Press release

EV Finance Market to Skyrocket, Hitting USD 1,419.1 billion by 2035 Amidst Global Electric Mobility Revolution

The global electric vehicle (EV) finance market is poised for exponential growth, with a new market report forecasting its value to surge from an estimated USD 89.0 billion in 2025 to a staggering USD 1,419.1 billion by 2035. This massive expansion reflects a Compound Annual Growth Rate (CAGR) of 31.9%, driven by the steep global adoption curve of electric vehicles, supportive government policies, and rapid financial innovation.The report highlights that the EV finance market-which includes loans, leases, and subscription models-is playing an essential role in accelerating the transition to electric mobility by addressing the high upfront cost of EVs. This specialized sector, currently holding about 7.1% of the broader automotive financing market, is becoming a primary engine for green investment and clean mobility funding worldwide.

Dive Deeper into the Data-View the Full Report Here: https://www.futuremarketinsights.com/reports/sample/rep-gb-25798

Market Drivers and Digital Transformation

The accelerated growth is underpinned by several key factors. Government-led incentives, such as tax rebates and subsidies, are directly influencing financing dynamics, making EVs more affordable for consumers and fleets. Financial institutions are responding by designing EV-specific loan products with lower interest rates and flexible repayment terms.

Crucially, digitalization and Fintech innovation are reshaping the market. Platforms are integrating AI-driven credit scoring and blockchain-enabled smart contracts to streamline the approval process, enhance transparency, and reduce transaction costs. This digital evolution is creating a more efficient and accessible lending ecosystem, particularly through the proliferation of subscription-based EV financing options that reduce ownership risk and improve flexibility for buyers.

NBFCs and Passenger Cars Lead the Segments

A deep dive into the market segmentation reveals clear leaders.

Financial Institutions

Non-Banking Financial Companies (NBFCs) are projected to be the dominant financial institution segment, commanding an estimated 47.5% market share in 2025. Their dominance stems from their ability to offer flexibility, competitive interest rates, and minimal documentation, particularly in semi-urban and underserved markets where traditional banks may have limited reach. NBFCs are leveraging digital platforms and strategic partnerships with EV manufacturers to provide fast, end-to-end financing support.

Vehicle Type

The Passenger Car segment is anticipated to hold the largest share, at 43.2% in 2025, making it the leading category for financed electric vehicles. Rising model availability, increasing consumer awareness of sustainable options, and customized loan products tailored to this segment are fueling its growth. The improving total cost of ownership (TCO) compared to internal combustion engine vehicles, along with governmental support, reinforces financing confidence in passenger EVs.

Global Growth Hotspots

While growth is strong globally, certain regions are leading the charge:

• China is forecasted to have the highest CAGR at 43.1%, supported by its dominant EV market and state-backed financing programs.

• India follows with a projected CAGR of 39.9%, driven by rapid adoption in the two-wheeler and three-wheeler segments and supportive public sector financing schemes.

• Germany is expected to grow at 36.7%, fueled by strong corporate fleet financing and structured EV leasing programs.

• The United Kingdom (30.3% CAGR) and the United States (27.1% CAGR) are also key growth regions, leveraging personal contract purchase plans, federal incentives, and sophisticated dealership financing models.

Competitive Landscape Overview

The Electric Vehicle Finance market features a robust competitive landscape where traditional financial powerhouses compete with automaker-backed entities and innovative Fintechs. The key players are actively expanding their tailored financing solutions to capture market share:

• Traditional Banks: Institutions like JPMorgan Chase & Co, Wells Fargo, Bank of America, PNC Financial Services Group, and US Bank offer competitive auto loan and leasing options, leveraging their vast capital and customer bases.

• Specialized Auto Financiers: Players such as Ally Financial, Capital One Auto Finance, Citizens Financial Group, and Santander Consumer USA focus on flexible repayment structures and user-friendly online lending platforms to enhance accessibility.

• Automaker Financial Arms: Captive finance companies, including Tesla Finance, Toyota Financial Services, Ford Credit, Nissan Motor Acceptance Corporation, and Volkswagen Financial Services, are critical, providing integrated purchase and leasing packages directly through dealer networks. These entities often provide specialized services like battery leasing and residual value guarantees, which help mitigate depreciation risks for buyers and lenders.

The competition is increasingly focused on offering lower financing costs, developing subscription-based ownership models, and integrating ESG-linked financing instruments to align with the global push for sustainability. Risk management around evolving battery technology and residual values remains a critical differentiator in this rapidly maturing market.

Full Market Report available for delivery. For purchase or customization, please request here - https://www.futuremarketinsights.com/reports/sample/rep-gb-25798

Explore FMI's related ongoing Coverage in Automotive Domain:

Electric Drive Unit Market : https://www.futuremarketinsights.com/reports/electric-drive-unit-market

Electric Transporters Market : https://www.futuremarketinsights.com/reports/electric-transporters-market

Electric Lift Truck Market : https://www.futuremarketinsights.com/reports/electric-lift-truck-market

Contact Us:

Future Market Insights Inc.

Christiana Corporate, 200 Continental Drive,

Suite 401, Newark, Delaware - 19713, USA

T: +1-347-918-3531

Website: https://www.futuremarketinsights.com

About Future Market Insights (FMI)

Future Market Insights, Inc. (ESOMAR certified, recipient of the Stevie Award, and a member of the Greater New York Chamber of Commerce) offers profound insights into the driving factors that are boosting demand in the market. FMI stands as the leading global provider of market intelligence, advisory services, consulting, and events for the Packaging, Food and Beverage, Consumer Technology, Healthcare, Industrial, and Chemicals markets. With a vast team of over 400 analysts worldwide, FMI provides global, regional, and local expertise on diverse domains and industry trends across more than 110 countries

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release EV Finance Market to Skyrocket, Hitting USD 1,419.1 billion by 2035 Amidst Global Electric Mobility Revolution here

News-ID: 4203442 • Views: …

More Releases from Future Market Insights Inc

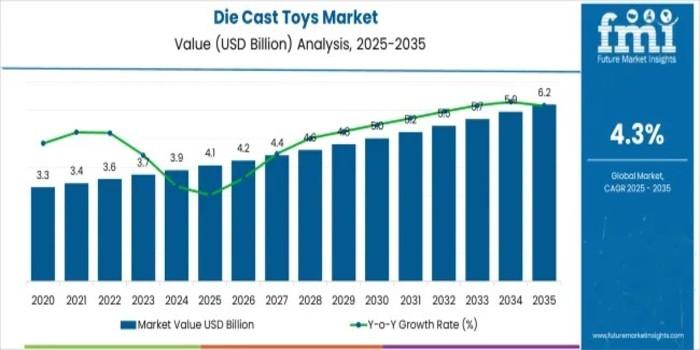

Global Die Cast Toys Market Forecast to Reach USD 6.2 Billion by 2035 Driven by …

The global die cast toys market is forecasted to expand from an estimated USD 4.1 billion in 2025 to USD 6.2 billion by 2035, exhibiting a steady compound annual growth rate (CAGR) of 4.3% over the next decade, according to the latest market analysis. This growth reflects a sustained consumer interest in collectible, high-quality die cast toys, particularly in niche markets targeting both children and adult hobbyists.

Between 2025 and 2030,…

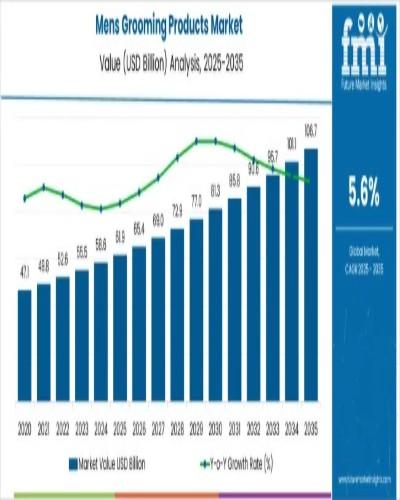

Global Men's Grooming Products Market Forecast to Reach USD 106.7 billion by 203 …

The global men's grooming products market is poised for substantial growth over the next decade, with its valuation expected to rise from USD 61.9 billion in 2025 to USD 106.7 billion by 2035. This growth reflects a robust compound annual growth rate (CAGR) of 5.6%, driven by shifting cultural norms, increased disposable incomes, and heightened consumer awareness of grooming and personal care.

The men's grooming market is set to cross two…

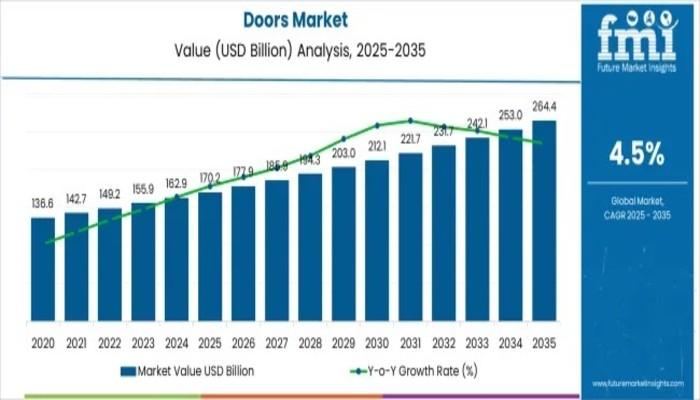

Doors Market Forecast Projects Steady 4.5% CAGR to USD 264.4 Billion by 2035 Ami …

The global doors market is poised for sustained growth, with a projected increase from USD 170.2 billion in 2025 to USD 264.4 billion by 2035, according to the latest market analysis. Registering a compound annual growth rate (CAGR) of 4.5%, the industry reflects stable demand across residential, commercial, and institutional sectors worldwide. This forecast underscores consistent procurement trends shaped by urban expansion, evolving building regulations, and advances in material and…

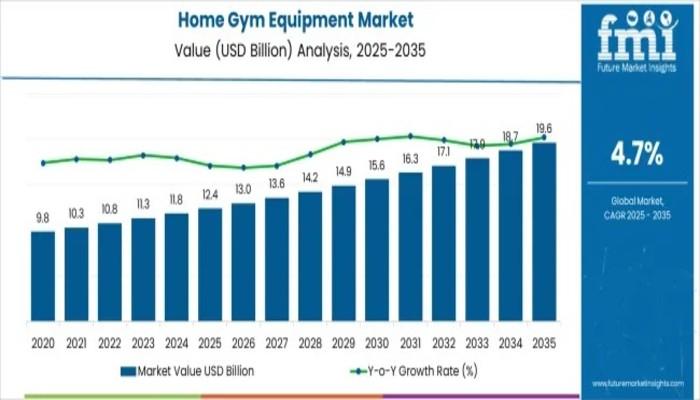

Home Gym Equipment Market Set to Reach USD 19.6 billion by 2035 Amid Rising Heal …

The Home Gym Equipment Market is forecasted to grow from an estimated value of USD 12.4 billion in 2025 to USD 19.6 billion by 2035, exhibiting a steady compound annual growth rate (CAGR) of 4.7%, according to the latest market analysis. This decade-long growth reflects evolving consumer preferences towards health and fitness, accelerated adoption of home-based workout solutions, and continuous innovation in smart fitness technologies.

Market Overview:

The global market for…

More Releases for Financial

Financial Leasing Services Market Share, Size, Financial Summaries Analysis from …

Infinity Business Insights has recently released a comprehensive research report titled "Financial Leasing Services Market Insights, Extending to 2031." This publication spans over 110+ pages and offers an engaging presentation with visually appealing tables and charts that are self-explanatory. The worldwide Financial Leasing Services market is expected to grow at a booming CAGR of 6.3% during 2024-2031. It also shows the importance of the Financial Leasing Services market main players…

Global Financial Aid Management Software Market Streamlining Financial Assistanc …

Overview for the report "Financial Aid Management Software Market" Helps in providing scope and definations, Key Findings, Growth Drivers, and Various Dynamics by Infinitybusinessinsights.com. This report will help the viewer in Better Decision Making.

At a predicted CAGR of 10.9% from 2023 to 2028, The Market for Financial Assistance Management Software will increase from USD 1.07 billion in 2022 to USD X.XX billion by 2030. The market's expansion can be attributed…

What will be Driving Growth Financial Leasing Market 2027 | Bank Financial Leasi …

Financial Leasing Market research is an intelligence report with meticulous efforts undertaken to study the right and valuable information. The data which has been looked upon is done considering both, the existing top players and the upcoming competitors. Business strategies of the key players and the new entering market industries are studied in detail. Well explained SWOT analysis, revenue share and contact information are shared in this report analysis.

Ask for…

Financial Leasing Market 2017 Analysis – CDB Leasing, ICBC Financial Leasing C …

A financial lease is a method used by a business for acquisition of equipment with payment structured over time. To give proper definition, it can be expressed as an agreement wherein the lessor receives lease payments for the covering of ownership costs. Moreover, the lessor holds the responsibility of maintenance, taxes, and insurance.

In this report, RRI studies the present scenario (with the base year being 2017) and the growth prospects…

Financial Leasing Market Is Booming | KLC Financial, SMFL Leasing, GM Financial, …

HTF MI recently introduced Global Financial Leasing Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are Sumitomo Mitsui Finance and Leasing, Maldives, HNA Capital, KUKE S.A., KLC…

Financial Analytics Market: Banking & financial sector expected to make most of …

The Financial Analytics Market deals with the development, manufacture and distribution of financial analytics tools for enterprises of all kinds and sizes. Financial data analytics can be described as a set of tools, techniques and processes used to find out answers for various business questions as well as to forecast future scenarios regarding finance and the economy.

The services provided by the Financial Analytics Market are used for analyzing the equity…