.

Progressive Corporation is a pioneer in PAYD and PHYD insurance models in North America, leveraging robust telematics platforms and mobile applications to offer personalized insurance solutions. Allstate Corporation has strategically integrated connected car technologies and AI-driven analytics to optimize risk assessment and enhance customer engagement. State Farm has focused on fleet-specific UBI solutions, employing predictive modeling and behavioral insights to deliver cost-efficient premiums.

Global insurers such as AXA, Allianz SE, and Zurich Insurance Group are expanding their UBI offerings across Europe and Asia-Pacific, investing in telematics partnerships, AI-driven platforms, and regional collaborations to strengthen market presence. These companies prioritize innovation, regulatory compliance, and customer-centric product design to maintain competitive differentiation and capitalize on the rapidly growing UBI market.

Dive deeper into the market data: https://www.persistencemarketresearch.com/market-research/automotive-usage-based-insurance-market.asp

Future Opportunities and Growth Prospects

The automotive usage-based insurance market is poised for sustained growth, driven by technological evolution, regulatory support, and changing consumer preferences. The proliferation of connected vehicles, AI-enabled analytics, and 5G infrastructure will continue to enhance UBI offerings, making policies more dynamic, predictive, and tailored to individual driving behaviors. Expansion in emerging economies, particularly in Asia-Pacific and Latin America, presents substantial growth potential, fueled by increasing vehicle ownership, urbanization, and demand for cost-effective insurance solutions.

Emerging opportunities also include integration with smart city initiatives, fleet management solutions, and mobility-as-a-service (MaaS) platforms. Regulatory frameworks that promote safer driving, environmental sustainability, and data transparency will further shape market dynamics, driving innovation and adoption. Insurers that successfully leverage telematics, AI, IoT, and 5G technologies while addressing consumer expectations for transparency, cost savings, and convenience are well-positioned to capture significant market share in the coming decade.

In conclusion, the automotive usage-based insurance market represents a transformative segment of the global insurance industry, offering substantial opportunities for growth, innovation, and strategic differentiation. With the convergence of technology, data-driven insights, and evolving consumer behavior, UBI is set to redefine traditional insurance models, delivering measurable benefits for insurers, policyholders, and society at large.

Explore more related market insights and reports by visiting our website.

Autonomous Underwater Vehicles Market Trends: https://www.persistencemarketresearch.com/market-research/autonomous-underwater-vehicles-market.asp

Electric Power Distribution Automation Systems Market Trends: https://www.persistencemarketresearch.com/market-research/electric-power-distribution-automation-market.asp

Wheel Loaders Market Trends: https://www.persistencemarketresearch.com/market-research/wheel-loaders-market.asp

Smart Bicycle Accessories Market Trends: https://www.persistencemarketresearch.com/market-research/smart-bicycle-accessories-market.asp

Ship Repair and Maintenance Service Market Trends: https://www.persistencemarketresearch.com/market-research/ship-repair-and-maintenance-service-market.asp

Contact Us:

Persistence Market Research

G04 Golden Mile House, Clayponds Lane

Brentford, London, TW8 0GU UK

USA Phone: +1 646-878-6329

UK Phone: +44 203-837-5656

Email: sales@persistencemarketresearch.com

Web: https://www.persistencemarketresearch.com

About Persistence Market Research:

At Persistence Market Research, we specialize in creating research studies that serve as strategic tools for driving business growth. Established as a proprietary firm in 2012, we have evolved into a registered company in England and Wales in 2023 under the name Persistence Research & Consultancy Services Ltd. With a solid foundation, we have completed over 3600 custom and syndicate market research projects, and delivered more than 2700 projects for other leading market research companies' clients.

Our approach combines traditional market research methods with modern tools to offer comprehensive research solutions. With a decade of experience, we pride ourselves on deriving actionable insights from data to help businesses stay ahead of the competition. Our client base spans multinational corporations, leading consulting firms, investment funds, and government departments. A significant portion of our sales comes from repeat clients, a testament to the value and trust we've built over the years.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Automotive Usage-Based Insurance Industry Projected to Surpass USD 270.3 Billion by 2032, Witnessing a Robust 21.3% CAGR | Persistence Market Research here

News-ID: 4203478 • Views: …

More Releases from Persistence Market Research

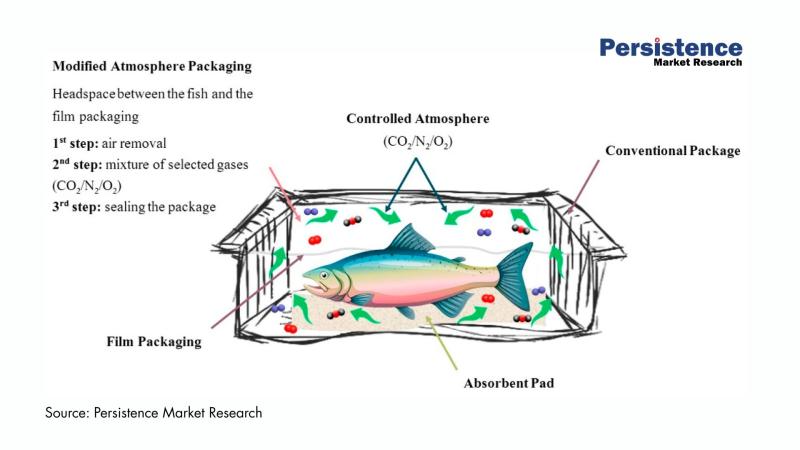

Active Modified Atmospheric Packaging Market to Surpass US$ 37.9 Bn by 2033, Dri …

The global active modified atmospheric packaging market is entering a dynamic growth phase as food manufacturers, healthcare suppliers, and logistics companies intensify their focus on extending product freshness, minimizing waste, and improving supply chain resilience. Active modified atmospheric packaging (AMAP) integrates advanced gas control technologies, moisture regulators, and antimicrobial features to create optimal internal environments for perishable products.

According to the latest study by Persistence Market Research, the global active modified…

Shunt Capacitor Market Expected to Reach US$2.0 Bn by 2033 Driven by Grid Modern …

The global shunt capacitor market is set for sustained growth as power grids worldwide undergo modernization to meet rising electricity demand and improve energy efficiency. According to the latest study by Persistence Market Research, the global shunt capacitor market size is likely to be valued at US$ 1.3 billion in 2026 and is projected to reach US$ 2.0 billion by 2033, expanding at a CAGR of 6% during the forecast…

Tire Cord & Tire Fabrics Market Set to Hit US$9.0 Bn by 2032 Driven by Radializa …

The global tire cord & tire fabrics market is entering a dynamic growth phase as automotive production rebounds, mobility patterns evolve, and manufacturers prioritize high-performance reinforcement materials. Tire cords and fabrics form the structural backbone of tires, providing dimensional stability, strength, and resistance to wear under demanding operating conditions.

According to the latest study by Persistence Market Research, the market is valued at US$5.9 billion in 2025 and is projected to…

Event Tourism Market Set for Exponential Growth through 2032 - PMR Research

The global Event Tourism Market is poised for remarkable expansion, driven by sustained demand for live experiences, increased business travel, hybrid event adoption, and a rebound in international tourism. According to industry projections, the market is expected to grow from an estimated US$1,538.3 billion in 2025 to US$2,631.5 billion by 2032, registering a CAGR of 7.3% over the forecast period.

This robust growth underscores the evolution of event tourism into one…

More Releases for UBI

Usage Based Insurance (Ubi) Market: A Comprehensive Overview

The Usage-Based Insurance (UBI) Market was valued at USD 43.38 billion in 2023 and is expected to grow to approximately USD 87.0 billion by 2033, reflecting a CAGR of about 7.2% from 2024 to 2033.

Usage Based Insurance (Ubi) Market Overview

The Usage-Based Insurance (UBI) Market is experiencing significant growth, driven by advancements in telematics and the increasing adoption of connected vehicles. UBI models, such as Pay-As-You-Drive (PAYD) and Pay-How-You-Drive (PHYD), utilize…

Usage Based Insurance (Ubi) Market Size Unlocking New Opportunities for Success

The global Usage-Based Insurance (UBI) Market was valued at approximately USD 33.27 billion in 2023 and is projected to reach around USD 232.94 billion by 2032, growing at a compound annual growth rate (CAGR) of 24.14% from 2024 to 2032.

Usage Based Insurance (Ubi) Market Overview

Usage-Based Insurance (UBI) is an innovative auto insurance model that determines premiums based on individual driving behaviors, such as distance traveled, speed, braking patterns, and time…

Usage-based Insurance (UBI) Market Revenue Sizing Outlook Appears Bright

Global Usage-based Insurance (UBI) Market Report from Market Insights Report highlights deep analysis on market characteristics, sizing, estimates and growth by segmentation, regional breakdowns & country along with competitive landscape, player's market shares, and strategies that are key in the market. The exploration provides a 360° view and insights, highlighting major outcomes of the industry. These insights help the business decision-makers to formulate better business plans and make informed decisions…

Usage-based Insurance (UBI) Market Will Generate Record Revenue by 2029

The global UBI market is anticipated to grow at a CAGR of 27.9% during the forecast period. Due to the increasing demand for usage-based insurance for automotive continues, along with the strong ecosystem is getting created around connected automotive services. This ecosystem involves participants such as automotive IoT and insurance platform providers, data platform and analytics companies, automotive insurance black box and telematics providers, big data companies, and cloud service providers. For…

Usage-based Insurance (UBI) Market to Witness Growth Acceleration by 2029

The global UBI market is anticipated to grow at a CAGR of 27.9% during the forecast period. Due to the increasing demand for usage-based insurance for automotive continues, along with the strong ecosystem is getting created around connected automotive services. This ecosystem involves participants such as automotive IoT and insurance platform providers, data platform and analytics companies, automotive insurance black box and telematics providers, big data companies, and cloud service providers. For…

Usage-Based Insurance (UBI) Market by Policy Type [Pay-As-You-Drive Insurance (P …

UBI Market Size

The global usage-based insurance market size was valued at $28.7 billion in 2019, and is projected to reach $149.2 billion by 2027, growing at a CAGR of 25.1% from 2020 to 2027. Usage-based insurance is expected to grow rapidly in the coming years. Key drivers of the usage-based insurance market include the growing adoption of telematics technology in the automotive insurance space.

Download Free Sample: https://reports.valuates.com/request/sample/ALLI-Auto-0U87/Usage_Based_Insurance

Trends Influencing the Global…